Solana Breakpoint 2025 will be held from December 11 to 13 in Abu Dhabi, UAE, gathering over 6,000 developers and project teams from more than 100 countries to focus on the latest developments and future growth of the Solana ecosystem.

Industry leaders such as Raoul Pal, co-founder and CEO of Real Vision; Anatoly Yakovenko, co-founder of Solana; Lily Liu, chair of the Solana Foundation; and Mike Novogratz, founder and CEO of Galaxy, attended and delivered speeches. BlockBeats will provide real-time updates and coverage from the conference, with the latest content as follows:

December 12

Jupiter Stablecoin JupUSD Expected to Launch Next Week

On December 12, Jupiter announced at the Solana Breakpoint conference that its stablecoin JupUSD is expected to launch next week.

BlockBeats previously reported that on October 8, Ethena partnered with Jupiter to launch the native Solana stablecoin JupUSD. The token is planned to go live in the fourth quarter. Jupiter plans to "gradually convert" approximately $750 million of USDC in its liquidity provider pool into JupUSD.

December 11

Raoul Pal: The Current Bull Market Cycle Should Peak in 2026, Cryptocurrency is Essentially a Macro Asset

On December 11, Raoul Pal, former Goldman Sachs executive, author of "Global Macro Investor," and co-founder and CEO of Real Vision, stated at the Solana Breakpoint conference:

"The decline in labor force participation means a shrinking workforce. And demographic structure is key to driving debt. Population growth will continue to decline, which means the debt-to-GDP ratio will continue to rise, and that is the problem.

We have to face the global debt issue, and currency devaluation has always been a way to address (or delay) this problem. We are starting to see signs that the Federal Reserve has to reconsider its balance sheet and start thinking about how to 'monetize' all this debt. Over the next 12 months, we will need to print about $8 trillion in cash through liquidity injections.

I know many people may think the crypto cycle is over and feel that 'the good days are gone.' But in fact, what drives all this is cyclicality, not the Bitcoin halving cycle, but driven by the debt maturity cycle.

So, I believe this is not a 4-year cycle, but a 5-year cycle. In a 5-year cycle, we have already passed the trough, and the next step is the upward phase, with the cycle expected to peak at the end of 2026, not 2025. This is a breakthrough understanding for us as global macro investors: understanding that cryptocurrency is essentially a macro asset.

Moreover, the altcoin/Bitcoin cross rate is driven by the business cycle, and the business cycle seems to be bottoming out, not peaking."

Solana Co-founder: Stablecoins are the Clear Direction Now, Solana Aims to Capture as Much Market Share as Possible

On December 11, Anatoly Yakovenko, co-founder of Solana, stated at the Solana Breakpoint conference that the core of achieving growth lies in continuously building products that people need. He emphasized that stablecoins are the clear direction now, with an expectation of $1 to $10 trillion in stablecoins being brought on-chain, driving the gradual tokenization and on-chain integration of approximately $500 trillion in global assets.

Toly stated that the strong property rights protection and free-market capitalism brought by public chains and cryptography do not conflict with Wall Street logic, but rather complement it by eliminating faults and risks through software, thereby expanding Wall Street's financial scale at a faster pace. He emphasized that stablecoins are expanding rather than replacing the dollar, and that L1, especially PoS networks, have clear value capture mechanisms, with Solana aiming to capture as much market share as possible in this competition.

Lily Liu: SOL Spot ETF Has Seen Nearly $1 Billion in Net Inflows in 6 Weeks, DAT Company Will Serve as a Bridge Connecting Solana and the Public Market

On December 11, Lily Liu, chair of the Solana Foundation, stated at the Solana Breakpoint 2025 conference:

"Solana is the first blockchain platform to establish a policy research institute. Today, it is imperative for every institution to formulate a digital asset strategy. As these institutions enter the blockchain space, they are choosing Solana. Western Union processes over $60 billion in remittance business annually and has chosen Solana. Pfizer processes $20 trillion in merchant payments annually and has also chosen Solana. Other institutions are following suit.

Of course, ETFs are a major theme this year. We have finally welcomed the physically-backed Solana staking ETFs—they made a significant entry into the Solana ecosystem about six weeks ago, and in just six weeks, the assets under management have approached $1 billion. While the overall market has performed poorly, we have seen continuous net inflows for three consecutive weeks. Six physically-backed Solana staking ETFs have already been listed in the U.S. market.

Another important theme this year, though somewhat controversial, is DAT (Digital Asset Treasury). Many view DAT as a short-term liquidity tool, but we hold the opposite view. Because Solana is one of the few platforms that allows enterprises to build both at the infrastructure layer and the asset layer. We believe DAT will be a long-term ecosystem company that will serve as a bridge connecting Solana with the public market, building infrastructure, asset management systems, and integrating all these functions."

Coinbase Executive: App Now Features DEX Trading Functionality Based on Solana

On December 11, Andrew Allen, head of Solana products at Coinbase, stated at the Solana Breakpoint conference that Coinbase has launched DEX trading functionality based on Solana within its app, allowing users to trade any Solana-based tokens directly in a familiar interface, with payments made using USDC, cash, bank accounts, or debit cards, while the entire slippage and routing are handled automatically in the background.

Andrew stated that Coinbase is fully expanding its native support for Solana, and in the future, users will be able to see Solana assets directly in the app, ensuring that they can reach millions of Coinbase users without the need for a token listing process, provided there is sufficient liquidity.

Bitwise Co-founder: Applications in the Solana Ecosystem Truly Utilize the Last 1% of Network Performance

On December 11, the co-founder and CIO of Bitwise stated at the Solana Breakpoint conference that compared to networks like Ethereum, applications on Solana truly utilize the last 1% of performance, providing users with the next marginal liquidity and scalability.

On many chains, running a node is simply "downloading software, double-clicking to start," and after that, it makes little difference who stakes more or less; the applications that can be built for the network and users are almost the same; but on Solana, the application landscape changes daily, with protocol layers, performance, and capacity rapidly iterating, and node performance directly determines the ceiling.

Because of this, we are particularly concerned: when this product (referring to staking ETFs/trusts) locks in more and more SOL and its weight increases, it is essential to ensure that the ecosystem, developers, users, and even the entire community feel that its scale expansion will not "break" the market structure or ecosystem, but rather make the network more stable, reliable, and capable of supporting the next round of innovation.

Paxos CEO: Applied to the U.S. SEC for Clearing Agency License to Natively Issue On-Chain Stocks and Bonds

On December 11, Chad Cascarilla, co-founder and CEO of Paxos, stated at the Solana Breakpoint conference that Paxos has applied to the U.S. SEC to become a clearing agency, which will enable it to directly custody and natively issue on-chain stocks and bonds, allowing users to hold real underlying assets rather than derivatives. He emphasized that this will lay a critical foundation for the large-scale on-chain integration of traditional financial assets.

Cascarilla stated that Paxos aims to drive traditional assets into the on-chain environment and continue to expand in the areas of stablecoins and asset tokenization, including the growth of USDG and gold tokenization products. He believes that public chains will become a unified global asset trading arena, significantly enhancing market accessibility and liquidity.

Galaxy DeFi Head: Solana is the Only Blockchain Capable of Supporting Tokenized Securities

On December 11, Marcantonio, head of Galaxy DeFi, stated at the Solana Breakpoint conference: "Galaxy Digital is listed on NASDAQ as a publicly traded stock. But we chose to tokenize our stock on Solana because, in our view, Solana is the only blockchain that possesses the necessary speed and efficiency to support tokenized securities."

We hope that Solana can achieve absolute dominance, so that when you compare the prices of Solana and the same assets on Nasdaq, you would choose to buy on Solana. That is our ultimate goal."

Anza Chief Economist Max Resnick: SOL Trading Volume on Solana Network is Three Times That of Binance, Competition is Extremely Fierce

On December 11, Max Resnick, chief economist of Anza, a research and development company for Solana, stated at the Solana Breakpoint conference, "We reached 100,000 TPS in May. Not on the testnet, not in the white paper, but in the official launch. The market structure is also evolving in real-time: proprietary market makers are tightening the spreads, and now the SOL-USD trading volume is three times that of Binance, with competition being extremely fierce, and the order book is becoming tighter and deeper every day."

Circle CEO: Circle Gateway to Launch on Solana

On December 11, Jeremy Allaire, co-founder and CEO of Circle, announced at the Solana Breakpoint conference that Circle will soon launch Circle Gateway on Solana, enabling cross-chain instant access to a unified USDC balance.

Sunrise CEO: Successfully Launched MON, Trading Volume Exceeds Hyperliquid and Several CEXs in the First 24 Hours

On December 11, Saeed, CEO of Sunrise, a liquidity gateway in the Solana ecosystem, stated at the Solana Breakpoint conference that the first asset launched on Solana by Sunrise is the MON token. We brought a non-native token that was not originally issued on Solana directly into the Solana ecosystem on its first day, first minute. It competes not only with all other on-chain trading venues but also directly faces numerous CEX competitors.

As a result, within 24 hours of listing, its trading volume exceeded that of well-known platforms such as Hyperliquid, KuCoin, Kraken, Coinbase, Bybit, Bitget, and Gate—some of which have user bases exceeding one million. Even more impressively, it has tighter spreads than these established CEXs and higher trading volumes, all supported solely by the native user base of Solana.

Additionally, Saeed believes that if assets can be issued on Solana and can be competitive like their centralized counterparts, then this is not just about listing crypto tokens, but could also include stocks, commodities, or any financial products.

Helius CEO: Recommends Investors Buy BSOL to Help Developers Build Faster Applications

On December 11, mert, CEO of Helius, stated at the Solana Breakpoint conference that investors can purchase BSOL, the stock token managed by Bitwise (i.e., the Bitwise-issued SOL spot ETF), but because you bought it, we use the proceeds to make the network run faster—thus, your transaction directly helps developers build applications faster.

Circle CEO: Solana's Appeal is Growing, More Platforms are Adopting USDC on Solana as Their Main Infrastructure

On December 11, Jeremy Allaire, CEO of Circle, stated at the Solana Breakpoint conference that Solana's trading volume far exceeds that of all other chains. The infrastructure of Solana is becoming increasingly mature, and its appeal is growing day by day. More and more large platforms aimed at consumers and merchants are using USDC on Solana as their preferred infrastructure.

DoubleZero Co-founder: 15 Core Contributors are Providing Fiber Optic Cables for Solana to Build a High-Performance Alternative Internet

On December 11, Austin Federa, co-founder of DoubleZero, stated at the Solana Breakpoint conference that DoubleZero has many independent contributors—now increased to 15—who are contributing fiber capacity to the Double Zero network. These are real physical fiber cables that are being integrated to create a completely independent transmission path for Solana.

This "crowdsourced fiber" approach is unprecedented: all existing high-performance chain networks are operated by a single company holding a master private key; Double Zero does not have such a "single point" but is instead laid out and controlled by 15 contributors each managing their own fiber lines.

Yat Siu: Animoca Brands has Invested in Over 628 Portfolio Companies, About 200 of Which are Gaming Projects

On December 11, Yat Siu, co-founder and director of Animoca Brands, stated at the Solana Breakpoint conference that Animoca Brands has invested in over 628 portfolio companies, of which about 200 are gaming projects. He believes that Bitcoin is similar to digital gold, while altcoins are akin to the stock market, serving as the growth engine of the crypto space. Given that altcoins carry real use cases, their total market capitalization will eventually far exceed that of Bitcoin.

OSL Group to Issue Stablecoin USDGO on Solana

On December 11, Zhang Yinghua, Chief Business Officer of OSL Group, announced at the Solana Breakpoint 2025 summit that OSL Group will launch the USD stablecoin USDGO in collaboration with the Solana network. OSL Group will serve as the brand and distributor of USDGO, while Anchorage Digital Bank will be the issuer.

It is reported that USDGO will be pegged to the US dollar at a 1:1 ratio and will be subject to U.S. federal regulation, with plans for an official launch in the first quarter of 2026. Solana will be the first public chain to deploy USDGO, with plans to expand to more chains in the future. This is not just "another stablecoin," but a truly compliant stablecoin payment infrastructure for enterprises and institutions.

Bhutan Announces Launch of the World's First Sovereign-Backed Gold Token TER on Solana

On December 11, government officials from Bhutan announced at the Solana Breakpoint 2025 summit another milestone collaboration with Solana, marking a key step for Bhutan towards becoming a "crypto-friendly nation":

On December 17, 2025—Bhutan's National Day—the world's first sovereign-backed gold token will launch on the Solana chain. The token is named "TER," which means "treasure" in Bhutanese.

It is reported that TER will be a SPL token anchored 1:1 to Bhutan's treasury gold, auditable in real-time, and settled in seconds, marking its first entry into the on-chain world.

Solayer Mainnet Alpha Version Officially Launched, Supporting Real-Time Financial Applications

On December 11, Solayer officially released its InfiniSVM mainnet Alpha version. InfiniSVM is a hardware-accelerated blockchain capable of achieving a sustained throughput of 300,000 transactions per second, with sub-second finality. This network allows developers to deploy existing Solana applications while achieving outstanding performance, unlocking application scenarios in high-frequency trading, real assets, and institutional finance.

Users can connect SOL through sBridge and immediately interact with deployed applications. Developers can access documentation and deployment tools to start building applications on InfiniSVM.

This release coincides with the Solana Breakpoint taking place in Abu Dhabi, marking Solayer's integration into the Solana ecosystem and its commitment to providing support while continuously expanding its capabilities in demanding application categories.

Galaxy Founder: Solana is Still Viewed as a Blockchain Network "Born for Capital Markets"

On December 11, Mike Novogratz, founder and CEO of Galaxy, stated at the Solana Breakpoint conference:

"As regulation becomes clearer, the industry has entered a phase where 'we must truly build products that users will use.' The value of crypto assets is driven by community and real growth, and the narrative must be supported by real usage and innovation. Solana, with its high-speed performance, is seen as a chain 'born for capital markets,' and Galaxy's collaboration with Jump is also based on its capabilities in high-frequency infrastructure."

The cryptocurrency market has experienced fluctuations this year, but I remain optimistic. Just this year, a client of Galaxy completed a Bitcoin sell-off transaction worth $9 billion, with early investors cashing out some profits to diversify their portfolios. Meanwhile, a steady stream of new entrants continues to buy Bitcoin. I have been attending conferences in Abu Dhabi for the past few days, which has further reinforced my optimistic outlook. The Abu Dhabi Financial Week brought together top investors from around the world, including capital giants. After engaging with these industry leaders, I am even more convinced that the global wave of embracing blockchain and digital assets is accelerating, not slowing down."

Kyle Samani Explains Solana ACE: Will Allow Developers to Specify Custom Sorting Rules

On December 11, Kyle Samani, co-founder of Multicoin and chairman of Forward Industries (FORD), stated at the Solana Breakpoint conference that ACE (Application-Controlled Execution) will allow developers to specify custom sorting rules while still operating on a single global system with a global liquidity pool.

As part of Solana's "Internet Capital Markets" roadmap for July 2025, ACE grants smart contracts millisecond-level control over transaction sorting, combining traditional financial microstructure with blockchain scalability to reduce fragmentation in DeFi.

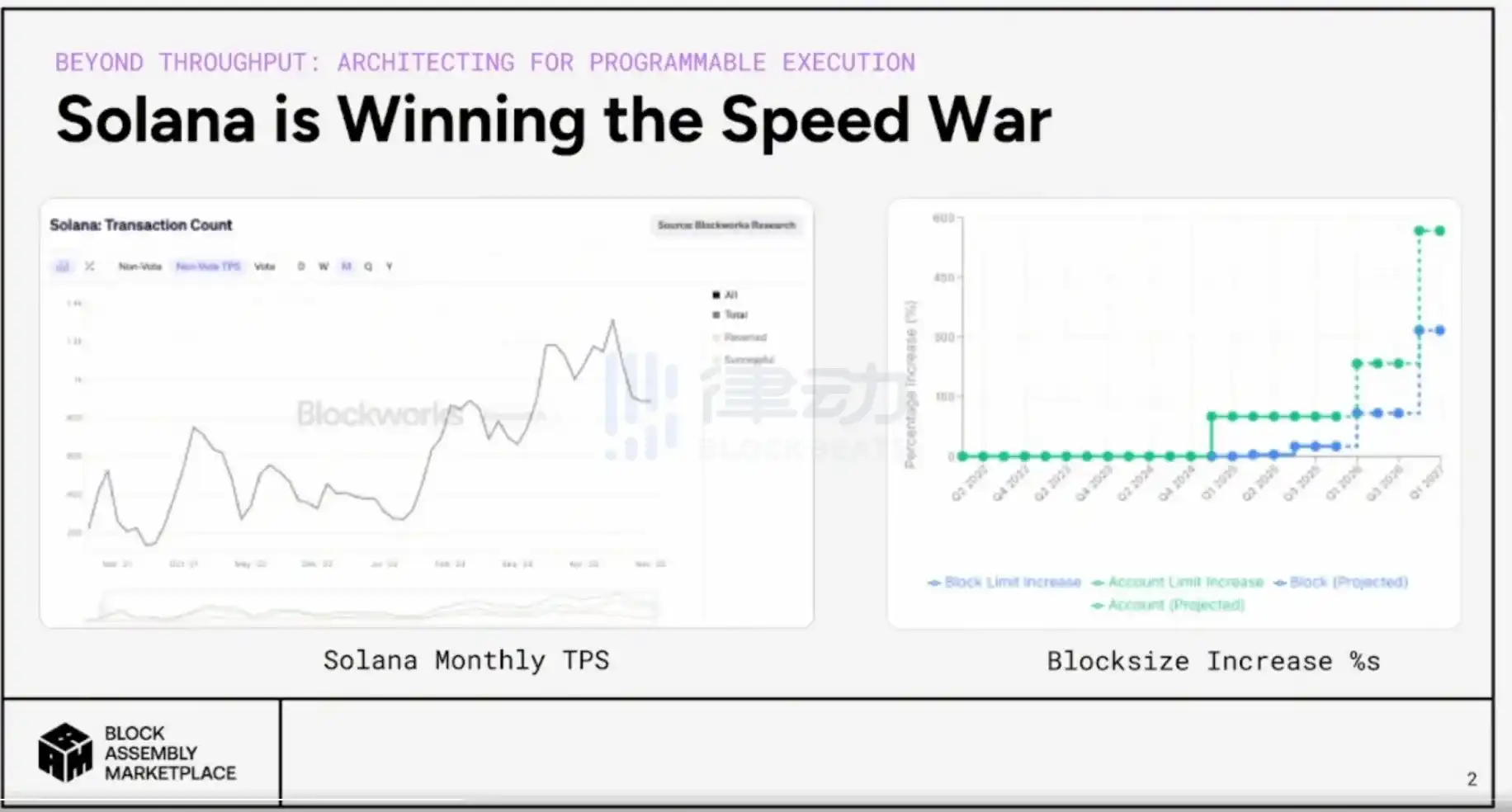

Jito Co-founder: Solana is Winning the Speed War, Network Block Computation Limit Will Jump to 100 Million Computation Units Early Next Year

On December 11, buffalu, co-founder and CEO of Jito, stated at the Solana Breakpoint conference that Solana is winning the speed war, which is becoming very evident. "Over the past few years, we have witnessed a sixfold increase in transactions per second, thanks to the collective efforts of all Solana ecosystem engineers and outstanding application developers.

In the chart on the right, you can see the continuous growth of block space over the past few years. At the beginning of this year, Solana's computation limit per block was about 48 million computation units, which was then raised to 50 million and 60 million computation units. It is expected to jump to 100 million computation units early next year and continue to maintain exponential growth."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。