Original / Odaily Planet Daily (@OdailyChina)

A New Change in the Prediction Market Sector!

Just yesterday, Kalshi, one of the duopolies in the prediction market, joined forces with platforms like Crypto.com, Robinhood, Coinbase, and Underdog to establish the Coalition for Prediction Markets (CPM). This is also Kalshi's first external joint action to cope with regulatory pressure after being embroiled in the "market-making crisis." Following Federal Judge Victor Bolden's order to pause enforcement against Kalshi in Connecticut, this move by Kalshi is undoubtedly a new attempt at a "curveball rescue"—as Kalshi CEO Tarek Mansour stated: "CPM aims to give a voice to prediction markets and resist negative traditional lobbying groups." In a certain sense, the establishment of the Coalition for Prediction Markets also marks a footnote for the prediction market sector as it transitions from the crypto industry to a larger stage. Odaily Planet Daily will briefly analyze this event and its potential impacts in this article.

The Undercover Battle Between Prediction Markets and Traditional Gambling: Using Industry Associations to Counter Traditional Lobbying

We have previously provided detailed introductions and analyses of prediction markets in several articles (recommended reading “The Future Battle of Prediction Markets: Left is the Casino, Right is the News”, “Why Prediction Markets Are Not Gambling Platforms”). The reason Kalshi had to unite with major players like Coinbase and Robinhood to establish the CPM prediction market alliance is relatively straightforward—either there are common interests, or there are common enemies.

Currently, the biggest enemy facing Kalshi and other prediction market platforms is not regulatory agencies, but the traditional gambling industry.

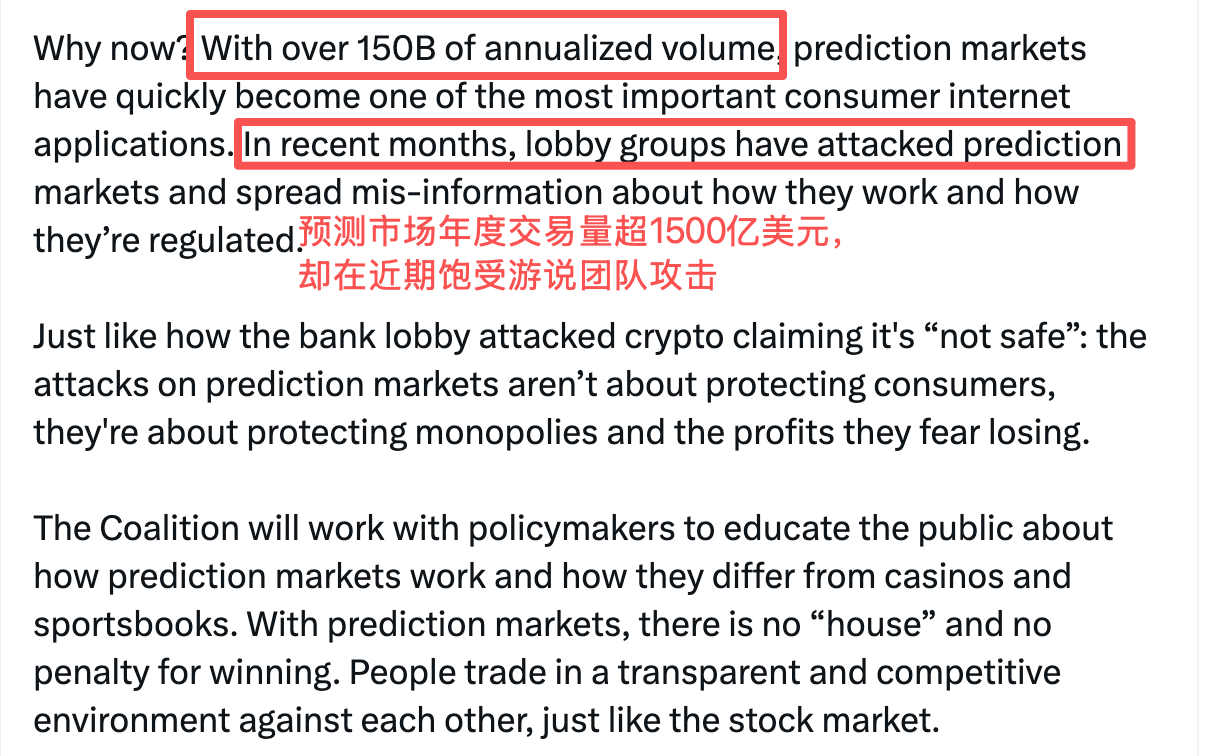

According to Kalshi CEO Tarek Mansour in a post, "In recent months, many lobbying groups have attacked prediction markets, spreading misinformation about their operations and regulatory frameworks." The crux of the matter is that the "cake" of prediction markets has already interfered with others' "rice bowls"—the traditional gambling platforms in the United States.

After all, this is an emerging sector with an annual trading volume exceeding $150 billion. Last month, the total trading volume of Kalshi and Polymarket approached $10 billion, and both have valuations exceeding $10 billion. The latest round of financing for Kalshi reached $1 billion, with a valuation of $11 billion; previously, Polymarket completed a $2 billion investment from the parent company of the New York Stock Exchange, ICE, and is seeking a new round of financing with a valuation of $12-15 billion.

From the current information, Kalshi and many exchanges and trading platforms entering the prediction market are leveraging the idea of industry associations and "lobbying counterattacks" to address the regulatory crises they face—traditional gambling platforms lobby local governments for pressure because they cannot tolerate users being siphoned off to prediction markets? Then I will "return the favor" by gathering all possible forces through an industry association to strive for the broadest unified alliance.

The investigations and user lawsuits initiated by local regulatory agencies in Connecticut and Nevada against Kalshi are actually backed by the employment opportunities and high tax revenues provided by the gambling industry, which local finances rely on.

In this regard, Kalshi CEO Tarek Mansour is very clear, as he stated—just as banking lobbying groups attack cryptocurrencies as "unsafe," the attacks on prediction markets are not to protect consumers, but to protect monopolistic companies and their profits they fear losing.

In the world, everyone is seeking profit; in the world, everyone is seeking benefits.

Faced with a rapidly developing "emerging industry" like prediction markets, which can see valuations multiply tenfold in a few months, traditional gambling monopolies are naturally unwilling to be quietly swept into the dustbin of history.

The reality is that, as an industry distinct from traditional gambling, the real demand for prediction markets is far stronger than what is visible, and the informational value they reflect is far more important than most people think.

Prediction Markets Rapidly Penetrate the U.S. Market: Nearly 50% of Users Are Under 45

According to the official introduction of the Coalition for Prediction Markets (CPM):

- Prediction markets have become one of the most accurate and user-friendly tools for the public to understand changing economic, cultural, and political trends; nearly half of U.S. citizens under 45 have used prediction markets, and the market's expansion speed continues to accelerate;

- In October of this year, the valuation of the prediction market industry reached $28 billion;

- The predictive performance of prediction markets is about 30% higher than that of traditional polls.

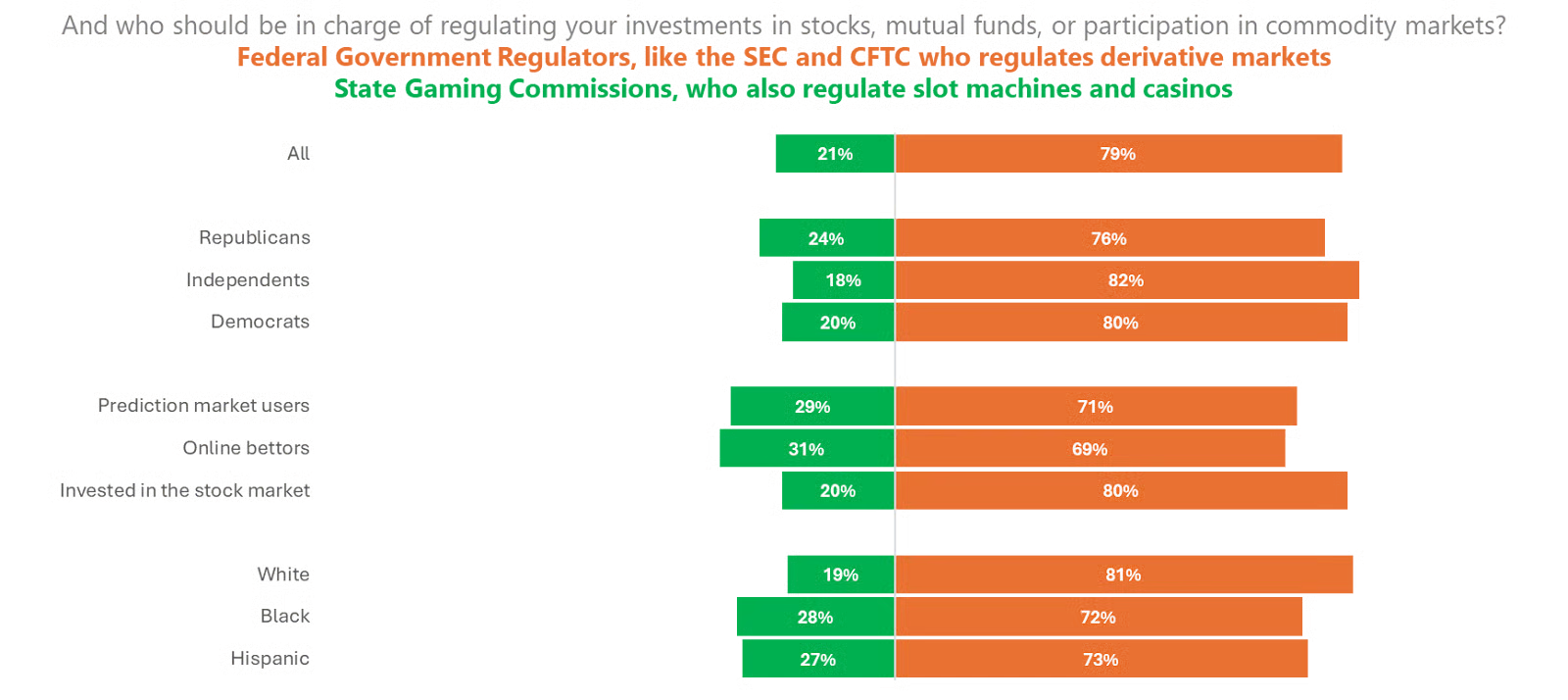

- Over 70% of Americans believe that prediction markets should not be treated as gambling.

In addition, the reasons why prediction markets differ from traditional gambling industries are as follows:

First, prediction markets have no "house," nor is there a penalty for winning (as in casinos). Prediction markets aggregate information from thousands of people to generate real-time probabilities of outcomes and should be viewed as more analytical than gambling; participating in prediction markets requires knowledge and analysis similar to financial investment, rather than purely probability-based gambling; prediction markets create public informational value by generating predictions useful to media, alliances, and owners (such as assisting policy decisions, public opinion filtering, event trend forecasting, etc.).

Second, as a contract market designated by the CFTC, Kalshi enjoys exclusive federal jurisdiction. In simple terms, local laws do not have the authority to adjudicate the legality of Kalshi and other prediction market platforms' operations. "Prediction markets should have the same rigor as modern financial markets—clear rules and federal oversight. The best way to protect consumers is to have these markets federally regulated and to establish consistent user protection measures."

Third, prediction markets cover a wider range of fields and can generate public informational value. "Millions of Americans have become active users of prediction markets, which have become the most powerful way to leverage collective intelligence and often outperform traditional polls. Economists, news networks (CNN, CNBC), journalists, policymakers, and readers now rely on prediction markets to obtain quality information in the noisy public opinion arena."

Kalshi's Strategy: Combining Top-Level Approaches with Grassroots Power

It is evident that, faced with the tightening "regulatory chains" from local agencies, Kalshi's solution is to break through in a different direction—

On one hand, by establishing the Coalition for Prediction Markets (CPM), Kalshi emphasizes that it will subsequently protect industry transparency, market integrity, and customer protection standards;

On the other hand, Kalshi CEO Tarek Mansour reiterated the jurisdictional scope, defining prediction markets as a new industry distinct from local gambling industries, and may subsequently seek to escape the quagmire of lawsuits and the regulatory traps of local protectionism through federal government power.

Unlike Polymarket, which focuses more on on-chain prediction event platform supply content and has returned to the U.S. market through the acquisition of the derivatives exchange QCX, Kalshi, which has always emphasized "compliance," values the long-term stable operation of its business more. After completing a financing round with a valuation of $11 billion, it cannot and will not allow itself to face countless regulatory obstacles on the path to commercial success.

Perhaps this is also the reason why Kalshi chose to unite with industry forces like Coinbase, Robinhood, Crypto.com, and Underdog to initiate the Coalition for Prediction Markets—both to bind interests with peers and present a united front; and to "make things bigger" and "take the top-level approach," allowing federal regulatory agencies to intervene, thereby highlighting its identity and status as an "industry innovation leader."

Conclusion: Prediction Markets Will Surpass the Gambling Industry to Grow into a "New Internet Sector"

In conclusion, I would like to wrap up with two recent interesting events involving Kalshi and Polymarket, the two "duopolies" in the prediction market—

One event is that Matt Huang, co-founder of Paradigm, which led Kalshi's investment, recently criticized the "duplicate calculation" of Polymarket's trading data, which was subsequently clarified by deployer, co-founder of the AI agency platform Bankr, stating that "Polymarket's trading data is accurate, and Paradigm is smearing its competitor due to its investment in Kalshi". One cannot help but marvel at how straightforward the business wars in the real world are; even a capital star with a valuation of billions cannot escape the cliché of "spreading dirt online and engaging in verbal battles."

The other event is that Kalshi CEO Tarek Mansour recently stated on the 20VC podcast that the competitive relationship between Kalshi and Polymarket is more like a contest between sports legends, akin to "NFL quarterback stars Tom Brady vs. Eli Manning," or like "Messi vs. Cristiano Ronaldo" in the football realm, "the prediction market industry is maturing rapidly due to competition."

As prediction markets bet on events far beyond sports and the crypto realm, this new entity, combining news products, trading targets, and competitive gaming, is gradually becoming independent from the cryptocurrency sector, just as Uber, Didi, and Meituan pioneered the shared economy, becoming the next "new internet sector."

As for the inefficient, zero-sum, and non-incremental traditional gambling industry, it may ultimately be crushed, replaced, and ground into a pile of rubble on the "golden path" of the industry by prediction markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。