Original Author: Shao Jiadian

Introduction

In the past few years, the term "issuing tokens" has become one of the most sensitive phrases in the Web3 world. Some have gained fame overnight because of it, while others have faced investigations, refunds, and account bans. The issue lies not in "issuing," but in "how to issue." While some tokens are listed on mainstream exchanges, have communities, and possess DAOs, others are deemed illegal securities. The distinction is whether they are issued within a legal framework.

The reality in 2025 is that utility tokens are no longer in a gray area. Regulators are scrutinizing every TGE, every SAFT, and every "airdrop" with a magnifying glass.

This article is written for every Web3 project founder: on the road from Testnet to DAO, the legal structure is the skeleton of your project. Before issuing tokens, learn to build the skeleton first.

Note: This article is based on an international legal perspective and does not target or apply to the legal environment in mainland China.

The "Identity" of Tokens Cannot Be Defined Just by Writing a White Paper

Many teams will say, "Our token is just a utility token, with no profit distribution, so it should be fine, right?"

But the reality is different. In the eyes of regulators, the "identity" of a token depends on market behavior, not on how you describe it.

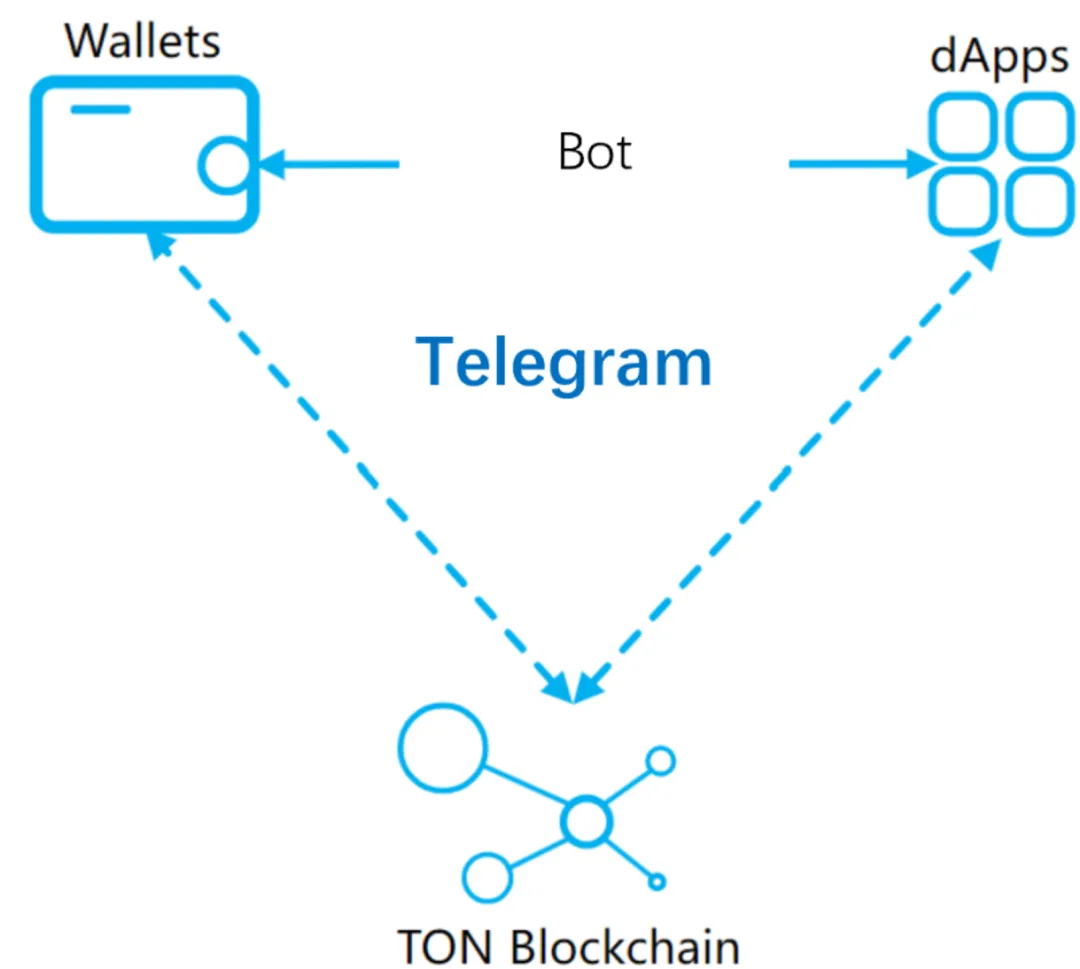

A typical case is Telegram's TON project.

Telegram raised $1.7 billion from investors, claiming the token was merely "fuel" for a future communication network;

Telegram raised $1.7 billion from investors, claiming the token was merely "fuel" for a future communication network;

However, the U.S. SEC deemed this financing to constitute an unregistered securities offering—because the investors' purpose for purchasing was clearly "future appreciation," not "immediate use."

The result was that Telegram had to refund the investment and pay fines, and the TON network was forced to operate independently from Telegram.

Lesson: Regulators look at "investment expectations," not "technical visions." As long as you use investors' money to build an ecosystem, it carries securities attributes.

So, do not fantasize about using the "utility" label to eliminate risks. The nature of tokens is dynamically evolving—early in the project, it may be an investment contract, and only after the mainnet can it potentially become a true usage certificate.

First, Identify What Type of Project You Are

What determines your compliance path is not the token name or total supply, but the type of project.

- Infrastructure Projects (Infra):

For example, Layer 1, Layer 2, public chains, ZK, storage protocols.

Typically adopting a "Fair Launch," with no pre-mining or SAFT, tokens are generated by node consensus.

Projects like Bitcoin, Celestia, and EigenLayer fall into this category.

The advantage is a naturally distributed structure with low regulatory risk; the downside is difficulty in financing and long development cycles.

- Application Layer Projects (App Layer):

For example, DeFi, GameFi, SocialFi.

Tokens are pre-mined by the team (TGE) and the ecosystem treasury is led by the team, with typical representatives like Uniswap, Axie Infinity, and Friend.tech.

The business model is clear, but compliance risks are high: sales, airdrops, and circulation all require handling regulatory disclosures and KYC issues.

Conclusion: Infrastructure survives on consensus, while application projects rely on structure for survival. Without a well-designed structure, all "Tokenomics" are mere talk.

Testnet Phase: Don’t Rush to Issue Tokens, Build the "Legal Skeleton" First

Many teams start looking for investors, signing SAFTs, and pre-mining tokens during the Testnet phase.

But the most common mistake at this stage is:

Claiming "this is just a utility token" while taking investors' money.

The U.S. Filecoin serves as a cautionary case. It raised about $200 million through SAFT before the mainnet launch, and although it received an SEC exemption, due to delays in launch and the tokens being temporarily unavailable, investors questioned its "securities attributes," ultimately leading the project to incur huge compliance costs to rectify the situation.

The correct approach is:

- Distinguish between two entities:

- DevCo (Development Company) responsible for technology development and intellectual property;

- Foundation / TokenCo (Foundation or Token Company) responsible for ecosystem building and future governance.

- Financing method: use an equity + Token Warrant structure, rather than directly selling tokens.

Investors gain rights to future tokens, rather than immediate token assets.

This method was first adopted by projects like Solana and Avalanche, allowing early investors to participate in ecosystem building while avoiding direct triggers for securities sales.

Principle: The legal structure at the project's early stage is like the genesis block. If the logic is wrong once, compliance costs may multiply tenfold.

Mainnet Issuance (TGE): The Moment Most Likely to Attract Regulatory Scrutiny

Once tokens can be traded and have a price, they enter the regulatory radar. This is especially true when it involves airdrops, LBP (Liquidity Bootstrapping Pool), and Launchpad public distributions.

- Public Chain Projects:

For example, Celestia, Aptos, Sui, etc., typically generate tokens automatically through a network of validators at TGE,

The team does not directly participate in sales, and the distribution process is decentralized, minimizing regulatory risk.

- Application Layer Projects:

For instance, airdrops from Arbitrum and Optimism, or community distributions from Blur and Friend.tech,

Have drawn attention from some regulatory agencies regarding whether their "distribution and voting incentives constitute securities sales."

The safety line during the TGE phase lies in disclosure and usability:

- Clearly define the token's use cases and functions;

- Disclose token distribution ratios, lock-up periods, and unlocking mechanisms;

- Implement KYC/AML for investors and users;

- Avoid "expected returns" type promotions.

For example, the Arbitrum Foundation clearly stated during TGE: its airdrop is solely for governance purposes and does not represent investment or profit rights; and gradually reduced the foundation's leading role in community governance—this is the key path to "de-securitization" of the token.

DAO Phase: Learn to "Let Go" and Truly Decentralize the Project

Many projects end after "issuing tokens," but the real challenge is—how to relinquish control and return the tokens to public goods.

Taking Uniswap DAO as an example:

- Initially led by Uniswap Labs for development and governance;

- Later managed by Uniswap Foundation for treasury and funding ecosystem projects;

- The community decides on protocol upgrades and parameter adjustments through UNI voting.

This structure makes it harder for regulators to identify it as a "centralized issuer," and also enhances community trust.

However, some projects that did not manage the DAO transition well, such as certain GameFi or NFT ecosystems, are viewed as "pseudo-decentralized" because the team still controls the majority of tokens and holds voting power, thus still facing securities risks.

Decentralization is not "laissez-faire," but "verifiable exit." Achieving a triangular balance among code, foundation, and community is the safe DAO structure.

What Regulators Are Watching: Can You Prove "This Is Not a Security"

Regulators are not afraid of you issuing tokens; they fear that you claim "this is not a security" while behaving like one.

In 2023, the SEC's lawsuits against Coinbase, Kraken, and Binance.US listed dozens of "utility tokens," determining that they exhibited "investment contract" characteristics during their sales and marketing phases. This means that as long as a project conveys "expected returns" during token sales, even if the token itself has utility, it will be regarded as a security.

Therefore, the key to compliance is dynamic response:

- Testnet → Focus on technology and development compliance;

- TGE → Emphasize use cases and functional attributes;

- DAO → Reduce team control and strengthen governance mechanisms.

Each stage carries different risks, and each upgrade requires reassessing the token's positioning. Compliance is not a stamp of approval, but a continuous iteration.

Conclusion: Projects That Survive Cycles Do Not Rely on "Speed," but on "Stability"

Many projects fail not because of poor technology, but because of poor structure. While others are still discussing "price fluctuations," "airdrops," and "listings," truly smart founders are already building legal frameworks, writing compliance logic, and planning DAO transitions.

The issuance of utility tokens is not about circumventing regulation, but about using law to prove you do not need regulation. When code takes over the rules, law becomes your firewall.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。