Today I feel worse than yesterday, but after waking up at night, I just couldn't fall back asleep, so I got up and continued typing. Before I knew it, it was almost four in the morning, and I ended up writing quite a bit tonight, more than I expected. Being sick has actually made my focus sharper. 😂

Currently, the market's stability is relatively good. Although the latest non-farm payroll data shows an increase in the unemployment rate, the market does not see this as a precursor to recession. Instead, there is hope that the rising unemployment rate could stimulate the Federal Reserve to have more opportunities for rate cuts. So far, the response from the U.S. stock market has been decent, and the price of $BTC has slightly rebounded.

I noticed some friends are still asking about Japan's interest rate hike on Friday. The conclusion about the rate hike has already been anticipated by the market, and it is almost certain that Japan will raise interest rates. The market has reacted accordingly, and I personally feel there won't be a significant reaction when it's announced on Friday. Moreover, the post-hike rate of 0.75% is not particularly high; the market is more concerned about the potential for further rate increases in the future.

Looking at Bitcoin's data, what needed to happen has happened. The turnover rate has started to rise significantly. For a long time now, the turnover rate during workdays has remained very high, indicating that short-term investors are under considerable pressure. The higher the short-term turnover, the more challenging the market becomes, and it's difficult to see price increases with consistently high turnover rates.

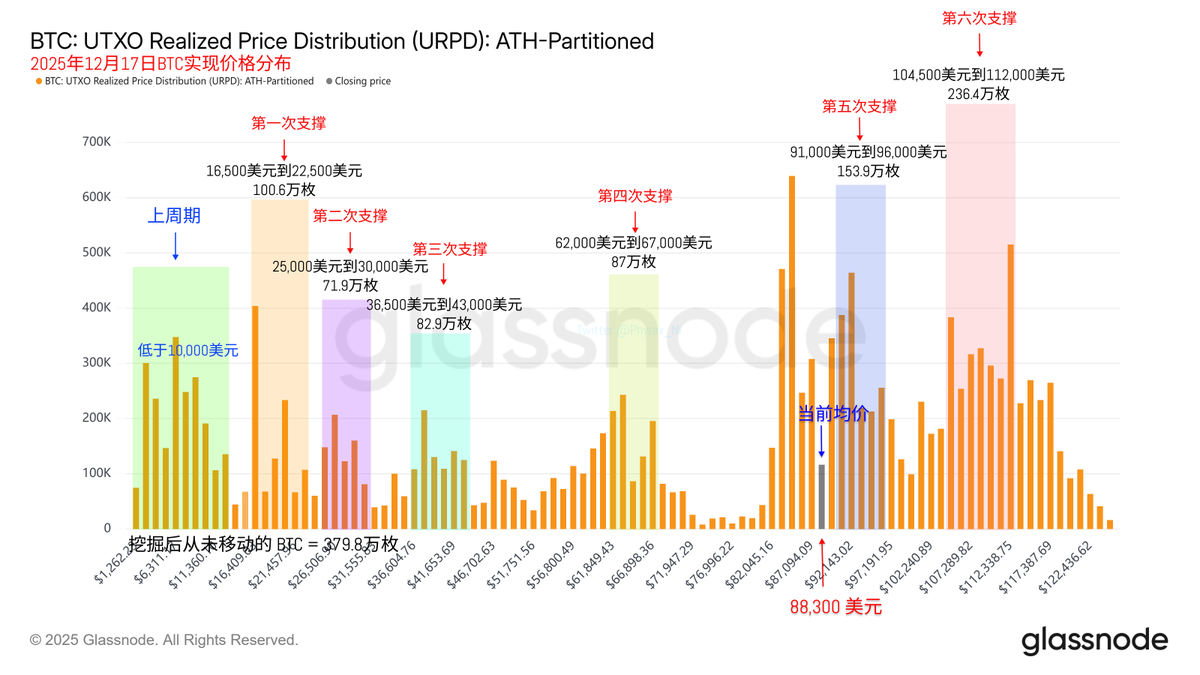

However, from the perspective of the chip structure, earlier investors still show strong rationality. Even those who are at a loss from high positions have not taken significant actions, which makes it feel like they are gradually rebuilding a bottom. This leads me to believe that breaking below $80,000 is not very easy. This situation has occurred a few times before, so let's wait and see.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。