Selected News

Gemini's US stock pre-market rises over 18%, previously approved to enter prediction markets

Solana's native Perp DEX Phoenix starts internal testing today, open for waitlist applications

Binance has at least 236 points for users to claim 2000 US airdrop

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a translation of the original content:

[STANDX]

STANDX is gaining attention today for launching a trading points program. This program allows users to earn points through trading activities and holding $DUSD (a yield-generating stablecoin). The initiative also offers additional incentives for users utilizing the Binance wallet, providing a 10% points bonus until January 7. The project is developed by a team with backgrounds in Binance Futures and Goldman Sachs, emphasizing a self-custody model and offering automated rewards through its Perp DEX platform. Due to its innovative approach to trading and rewards, as well as the potential for high returns, the initiative has sparked widespread interest.

[FERRA]

FERRA is highly regarded today for its dynamic liquidity layer and social DLMM DEX on Sui, designed specifically for liquidity providers, yield farmers, builders, and speculators. The protocol's leaderboard is now live, and in the future, 0.25% of the token supply will be allocated to top creators and the Kaito ecosystem. The discussion focuses on FERRA's innovative DLMM and CLMM models, which provide dynamic and centralized liquidity market-making capabilities. The project has also secured significant seed pre-financing and actively engages with the community through the leaderboard and token allocation plans.

[SEI]

SEI is in the spotlight today due to its partnership with Xiaomi, the world's third-largest smartphone manufacturer. This collaboration will see SEI's crypto wallet and discovery app pre-installed on new devices sold by Xiaomi outside of China and the US starting in 2026. The integration aims to bring stablecoin payments and on-chain transactions to Xiaomi's global user base, marking a significant step towards mainstream adoption of cryptocurrency. The partnership is expected to cover over 170 million new devices annually, greatly enhancing SEI's influence and reach in the crypto space.

[KINDRED]

Today's discussions about KINDRED focus on its upcoming TGE (Token Generation Event) and its innovative AI partners. These AI partners are designed to possess emotional intelligence and personalized characteristics. The community is excited about KINDRED's AI being able to establish meaningful connections with users through licensed IP and original characters. As the TGE approaches, many users are discussing their strategies and expectations for the event. Additionally, KINDRED's AI emphasizes unique emotional resonance, distinguishing it from generic AI models.

[MET]

Today's main discussions about MET revolve around the significant updates and strategic initiatives of Meteora. Meteora announced a buyback of MET tokens worth $10.6 million, accounting for 2.3% of its total supply, and launched Comet Points—a new MET staking reward system. The updates also include product improvements such as automated vaults, limit orders, and pool discovery pages. These initiatives are seen as efforts to increase revenue, optimize spending, and return value to token holders, thereby aligning incentives between the company and its users.

Selected Articles

Tonight, the Federal Reserve will hold one of its most closely watched interest rate decisions of the year. The market generally bets that a rate cut is almost a certainty. However, what will truly determine the trajectory of risk assets in the coming months is not another 25 basis point cut, but a more critical variable: whether the Federal Reserve will re-inject liquidity into the market. Therefore, this time, Wall Street is focused not on interest rates, but on the balance sheet.

In November 2025, the spot trading volume of mainstream CEXs decreased by 27% compared to October. The top three in terms of change rate are Coinbase -5.42%, Kucoin -16.50%, and Crypto.com -17.72%. The bottom three are OKX -27.18%, Bybit -31.42%, and Gate -43.91%. The contract trading volume of mainstream CEXs in November decreased by 26% compared to October. The top three in terms of change rate are HTX -14.21%, Kucoin -14.38%, and OKX -21.15%. The bottom three are Kraken -26.07%, Bybit -28.66%, and Bitget -48.47%.

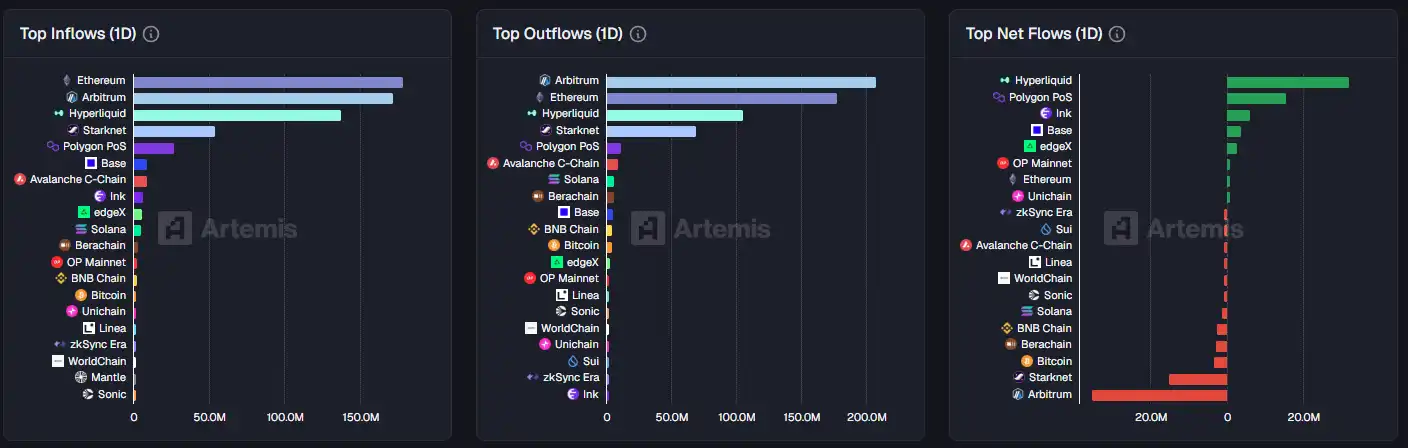

On-chain Data

On-chain fund flow situation for the week of December 11

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。