As soon as Federal Reserve Chairman Powell announced a 25 basis point rate cut, silver prices surged past historical records, reaching $61, while U.S. Treasury yields rose instead of falling, gold experienced slight fluctuations, and Bitcoin unexpectedly plummeted.

In the early hours of December 11, 2025, the Federal Reserve announced a reduction in the target range for the federal funds rate by 25 basis points to 3.5%-3.75%, marking the third rate cut of the year.

The policy statement indicated that U.S. economic activity is expanding moderately, but job growth has slowed, and inflation remains high to some extent. This widely anticipated rate cut triggered a series of unconventional market reactions.

1. Policy Shift

At its final meeting of 2025, the Federal Reserve announced a 25 basis point rate cut as expected. This marks the sixth rate cut since the current easing cycle began in September 2024.

● The policy statement pointed out that weak signals from the labor market were the main reason for this rate cut. Bai Xue, senior vice president of the research and development department at Dongfang Jincheng, believes this is a preemptive, risk management-style policy adjustment aimed at preventing weakness in the labor market from affecting consumption and economic growth.

● Unlike previous meetings, this meeting saw three dissenting votes, the highest number of dissenting votes since September 2019. One member advocated for a 50 basis point cut, while two others preferred to keep rates unchanged.

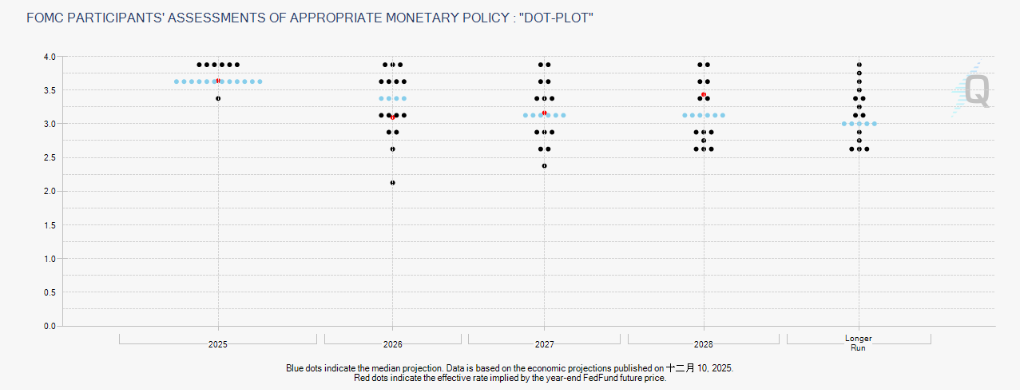

● The dot plot indicates that Federal Reserve officials expect only one more rate cut in 2026. However, Wen Bin, chief economist at China Minsheng Bank, pointed out that if the new Federal Reserve chairman adopts a dovish stance, the actual rate cut next year may exceed the dot plot's predictions.

2. Unusual U.S. Treasuries

● In the context of the Federal Reserve's rate cut, the U.S. Treasury market exhibited an unusual trend not seen in nearly thirty years—yields rose instead of falling. Since the Federal Reserve began easing monetary policy, the yield on the 10-year U.S. Treasury has increased by nearly half a percentage point.

● As of December 9, the yield on the 10-year U.S. Treasury climbed to 4.17%, the highest level since September; the yield on the 30-year U.S. Treasury also rose to about 4.82%, a recent high. This trend is completely contrary to typical behavior during a rate cut cycle.

● There are three different interpretations of this unusual phenomenon in the market: optimists believe it indicates confidence that the economy will not fall into recession; neutrals think it is merely a return of Treasury yields to pre-2008 norms; pessimists worry that this is a "bond vigilante" punishing the U.S. for fiscal disorder.

● Barry, head of global interest rate strategy at JPMorgan, pointed out two key factors: first, the market has already priced in easing expectations, and second, the Federal Reserve chose to cut rates significantly while inflation remains relatively high, maintaining economic expansion rather than ending it.

3. Silver Surge

● In stark contrast to the cautious U.S. Treasury market, the silver market is experiencing historic gains. On December 12, spot silver broke through $64 per ounce, setting a new historical high. Since the beginning of the year, silver has surged an astonishing 112%, nearly double the increase in gold.

● Several factors are driving the rise in silver prices. The Federal Reserve's rate cut expectations have reduced the opportunity cost of holding non-interest-bearing assets. Additionally, silver has been included in the U.S. critical minerals list, raising market concerns about potential trade restrictions.

● More fundamentally, the silver market has experienced a supply gap for the fifth consecutive year. According to the Silver Institute, the global silver supply gap is expected to be between 100 million and 118 million ounces in 2025.

● Industrial demand has become a long-term support for the silver market, particularly as the amount of silver used in the photovoltaic industry is expected to account for 55% of total global silver demand. The International Energy Agency predicts that by 2030, solar energy alone will drive an annual increase in silver demand of nearly 150 million ounces.

4. Gold Fluctuations

In comparison, the gold market's reaction to the Federal Reserve's rate cut has been relatively mild. After the Federal Reserve announced the rate cut, COMEX gold futures prices rose slightly by 0.52%, settling at $4,258.30 per ounce.

● The holdings of gold ETFs also showed subtle changes. As of December 12, the world's largest gold ETF—SPDR—held approximately 1,049.11 tons of gold, slightly down from the October peak but still a significant 20.5% increase compared to the same period last year.

● Central bank gold purchases provide long-term support for gold. In the third quarter of 2025, global central bank gold purchases reached 220 tons, a 28% increase from the previous quarter. The People's Bank of China has increased its gold reserves for the 13th consecutive month.

● Market analysis indicates that gold prices are experiencing short-term fluctuations primarily due to two opposing forces: on one hand, support from the Federal Reserve's rate cut, and on the other hand, pressure from a potential easing of geopolitical tensions and a decline in investment demand.

5. Bitcoin's Cold Reception

● While traditional assets reacted in various ways to the Federal Reserve's rate cut, the cryptocurrency market appeared unusually calm. Bitcoin briefly surged to $94,500 after the Federal Reserve's rate cut announcement, then quickly plummeted to around $92,000.

● Within 24 hours, the total liquidation amount in the cryptocurrency market exceeded $300 million, with 114,600 people liquidated. This reaction is in stark contrast to the market's usual perception of Bitcoin as a risk asset.

● Analysts pointed out that Bitcoin is currently in a clear decoupling state. Despite companies like MicroStrategy continuing to buy Bitcoin, the structural selling pressure in the market remains strong.

● Standard Chartered recently significantly lowered its Bitcoin price forecast, adjusting the target price for the end of 2025 from $200,000 to around $100,000. The bank believes that the buying by Bitcoin whales may have "come to an end."

6. The Logic of Market Divergence

The starkly different reactions of various asset classes to the same monetary policy event are underpinned by profound market logic. The uncertainty surrounding the Federal Reserve's policy path is one of the core factors.

● According to the latest economic forecast summary, Federal Reserve officials have raised their median forecasts for U.S. economic growth from 2025 to 2028, increasing the 2026 growth forecast from 1.8% to 2.3%.

● However, divisions within the Federal Reserve regarding the future policy path are widening. Cui Xiao, senior economist at Swiss private bank Pictet, pointed out: "The divergence in the Federal Reserve's dot plot for interest rate predictions for 2026 is significant, and the median forecast of 3.375% is very unstable."

● On the other hand, concerns about the Federal Reserve's independence are growing. U.S. President Trump has repeatedly expressed dissatisfaction with the pace of the Federal Reserve's rate cuts, stating that the cut was "too small and should be doubled."

● Trump's criteria for the next Federal Reserve chairman are "whether they are willing to cut rates immediately." If a chairman perceived as more "submissive" takes office, it may further undermine market confidence in the Federal Reserve's independence.

● Within 24 hours of the Federal Reserve's rate cut announcement, COMEX silver futures had accumulated a 109% increase for the year, while the yield on the 10-year U.S. Treasury rose to a three-month high of 4.17%.

When the Federal Reserve's rate cut—a traditional signal to boost risk assets—triggers a series of unconventional reactions across different markets, the market is sending a clear signal: pure monetary policy is increasingly unable to dictate the complex logic of asset prices.

As the transition of the Federal Reserve chairmanship approaches and economic data fluctuates, the market in 2026 may face more "abnormal" tests. Those investors who can identify the core drivers of different assets may find new balance amid this divergence.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。