Original Title: Crypto cards don't have any future

Original Author: @paramonoww

Compiled by: Peggy, BlockBeats

Editor's Note: Crypto cards were once seen as a bridge connecting traditional payment systems with the crypto world, but as the industry has developed, the limitations of this model have become increasingly apparent: centralization, compliance dependence, lack of privacy, additional fees, and even a contradiction to the core spirit of cryptocurrency.

This article delves into the essence of crypto cards, pointing out that they are merely transitional solutions and not true decentralized payment innovations. At the same time, the article presents EtherFi as one of the few models that align with crypto values, showcasing the potential for the fusion of DeFi and TradFi.

The following is the original text:

My overall view is that cryptocurrency cards are just a temporary solution to two well-known problems: first, making cryptocurrency accessible to the masses; second, ensuring that cryptocurrency can be accepted globally as a payment method.

Crypto cards are still just cards. If someone truly believes in the core values of cryptocurrency but thinks that the future will be dominated by cards, then you might need to rethink your vision.

All crypto card companies will eventually disappear

In the long run, crypto cards are likely to vanish, but traditional cards will not. Crypto cards merely add a layer of abstraction; they are not pure cryptocurrency applications. The card issuers are still banks. Yes, they may have different logos, designs, and user experiences, but as I mentioned earlier, this is just abstraction. Abstraction makes things more convenient for users, but the underlying processes remain unchanged.

Different public chains and Rollups have been obsessed with comparing their TPS and infrastructure to Visa and Mastercard. This goal has existed for years: either to "replace" or, more radically, to "disrupt" Visa, Mastercard, AmEx, and other payment processing institutions.

But this goal cannot be achieved through crypto cards—they are not substitutes; rather, they bring more value to Visa and Mastercard.

These institutions remain key "gatekeepers," with the authority to set rules, define compliance standards, and even ban your card, company, or even bank if necessary.

In an industry that has always pursued "permissionless" and "decentralization," why now hand everything over to payment processing institutions?

Your card is Visa, not Ethereum. Your card is a traditional bank, not MetaMask. You are spending fiat currency, not cryptocurrency.

The crypto card companies you love have done almost nothing except slap their logos on the cards. They are merely leveraging the narrative and will disappear in a few years, while those digital cards issued until 2030 will not truly operate by then.

Later, I will explain how easy it is to create a crypto card now—you might even be able to make one yourself in the future!

The same problem + more fees

The best analogy I can think of is "application-specific sorting." Yes, applications can autonomously handle transactions and profit from them; this idea is cool, but it is only temporary: infrastructure costs are decreasing, communication is maturing, and economic issues exist at a higher level, not a lower one. (If you're interested, check out @mvyletel_jr's excellent talk on ASS.)

Crypto cards are the same; yes, you can top up with cryptocurrency, and the card will convert it to fiat for payments, but the issues of centralization and permissioned access still exist.

It does help in the short term: merchants do not need to adopt new payment methods, and crypto spending is almost "invisible."

But this is just a transitional step toward the goal that most crypto believers truly want:

Demand: Direct payment with stablecoins, Solana, Ethereum, Zcash

Not needed: Indirect path of USDT → crypto card → bank → fiat currency

Adding a layer of abstraction also adds a layer of fees: spread fees, withdrawal fees, transfer fees, and sometimes even custodial earnings. These fees may seem trivial, but they compound: saving a penny is earning a penny.

Using a crypto card does not mean you are "unbanked" or have achieved de-banking

Another misconception I have observed is that people think using a crypto card means they do not have a bank account or have achieved de-banking. Of course, this is not true. Under the label of crypto cards, there is still a bank, and the bank must report some of your information to the local government. Not all data, but at least some key data.

If you are a citizen or resident of the EU, the government will know about your bank account interest, large suspicious transactions, certain investment income, account balances, etc. If the underlying bank is in the U.S., they know even more.

From a crypto perspective, this has both pros and cons. The advantage is transparency and verifiability, but the same rules apply when you use a standard debit or credit card issued by a local bank. The downside is that it is not anonymous or pseudonymous: the bank still sees your name, not your EVM or SVM address, and you still need to do KYC.

Restrictions still exist

You might say that crypto cards are great because they are really easy to set up: download the app, complete KYC, wait 1-2 minutes for verification, top up with cryptocurrency, and then you can use it. Yes, this is indeed a killer feature, extremely convenient, but not everyone can use it.

Citizens of Russia, Ukraine, Syria, Iraq, Iran, Myanmar, Lebanon, Afghanistan, and half of Africa cannot use cryptocurrency for daily spending without residency in another country.

But hey, that's just 10-20 countries that don't qualify; what about the other 150+ countries? The issue is not whether the majority can use it, but the core value of crypto: a decentralized network where nodes are equal, financial equality exists, and everyone has equal rights. This does not exist in crypto cards because they are not "crypto" at all.

Max Karpis perfectly explains here why "new banks" are doomed to fail from the start.

Max Karpis believes that "new banks" are doomed to fail from the start because they face multiple structural barriers: extremely high regulatory and compliance costs, lack of scale and user trust, business models reliant on third parties and fragile, significant funding pressure, and difficulty in profitability. In contrast, giants like Revolut have a large user base, data advantages, and compliance barriers, allowing them to quickly replicate innovations and win through scale, making it difficult for startup new banks to survive or achieve disruption in competition.

As a reference, the scenario where I actually used cryptocurrency for payment was when booking flights on Trip.com. They recently added an option to pay with stablecoins, allowing direct payment from your wallet, and of course, anyone in the world can use it.

Don't use Booking; use Trip for real crypto payments. This is my sincere recommendation.

This is the real application scenario for cryptocurrency and a genuine crypto payment. I believe the ultimate form will look like this: wallets will be specifically optimized for payment and consumption user experiences, or (less likely) wallets will evolve into crypto cards if crypto payments are widely adopted in some way.

The function of crypto cards is similar to liquidity bridges (Rain)

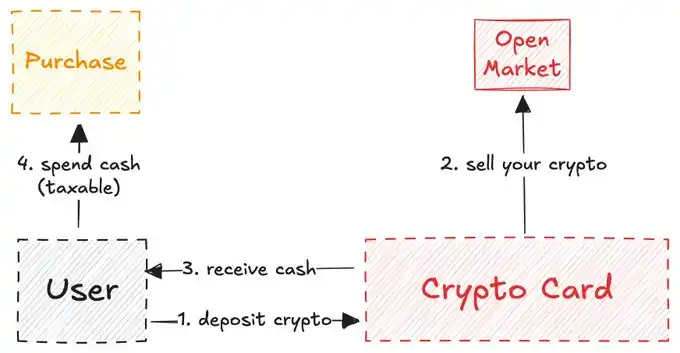

I have an interesting observation: the operation of self-custodied crypto cards is very similar to cross-chain bridges.

This only applies to self-custodied cards: cards issued by centralized exchanges (CEX) are not self-custodied, so exchanges like Coinbase have no obligation to let users mistakenly believe that their funds are under their control.

A reasonable use case for CEX cards is that they can serve as proof of funds for government, visa applications, or similar scenarios. When you use a crypto card linked to CEX balances, you are still operating within the same ecosystem.

Self-custodied crypto cards, however, operate like liquidity bridges: you lock funds (cryptocurrency) on chain A (crypto balance) and then unlock funds (fiat currency) on chain B (real world).

This "bridge" plays a role in the crypto card space similar to shovels during the California Gold Rush: it is a key secure channel connecting crypto-native users with businesses wanting to issue their own cards.

@stablewatchHQ provides an excellent analysis of this bridge, arguing that it is essentially a Card-as-a-Service (CaaS) model. This is the aspect that those discussing crypto cards often overlook. These CaaS platforms provide the infrastructure for businesses to launch their own branded cards.

Related Reading: "The Crypto Payment Card Market: Bridging Digital Assets and Global Commerce"

Rain: How crypto cards were born

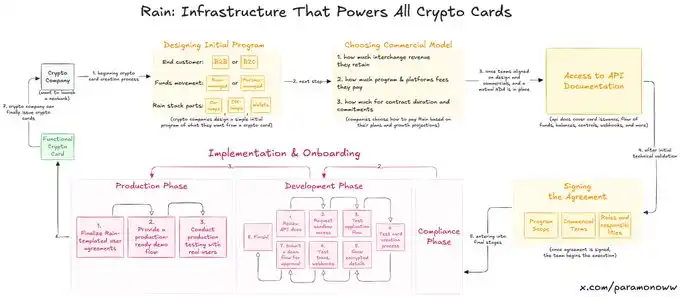

Half of your favorite crypto cards may be powered by @raincards, and you may have never heard of it. Rain is one of the foundational protocols in the new banking system because it handles almost all the core components behind crypto cards. The remaining companies just need to slap their logos on top (it sounds harsh, but the reality is close to this).

I made a diagram to help you understand how Rain works and how easy it is to set up a crypto card. Hint: it looks better when zoomed in.

Rain enables companies to quickly launch their own crypto cards, and frankly, Rain's execution capabilities could even exist long-term outside the crypto space. So, stop fantasizing that teams need to raise tens of millions of dollars to issue crypto cards; they do not need that funding—they just need Rain.

I emphasize Rain because people generally overestimate the effort required to issue crypto cards. Perhaps I will write a separate article about Rain in the future because it is truly an underestimated technology.

Crypto cards lack privacy and anonymity

The lack of privacy or anonymity in crypto cards is not an issue with the cards themselves, but rather a problem that those promoting crypto cards deliberately ignore, hiding behind the so-called "crypto values."

Privacy is not a widely used feature in the crypto space; pseudo-privacy (pseudo-anonymity) does exist because we see addresses rather than names. However, if you are ZachXBT, Igor Igamberdiev from Wintermute, Storm from Paradigm, or others with strong on-chain analysis capabilities, you can significantly narrow down the real identity corresponding to a given address.

Of course, the situation with crypto cards is even less pseudo-private than traditional cryptocurrencies, as you must complete KYC when activating a crypto card (in reality, you are not activating a crypto card but opening a bank account).

If you are in the EU, companies providing crypto cards will still send some of your data to the government for tax or other purposes that the government needs to know. Now, you have given regulators a new opportunity to track you: linking your crypto address to your real identity.

Personal Data: The Currency of the Future

Cash still exists (the only form of anonymity, except for the seller who can see you), and it will continue to exist for a long time. But ultimately, everything will be digitized. The current digital systems do not provide any benefits in terms of privacy for consumers: the more you spend, the higher the fees you pay, and in exchange, they know more about you. What a "great deal"!

Privacy is a luxury, and in the realm of crypto cards, it will continue to be so. An interesting idea is that if we achieve truly good privacy, even making businesses and institutions willing to pay for it (not like Facebook, but on the condition of our consent), it could become the currency of the future, perhaps even the only currency in a workless, AI-driven world.

If everything is destined to fail, why are we still building Tempo, Arc Plasma, and Stable?

The answer is simple—locking users into the ecosystem.

Most non-custodial cards choose L2 (for example, MetaMask uses @LineaBuild) or independent L1 (for example, Plasma Card uses @Plasma). Due to high costs and finality issues, Ethereum or Bitcoin are usually not suitable for such operations. Some cards use Solana, but this is still a minority.

Of course, companies choose different blockchains not only for infrastructure but also for economic benefits.

MetaMask uses Linea not because Linea is the fastest or the most secure, but because both Linea and MetaMask belong to the ConsenSys ecosystem.

I specifically used MetaMask as an example because it uses Linea. Everyone knows that almost no one uses Linea; it is far behind Base or Arbitrum in the L2 competition.

But ConsenSys made a smart decision to place Linea at the base of their cards because it locks users into the ecosystem. Users are accustomed to a good user experience rather than through something they use daily. Linea naturally attracts liquidity, trading volume, and other metrics, rather than relying on liquidity mining activities or begging users to cross-chain.

This strategy is similar to what Apple did when it launched the iPhone in 2007, keeping users on iOS to the point where they cannot switch to other ecosystems. Never underestimate the power of habit.

EtherFi is the only viable crypto card

After these reflections, I conclude that @ether_fi may be the only crypto card that truly aligns with the spirit of crypto (this research was not sponsored by EtherFi; even if it were, I wouldn't mind).

In most crypto cards, the cryptocurrency you top up is sold off, and then your balance is supplemented with cash (similar to the liquidity bridge I described earlier).

Most common crypto cards

EtherFi is different: the system never sells your cryptocurrency; instead, it gives you a cash loan and uses your crypto assets to earn returns.

EtherFi's model is similar to Aave. Most DeFi users dream of being able to seamlessly use crypto assets to collateralize loans for cash, and this capability has emerged. You might ask, "Isn't this the same? I can top up with cryptocurrency and spend with a crypto card like a regular debit card; this extra step seems unnecessary, right?"

EtherFi's mechanism (simplified version)

The problem is that selling your cryptocurrency is a taxable event, sometimes even easier to tax than everyday spending. In most cards, every transaction you make could be taxed, leading you to pay more taxes (again, using a crypto card does not mean de-banking).

EtherFi somewhat solves this problem because you are not actually selling cryptocurrency; you are just using it as collateral for a loan.

With this alone (along with no foreign exchange fees, cashback, and other benefits), EtherFi becomes the best example of the intersection of DeFi and TradFi.

Most cards try to pretend they are crypto products, but in reality, they are just liquidity bridges, while EtherFi genuinely targets crypto users, not merely to bring cryptocurrency to the masses: it allows crypto users to spend locally until the masses realize how cool this model is. Among all crypto cards, EtherFi may be the only project that can survive long-term.

I believe crypto cards are an experimental ground, but unfortunately, most of the teams you see are merely leveraging the narrative without giving due recognition to the underlying systems and developers.

Let's see where progress and innovation will take us. Currently, we see the globalization of crypto cards (horizontal growth) but a lack of vertical growth, which is precisely what this payment technology needed in its early stages.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。