Written by: Oliver, Mars Finance

At 3 AM Beijing time on December 11, 2025, Federal Reserve Chairman Powell pressed the button that the market had long priced in: a 25 basis point rate cut.

The subsequent plot was supposed to unfold according to the script of the crypto market: liquidity gates opened, the dollar index plummeted, and Bitcoin surged towards the $100,000 mark. In fact, the first 15 minutes played out this way—Bitcoin violently surged to $94,476, with alerts of liquidated short positions ringing out across the network.

However, the celebration lasted less than an hour. As Wall Street traders meticulously interpreted the Federal Open Market Committee (FOMC) statement and the Summary of Economic Projections (SEP), market sentiment underwent a dramatic reversal. Bitcoin not only retraced all its gains but also fell to $91,384 in the following hours, forming a standard "inverted V" pattern.

Why did the main funds choose to decisively flee despite the seemingly dual benefits of "rate cut + bond buying"?

This was not a simple case of "good news being priced in," but rather a time-differential game caused by algorithmic misinterpretation of headlines and human logic correction. When you dissect the three core details of this FOMC meeting—upward revision of GDP expectations, false QE, and unprecedented internal division—you will find that $94,000 is not the starting point of a bull market, but a trap set for bulls by the macro fundamentals.

The Illusion of Algorithms: $40 Billion of "Pseudo QE"

Looking back at the surge at 3 AM, the core driver was not the rate cut itself (after all, the CME FedWatch had already given an 88% probability prediction), but a highly misleading breaking news: the Federal Reserve announced it would purchase $40 billion in short-term government bonds each month.

For high-frequency trading algorithms and clickbait media, the keyword capture logic is very simple: "Fed" + "Buying Bonds" = "QE" = "Liquidity Injection."

Thus, machines instantly filled the buy orders. The market mistakenly believed that the Federal Reserve had initiated quantitative easing alongside the rate cut, which was double the joy.

But the devil was hidden in the operational details released by the New York Fed shortly thereafter. This was not a QE (quantitative easing) aimed at lowering long-term rates and stimulating the economy, but rather an RMP (Reserve Management Purchase) targeting only short-term government bonds.

The details revealed that the Fed was buying bonds because the reserve balances in the banking system had fallen to the edge of "adequate levels," and to address potential liquidity withdrawal due to the upcoming April tax season. In other words, this $40 billion was merely a patch to repair the "pipes" of the interbank market, aimed at preventing a spike in repo rates that could lead to a financial system stall, rather than injecting liquidity into risk asset pools.

When human traders realized that this money would be locked in the banks' reserve accounts and would not spill over into Bitcoin or Nasdaq, the first round of valuation correction began. Those who chased prices above $94,000 were essentially paying for their blind spots regarding monetary policy tools.

The "Backstab" of GDP Data: Prosperity is Bitcoin's Enemy

If the "pseudo QE" only triggered a retreat in sentiment, then the revision of GDP data in the SEP fundamentally undermined the logical foundation of Bitcoin's "rate cut bull" narrative.

In this updated forecast, the Fed significantly raised its growth expectation for U.S. GDP in 2026 from 1.8% in September to 2.3%. Meanwhile, the unemployment rate expectation for 2027 was lowered from 4.3% to 4.2%.

This set of data conveyed an extremely hawkish signal to the market: the U.S. economy is not in recession but is exhibiting remarkable resilience at this interest rate level. This is not a figment of the Fed's imagination from their office, but a lagging confirmation of real data.

If we take a look at real-time data, the situation is even "hotter."

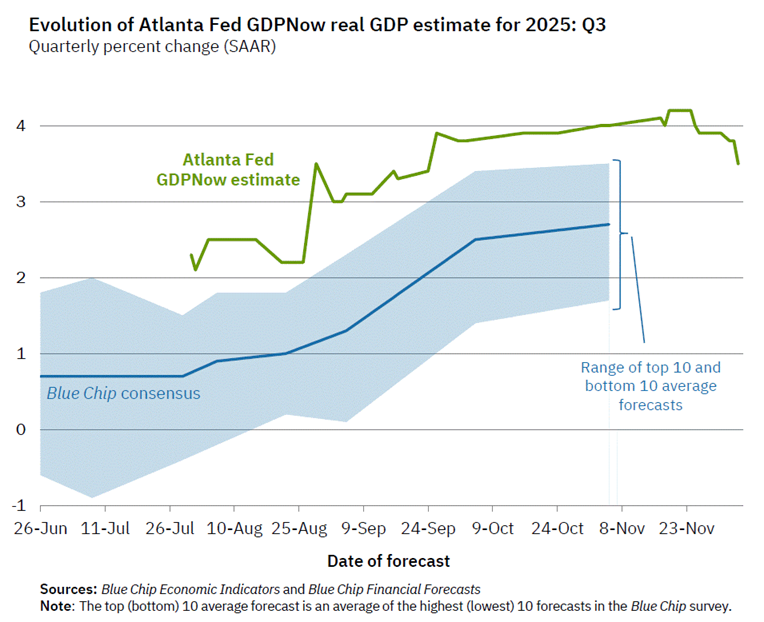

Atlanta Fed GDPNow

The model shows that the estimated actual GDP growth rate for Q3 2025 once surged to around 4%, far exceeding the blue-chip consensus expectation of 2.5%. This indicates that the U.S. economy is in a period of extremely strong expansion, not on the brink of recession.

For traditional financial markets, this is good news for a "soft landing" or even "no landing"; but for Bitcoin, this is the most awkward script.

First, strong economic growth means that the Fed has no urgent need to cut rates. Powell emphasized at the press conference that "the economy is strong but needs to be rebalanced," which actually hints that the future path of rate cuts will be prolonged and diluted. The market originally expected the Fed to significantly ease due to economic weakness (recession-style rate cuts), but instead, it received a preventive rate cut because the economy is doing too well (preemptive rate cuts).

Second, the upward revision of GDP expectations directly raised the pricing of the neutral interest rate (R-star). When the U.S. economy can grow at a rate of 2.3% or even higher, funds remaining in dollar assets (such as U.S. stocks and bonds) can achieve decent risk-free or low-risk returns. This diminishes Bitcoin's appeal as an "anti-inflation" and "anti-recession" asset.

Broken Consensus: The Largest Internal Division in 37 Years

The final blow that caused Bitcoin to continue its downward trend below the $92,000 mark came from deep skepticism about the Fed's control.

This vote saw the most severe division since 2019, and even in 37 years. Among the 12 voting members, 3 cast dissenting votes, a ratio as high as 25%.

Even more unsettling is the composition of the opposition, which displayed a complete policy rift: one side is Miran, a governor appointed by Trump, who believes the rate cut is too small and advocates for a direct cut of 50 basis points, representing the radical easing faction; the other side includes Kansas City Fed President Schmid and Chicago Fed President Goolsbee, who believe there should be no rate cut at all and advocate for maintaining rates, representing the stubborn hawks.

This "left-right struggle" situation is extremely rare in the history of the Fed. It sends a dangerous signal to the market: Powell has lost absolute control over the committee, and there is a complete lack of consensus within the Fed on the core issues of "whether inflation is under control" and "whether employment is deteriorating."

The dot plot further confirms this division. Although the median shows another rate cut next year, as many as 7 officials (including non-voting members) actually opposed this rate cut or leaned towards rates being higher than expected next year. This means that every future FOMC meeting will turn into a political game full of uncertainties.

What capital hates most is not bad news, but uncertainty. A divided Fed means that the predictability of monetary policy has plummeted. For the crypto market, which relies on liquidity expectations, this is undoubtedly a heavy blow. Institutional funds chose to take profits around $91,000 to avoid the risks brought by this policy chaos.

The Noose of Real Interest Rates Remains Tight

Stepping back from last night's candlestick chart, when we examine the macro environment over a longer cycle, we find that the pressure on Bitcoin has not eased with the rate cut.

Although the nominal interest rate was lowered by 25 basis points, the pace of decline in inflation data remains slow (core PCE expectations only slightly adjusted to 2.4%). This means that the "real interest rate" adjusted for inflation remains at restrictive levels.

Powell acknowledged at the press conference that inflation risks are still skewed to the upside, and employment growth may be overestimated. However, he did not provide clear guidance for future rate cuts, repeatedly emphasizing that "there is no preset path." This ambiguous statement, combined with the $40 billion of "pseudo QE" and strong GDP expectations, creates an extremely awkward "middle ground."

In this middle ground, the economy is too good to need easing, and inflation is too high to allow easing.

Conclusion: Waiting for a New Narrative Amid Deleveraging

This script of rising first and then falling has taught all crypto investors a lesson: at this point in late 2025, relying solely on the macro narrative of "the Fed cutting rates" has become ineffective. The market is shifting from "seeking liquidity" to "repricing risk."

As the Nasdaq index encounters resistance and falls from historical highs, traditional financial markets have begun trading on the logic of "hawkish rate cuts." For Bitcoin, having lost the halo of "recession hedging" in the short term and not receiving the support of "flooding liquidity," a correction to clear leverage may be an inevitable fate.

In the next 24 hours, please closely monitor the fund flows of ETFs. If institutional funds recognize the above macro logic correction, then the selling pressure we saw last night may just be the beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。