This article is merely a personal market opinion and does not constitute investment advice. Any trading based on this is at your own risk.

Since the lowest point on November 21, BTC has rebounded by over 17%, reaching around 94,700 at its peak. Some friends have been quite anxious lately, constantly urging updates in the background, with some unsure whether to close their short positions at low levels, while others are asking if they should buy in to chase the upward trend.

First, let me state my personal conclusion: I believe BTC is forming its own weekly right shoulder high this month.

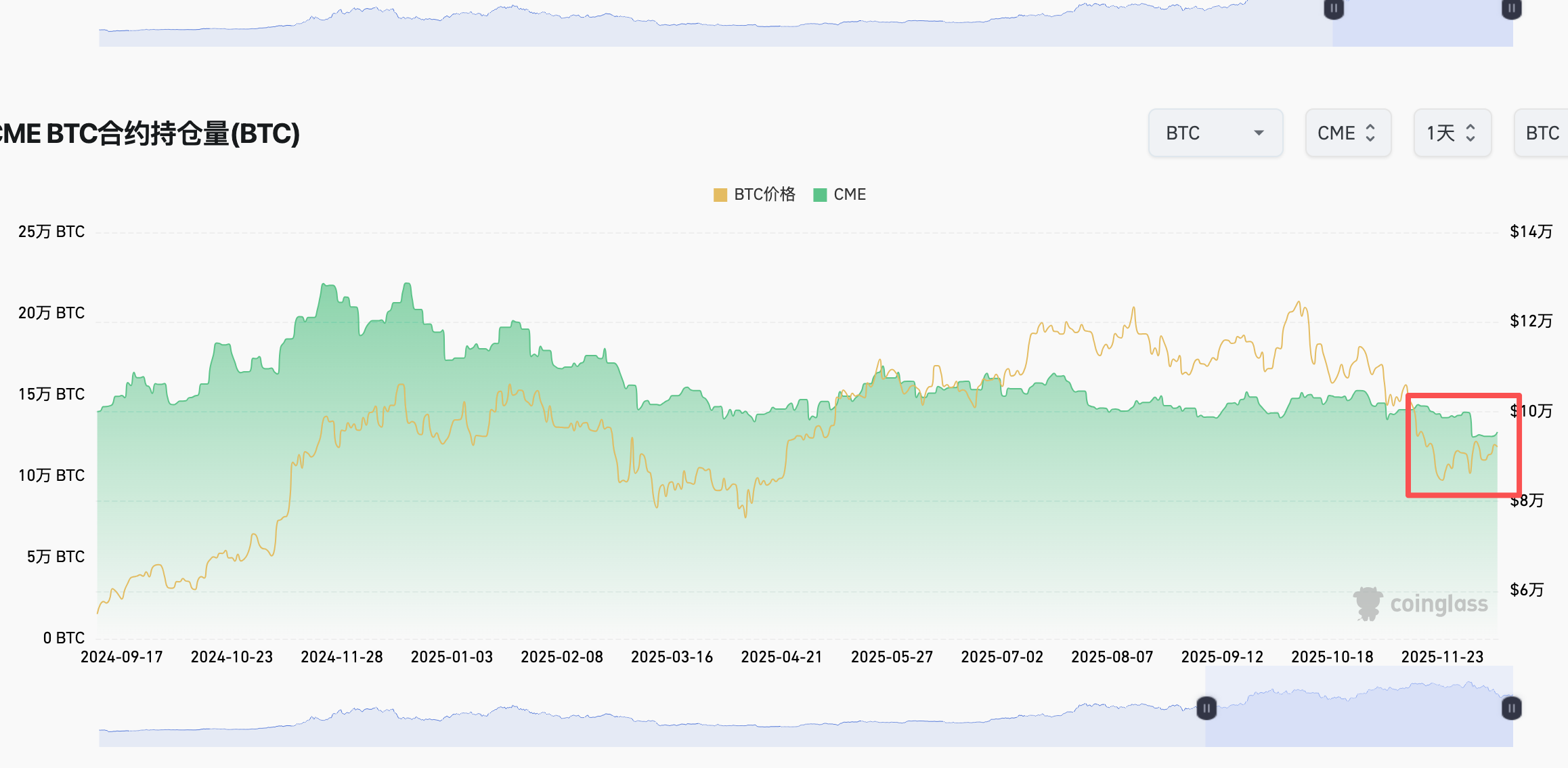

The above chart shows the coin-based open interest of CME contracts. As we can see, BTC has rebounded nearly 20%, yet the open interest is still lower than it was when it was at the low of 84,000. The green line in the chart indicates a sharp drop in open interest on December 2, which, combined with the rebound that day, confirms it was due to short positions being closed. The open interest has not increased with the recent price rise, indicating that there are no new long positions entering the market, which is a warning sign. A healthy rise must be accompanied by an increase in volume. In summary, the rebound is due to short covering, and there is no real "demand" force entering to buy. Once selling pressure starts to increase again, the market could drop at any time. This is a rebound without solid foundations at the bottom. Without sufficient bottoming and turnover, the selling pressure will only increase as prices rise.

So, the question arises: where is the endpoint of the rebound? I personally see three different possibilities, with the last one being the worst-case scenario (which I believe is highly unlikely).

As shown in the chart:

Possibility 1: This is currently the scenario I believe has the highest probability, with the rebound stopping between 93,000 and 96,000—i.e., the purple box area in the chart above. During the decline, this area had some resistance, trapping some positions. When the price rebounds to this area, selling pressure will emerge. In fact, from the high on December 3 and the rebound to this area in the past two days, we can see that upper shadows have started to appear, indicating that selling pressure is beginning to show. Unless this selling pressure is absorbed, it will be difficult for the price to move further up.

Possibility 2: 100,000, which is already a low-probability event. First, it needs to break through the small trapped area from mid-November to help a group of people get out of their positions before reaching this area. Above 100,000 is a larger and more obvious fluctuation zone, which has trapped another group of people. In the absence of real buying pressure, who will help them get out?

Possibility 3: 107,000, which is almost impossible. This is the head formed after three months of fluctuations. The trapped positions are not ordinary. Getting out? Those who are trapped will definitely have to cut losses at the bottom; if these people are not forced out, who will the main players profit from? At this stage, I can't imagine any significant positive news that could suddenly stimulate buying pressure and push the price up like an army.

Therefore, from my personal perspective, the cost-effectiveness of BTC moving upwards is already low. Continuing to rebound instead presents a shorting opportunity. The interest rate cuts are over, and Powell's statements have concluded; we should see a direction today.

ETH's surge yesterday was quite strong. It broke through the trapped area corresponding to BTC's situation 1 (the lowest purple box). However, we can also see that when it first broke through on November 29, it fell back immediately. The high on December 3 also failed to absorb all the selling pressure in this area and fell back again. Yesterday, it successfully broke through with increased volume for the third time.

Currently, it is facing the trapped area corresponding to BTC's situation 2. The upper shadows and high trading volume in the past two days indicate that after entering this area, selling pressure has surged, with volume increasing but prices not rising.

Further up, the position corresponding to BTC's situation 3 is 3,750, above which is the "liberation army zone." I find it hard to believe that the price can reach this level.

In summary, the endpoint of ETH's rebound is likely to fall between 3,380 and 3,650, becoming increasingly difficult as it rises. We will see how it performs today.

Follow me to maximize trend profits with minimal operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。