Original Title: "Changes in the Next Chair of the Federal Reserve! Walsh's Policy Proposals: Rate Cuts + Balance Sheet Reduction"

Original Author: Bao Yilong, Wall Street Insights

Deutsche Bank analyzes that if Walsh is elected as the Chair of the Federal Reserve, his policy proposals may present a unique combination of "rate cuts and balance sheet reduction."

On December 16, Wall Street Insights mentioned that U.S. President Trump stated in a media interview that former Federal Reserve Governor Kevin Walsh has emerged as a leading candidate for the position of Federal Reserve Chair alongside Kevin Hassett. He said:

"I think both Kevins are great."

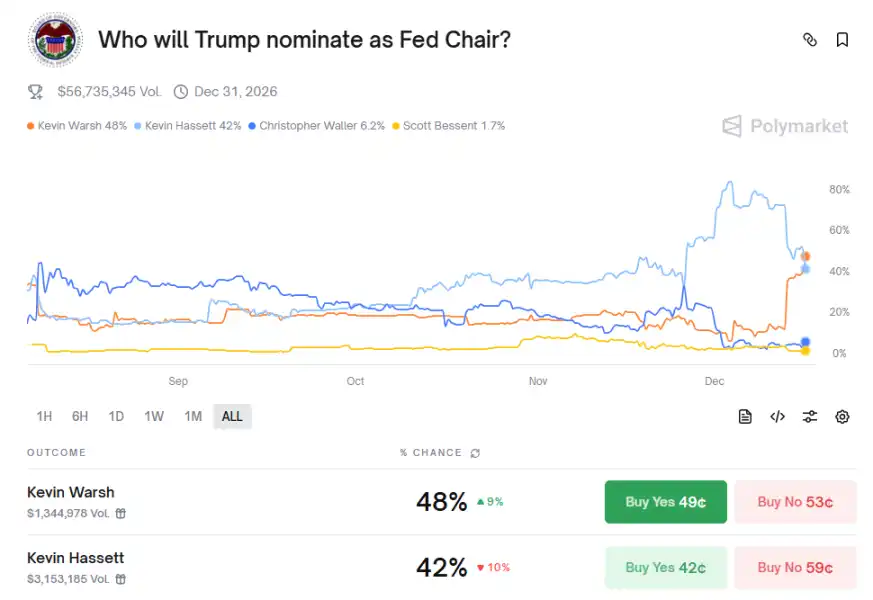

Trump's statement led to a significant decline in Hassett's odds on the prediction market Kalshi. As of Tuesday, data from Polymarket showed that the prediction market believes Walsh has a greater chance than Hassett of becoming the next Federal Reserve Chair.

On December 15, according to news from the Wind Trading Desk, Deutsche Bank's Matthew Luzzetti team published a research report that deeply analyzed Walsh's policy proposals. The report analyzed that if Walsh is elected, he would support rate cuts but would also demand a reduction in the balance sheet.

The report pointed out that the premise of "rate cuts and balance sheet reduction" is that regulatory reforms lower banks' reserve requirements, and the feasibility of this in the short term is questionable.

Deutsche Bank believes that the market needs to closely monitor whether the new Chair can maintain independence under Trump's pressure for significant rate cuts, as well as the process of establishing their policy credibility.

Walsh's Background

Unlike economist Hassett, Walsh comes from a legal background and has extensive experience in both the public and private sectors.

In the public sector, he served as a Federal Reserve Governor from 2006 to 2011, during which time the Federal Reserve was responding to the global financial crisis, and he played an important liaison role between the Federal Reserve and the markets.

He has been a strong critic of the Federal Reserve's aggressive balance sheet operations over the past 15 years, arguing that quantitative easing has deviated from the central bank's core responsibilities.

Walsh is currently a partner at the Duquesne family office of Stan Druckenmiller, as well as a distinguished visiting scholar at the Hoover Institution and a lecturer at Stanford Business School.

This experience spanning academia, regulatory agencies, and the investment community gives him a profound understanding of financial markets and monetary policy.

Walsh's Attitude Towards QE

Deutsche Bank points out that in recent years, Walsh has made numerous criticisms of the Federal Reserve, involving both short-term policy decisions and long-term strategic considerations.

First, Walsh has consistently criticized the Federal Reserve for its aggressive use of the balance sheet over the past fifteen years.

While he supported the Federal Reserve's quantitative easing (QE) program in response to the global financial crisis, he warned that continuing QE thereafter was inappropriate, as it could trigger inflation and financial stability risks, and cause the Federal Reserve to deviate from its core responsibilities by intervening in credit allocation policies that could distort market signals.

The report cites Walsh's recent remarks:

"In the summer and fall of 2010, during a period of strong economic growth and financial stability, I was extremely concerned that the decision to purchase more government bonds would entangle the Federal Reserve in the complex political affairs of fiscal policy. The second round of quantitative easing was introduced, and I disagreed with that decision, shortly thereafter resigning from the Federal Reserve."

Walsh further believes that the Federal Reserve's active use of the balance sheet may have ushered in a "monetary-dominated" period. He argues that by artificially keeping interest rates low for an extended period, the Federal Reserve has played a leading role in facilitating the accumulation of U.S. government debt.

Walsh's Criticism of Other Policies

In addition to the balance sheet, Walsh has also criticized the Federal Reserve on multiple fronts.

For example, he believes the Federal Reserve relies too heavily on data and lacks foresight, while also criticizing the routine use of forward guidance by the Federal Reserve. He recently pointed out:

"Forward guidance, a tool that was prominently introduced during the financial crisis, has almost no effect in normal times."

Walsh also questions other aspects of the Federal Reserve's formulation and interpretation of monetary policy, including the mistaken belief that "monetary policy is unrelated to money," "black box DSGE models are grounded in reality," and "Putin and the pandemic are responsible for inflation, not government spending and the surge in money printing."

The report analyzes that these criticisms imply that Walsh hopes to focus more on the size of the Federal Reserve's balance sheet and money supply in the execution of monetary policy, and may seek comprehensive reforms of the Federal Reserve's research team.

Finally, while he describes the independence of the Federal Reserve as a "valuable" endeavor, he also believes that the Federal Reserve itself has invited questions about its independence. Walsh points out:

"The Federal Reserve's oversized role and poor performance have undermined the important and valuable rationale for monetary policy independence."

Additionally, Walsh condemns the Federal Reserve's mission creep, including considerations of issues such as climate and inclusivity.

Recent Policy Impact Outlook

Although Walsh has recently advocated for lowering interest rates, Deutsche Bank believes he is structurally not dovish.

His views during his tenure as a governor during the global financial crisis were sometimes more hawkish than his colleagues, especially on balance sheet issues. Recently, he expressed that he did not support the Federal Reserve's decision to cut rates by 50 basis points last September.

In terms of policy decision-making, Walsh's recent remarks suggest he may support lowering the policy interest rate, although this move may come at the cost of reducing the size of the bank's balance sheet.

However, given that reserves are already at sufficient levels and the Federal Reserve has recently restarted its reserve management purchase program, this trade-off would only be feasible if regulatory reforms lower banks' reserve requirements.

While several Federal Reserve officials, including Vice Chair Bowman and Governor Milan, have recently made this argument, it is unclear whether these changes are realistic in the short term.

The report concludes that, from a broader perspective, regardless of whom President Trump chooses, the market may test the independence of the next Federal Reserve Chair and the credibility of their commitment to achieving inflation targets.

Deutsche Bank emphasizes that the new Chair will always need to earn this trust. Given Trump's demand for significant rate cuts from the Federal Reserve, this demand may be more urgent.

Therefore, Deutsche Bank is skeptical about whether there will be substantial changes in policy after the leadership transition at the Federal Reserve in June, especially since the new Chair will only have one vote in a particularly divided committee.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。