Original | Odaily Planet Daily (@OdailyChina)

Author|Golem (@web 3golem)_

On the evening of December 15, Bitcoin experienced another flash crash, plummeting from $89,000 to around $85,000, nearing the December 1 low point ($83,822). Accompanying the sharp decline, the market fear and greed index dropped to 21 (extreme fear).

"Others fear, I am greedy"? The temptation to bottom-fish or engage in swing trading is enormous right now, but it is also very easy to step on a landmine. The flash crash on Monday is by no means an isolated incident. The "three hidden dangers" buried in the macroeconomic landscape of December are firmly suppressing Bitcoin's upward potential. A larger storm of decline may just be beginning.

Tuesday's Non-Farm Payroll Data Night

On the evening of December 16, at 21:30 (UTC+8), the U.S. Department of Labor will release the non-farm employment data for November. Due to the previous U.S. government shutdown, the household employment survey data for October was not collected, resulting in a blank for the October unemployment rate; thus, the October non-farm data has been canceled, but the Department of Labor will incorporate the October business survey (non-farm employment) data into the November release.

Although the non-farm data based on the business survey is still useful, the lack of a comparison with the October household survey data may amplify the contradictions between non-farm employment figures and the unemployment rate, leading to an incomplete and potentially ambiguous market interpretation. This merged report, lacking some key indicators, may increase speculative trading or volatility in the market, putting pressure on Bitcoin prices, and institutions will treat this report as "important but requires caution."

Citigroup economists also pointed out that the latest employment report to be released on the evening of December 16 may send more contradictory signals. The bank expects a decrease of about 45,000 jobs in October, but an increase of 80,000 in November. They also predict that the unemployment rate will rise from 4.4% to 4.52%, while a Reuters survey of economists shows the unemployment rate at 4.4%. The Federal Reserve's own quarterly forecast indicates that the median unemployment rate at the end of this year is about 4.5%.

Additionally, this is the first non-farm employment data following the Federal Reserve's announcement of a 25 basis point rate cut on December 10. Due to expectations regarding the Federal Reserve's rate cut decision in January 2026, the market may amplify its reactions to wages, industry changes, and total employment figures.

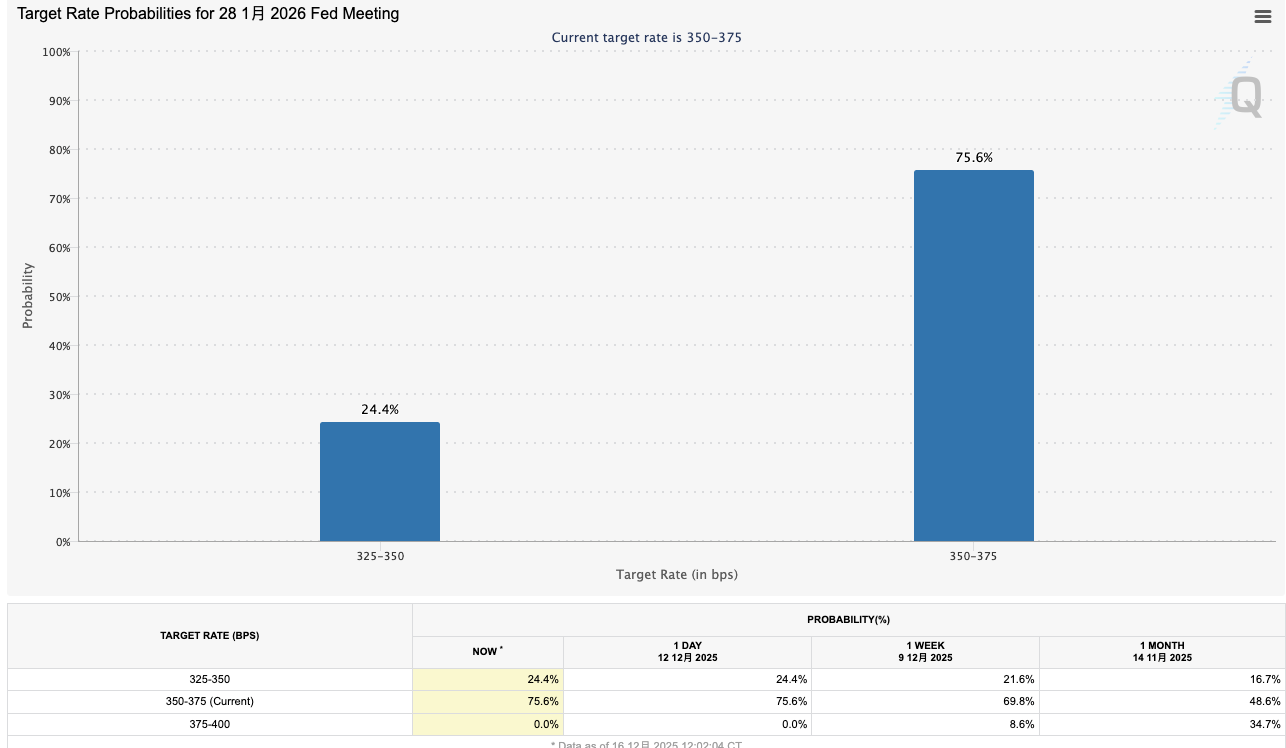

The impact of the non-farm report data is primarily on the market's expectations for the Federal Reserve's rate cut in January 2026. According to CME's "FedWatch," the probability of a 25 basis point rate cut by the Federal Reserve in January 2026 is only 24.4%, while the probability of maintaining the current rate is 75.6%.

Morgan Stanley strategist Michael Wilson analyzed that if the non-farm employment report released tonight is moderately weak, it may intensify market expectations for the Federal Reserve to cut rates again at least in the first quarter of next year.

However, the Financial Times believes that the U.S. non-farm employment report to be released tonight will provide policymakers and investors with a more complete picture of the U.S. labor market, ending months of partial blind flying. Although the Federal Reserve lowered rates to a three-year low on December 10 amid significant disagreement, the current debate still centers on whether to prioritize high inflation or a weak job market.

Therefore, in an already negative market environment, if the non-farm data report fails to provide positive signals again, Bitcoin will face another downward crisis.

Friday's Bank of Japan Rate Decision

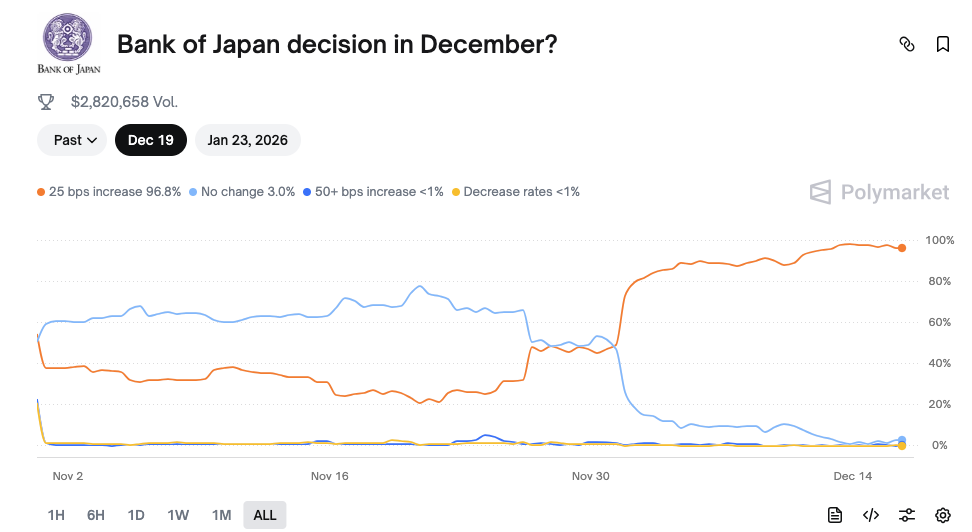

On Friday, December 19, the Bank of Japan will announce its rate decision. The market widely believes that a 25 basis point rate hike (to 0.75%) is a "done deal." According to Polymarket data, the probability of the Bank of Japan raising rates by 25 basis points on December 19 has reached 97%, which would bring Japanese interest rates to their highest level in 30 years since 1995.

Investors are closely watching the Bank of Japan's rate hike because yen carry trades have injected a significant amount of capital into global financial markets, including the crypto market, over the past decade. For more than a decade, the Bank of Japan's rates have remained in the "near 0% or slightly negative" ultra-loose range, with many institutions and investors borrowing yen at ultra-low interest rates to invest in U.S. Treasuries, U.S. stocks, or Bitcoin, "earning" interest differentials or risk returns.

However, a rate hike by the Bank of Japan would shatter this dynamic, as investors would no longer have access to "free yen" for arbitrage in global financial markets, putting pressure on stock and crypto markets, while the yen strengthens, and Japanese 10-year and 30-year government bond yields rise.

Some macro analysts believe that if the Bank of Japan raises rates as expected on December 19, Bitcoin may further retreat to the $70,000 level. Analyst AndrewBTC, tracking historical data, states that every rate hike by the Bank of Japan since 2024 has been accompanied by a decline in Bitcoin prices of over 20%, such as a drop of about 23% in March 2024, about 26% in July 2024, and about 31% in January 2025. If the Bank of Japan raises rates next week, similar downward risks may re-emerge.

In fact, the market in December has been overshadowed by the prospect of a rate hike by the Bank of Japan. To some extent, the market has almost digested the possibility of the Bank of Japan raising rates from 0.5% to 0.75% in December. But the key issue is that the Bank of Japan's rate hike in December is not a one-time action, but the beginning of a new rate hike cycle.

Multiple sources have revealed that Japan may have more rate hikes after Friday's increase. These sources indicate that Japanese officials believe that even if rates are raised to 0.75%, the Bank of Japan has not yet reached a neutral interest rate level. Some officials believe that 1% is still below the neutral rate level. Insiders have stated that even if the Bank of Japan updates its neutral rate estimates based on the latest data, it does not believe that the range will significantly narrow. Currently, the Bank of Japan estimates the nominal neutral rate range to be about 1% to 2.5%.

In this context, Bitcoin not only faces price pressure this week but may also continue to decline in the near future. Crypto investors should prepare themselves mentally.

Uncertainty Over Next Fed Chair Nomination Intensifies

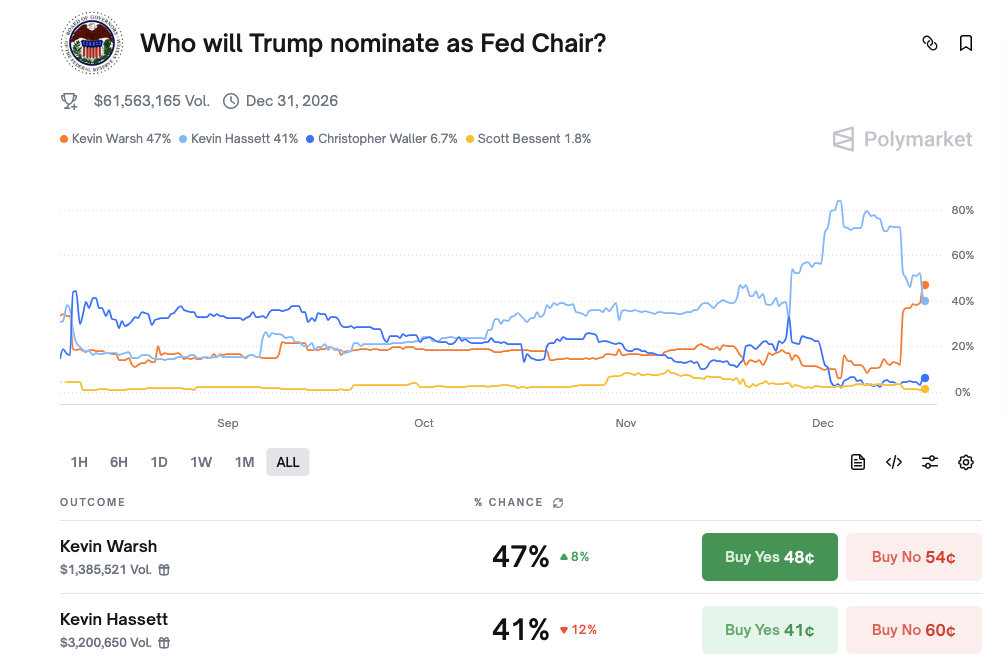

Hassett has been a popular candidate to succeed Powell as the next Fed Chair. Even as the candidate list narrowed to five in early December, Hassett's odds of winning on Polymarket remained far ahead_ (Related reading: Countdown to Fed "Leadership Change": 5 Major Candidates Revealed, Who Will Be the Final Winner?)._ The reason is that Hassett is a "Trump appointee" and aligns with Trump on the Fed's rate cut policy (Trump has consistently advocated for rapid rate cuts).

However, on December 13, things began to change. Trump stated during an interview in the Oval Office that both Kevins (Walsh and Hassett) are excellent, and the other candidates are also very good.

At the same time, sources revealed that Trump had a 45-minute meeting with Walsh at the White House, during which he pressured Walsh to guarantee support for rate cuts if he were to be elected Fed Chair. Trump confirmed this in the interview: "He believes rates must be cut, and everyone I have talked to thinks the same." Trump stated that he believes the next Fed Chair should consult him on interest rate policy.

After this news broke, Walsh's odds of being nominated as the next Fed Chair on Polymarket rose to 38%, while Hassett's odds dropped from 75% to 50%.

On December 15, sources revealed that some high-level individuals closely associated with Trump are opposing Hassett's nomination as the next Fed Chair due to concerns that Hassett is too closely tied to the president. Since then, Hassett's advantage on Polymarket has disappeared; as of now, Walsh's nomination probability is 47%, while Hassett's is 41%, slightly trailing Walsh.

This is not good news for crypto investors, as they are not interested in the political struggles in the U.S., but because Walsh is not part of the "rate cut faction." Walsh has long been considered a "hawk," with economic policies leaning towards tightening rates and combating inflation, advocating for a reduction in the central bank's balance sheet. If he takes office, it will clearly suppress the development of the crypto market from a macro perspective.

The sharp drop in Bitcoin on the evening of December 15 was also influenced by the short-term sentiment surrounding Walsh's nomination as the next Fed Chair. However, if Trump confirms Walsh's nomination by the end of December, the Christmas rally that crypto investors are looking forward to may also disappear.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。