Original | Odaily Planet Daily (@OdailyChina)

As 2025 is about to end, as the person who "loves to talk about making money and loves to write about interactions" among the authors of Odaily Planet Daily (most of this year's interaction tutorial articles were written by me), it is time to summarize the year in making money.

After clearing out the AI Agent section of meme coins at the beginning of the year, I spent most of my time on various popular interaction projects, trying out all the hot projects I could make money from, and of course, I didn't miss out on the pitfalls. As the end of the year approaches, I have also talked a lot with many friends who are equally enthusiastic about making money, summarizing the changes in this year's landscape. Because of this, I deeply feel that making money in 2025 has quietly shifted from "everyone mining for gold" to "a collective retreat."

Making money profits plummet, studios collectively exit

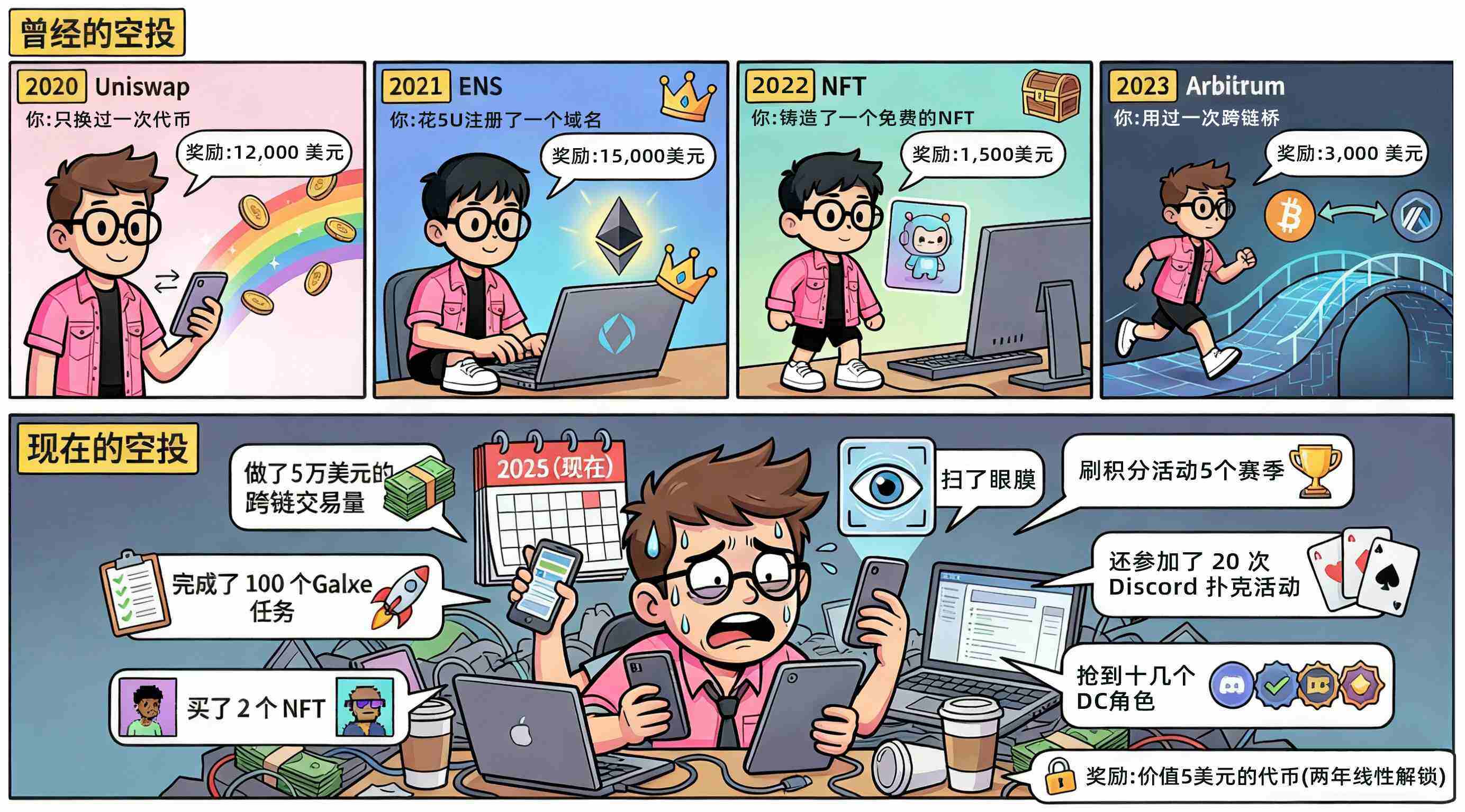

Looking back at 2025, the making money track has rapidly fallen from the "myth of getting rich" to the "winter of internal competition." Big profits have disappeared, small profits have shrunk, and "being counter-mined" has become the norm. This year, the most common phrase among "money makers" has most intuitively revealed this change: "Small profits are only 5 to 10 dollars, and the gas fees for claiming airdrops are more expensive than the coins; in the past, over 10% of non-locked airdrop rewards, now only 2 to 3% remain, and they have to be unlocked in batches."

The sharp decline in profits has directly triggered a mass exit from studios. "From once casually making money to now not even being able to cover the basic salaries of the team. It's not that we aren't trying hard, it's that the door of the times has quietly closed." According to interviews with Odaily Planet Daily, a large number of teams are either shutting down directly or shifting to more controllable businesses like cross-border e-commerce; the few remaining teams are almost entirely relying on Binance Alpha's daily "certain airdrops" to barely survive. However, the value of Binance Alpha's airdrop tokens has significantly decreased throughout November, and studios are likely to face a second wave of concentrated exits in the short term.

Even more absurdly, this year, many studios' largest source of profit is not token airdrops, but hoarding hardware. A friend from a studio joked: "I didn't make much money this year, but the memory sticks I hoarded in February went from 55 yuan to 240 yuan, making them the most profitable investment of the year."

The making money track has shifted from "myth of getting rich" to "winter of internal competition"

No altcoin market is the root cause of declining profits

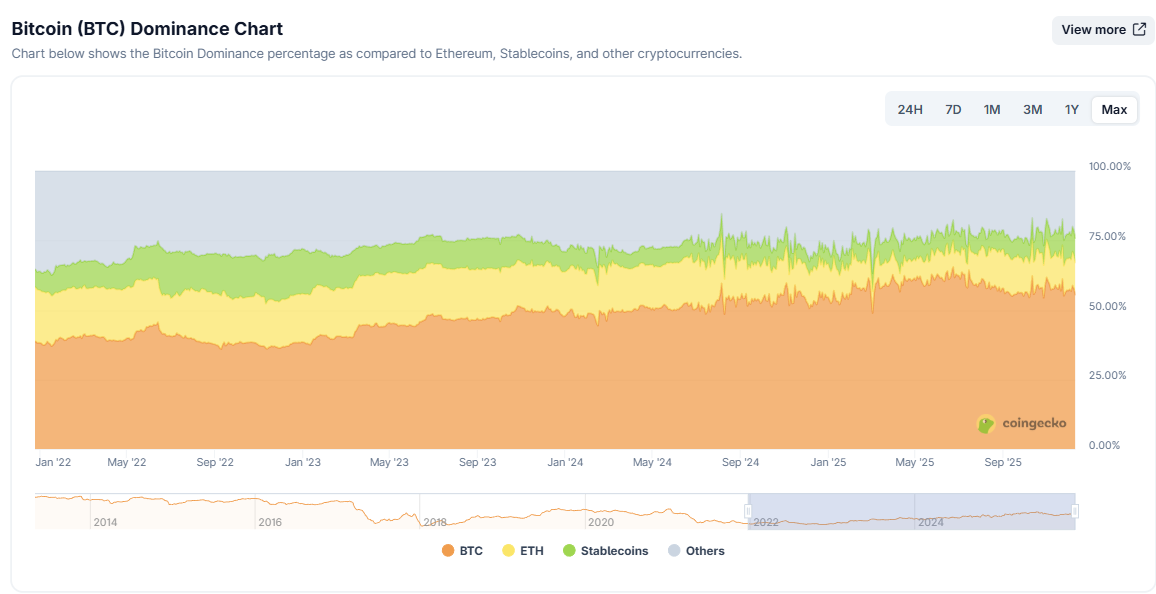

Making money profits essentially rely on the subsequent performance of airdrop tokens, and the amplification of airdrop value often depends on the tailwind of the "altcoin season"—that golden window when altcoins collectively rotate and surge by hundreds of times. However, throughout 2025, the crypto market has fallen into a prolonged pattern dominated by BTC, with altcoins overall remaining sluggish. According to on-chain data, BTC's market cap share has continued to rise, peaking at 63% this year. BTC's dominance means liquidity does not overflow, altcoins do not rotate, and new projects find it harder to gain momentum—without price amplifiers, airdrop values cannot rise, and making money profits are destined to weaken.

This "lack of altcoin market" situation directly strikes at the core pain point of making money—initial investments in gas fees, time, and resources often yield tokens that open low and fall further, or even go to zero, with single profits shrinking from the past tens or even hundreds of dollars to just a few dollars, barely covering gas fees.

Further analysis shows that, on one hand, the market cap of newly launched projects has generally opened lower this year, with the valuation system collapsing entirely. From the previous ARB and STARK airdrops, which opened with market caps of 10 to 20 billion dollars, to now many projects starting with only a few hundred million or even tens of millions in FDV, the prices lack imagination, and airdrops are already worthless at launch. (It must be said that the previously inflated valuations of top projects, with data being artificially inflated and lacking stickiness, are also inseparable from the airdrop crowd that abandons them after making money.)

On the other hand, even if the opening valuation is not high, it is difficult to expect a "catch-up." Many projects have "insider trading" entering early, and once they go live, they ruthlessly dump on the market, or even directly run away, with various forms of collapse occurring repeatedly: halving in a single day, plummeting over 80%, rising sharply at launch and then continuously declining, concentrated selling of airdrops, etc. (For more related content, read: From Sahara to Tradoor, a review of recent altcoin "varied decline" tactics) Many "old money makers" lament that "sell as soon as you make money" should become a hard rule, because 90% of altcoins are destined to go to zero, and the risks of heavy betting far exceed potential returns.

Therefore, the opening profits of airdrops are already extremely limited, and if one chooses to stubbornly hold on to the market and be a "diamond hand," they often not only miss the rebound but end up with even lower profits.

Despite the significant decline in making money profits in 2025, the track has not completely stagnated. Odaily Planet Daily has observed that the methods of making money are quietly diversifying, no longer just participating in testnet interactions daily or boosting mainnet trading volumes to earn token airdrops, but gradually forming multiple sub-directions.

Diversification of making money

From traditional making money to "skill-based making money"

In 2025, the biggest innovation in the making money track is the "mouth-based economy." InfoFi (Information Finance) incentivizes high-quality information creators through tokens, while alleviating the issues of information fragmentation and lack of trust in the crypto world.

Since Kaito launched the "Yap-to-Earn" mechanism, it has become easy to see a flood of posts analyzing "upcoming TGE projects" while scrolling through Twitter. Subsequently, Cookie launched Cookie Snaps, highlighting "analyzing crypto projects and KOLs to obtain quality CT content rewards," while Galxe used Starboard to help projects filter and incentivize key contributors through a data-driven approach. The introduction of these mechanisms has led KOLs to compete to publish project analysis posts to vie for token airdrops, making the concept of "mouth-based making money" popular in the community—where posting and writing reviews can easily earn project airdrops.

Traditional making money may have reached a turning point. The past hard work of "using multiple accounts to script and desperately grinding interactions" often ends up being cut off by the witch system—resulting in not only wasted efforts but also not seeing a single profit. Projects that were once run alongside for years, filled with expectations, ended up with the disappointing result of "being counter-mined," leaving people utterly disheartened.

The arrival of the "mouth-based" era, with platforms like Kaito and Cookie using content points and influence rewards, has lowered the participation threshold, offering faster returns, lower costs, and greater potential. In this new landscape, a high-quality post on platform X, complete with images and opinions, can generate more value than a week of on-chain interactions.

Now, posting on platform X as a "mouth-based maker" is essentially a new form of creating a "making money" premium account; adapting to the new model of making money is essential to obtain more token airdrops.

Binance Alpha: The main source of survival income for studios

Since its launch in May 2025, Binance Alpha has been hailed as the "wealth engine" of the making money world, especially peaking during the "golden month" of September. Since May, Binance Alpha and Binance Booster (For more related content, read: Don't just grind for airdrops, Binance Alpha's Booster activities are also worth participating in) have provided studios with "stable startup funds," earning between 500 to 2000 dollars a month, allowing studios to transition from "survival" to "expansion." Many money makers joked: "Binance is throwing money around, creating the illusion that money is blowing in from the wind."

In September, Binance Alpha entered a "token inflation period," with a large number of project parties flocking to conduct TGE, with airdrop frequencies reaching 1 to 2 per day. Influenced by the "wealth effect" brought by Binance Alpha, on-chain data showed that the daily transaction volume of Binance's Web3 wallet once soared to 5 billion dollars, accounting for 95% of the mainstream wallet share; the number of users also surged from 100,000 in August to 400,000.

Despite the surge in users, profits have shown a "few monks and plenty of meat" situation. According to the Binance Alpha profit report released by crypto KOL Pump Pump Superman on September 17, among the 26 airdrop projects from September 2 to September 16, the highest profit project was STBL, which had a launch sale value of 200 dollars, and if held until September 17, its value soared to 675 dollars. If all 26 projects were held until September 17, their total value would be 2529 dollars; even if all were sold at launch, a profit of 1544 dollars could be obtained.

Binance Alpha profit report (data as of September 17)

However, starting in October, the profits from Binance Alpha have shown a clear downward trend. The community generally complains: "Some studios have already stopped grinding, and some accounts with less than 1000 dollars have also started to leave," as Binance Alpha has transitioned from the "big profit" era of September (where single airdrops often exceeded 100 dollars, with launch peaks of 300 dollars, even over 500 dollars) to the "small profit" or "break-even/minor loss" stage.

There are two reasons for this change. First is the "overcrowding," the wealth effect in September attracted a large number of new users, especially making money studios, with the threshold for points continuously rising and competition during the claiming phase becoming increasingly fierce. Many people could only watch helplessly as their shares were snatched away amidst endless error messages and verifications; but more critically is the "scarcity," although the number of participants in Binance Alpha dropped from over 400,000 to 200,000 in November, which seems like a significant decrease, the actual value of airdrop tokens has shrunk even more dramatically. Many projects opened and immediately fell or crashed, with single-token profits plummeting, making the impact of reduced profits far more severe than the decrease in participants.

Indeed, "mouth-based making money" and Binance Alpha have brought new ways to earn in the making money track, but in the lukewarm crypto market of 2025, they are merely short-term stimuli, with very limited profit windows. What truly allows making money to persist and stabilize profits are the two major backers: "new token launches" and "stablecoin financial management."

New token launches are also an important component of making money profits

Although new tokens this year have generally been "high open, low close," with it not uncommon for them to halve from their peaks or even drop by 90%, as long as they are high-financing projects with significant social media discussion and concentrated sentiment, the profits from new token launches remain quite impressive. For these types of projects, a reasonable price at launch and full unlocking at TGE essentially means "if you get in, you earn."

The logic behind this is not complex; these high-financing projects often have intensive promotional activities before and after their launch, combined with a large number of KOLs collectively boosting sentiment, causing market enthusiasm to rapidly peak in a short time. The higher the sentiment, the easier it is to create a liquidity rush effect at launch, which significantly raises the initial pricing. For making money players, there is no need to bet on the track or gamble on the long term; as long as they seize the launch window, they can benefit from this "short-term premium."

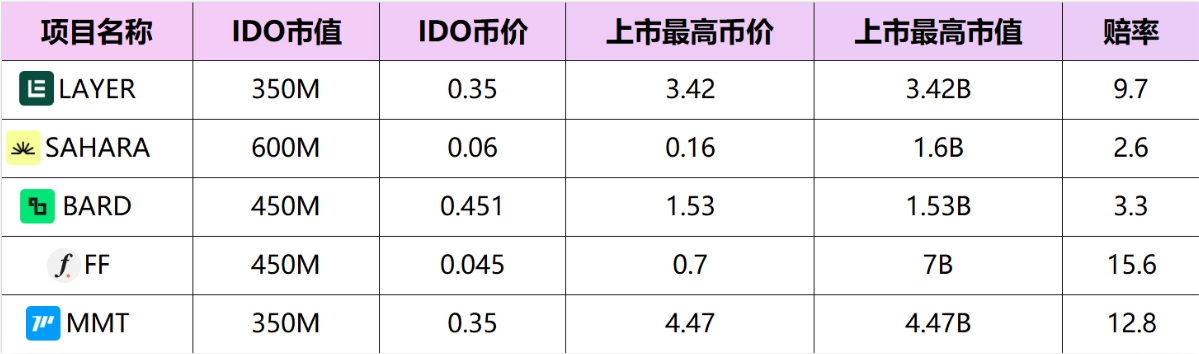

The five projects launched on the BuidlPad platform this year have all been "guaranteed profits" for new token launches. Overall, they generally provide instant returns of 2 to 5 times after TGE, with some like FF and MMT even reaching returns of over 10 times at historical peaks.

BuidlPad new token launch profit chart

In addition to BuidlPad, other popular new token launch platforms like Kaito and Legion, although some project launch prices are not fixed, as long as two signals are met: sufficient community enthusiasm before launch and obvious oversubscription during the subscription phase, they are generally worth participating in, with good returns on the day of TGE. Therefore, as December approaches, a new wave of new token launches has already begun, but not all projects are worth participating in; it is still necessary to conduct basic research and focus on projects with high financing, high oversubscription ratios, and high community discussion to have a chance at decent returns.

"Stablecoin financial management" is not a side issue, but the foundation for long-term making money

Making money is not just about "small bets for big gains"; earning stable returns is also a core requirement. The essence of making money has never been about taking risks, but rather obtaining more certain chips with minimal capital erosion. Therefore, depositing stablecoins for mining to earn airdrops essentially also falls under making money—simple operations, lower risks, and near-zero erosion.

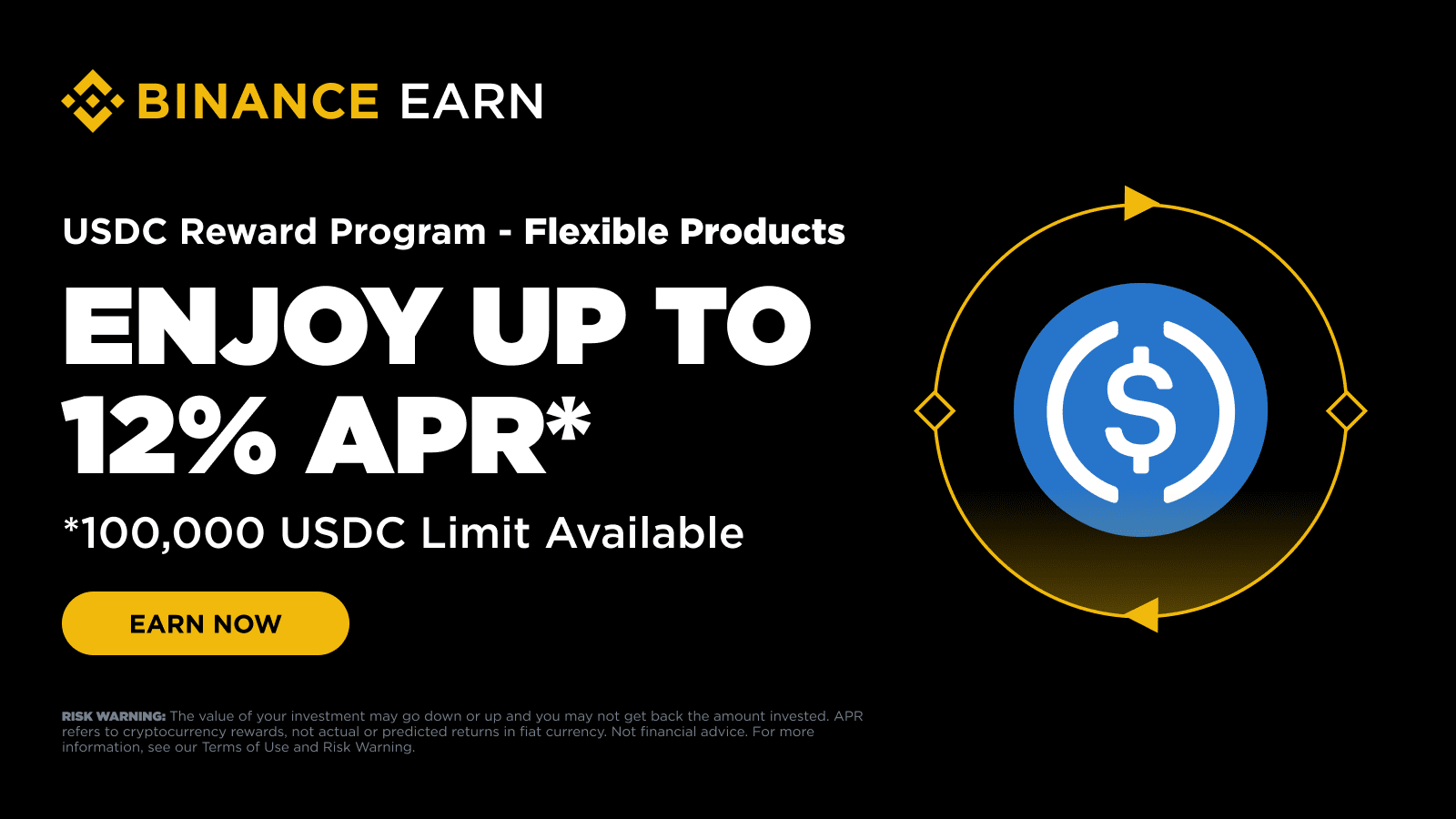

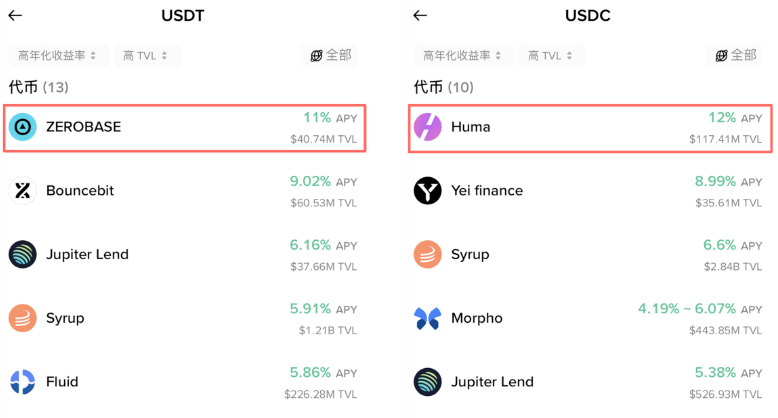

In August this year, Binance launched a month-long USDC savings activity, with a single account limit of 100,000 dollars and an annualized rate of up to 12%, which is a typical "high yield, low risk" making money opportunity. Thus, products that can stabilize around an annualized rate of about 10% are worth allocating some funds to—these are the "healing devices" that maintain blood levels during a bear market.

Binance launches USDC savings activity

In 2025, the "ceiling" for stablecoin mining returns is undoubtedly Plasma. On August 20, Plasma and Binance jointly launched an on-chain earning activity, allocating 1% of the total supply (100 million XPL) as deposit rewards and providing a 2% annualized return on USDT deposits. The activity exploded across the internet upon launch: the first round of 250 million USDT was snatched up in less than an hour; the second round of 250 million USDT lasted only 5 minutes. Subsequently, Binance lowered the single account subscription limit to 10,000 USDT and opened the last 500 million USDT quota, which was also fully subscribed within a few hours, with over 30,000 Binance users participating in total.

Based on Binance's final allocation of a total quota of 1 billion USDT, users depositing 10,000 USDT could approximately receive 1,000 XPL. Calculating at the opening price of 0.6 dollars, the airdrop profit would be about 600 dollars. More importantly, this profit only occupied about 1 month of time, translating to an annualized return of over 70%; plus the inherent annualized interest rate of about 2% on USDT, the actual returns for making money participants would be even higher. For stablecoin mining, this opportunity is undoubtedly a "rare find."

Plasma and Binance jointly launch on-chain earning activity

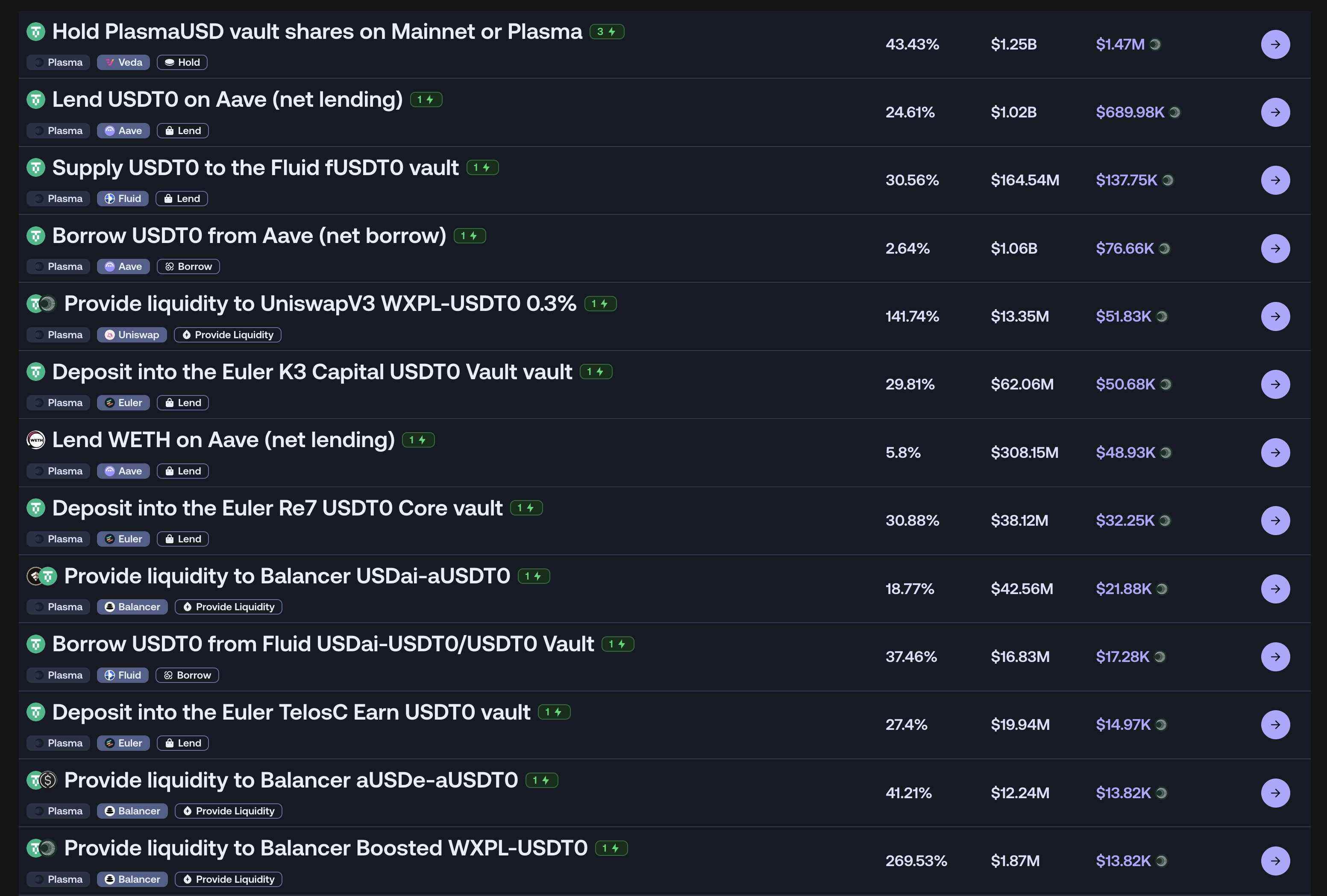

Additionally, "head mining" is also a golden opportunity for making money participants, with short-term annualized returns often reaching 30% to 40%. Community hot discussion projects like Plasma, Monad, or Linea have all provided token airdrops to reward network participants after their mainnet launches. Although these "head mining windows" are short-lived, the returns are substantial and are worth seizing as a key benefit.

Plasma mainnet launch day "head mining" profit chart

Finally, for individuals, in the Binance Web3 wallet, the financial products for USDT and USDC, DeFi projects with annualized returns exceeding 10% are generally worth participating in. Instead of randomly engaging in various activities on-chain, which can be hard to discern, it is better to directly choose DeFi products in the Binance wallet for higher security and easier operations.

Financial products in the Binance Web3 wallet

"Stablecoin financial management" is not a side issue, but the foundation for long-term making money. Only by steadily growing funds and maintaining the basic plate can one avoid being exhausted during cold market conditions and be "well-armed" during hot market conditions.

The industry does not collapse, and making money does not die

In 2025, it is not that the making money track is dead, but that the altcoin market is too poor. Whether in short-term speculation or long-term positioning, it is almost impossible to make money, and everyone is taking hits. Contract players face liquidation six times a month, accumulating debt; spot players have seen their investments go to zero twice in a year, questioning their lives; while making money participants may not wake up every day to find their wallets increased by hundreds of dollars like in the past two years, but their losses remain within a controllable range, making them one of the few groups that can still survive in this bear market.

Whether the market is cold or hot, making money remains a low-cost, sustainable path to profit.

During cold market conditions, making money allows us to slow down the pace. Although airdrop projects are decreasing, the slower pace actually provides time to research each project more thoroughly, to understand mechanisms, gameplay, and long-term value. Instead of recklessly opening high-leverage contracts on exchanges or blindly hoarding a bunch of altcoins, it is better to focus on refining a "premium account." The bear market may seem boring, but it is the most suitable phase for making investment research plans and preparing a "premium account."

During hot market conditions, making money resembles a "locking in profits" strategy. In a bull market, when altcoins rise collectively, the market valuations during new project TGEs are higher, and making money profits naturally increase. Compared to hoarding coins and making heavy bets on a single project, the advantage of making money lies in being able to ruthlessly sell at launch and cash out as soon as tokens are mined, not being completely tied to market sentiment. This not only allows for steady profit locking but also enables continuous accumulation of returns, providing controllable cash flow in a volatile bull market.

Therefore, regarding the changes in the making money track this year, 2026 will also require more strategic operations. While refining the X account, "mouth-based making money" is worth continuing to participate in; Binance Alpha should be evaluated comprehensively based on token value, airdrop thresholds, and trading erosion before deciding whether to participate; new token launches and stablecoin financial management should focus on finding quality targets to maintain stable returns across different market conditions.

Currently, while making money may not allow for overnight wealth like in previous years, steadily accumulating wealth is still achievable. The path of making money is ultimately a lonely one, relying on judgment, patience, and execution. Luck always exists, but those who can truly survive in the making money track and continuously accumulate wealth are those who understand persistence, learning, and rhythm.

The industry does not collapse, and making money does not die—I believe that as long as we persist, there will still be opportunities to laugh until the end in 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。