Original Title: 《Analysis: Stripe's Tempo is building the Apple of payment blockchains》

Author: Lex Sokolin

Translation and Compilation: BitpushNews

Speed is impressive!

Stripe's controversial payment chain—forked from Ethereum and undergoing key transformations for fintech applications—has now launched its testnet.

It is worth noting that the project has completed a seed round financing of $500 million, supported by Stripe and Paradigm, targeting the payment industry as its first market entry point.

(Source Chart: Technical Architecture Comparison)

Those interested can check the code repository here.

What we first notice is that the technology is released under the Apache or MIT open-source licenses. This is good news.

The Apache 2.0 license is a popular permissive open-source license introduced by the Apache Software Foundation, allowing broad commercial use, modification, and distribution, requiring only the retention of copyright notices, provision of license text, and indication of significant modifications, while including explicit patent grants from contributors to users.

Thus, the open-source community can freely adopt any technological achievements of Tempo. This means that while Ethereum may not gain the commercial landing advantages that Tempo brings to Stripe, it can still absorb the technological innovations at its protocol layer.

So, what are the key differences? We quote the core design description:

Payment Channels Reserved for TIP‑20 Transfers

TIP‑20 is a stablecoin issuance standard created through specific functions. Its core effect is to bundle stablecoin issuance with prioritized transfers on-chain.

In Ethereum, different stablecoin issuers compete with each other, and these issuers are not fundamentally different from other token issuers.

On Tempo, stablecoin issuance contracts are solidified in TIP20Factory, creating possibilities for future on-chain revenue. Establishing fast lanes for such tokens gives them a permanent advantage. However, anyone can use the factory contract, which means there is still competition at the distribution level, but the manufacturing level tends to be centralized.

Low Predictable Fees for Stablecoin Payments

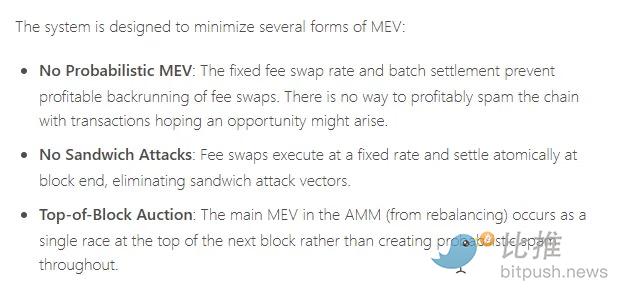

Users can directly pay Gas fees with USD stablecoins at the start. The fee automatic market maker (AMM) will convert it into the stablecoin preferred by validators. The target cost for TIP‑20 transfers is less than one thousandth of a dollar ($0.001). Liquidity providers in the AMM can earn 0.3% of the fee revenue from each exchange. This design also avoids miner extractable value (MEV) and arbitrage attacks on transactions—issues that have caused users over $1 billion in losses on Ethereum.

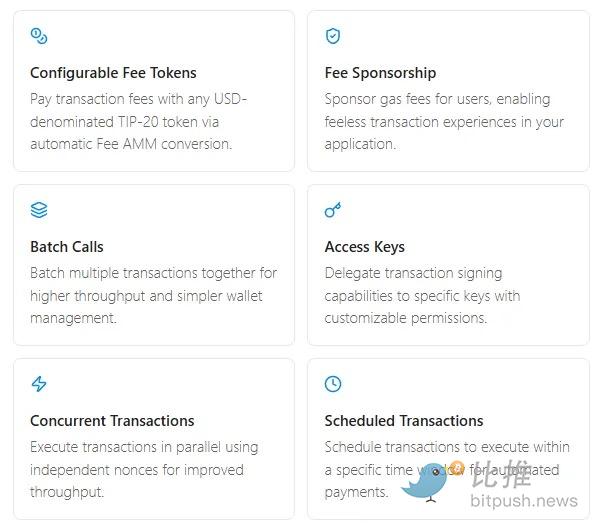

Generalizing the way users pay transaction fees is a commendable design direction, and Tempo achieves multi-directional payment options.

Here, any asset can be exchanged for stablecoins to pay Gas; whereas on Ethereum, although any asset (including stablecoins) can also be exchanged for ETH to pay Gas, this process is not automated and requires support from smart accounts.

More importantly, there is execution competition among different AMMs on Ethereum, rather than solidifying a specific AMM in the chain mechanism. This competition is crucial when trying to stimulate innovation for new financial primitives; however, for Tempo, which aims to industrialize financial primitives, its importance is relatively low.

Native Smart Account Integration

Tempo integrates high-quality concepts of smart accounts into transactions: (1) supports multi-operation batch payments (payroll, settlements, refunds); (2) fee sponsorship mechanism, allowing applications to pay Gas on behalf of users; (3) scheduled payment features, supporting periodic and timed payments at the protocol level; (4) modern authentication methods using passkeys (such as biometric logins).

(Appendix: Long-term competition trend chart between Microsoft and Apple according to Statista)

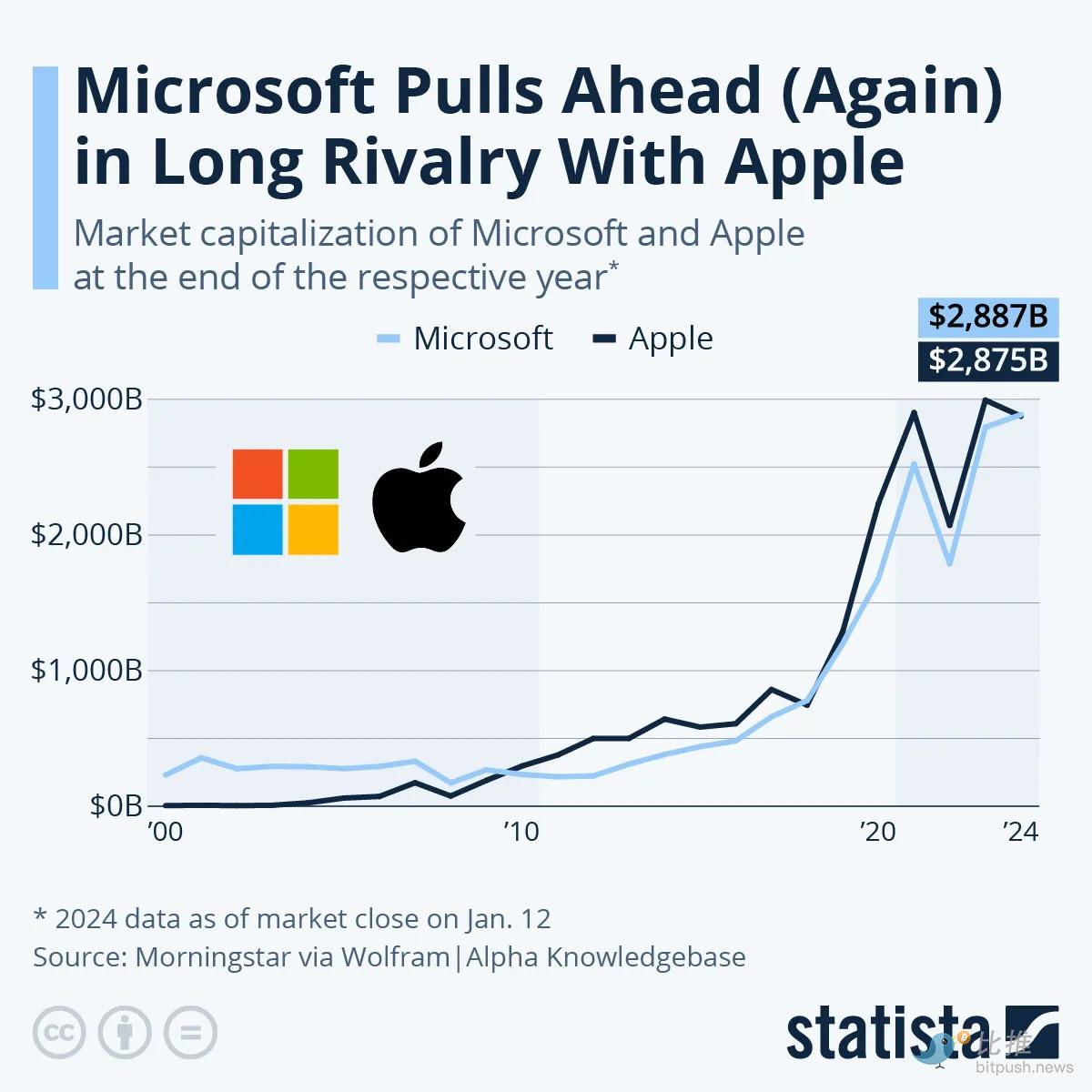

Just as Stripe itself integrates various fintech services into a single platform, Tempo is absorbing the most in-demand payment functions as a native part of the chain, rather than leaving it to third-party developers to compete for user recognition. This embodies the Apple-like software development philosophy—where all experiences are meticulously designed, proprietary, and vertically integrated—rather than the Windows-like model of gathering developers to create third-party applications (the latter may form functional breadth but often lacks security and a unified user experience). More broadly, this reflects the essential differences between closed and open architecture systems.

Performance and Finality

(Source: Ethereum Validator Distribution Map)

Tempo is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to use the same tools, languages, and frameworks (such as Solidity, Foundry, Hardhat) to deploy and interact with smart contracts. Its consensus algorithm employs Simplex BFT consensus (originating from Commonware, Tempo has invested $25 million in it). The validator set is currently privately licensed, which is an expected design for the initial stage of a private enterprise.

In contrast, Ethereum has anti-fragility and anti-censorship, meaning anyone can freely join or leave the validator set. Currently, there are about 1 million active validators on-chain daily.

Overall, the core impression of Stripe/Tempo is that it is rapidly advancing with a vertically integrated product approach, aiming to capture the fintech market. Its collaborations with AI companies, Web2 enterprises, and traditional banks fully demonstrate its strength in driving blockchain commercial landing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。