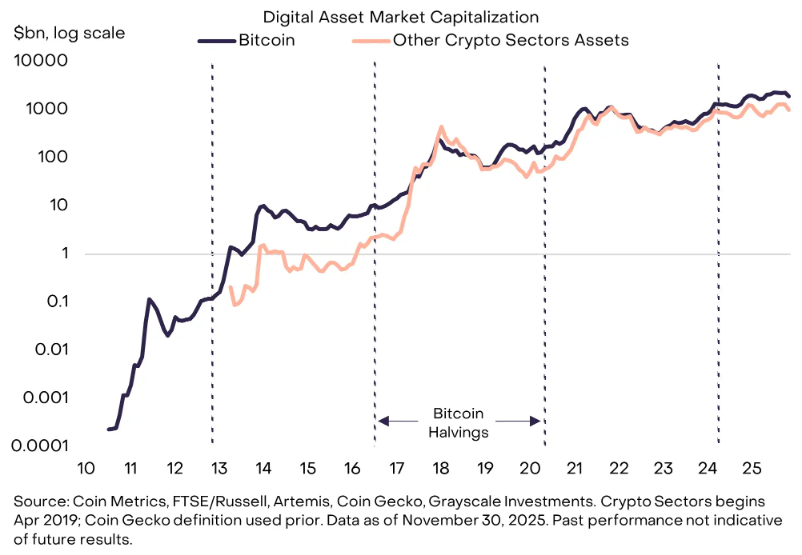

Many top institutions have recently released their outlooks for crypto assets in 2026, with a clear consensus: the market driving logic is undergoing a fundamental transformation. The traditional narrative centered around retail sentiment and the "four-year halving cycle" is fading, giving way to an era of structural growth dominated by institutional capital, clear regulation, and real utility.

1. Change in Market Paradigm: From Cyclical Speculation to Institutional Era

The core driving force of the future market is no longer the familiar rhythm.

1. The End of the "Four-Year Cycle Theory":

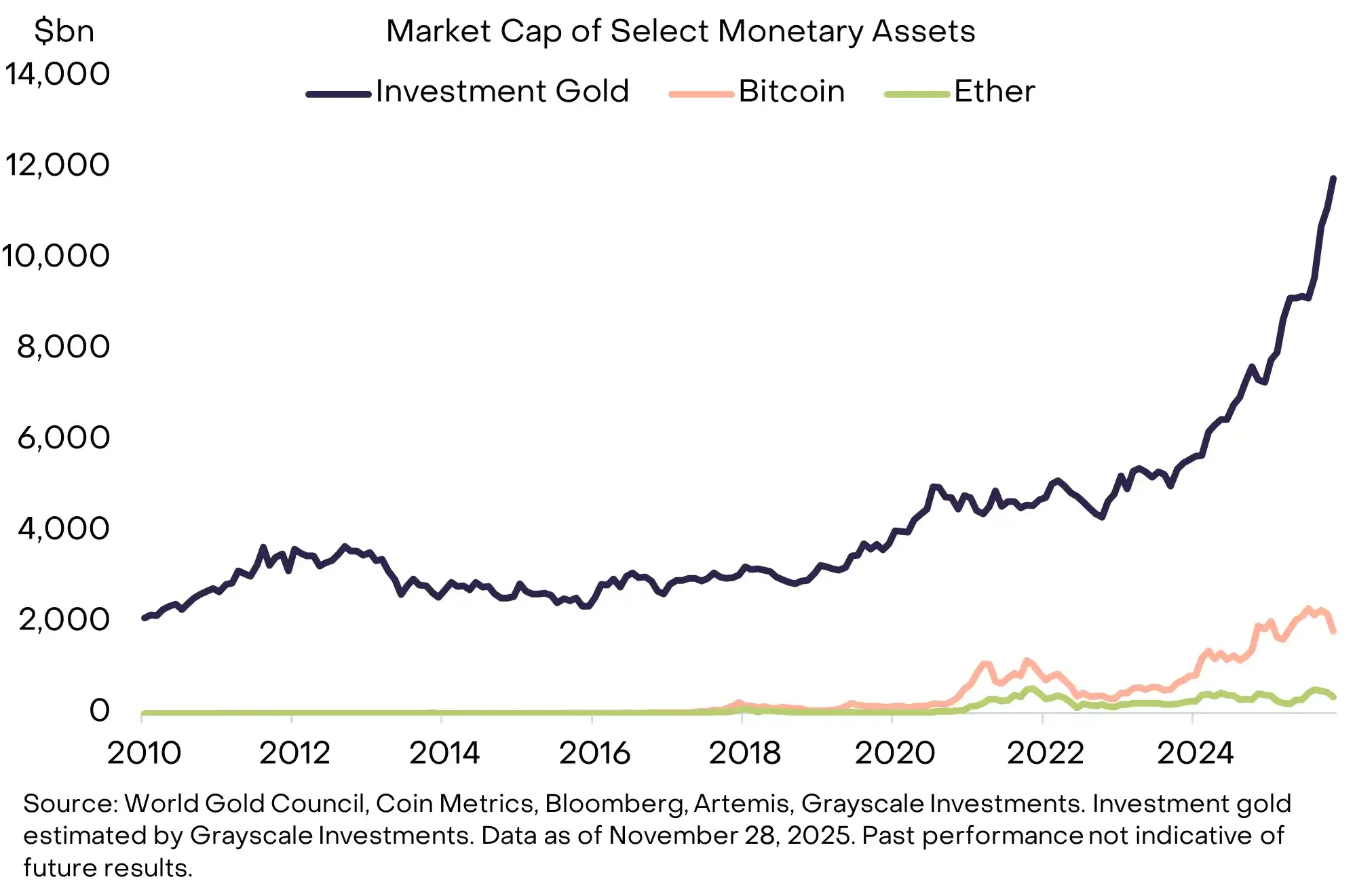

Grayscale clearly pointed out in its annual outlook that the traditional "halving-surge-correction" cycle of cryptocurrencies is becoming ineffective. The dominant force in the market is shifting from the cyclical frenzy of retail investors to the continuous inflow of compliant channels and long-term institutional capital.

- Structural Inflow of Institutional Capital:

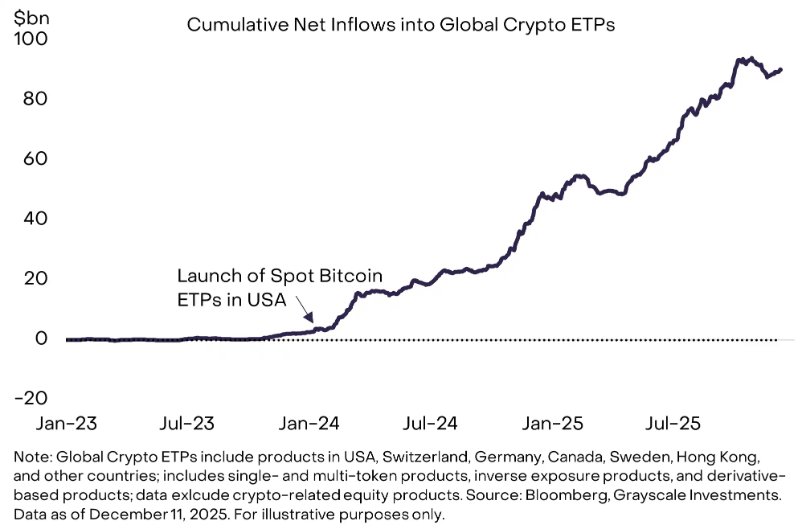

The entry of institutions is no longer an expectation but a current and future mainline. This is marked by the rapid development of exchange-traded products (ETPs) for crypto assets.

● Grayscale data shows that since the launch of the Bitcoin spot ETP in the U.S. at the beginning of 2024, global net inflows into crypto ETPs have reached approximately $87 billion.

● 21Shares predicts that by the end of 2026, the assets under management (AUM) of global crypto ETPs are expected to reach $400 billion. This "stable buying" model has changed the characteristics of price volatility.

- Regulation as a Cornerstone:

A clear regulatory framework is transforming from the greatest uncertainty into a key pillar of market development.

● Grayscale expects that in 2026, the U.S. will pass bipartisan-supported legislation on crypto market structure, which will "institutionalize" the status of blockchain finance in the U.S. capital markets.

● At the same time, the EU's MiCA framework and the already passed "GENIUS Act" (focused on stablecoins) in the U.S. are building a clearer regulatory environment globally, paving the way for large-scale participation by traditional financial institutions.

2. Core Growth Engines: Macroeconomic Narratives and Micro-Level Implementation

Under the new paradigm, specific investment themes revolve around value storage and financial efficiency.

- Macroeconomic Hedging Demand:

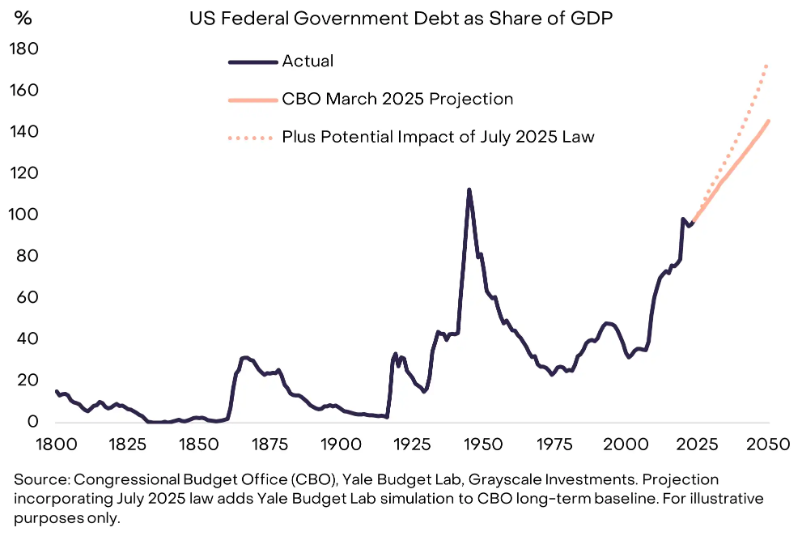

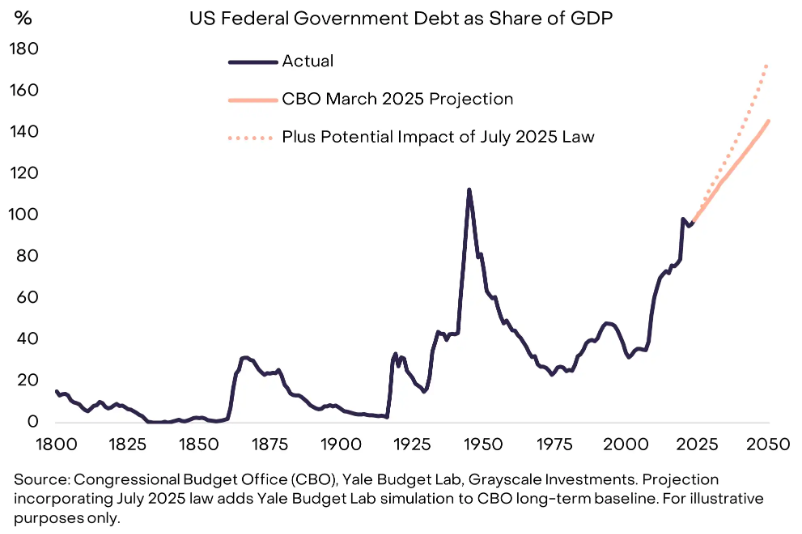

The rising public debt of major economies has raised concerns about the long-term value of fiat currencies. Bitcoin and Ethereum, due to their transparent and programmable scarcity, are seen as "value storage" assets in the digital age, attracting macro allocation capital inflows.

- Stablecoins: The Foundation Layer to Trillions:

Stablecoins have become the bridge connecting traditional finance and the crypto world.

● 21Shares predicts that its circulating market value will exceed $1 trillion by 2026. Its role is evolving from a trading tool to the "fundamental settlement layer of the internet."

● a16z noted that last year, stablecoins processed approximately $46 trillion in transaction volume, nearly three times the scale of Visa, and their smarter deposit and withdrawal channels will drive their explosion in the payment sector.

- Tokenization of Assets Reaches a Turning Point:

Representing and trading real-world assets (such as government bonds and private equity) in digital token form on-chain is moving from concept validation to scaling.

● 21Shares predicts that the total value of tokenized real-world assets (RWA) will surge from $35 billion in 2025 to over $500 billion in 2026. This not only enhances asset liquidity but also lays the foundation for building programmable financial products.

- Deep Integration of AI and Crypto:

Institutions like a16z have pointed out that by 2026, the combination of AI and blockchain will go beyond concepts. Core trends include:

a. Agent Economy: As AI agents autonomously conduct business activities, the demand for identity and credit systems to "know your agent" (KYA) will surge, requiring blockchain to provide trustworthy solutions.

b. Value Settlement Networks: Micro-payments for data and computing power between AI agents require an instant, global settlement network, with smart contracts and new protocols (like x402) supporting the vision of "the internet itself becoming a bank."

3. Pragmatism in Action: Competition and Integration in Niche Tracks

The market's focus will center on areas that can generate actual cash flow and user demand.

● Intensified Competition Among Smart Contract Platforms: Ethereum, through Layer-2 expansion, is becoming an institutional-grade tokenization infrastructure (like BlackRock's BUIDL fund). Solana is rapidly expanding in payments and DeFi due to its high throughput and low fees. Next-generation high-performance chains (like Sui, Monad) will compete for market share through architectural innovation.

● Yield and Sustainability: Investors will pay more attention to protocols that can generate sustainable income. Earning through staking or sharing real protocol revenue will become a common demand. DeFi, especially in the lending sector, is expected to accelerate development.

● Overvalued "Noise": Grayscale's report also clearly pointed out themes that are being overhyped in the short term: quantum computing and digital asset treasury companies (DATs) are expected to have no substantial impact on market valuations by 2026.

4. Risks and Divergences: Not Uniformly Optimistic

● Amidst the optimism, cautious viewpoints are also worth noting. Barclays Bank pointed out that without new major catalysts, the cryptocurrency market in 2026 may face a "down year" with declining trading volumes and sluggish growth. The slowdown in the spot market has already begun to put revenue pressure on trading platforms primarily targeting retail investors.

● This serves as a reminder to the market that the inflow of long-term institutional allocation capital is a slow and continuous process. It may support valuation bottoms and smooth volatility, but it may not instantly trigger a surge in market activity.

In 2026, the crypto asset market will no longer be the "Wild West" of the past. Institutionalization, regulatory compliance, and utility realization form the three foundational pillars of this new stage.

Although there are still divergences in short-term price trends, the consensus among mainstream financial institutions is: a more manageable volatility, a more solid infrastructure, and a deeper connection with the traditional financial world are taking shape in the crypto ecosystem. This is no longer a sprint around narratives, but a marathon testing the true value of technology and the depth of financial integration.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。