From an early internet technology pioneer to a globally renowned Bitcoin evangelist, MicroStrategy co-founder Michael Saylor's speech at the Binance Blockchain Week in Dubai painted a panoramic view of a future financial landscape anchored by Bitcoin as a value base for a global audience.

His discourse transcended short-term price fluctuations, delving into the deep logic of institutional transformation, firmly stating: Bitcoin is completing a historic leap—from a highly controversial investment asset to a fundamental capital supporting the development of the global digital economy.

The digital credit system derived from this core will completely reconstruct the traditional credit market, which is as large as $300 trillion, triggering a true revolution in financial order.

1. A Historical Turning Point

Saylor began by pointing out that the past twelve months have been a critical period for a "fundamental reversal" in the global attitude towards Bitcoin. This shift did not originate from within the tech community but stemmed from the top-level design of traditional power and capital centers, clearing the way for the comprehensive institutionalization of Bitcoin.

1. Strategic Embrace from Political High Levels

● The core signal of this turning point comes from the highest political levels in the United States. The U.S. President has publicly included support for Bitcoin and crypto assets in the national strategic framework, clearly stating the intention to compete for global leadership in the digital age.

● This is not empty campaign rhetoric; its practical significance is reflected in the appointments to key positions in the new government: the Secretary of the Treasury, the Chair of the Securities and Exchange Commission (SEC), and even core officials in commerce and intelligence systems, all of whom are open supporters of digital assets.

● This means that the recognition of Bitcoin has risen from a marginal issue to a systematic policy consensus that spans administrative and regulatory fields, providing unprecedented political certainty for the long-term development of the industry.

2. Rapid Disintegration of Traditional Financial Barriers

● If the political shift is the "starting gun," then the follow-up from the traditional banking system is the decisive "sprint." The global banking industry is known for its conservatism and risk aversion, but the pace of change over the past year has far exceeded expectations.

● Core regulatory agencies such as the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve have jointly issued guidance, clearly encouraging and allowing banks to engage in crypto asset custody, accept Bitcoin as collateral, and provide related credit services.

● Driven by this, top financial institutions, including JPMorgan Chase, Bank of America, and Citigroup, have shifted their attitudes from past skepticism and avoidance to actively exploring and implementing business. Wall Street's full acceptance marks the formal integration of Bitcoin into the arteries of modern finance, providing the strongest credit endorsement for its identity as "capital."

2. Why Bitcoin Can Become the "Cornerstone"

Saylor emphasized that Bitcoin's ability to bear the responsibility of "digital foundational capital" does not stem from faith or speculation, but because it has built a series of solid pillars over the past decade that no other asset can match.

1. A Massive Political and User Base

● Behind Bitcoin is a global community of interests. Hundreds of millions of users form a powerful social and political force. In the U.S. alone, the proportion of registered voters supporting cryptocurrencies has reached about 30%, making it a voter group that no politician can ignore. This broad and deep grassroots support is the fundamental guarantee for Bitcoin to withstand policy risks and promote favorable legislation.

2. Trillions of Dollars in Real Capital Accumulation

● Over $1 trillion in real capital has been permanently injected into the Bitcoin network. For example, MicroStrategy itself has continuously invested about $48 billion, holding assets that account for 3.1% of Bitcoin's total circulation. This large-scale, publicly listed institutional capital commitment is not short-term speculation but a strategic choice to view Bitcoin as a core reserve asset, proving its maturity as a means of value storage.

3. The Most Powerful Distributed Computing Network

● The Bitcoin network's computing power has exceeded 1000 EH/s, surpassing the total computing power of all data centers of tech giants like Google and Microsoft. This decentralized computing network, composed of millions of mining machines worldwide, is an insurmountable barrier to maintaining ledger security. The level of security it provides is unattainable by any centralized system or traditional financial infrastructure.

4. Energy Foundation Anchored in the Physical World

● The Bitcoin network continuously consumes about 24 gigawatts of electricity, equivalent to the full output of 24 large nuclear power plants, with its energy consumption exceeding the operational needs of the entire U.S. Navy. This large-scale, specialized use of real-world energy is a key process that firmly anchors the value of virtual digital assets in physical reality.

● It proves that Bitcoin's value is not a castle in the air but is supported by substantial global energy conversion.

3. From Capital to Credit

Saylor did not stop at macro discussions but used MicroStrategy itself as an example to elaborate on how to transform Bitcoin, this "primitive capital," into "digital credit" that can serve broader economic needs, outlining the specific practices of a "Bitcoin Treasury Company."

1. "Polarization" Capital Strategy: Restructuring Corporate Finance

● Traditional corporate finance faces a fundamental contradiction: the cost of corporate capital (such as an expected equity return rate of about 14%) is far higher than the return rate of cash-like assets held (about 3%), which essentially continues to erode shareholder value.

● MicroStrategy's strategy is to undergo a "polarization" transformation: by issuing equity or bonds (costing about 6%-14%), it raises funds to purchase Bitcoin assets with a historical annualized return rate of about 47%. This operation creates significant value surplus, making the company's capital structure stronger as it expands, achieving a fundamental shift from "value erosion" to "value creation."

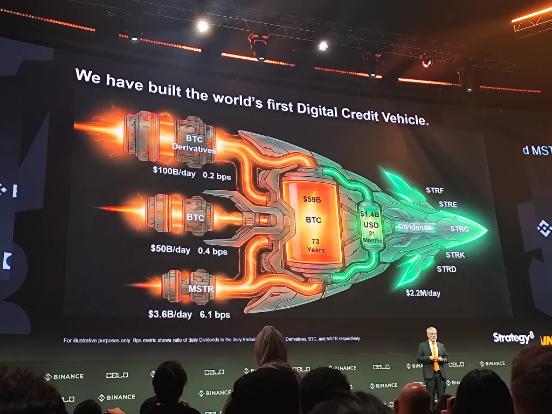

2. Building a "Digital Credit Product Factory"

The ultimate goal of the company is to transform the highly volatile Bitcoin capital into financial instruments that generate stable, predictable cash flows. To this end, they designed a product matrix for investors with different risk preferences:

● Flagship Product STRC: Positioned as a "high-yield bank account." Its price stabilizes around $100, with minimal volatility, but can provide an annualized yield of about 10.8% and pays monthly dividends. Its goal is to meet the needs of investors seeking stable cash flow and averse to principal volatility.

● Tiered Risk Products: STRF (and the euro version Stream) belongs to super-priority credit, with the highest safety and a yield of about 9%; STRD is a long-term high-yield tool, with yields up to 12.9%; STRK, as a structured product, allows investors to retain some Bitcoin appreciation while paying interest.

● Revolutionary Tax Efficiency: Saylor revealed one of the core advantages of its model—tax structure. By paying dividends to credit product holders in the form of "capital return" rather than "taxable interest," investors receive nearly tax-free cash flow. This makes STRC, a product with a nominal yield of 10.8%, have a post-tax equivalent yield of about 17% for U.S. investors, forming an absolute "dimensional reduction strike" compared to traditional bank savings or money market funds that require full taxation.

4. Future Vision

The vision Saylor painted goes far beyond product innovation of a single company; it represents a systematic reshaping of the global credit system.

1. Repairing the Deformed Global Yield Curve

● In economies like Switzerland and Japan, which have long been in a zero or even negative interest rate environment, the traditional financial system cannot provide real returns for savers.

● Digital credit tools can offer robust yields of over 10% in local currencies (such as Swiss francs and yen), effectively "rebuilding" a healthy yield curve for these economies, protecting the purchasing power of public savings and addressing the long-standing issue of financial repression in developed countries.

2. Comprehensive Upgrade of Traditional Credit Models

● Compared to traditional bank credit or corporate bonds, digital credit based on Bitcoin collateral has inherent advantages: high transparency (collateral ratios and risk models are publicly updated every 15 seconds), homogeneity (underlying assets are singular and clear), and extreme liquidity (collateral is one of the most liquid assets globally, and the credit products themselves are actively traded).

● Its issuance and matching efficiency is extremely high, with hundreds of millions of dollars in credit limits being established and funded within a day, while traditional real estate or project financing cycles can take years.

3. Fostering a Global "Bitcoin Treasury Company" Ecosystem

● MicroStrategy's model is replicable. In the future, localized "Bitcoin Treasury Companies" are expected to emerge in Japan, South Korea, Europe, and other regions. They will utilize the same logic to provide efficient digital credit services for their domestic markets. This means that the digital capital and credit system based on Bitcoin will no longer be limited to the U.S. or a few institutions but will become a global, open-competitive financial new ecosystem.

5. Embracing Volatility, Harnessing the Energy of the Digital Age

At the end of his speech, Saylor directly addressed the eternal question about Bitcoin's volatility. He provided a philosophically meaningful perspective: volatility is not a defect but an external manifestation of immense energy density. Just as nuclear reactions contain vast energy, Bitcoin's price fluctuations reflect the enormous energy it gathers as a "capital engine" of the new era that transforms the world.

For individuals and institutions, he offered clear paths of choice:

● If you seek long-term growth and can withstand volatility, then you should directly hold Bitcoin as a form of "digital capital."

● If you need stable cash flow or have a lower risk tolerance, then you can participate in the growth dividends of the Bitcoin network by investing in digital credit tools (like STRC) while effectively managing volatility risks.

● If you are a business or builder, you should consider how to integrate the "Bitcoin capital + digital credit" model into your own balance sheet or business structure to achieve a leap in efficiency.

Saylor's speech ultimately points to a grander proposition: the digitalization of the world is irreversible. From information to assets, and to the underlying rules of finance, everything is being digitally reconstructed. Bitcoin and the new financial system it has spawned are the core "sources of energy" in this reconstruction.

His closing remarks are profound: "Do not instinctively flee from the flames, but learn how to move forward within them." In this sweeping wave of digital civilization, Bitcoin is no longer just an investment target; it is a key cornerstone for understanding and participating in the future.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。