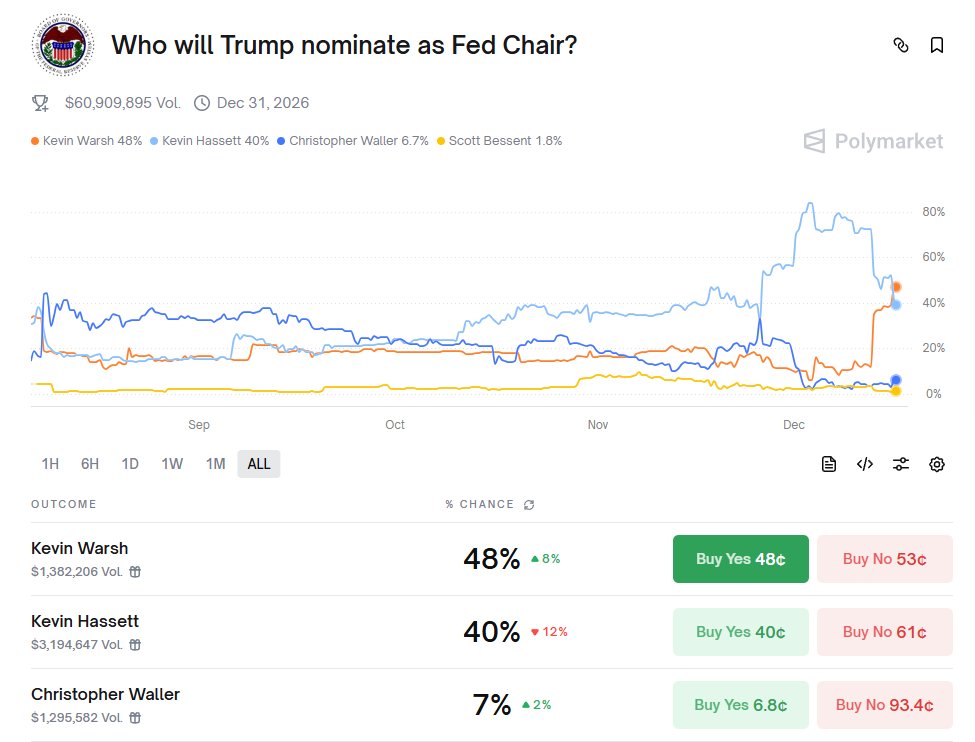

🚨 Polymarket data shows that the odds of Trump's confidant, Walsh, being promoted to the new chairman of the Federal Reserve have officially surpassed those of Hassett —

This may also be one of the hidden reasons for the market's continuous decline in recent days.

Walsh represents the monetary conservatives + political boundary faction:

He criticizes the Fed for too much QE and deviating from its functions;

He advocates for a return to the Fed's independence, not letting it take the blame for fiscal issues;

He believes that "inflation is created by the central bank itself, not some external excuse."

This means that if Walsh takes office, the Fed may no longer act as a cash machine for the Treasury but return to its traditional role as a tightening faction.

⚠️ Walsh's policy proposal: to advance interest rate cuts and balance sheet reduction simultaneously, which is an unconventional and highly uncertain policy combination.

It sounds like Powell's "dual strategy" 2.0 version, with the logic being —

Interest rate cuts are aimed at lowering short-term financing costs to support businesses and the economy;

Balance sheet reduction is intended to address the issue of excess liquidity in the financial system, curbing asset bubbles and regulatory arbitrage;

The prerequisite for simultaneous advancement: a complete reform of the regulatory framework to reduce banks' reliance on reserves.

In other words, he hopes to exchange regulatory measures for monetary policy space in the financial system.

However, the practical implementation is extremely challenging, which also means that the market may face significant uncertainty in the short term.

📉 Therefore, from a financial perspective, if Walsh takes office, he is unlikely to easily return to the old path of QE, which could be a suppressive signal for current asset prices —

U.S. stocks: interest rates may drop slightly, but liquidity will be gone, and bubble asset valuations won't hold up.

Bitcoin/Gold: without the Fed "opening the floodgates" as a source of liquidity, the bull market logic is questionable.

U.S. Treasuries: short on the short end and long on the long end; if balance sheet reduction persists, the supply-demand pressure on Treasuries will intensify, limiting the space for interest rate declines.

I now feel that Trump is also a genius! Is he playing some kind of script?

Hassett is suitable for pre-election, to create bubbles and garner votes;

Walsh may be suitable for post-election: to soothe the market and restore credit? 😂

It can't be that the "understanding king" is continuously releasing smoke bombs!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。