In the early morning, the Federal Reserve lowered interest rates by 25 basis points as expected, while also announcing the restart of balance sheet expansion. However, hawkish signals weakened the market's expectations for further easing, causing Bitcoin to quickly surge to around $94,500 at 4 AM, before briefly dropping below the $90,000 mark. On the daily chart, the MACD is still in a volume-upward state due to its lagging nature, but the market has seen two consecutive days of long upper shadow candlesticks, indicating strong resistance above.

Ethereum was also affected by the Federal Reserve's hawkish rate cut yesterday, initially surging before a significant pullback. Ethereum previously broke through the resistance level of 3,380 and has shown five consecutive bullish daily candles, but it failed to hold the key resistance level after the positive news was fully priced in. The MACD, which had been on an upward trend, is now showing signs of decreasing volume. A top divergence has also appeared on the 4-hour chart, indicating that the short-term bullish trend is facing obstacles.

Recommendations: Enter short positions for Bitcoin around the current price of 89,800-90,300, targeting 88,600-88,300, with a breakdown looking at around 87,900.

Recommendations: Enter short positions for Ethereum around 3,200-3,230, targeting 3,150-3,120, with a breakdown looking at around 3,090.

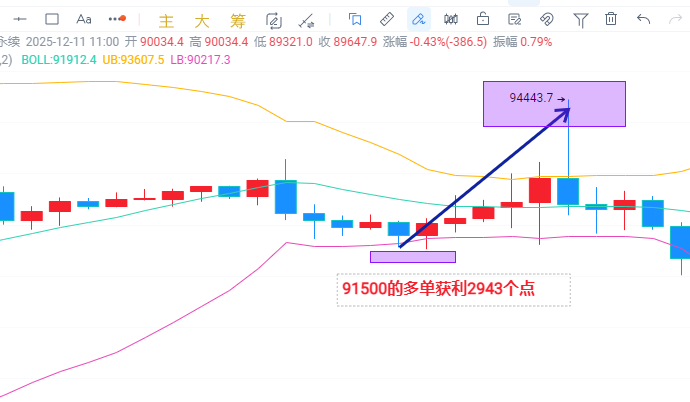

Additionally, the long position for Ethereum around 3,300 has already gained 146 points, and the long position for Bitcoin at 91,500 has gained 2,943 points. Congratulations to the clients who followed and profited.

The market is ever-changing, and these strategies are for reference only.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。