Bitcoin Treasuries’ November data reveals a treasury sector evolving from a single-asset experiment into a full-scale, multi-chain corporate strategy. From bitcoin to ethereum, solana, and even XRP, the report shows firms expanding their digital asset exposure while navigating price drawdowns, regulatory risks, and shifting investor expectations—all while doubling down on long-term accumulation.

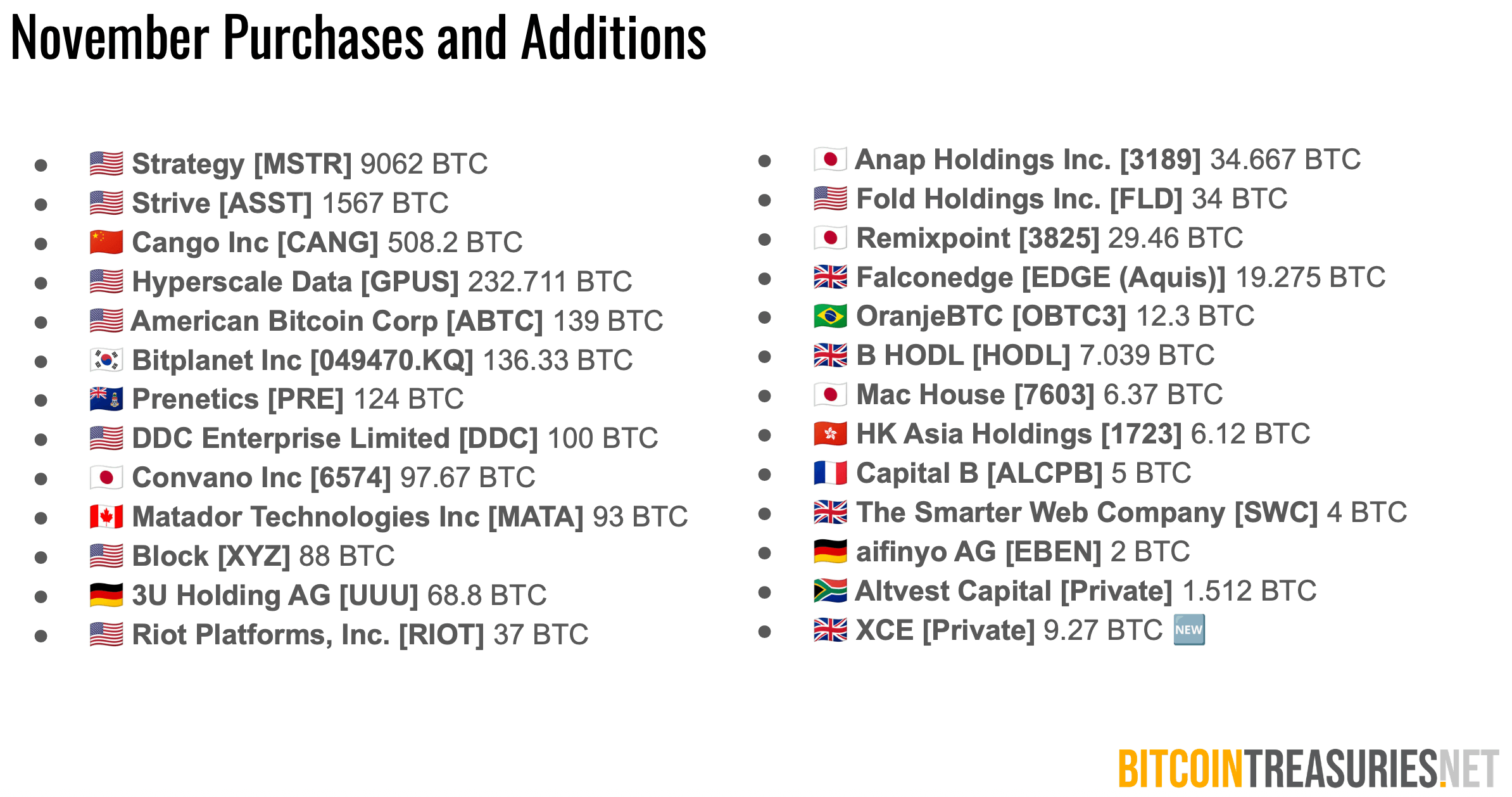

Bitcoin remains the bedrock of corporate treasury adoption, and November’s numbers reinforce that dominance. Researchers at bitcointreasuries.net found that more than 12,644 BTC were added across public and private treasuries, offset by 1,883 BTC in sales, bringing net accumulation to 10,761 BTC for the month. Total tracked holdings stand above 4 million BTC, including public companies, private firms, governments, funds, and defi entities—an aggregate stash valued around $363 billion at month’s end.

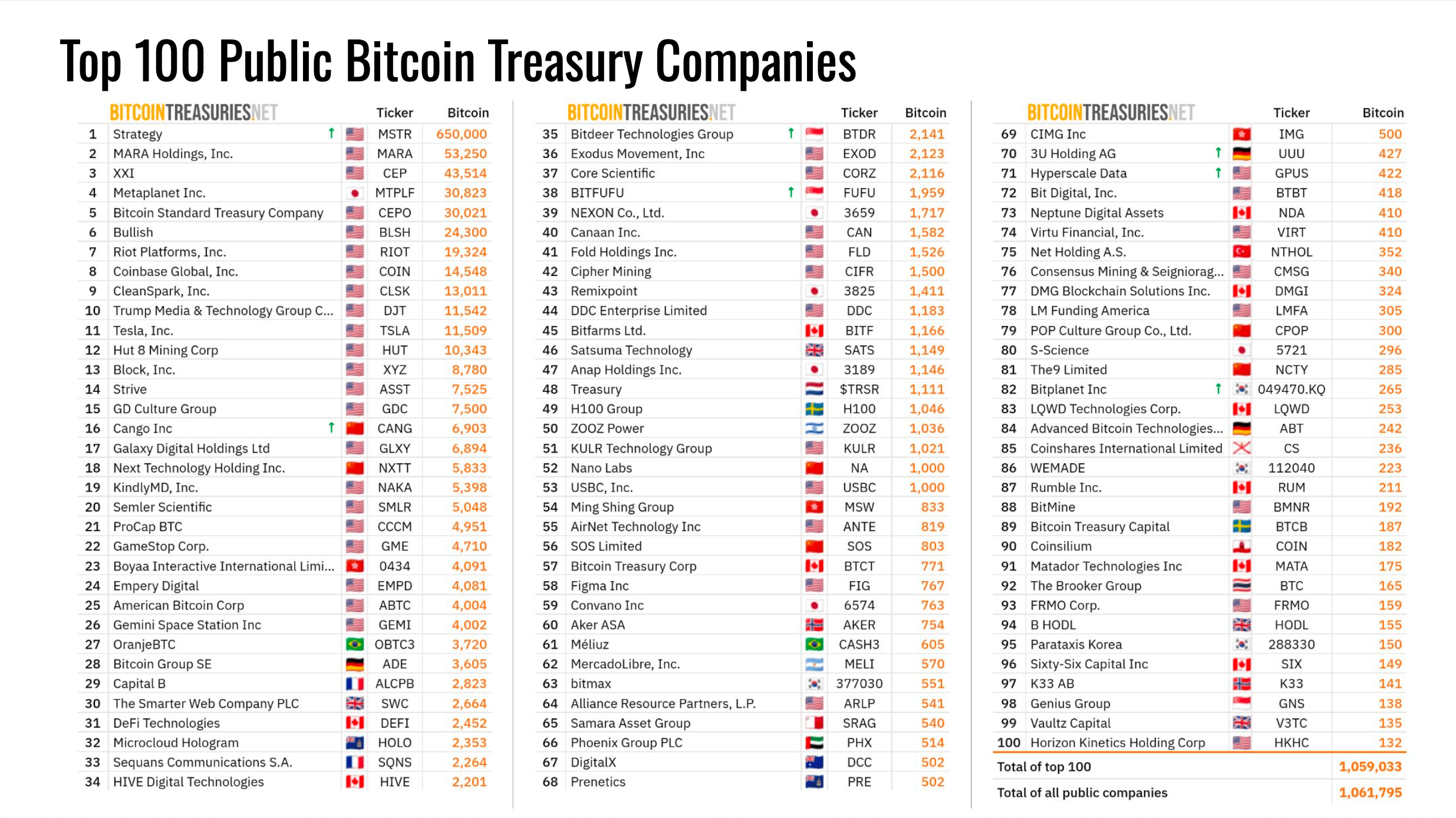

Top 100 BTC DATs in November 2025. Source: bitcointreasuries.net report.

Strategy once again towered over its peers, adding 9,062 BTC across three purchases and ending November with 649,870 BTC on its balance sheet—still the world’s largest DAT by a wide margin. But while bitcoin still commands the spotlight, Bitcoin Treasuries’ researchers emphasize a more global and diversified corporate map emerging beneath the surface.

Source: bitcointreasuries.net report.

Japan’s Metaplanet, China’s Cango, Europe’s Capital B, and Hong Kong–based firms all expanded BTC exposure, helping push non-U.S. public treasury holdings above 100,000 BTC—roughly 9% of global public company totals. Firms in Asia and Europe are increasingly leveraging local debt markets, tax regimes, and regulatory clarity to power DAT strategies that are no longer U.S.-centric.

Yet November wasn’t all smooth sailing. Bitcoin’s slide under $90,000 pushed 65% of tracked corporate buyers underwater on their cost basis, according to Bitcoin Treasuries’ heatmaps. Unrealized losses didn’t break treasury conviction, but they did force boards to confront the risks of stacking BTC at elevated prices—especially as stock performance lagged. Only a handful of DAT companies delivered year-to-date equity gains, even as nearly 50 firms managed double-digit returns over the past 6–12 months.

Read more: Analysts Target $1M Bitcoin With a Surging Institution-Led Cycle

Ethereum treasuries, meanwhile, marked another month of steady growth. Bitcoin Treasuries reports 6.36 million ETH held across roughly 68 corporate treasuries, valued near $20 billion. Firms added more than 260,000 ETH, fueled by aggressive accumulation from Bitmine and positive analyst sentiment around select ETH-exposed equities. But pessimism also crept in, with estimates of more than $4.5 billion in unrealized losses across ETH-heavy treasuries amid a 50% drawdown since July.

Solana treasury activity also jumped into sharper focus. The Strategic Solana Reserve data included in the Bitcoin Treasuries report shows 20 million SOL held across at least 20 companies—worth about $2.9 billion. Forward Industries alone controls more than 6.8 million SOL, while defi firms, biotech companies, and diversified corporates continue to incorporate SOL into broader DAT portfolios. Share buybacks, private placements, and capital-raising maneuvers showcased how Solana-centric firms are trying to balance treasury strategy with operational realities.

While Gamestop did not sell BTC in Q3, Eric Trump’s American Bitcoin surpassed Gamestop in BTC holdings in December.

Even XRP is making its way into treasury frameworks. Bitcoin Treasuries highlights Evernorth as the largest known XRP treasury, with 473 million XRP committed—valued near $1 billion—and several smaller firms experimenting with XRP as part of multi-asset reserves. Researchers estimate that, once planned purchases settle, XRP treasuries will approach $2 billion in value. The report notes that media sentiment around XRP’s role in settlement and treasury systems has improved modestly in recent months.

Regulatory turbulence remains a defining wildcard. Bitcoin Treasuries details potential MSCI delistings for 39 companies whose balance sheets exceed 50% crypto exposure—a list that includes Strategy, Marathon, Hut 8, Metaplanet, and others. Japan, Australia, Nasdaq, and other exchanges are also reassessing compliance standards for DAT companies, creating fresh uncertainty ahead of the February index review. If implemented, MSCI’s proposal could trigger billions in mechanical outflows from DAT equities.

Despite the challenges, Bitcoin Treasuries’ researchers frame November as evidence of a sector maturing rather than stalling. Multi-asset treasuries are on the rise. Financing mechanisms are evolving. Mining firms are integrating DAT models. And companies worldwide are discovering that digital assets—whether BTC, ETH, SOL, or XRP—can operate as both strategic reserves and long-term capital engines.

- What is a digital asset treasury (DAT)?

A DAT refers to companies that hold bitcoin, ethereum, solana, or other digital assets on their balance sheets as part of long-term treasury strategy. - Which assets grew most in corporate treasuries this month?

Bitcoin Treasuries found continued growth across BTC, ETH, SOL, and rising XRP commitments. - Are DAT companies increasing globally?

Yes— Bitcoin Treasuries reports rising corporate holdings in Japan, China, Europe, and Hong Kong. - How much BTC do public and private treasuries hold overall?

Bitcoin Treasuries estimates more than 4 million BTC held across all entities tracked in its November report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。