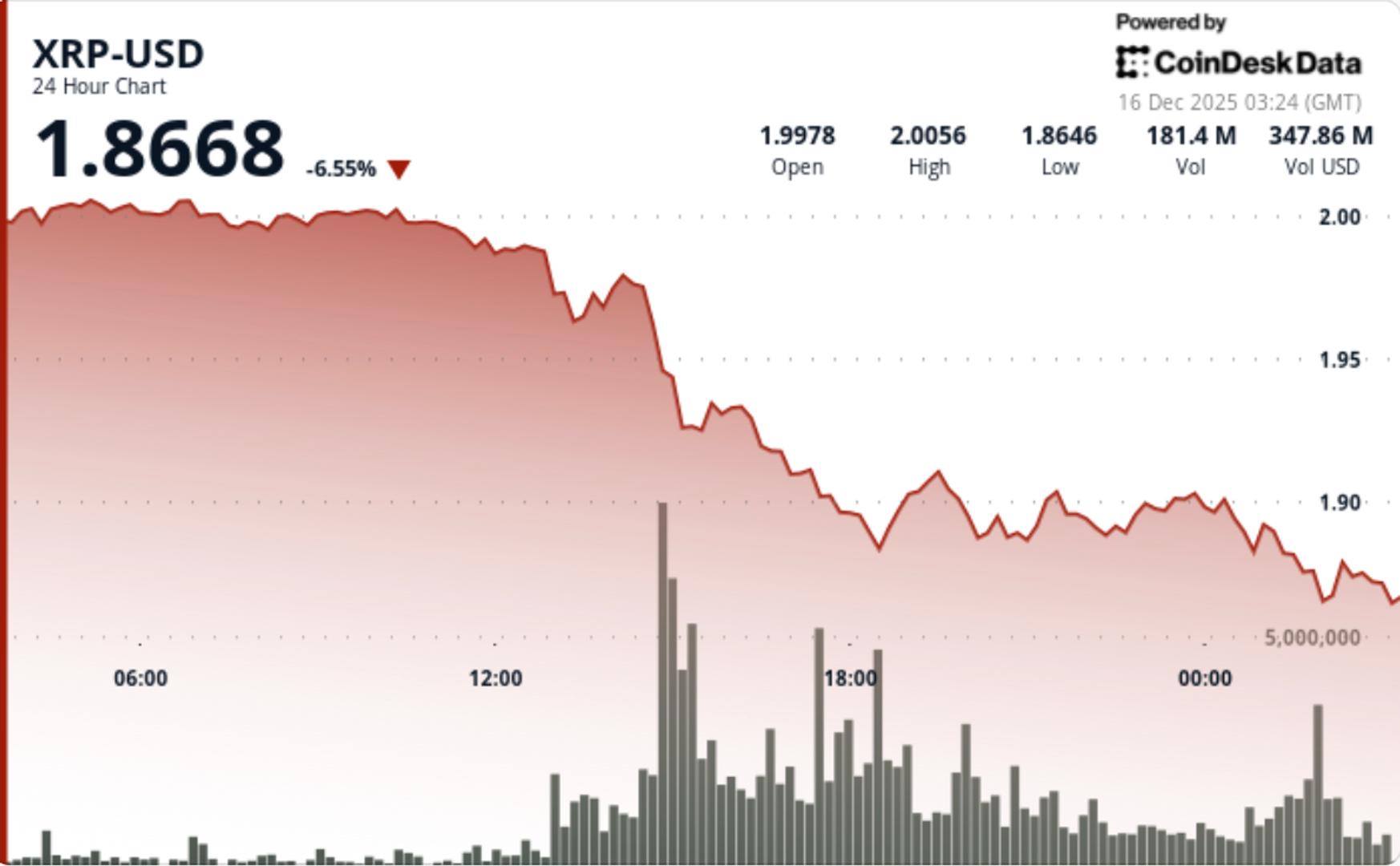

What to know : XRP fell 2.6% to $1.90 after failing to break resistance, indicating short-term bearish control. The breakdown below the $1.93 Fibonacci level marked a technical failure, with increased volume confirming active selling. Traders should watch the $1.93 resistance and $1.88–$1.90 support levels for potential shifts in momentum.

XRP lost a key technical level after a failed breakout attempt, with heavy volume confirming a shift toward short-term bearish control.

News background

XRP declined 2.6% over the past 24 hours, falling from $1.95 to $1.90 as broader crypto markets showed signs of fatigue. The move followed multiple failed attempts to sustain momentum above recent resistance, leaving XRP vulnerable once support levels were tested again.

There were no fresh fundamental catalysts driving the selloff. Instead, the move unfolded in a technically sensitive zone, where positioning had built up following earlier rebound attempts. As price stalled near resistance, selling pressure re-emerged, overwhelming bids during the European trading session.

Technical analysis

The breakdown below the $1.93 Fibonacci level marked a clear technical failure. This zone had previously acted as a pivot during consolidation, and its loss shifts short-term structure back in favor of sellers.

Volume expanded sharply during the rejection, with turnover rising 107% above daily averages, confirming that the move was driven by active distribution rather than low-liquidity drift. The rally attempt toward $1.95 showed early momentum with higher highs, but the inability to hold above $1.92 triggered systematic selling into strength.

From a structure perspective, XRP transitioned from range expansion to range rejection. As long as price remains capped below the $1.93–$1.95 zone, upside attempts are corrective rather than trend-changing.

Price action summary

XRP traded through a $0.09 range during the session, initially pushing toward $1.95 before reversing sharply. Selling intensified once price slipped back into the $1.92–$1.94 band, with bids thinning near the lower boundary.

Following the breakdown, XRP stabilized near $1.90, where selling pressure eased and volume began to normalize. Hourly price action shows consolidation forming just above the $1.88–$1.90 area, though no strong reversal signals have emerged yet.

What traders should know

The $1.93 level now acts as first major resistance. Any recovery attempt must reclaim this zone on strong volume to shift momentum back toward neutral. Failure to do so keeps downside risk in play.

On the downside, $1.88–$1.90 is the immediate area to watch. A sustained break below this base would expose deeper support levels, while successful defense could allow XRP to consolidate before the next directional move.

For now, volume behavior remains critical. Continued selling on rallies would confirm ongoing distribution, while fading volume near support would suggest the market is transitioning from breakdown to stabilization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。