Original Title: Anchored, But Under Strain

Original Authors: Chris Beamish, CryptoVizArt, Antoine Colpaert, Glassnode

Original Compilation: AididiaoJP, Foresigt News

Bitcoin remains trapped in a fragile range, with increasing unrealized losses, long-term holders selling, and persistently weak demand. ETF and liquidity remain sluggish, the futures market is weak, and options traders are pricing short-term volatility. The market is currently stable, but confidence is still lacking.

Summary

Bitcoin is still in a structurally fragile range, pressured by increasing unrealized losses, high realized losses, and significant profit-taking by long-term holders. Nevertheless, demand keeps prices anchored above the real market average.

The market has failed to reclaim key thresholds, particularly the cost basis of short-term holders, reflecting ongoing selling pressure from recent high buyers and seasoned holders. If signs of seller exhaustion appear, a retest of these levels in the short term is possible.

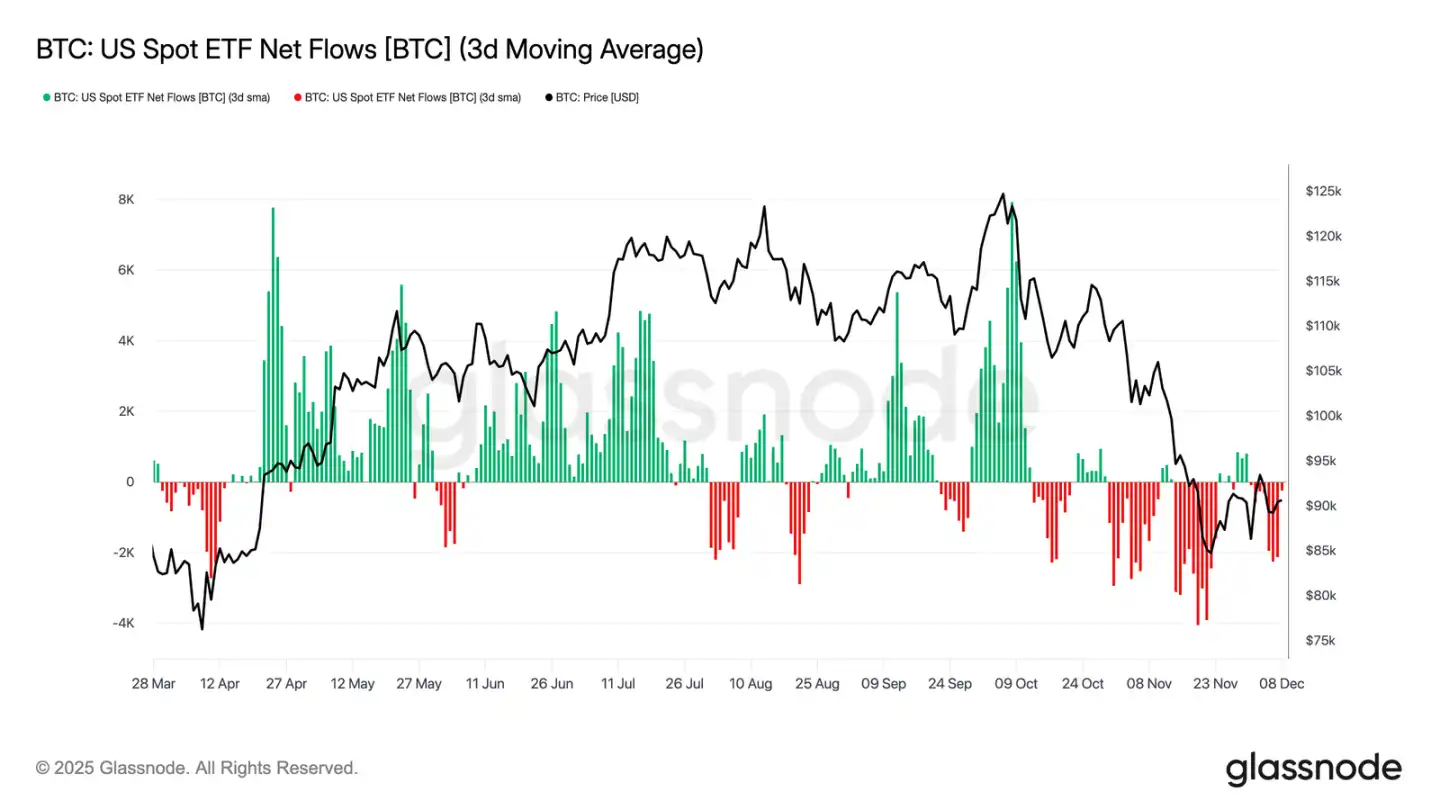

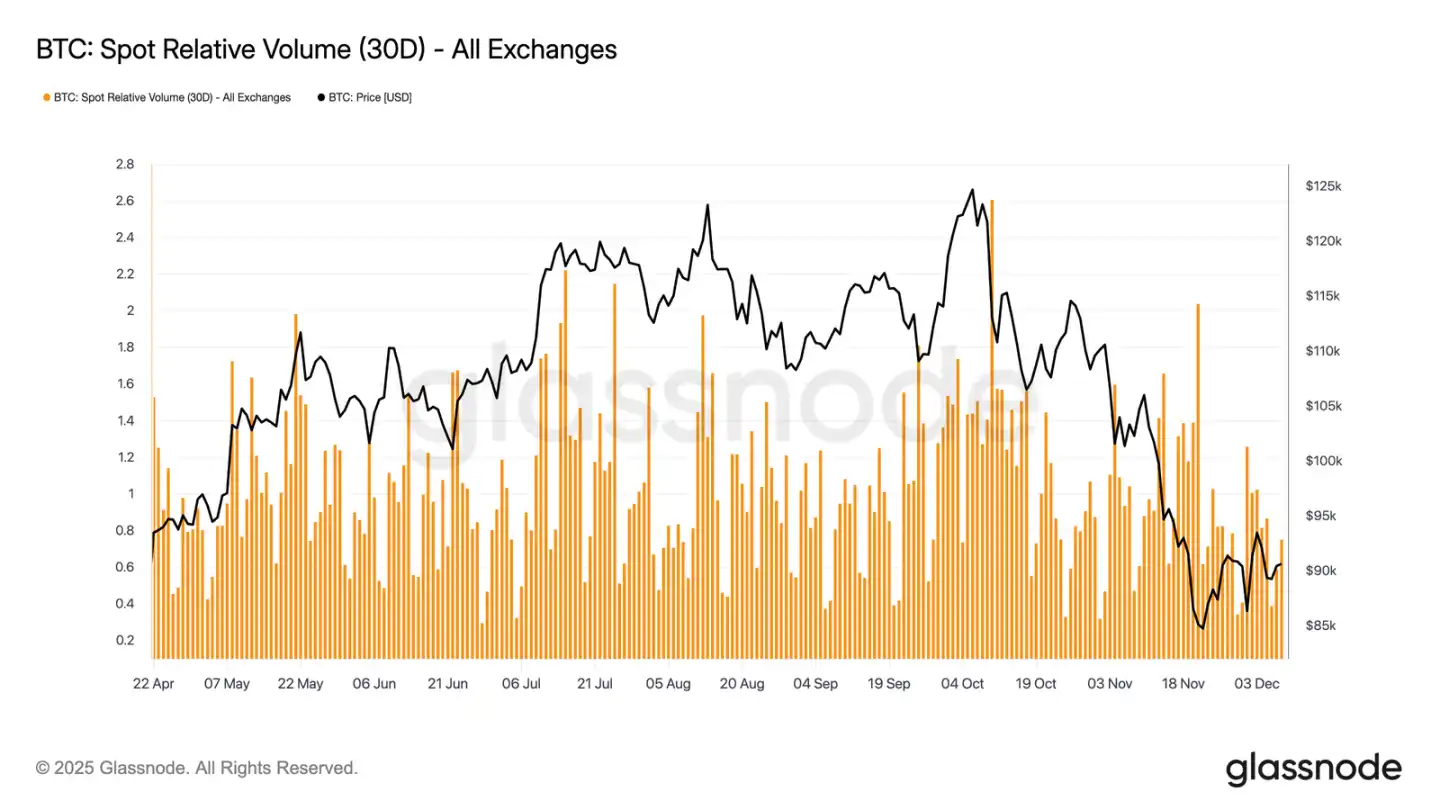

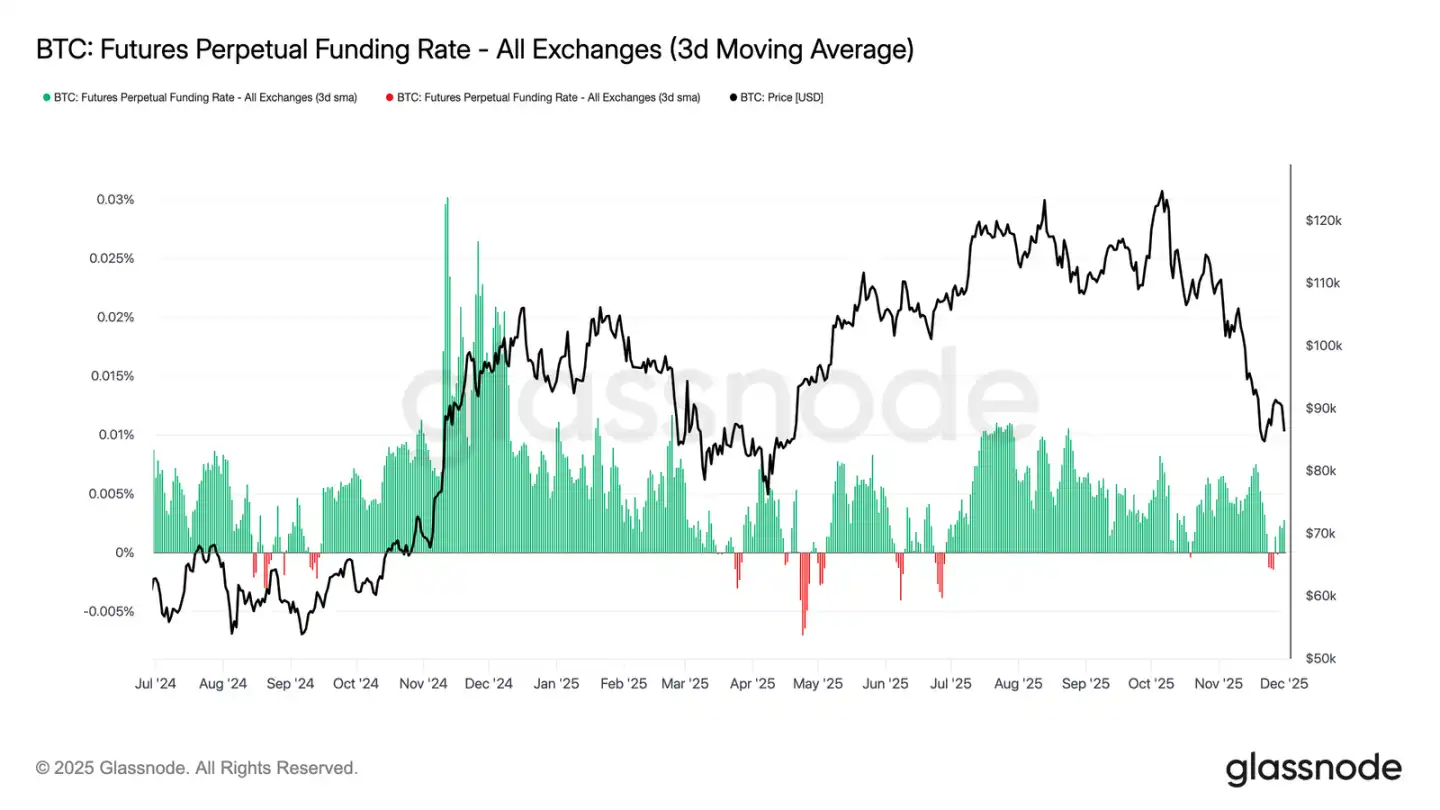

Off-chain indicators remain weak. ETF fund flows are negative, spot liquidity is thin, and futures positions show insufficient speculative confidence, making prices more sensitive to macro catalysts.

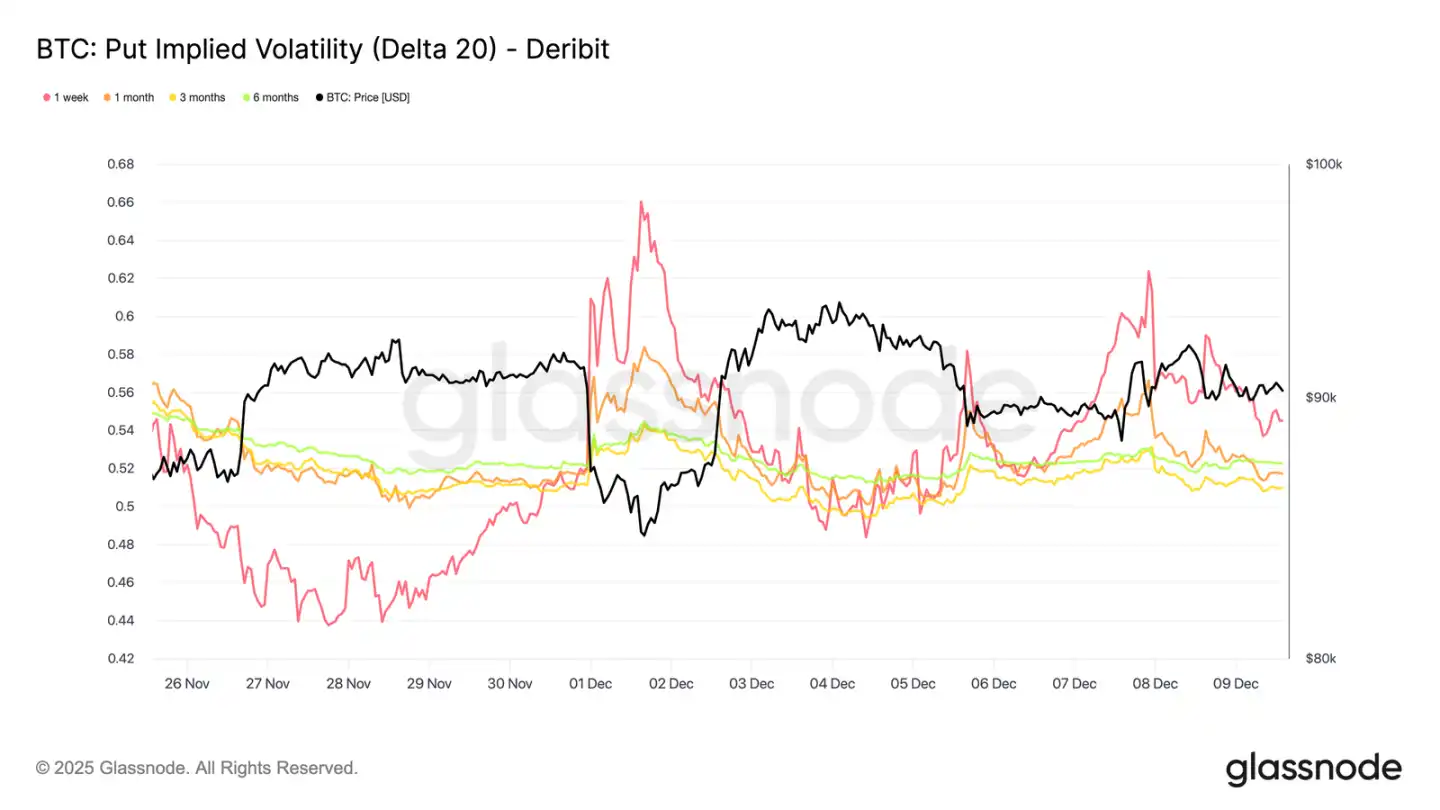

The options market shows defensive positioning, with traders buying short-term implied volatility (IV) and continuously demonstrating a demand for downside protection. The volatility surface signals short-term caution, but sentiment for longer durations is more balanced.

With the FOMC meeting as the last major catalyst of the year, implied volatility is expected to gradually decline in late December. Market direction depends on whether liquidity improves and whether sellers will relent, or if the current time-driven bearish pressure will persist.

On-Chain Insights

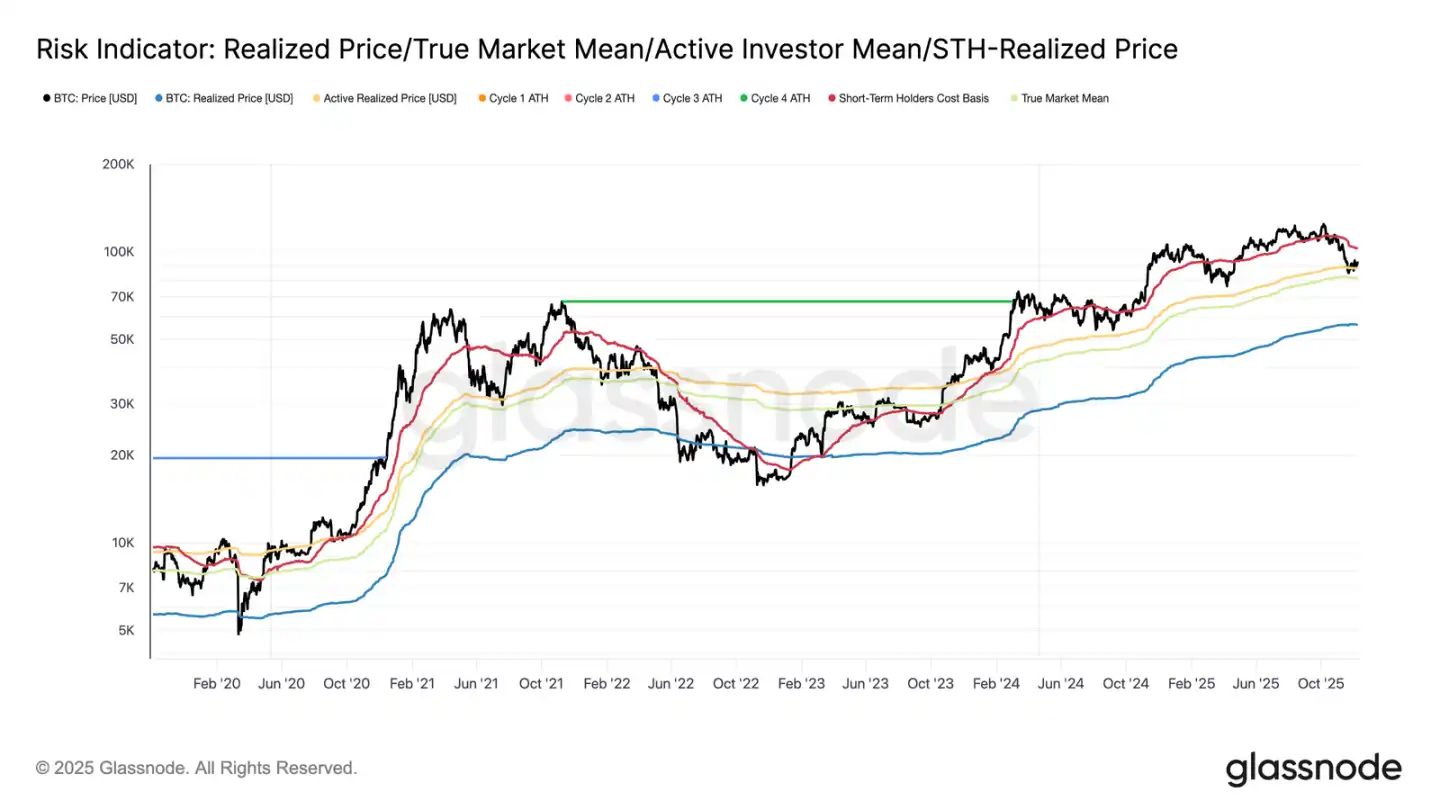

As Bitcoin entered this week, it remained constrained within a structurally fragile range, with the upper boundary at the cost basis of short-term holders ($102,700) and the lower boundary at the real market average ($81,300). Last week, we emphasized the weakening on-chain conditions, thin demand, and cautious derivatives landscape, all echoing the market dynamics of early 2022.

Although prices barely hold above the real market average, unrealized losses continue to expand, realized losses are rising, and spending by long-term investors remains high. The key upper limit that needs to be reclaimed is the 0.75 cost basis percentile ($95,000), followed by the cost basis of short-term holders. Until then, unless a new macro shock occurs, the real market average remains the most likely area for a bottom formation.

Time is Unfavorable for Bulls

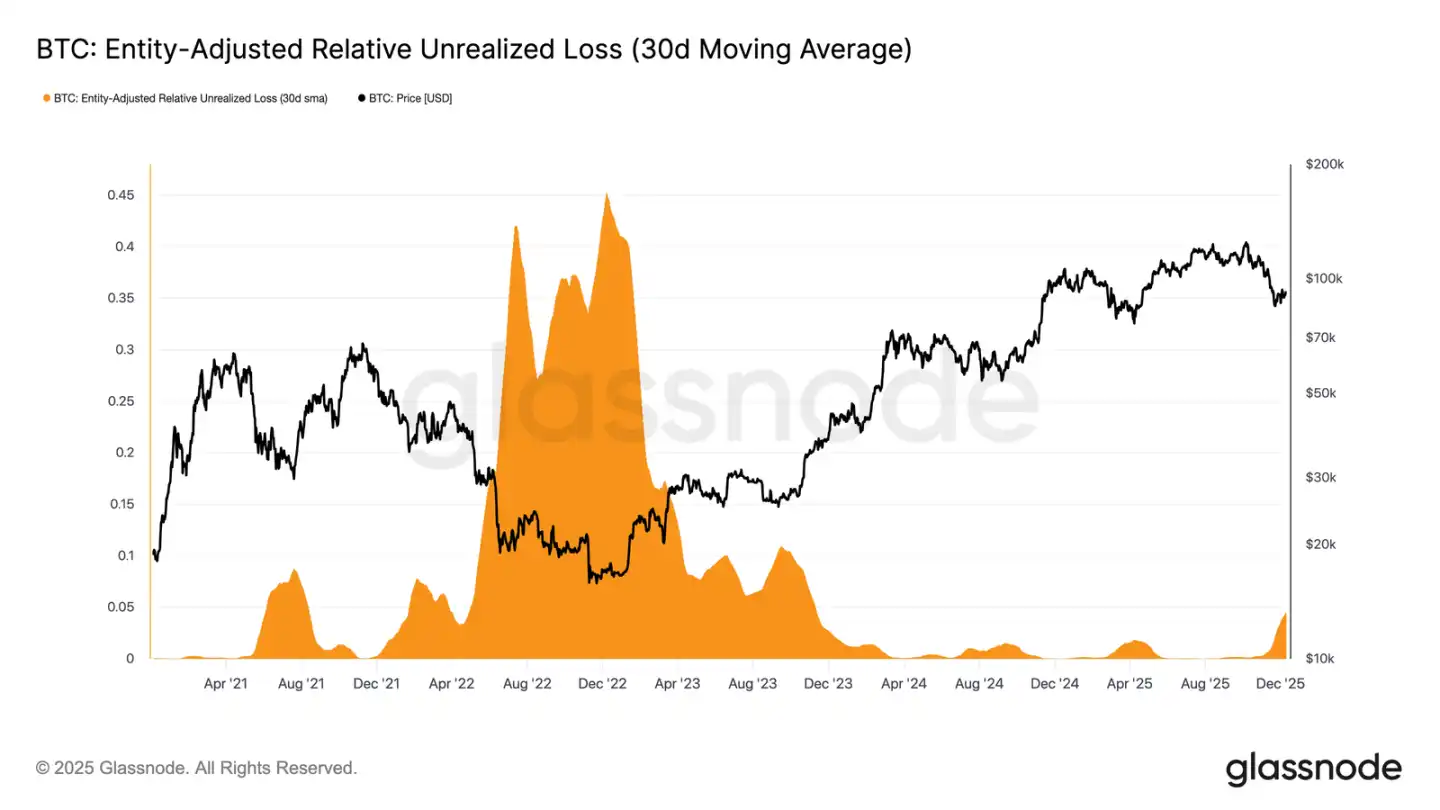

The market lingers in a mildly bearish phase, reflecting a tension between moderate capital inflows and ongoing selling pressure from high buyers. As the market hovers within a weak but bounded range, time becomes a negative force, making it harder for investors to endure unrealized losses and increasing the likelihood of realized losses.

Relative unrealized losses (30-day simple moving average) have climbed to 4.4%, having been below 2% for nearly two years, marking a shift from a phase of euphoria to one of heightened pressure and uncertainty. This indecision currently defines the price range, and resolving this issue requires a new round of liquidity and demand to rebuild confidence.

Increasing Losses

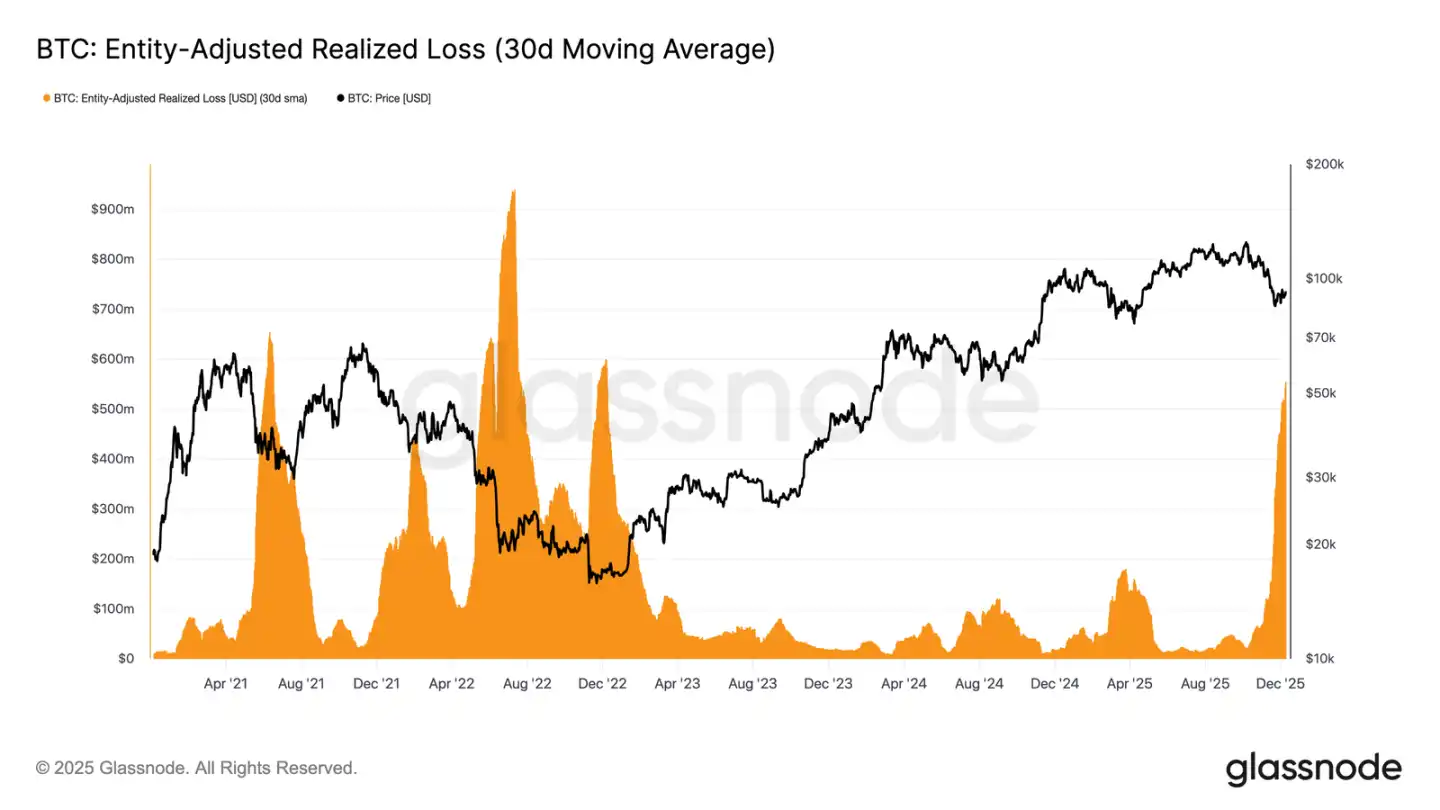

This time-driven pressure is more evident in spending behavior. Although Bitcoin has rebounded from the low of November 22 to around $92,700, the realized losses after adjusting the 30-day simple moving average entity have continued to rise, reaching $555 million per day, the highest level since the FTX collapse.

Such high realized losses during a mild price recovery reflect the growing frustration of high buyers, who choose to capitulate rather than hold through the rebound period.

Hindrance to Reversal

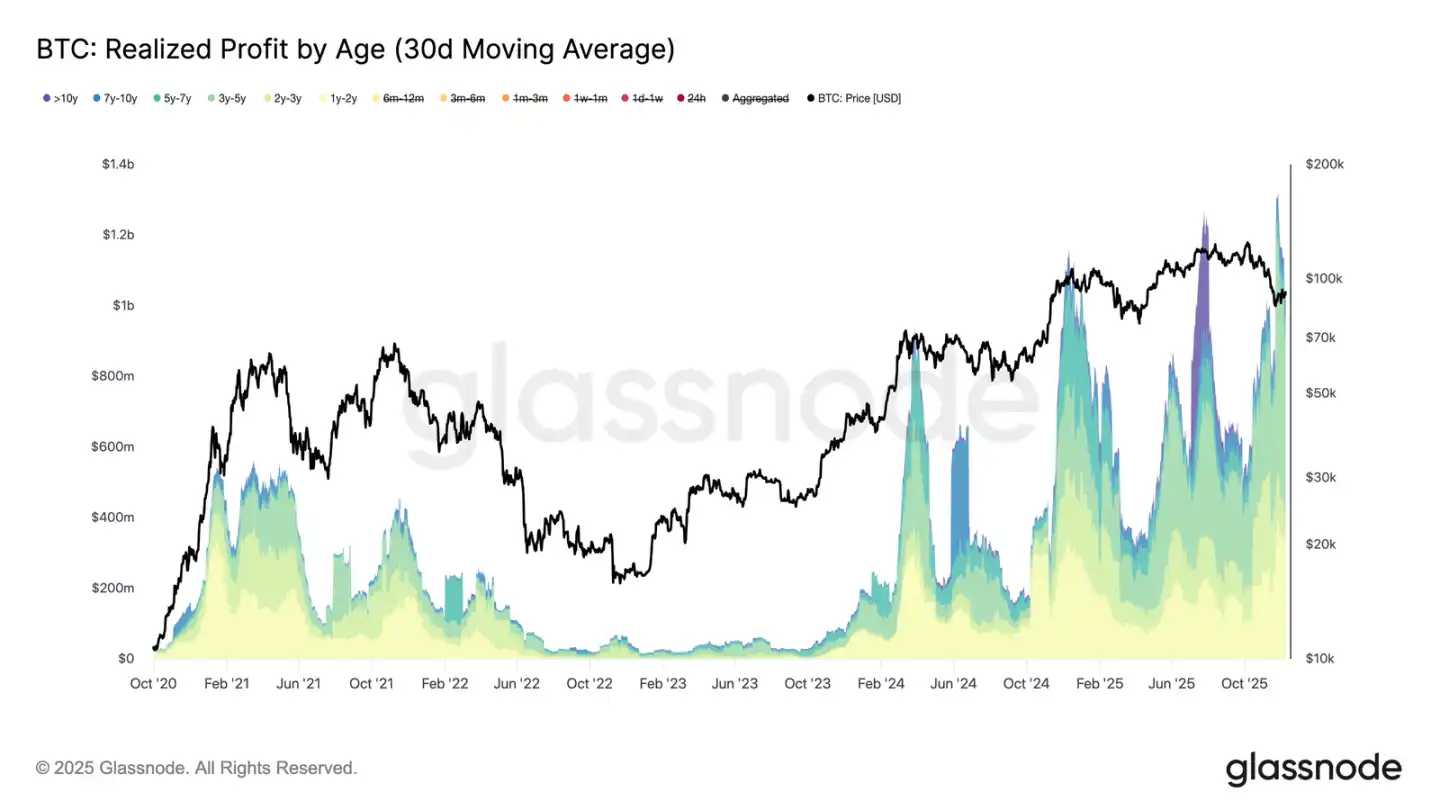

The rise in realized losses further hampers recovery, especially when it coincides with a surge in realized profits from seasoned investors. During the recent rebound, realized profits from holders of over one year (30-day simple moving average) exceeded $1 billion per day, peaking at over $1.3 billion at new historical highs. The dual forces of capitulation from high buyers and significant profit-taking by long-term holders explain why the market still struggles to reclaim the cost basis of short-term holders.

However, despite facing such immense selling pressure, prices have stabilized and even slightly rebounded above the real market average, indicating that persistent and patient demand is absorbing the sell-off. If sellers begin to show signs of exhaustion in the short term, this potential buying pressure could drive a retest of the 0.75 percentile (around $95,000) and even the cost basis of short-term holders.

Off-Chain Insights

ETF Dilemma

Turning to the spot market, U.S. Bitcoin ETFs have gone through another quiet week, with a three-day average net inflow remaining negative. This continues the cooling trend that began in late November, marking a stark contrast to the strong inflow mechanisms that supported price increases earlier this year. Redemptions from several major issuers remain stable, highlighting a more risk-averse stance taken by institutional allocators amid a broader market environment of instability.

As a result, the demand buffer in the spot market has thinned, reducing immediate buyer support and making prices more susceptible to macro catalysts and volatility shocks.

Liquidity Remains Sluggish

In parallel with weak ETF fund flows, Bitcoin's spot relative trading volume continues to hover near the lower limit of its 30-day range. Trading activity has weakened from November to December, reflecting price declines and decreased market participation. The contraction in volume reflects a more defensive positioning in the overall market, with liquidity-driven fund flows available to absorb volatility or maintain directional changes decreasing.

As the spot market trends toward calm, attention now turns to the upcoming FOMC meeting, which could serve as a catalyst to reactivate market participation depending on its policy tone.

Futures Market Sluggish

Continuing the theme of low market participation, the futures market also shows limited interest in leverage, with open interest failing to rebuild significantly, and funding rates remaining close to neutral levels. These dynamics highlight a derivatives environment defined by caution rather than confidence.

In the perpetual contract market, this week’s funding rates hovered around zero to slightly negative, underscoring the continued withdrawal of speculative long positions. Traders maintain balanced or defensive positions, applying little directional pressure through leverage.

Due to the sluggish derivatives activity, price discovery is more influenced by spot fund flows and macro catalysts rather than speculative expansion.

Short-Term Implied Volatility Soars

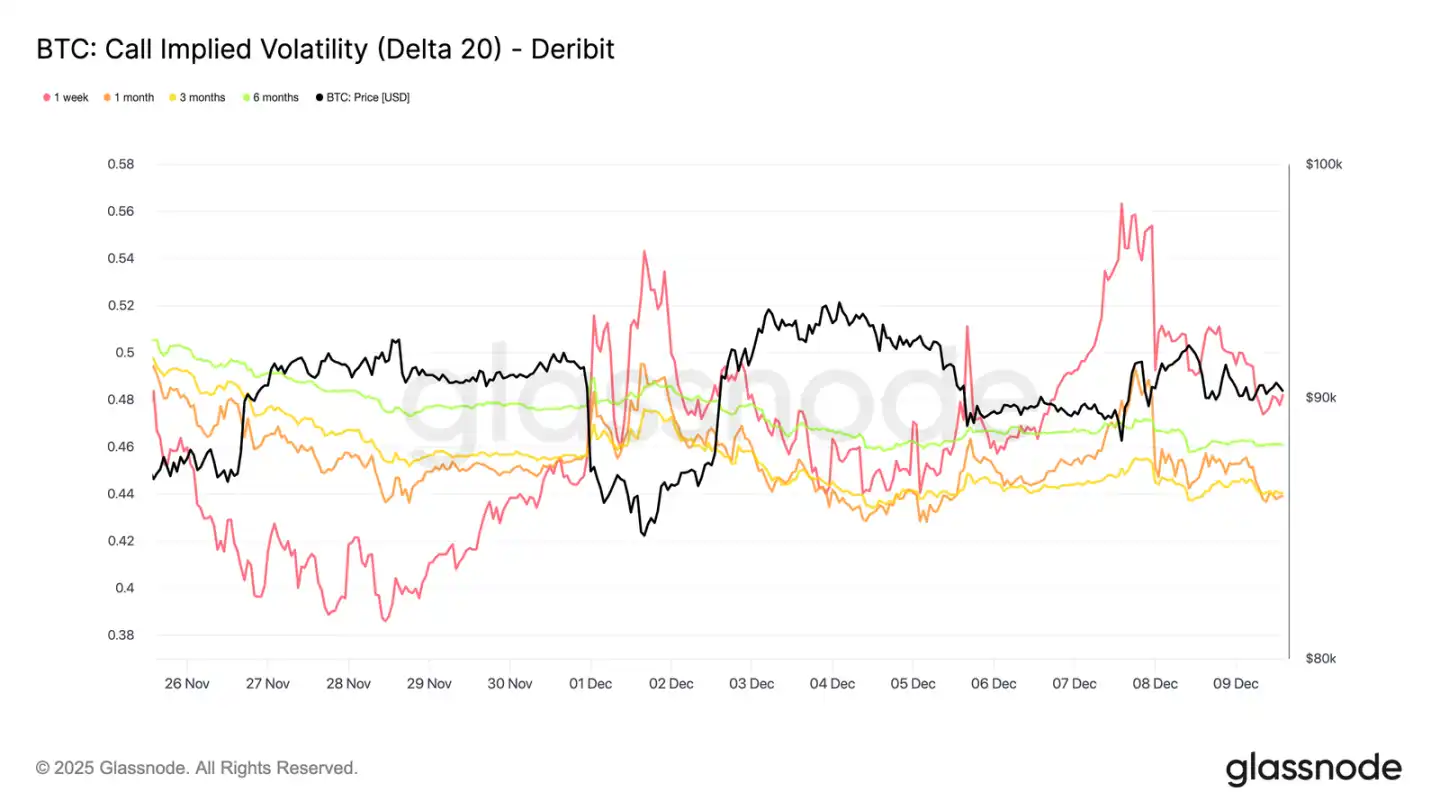

Turning to the options market, Bitcoin's lackluster spot activity sharply contrasts with the sudden rise in short-term implied volatility, as traders position for larger price movements. Interpolated implied volatility (estimating IV through fixed Delta values rather than relying on listed strike prices) more clearly reveals the pricing structure of risk across different durations.

For 20-Delta call options, the one-week IV has risen by about 10 volatility points compared to last week, while longer durations remain relatively stable. The same pattern appears in 20-Delta put options, with short-term downside IV rising while longer durations remain calm.

Overall, traders are accumulating volatility where they expect pressure to emerge, leaning towards holding convexity rather than selling ahead of the December 10 FOMC meeting.

Downside Demand Returns

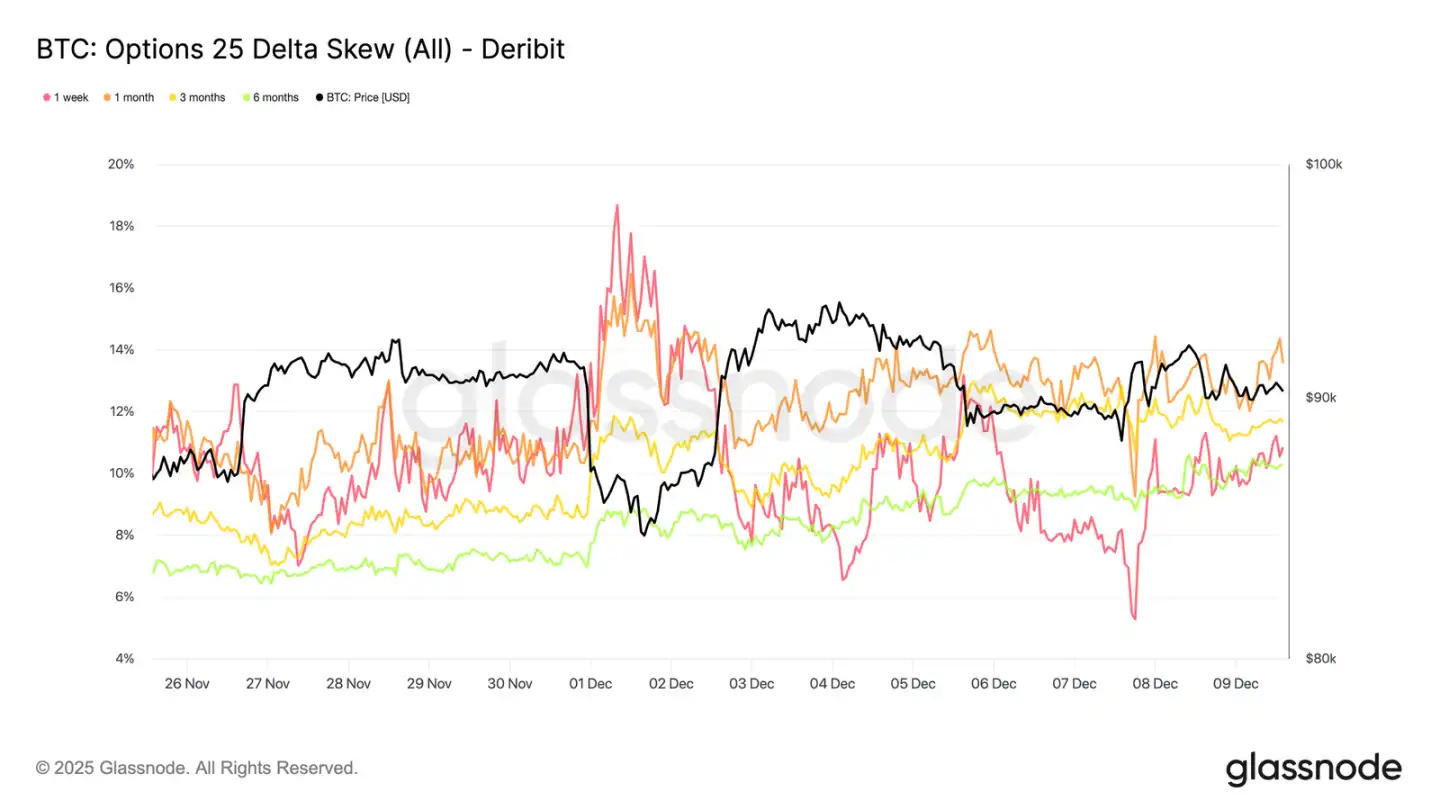

Accompanying the rise in short-term volatility is a renewed premium for downside protection. The 25-delta skew, measuring the relative cost of puts to calls at the same Delta value, has climbed to about 11% for one-week durations, indicating a significant increase in demand for short-term downside insurance ahead of the FOMC meeting.

The skew remains tightly clustered across durations, ranging from 10.3% to 13.6%. This compression indicates a preference for put protection across the entire curve, reflecting a consistent risk-averse tendency rather than isolated pressure limited to the short end.

Volatility Accumulation

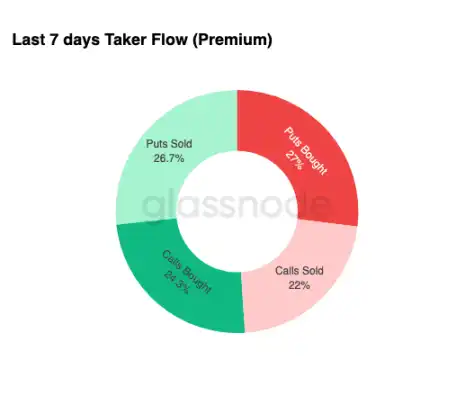

Summarizing the state of the options market, weekly fund flow data reinforces a clear pattern: traders are buying volatility rather than selling it. The premiums for bought options dominate the total nominal fund flows, with puts slightly leading. This does not reflect a directional bias but rather the state of volatility accumulation. When traders buy options on both ends, it signals hedging and a search for convexity rather than emotion-driven speculation.

Combined with rising implied volatility and a downward-leaning skew, the fund flow conditions suggest that market participants are preparing for volatility events with a downside bias.

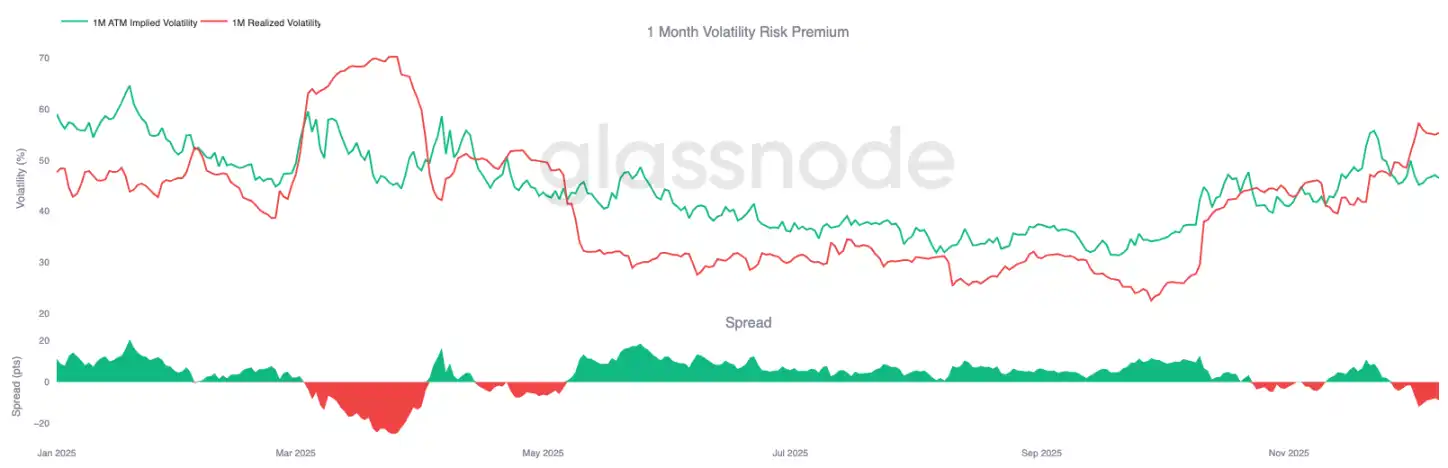

After the FOMC

Looking ahead, implied volatility has begun to ease, and historically, once the last major macro event of the year has passed, IV tends to compress further. With the FOMC meeting on December 10 as the last meaningful catalyst, the market is preparing to transition into a low liquidity, mean-reverting environment.

After the announcement, sellers typically re-enter, accelerating the decay of IV before the end of the year. Absent a hawkish surprise or a significant shift in guidance, the path of least resistance points to lower implied volatility and a flatter volatility surface, continuing into late December.

Conclusion

Bitcoin continues to trade in a structurally fragile environment, with rising unrealized losses, high realized losses, and significant profit-taking by long-term holders collectively anchoring price movements. Despite ongoing selling pressure, demand remains resilient enough to keep prices above the real market average, indicating that patient buyers are still absorbing the sell-off. If signs of seller exhaustion begin to appear, a push towards $95,000 to the cost basis of short-term holders remains possible in the short term.

Off-chain conditions echo this cautious tone. ETF fund flows remain negative, spot liquidity is sluggish, and the futures market lacks speculative participation. The options market reinforces a defensive posture, with traders accumulating volatility, buying short-term downside protection, and positioning for recent volatility events ahead of the FOMC meeting.

Overall, the market structure indicates a weak but stable range, supported by patient demand but constrained by ongoing selling pressure. The short-term path depends on whether liquidity improves and whether sellers will relent, while the long-term outlook hinges on the market's ability to reclaim key cost basis thresholds and emerge from this time-driven, psychologically pressured phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。