Five days after being named by Trump, the named candidate Kevin Walsh remained silent, while his competitor Kevin Hassett drew a clear red line in a television interview: the president's opinion "carries no weight."

With five months remaining in the term of current Chairman Jerome Powell, a key personnel appointment that will determine the future direction of global monetary policy has already entered a heated stage.

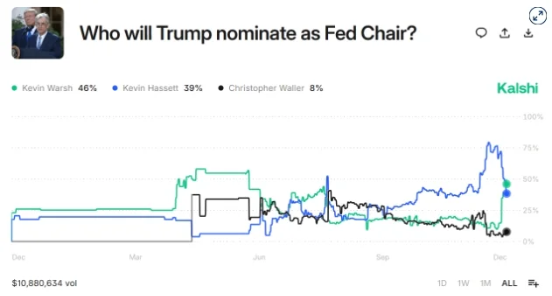

As of mid-December, prediction market platform Kalshi shows that the probability of former Federal Reserve Governor Kevin Walsh being nominated has surged to about 46%, while the once-leading White House National Economic Council Director Kevin Hassett's probability has dropped to 39%. The starting point and trigger for this reversal occurred within a week after December 10.

1. A Week of Surprises

● On December 12, U.S. President Trump made a disruptive statement in an interview with The Wall Street Journal. He explicitly pointed out that former Federal Reserve Governor Kevin Walsh is the "top candidate" for the next Federal Reserve Chairman.

● Trump also laid out his specific expectations for interest rates: he hopes to see the federal funds rate lowered to "1% or even lower" in a year to alleviate the financing pressure on U.S. national debt. He emphasized that the next chairman should consult him when formulating policies.

● Just two days later, another major candidate, Kevin Hassett, quickly responded. On December 14, he defended the independence of the Federal Reserve in a television interview, clearly stating that even if he were to take office, the president's opinion would "carry no weight," and decisions must be based on the consensus of the Federal Open Market Committee.

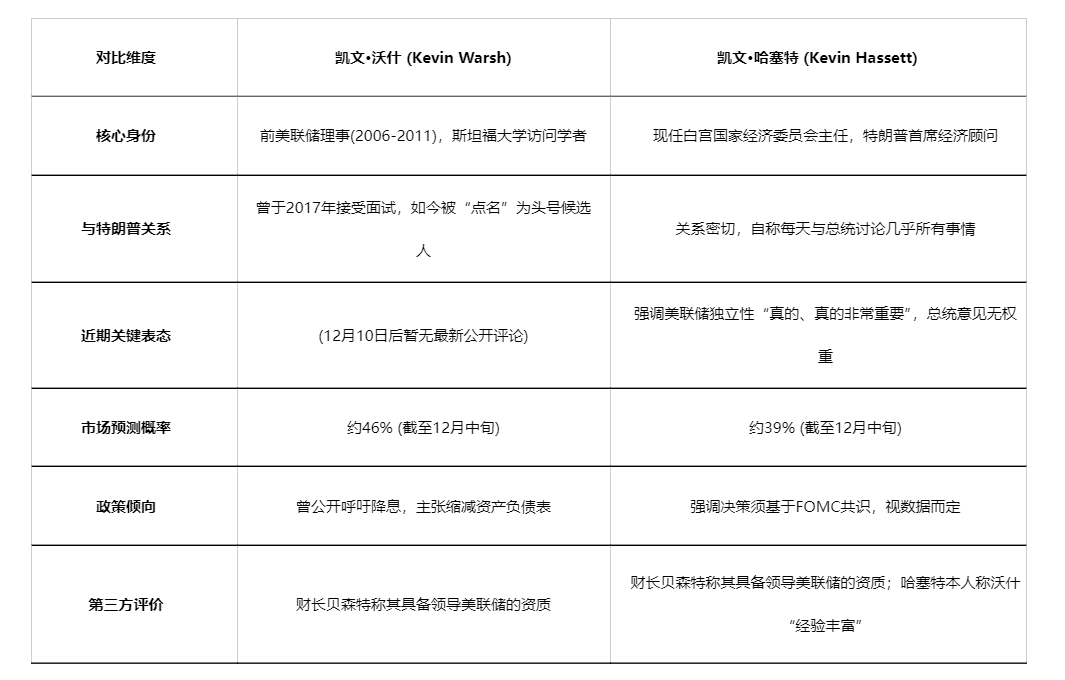

2. A Duel of Two Kevins

The backgrounds, philosophies, and relationships with the White House of the two "Kevins" create a stark tension in this showdown.

3. The "Fortress" of Independence and the "Underflow"

Hassett's firm statement on "the president's opinion carrying no weight" is not an isolated defense but the latest response to a months-long battle for independence.

● The front lines of this battle have long been established. In August of this year, Trump publicly pressured on social media to fire the head of the Bureau of Labor Statistics, accusing him of "artificially exaggerating" employment data during the previous administration. This move was interpreted by experts as an attempt to shift the blame for economic weakness onto former officials and to strengthen control over key economic sectors.

● Meanwhile, within the Federal Reserve, the personnel struggle is equally intense. Stephen Moore, seen as more aligned with Trump's stance, narrowly passed Senate voting to join the Federal Reserve Board. Another governor, Lisa Cook, was temporarily allowed to remain in her position due to court intervention.

● These events collectively paint a picture: Trump is attempting to influence the presentation of U.S. economic data and the formulation of monetary policy through personnel appointments.

4. A Global Crisis of "Trust"

The tremors caused by changes in Federal Reserve personnel extend far beyond Washington's political circles. At its core, it touches on the cornerstone of the modern global financial system: the institutional trust in the independence and credibility of major central banks.

● Chief economist Cheng Shi of ICBC International pointed out that more dangerous than the Federal Reserve's policies themselves going out of control is the market's imagination of "its potential to go out of control." Once this imagination takes hold, it will be factored into global asset pricing models, becoming a new, path-dependent "institutional expectation risk premium."

● The manifestation of this risk premium is concrete and severe. When the market begins to doubt the Federal Reserve's ability to resist political interference, investors may demand higher compensation for holding U.S. Treasury bonds (especially long-term bonds), leading to an increase in term premiums; at the same time, capital may flow into gold and other assets seen as "insensitive to institutional issues," triggering a weakening of the dollar.

● Historical lessons are close at hand. In the 1970s, the Federal Reserve frequently faced political interference due to a lack of clear legal protections and autonomy, ultimately leading to stagflation. Former Federal Reserve Chairmen Bernanke and Yellen have also rarely co-signed to support Powell, warning that once central bank independence is compromised, the costs will be extremely high.

5. The Economic Dilemma and Political Calculations Behind the Nomination

Trump's relentless pressure on the Federal Reserve is backed by complex economic realities and urgent political considerations.

● On one hand, the U.S. economy is walking a narrow path. Although inflation has fallen from its peak, it has not stabilized within the 2% target.

● On the other hand, signs of weakness are emerging in the labor market, with data showing that actual job gains have been significantly revised down. Meanwhile, the "big and beautiful" tax and spending bill introduced by the Trump administration has brought pressure for expanding fiscal deficits, which theoretically requires accommodative monetary policy to stimulate the economy.

In this context, Trump's publicly set target of "1% or even lower" for interest rates appears more like a political banner. It aims not only to reduce government debt costs but may also be expected to inject a short-term boost into the stock market and economic sentiment to cope with the upcoming midterm election pressures.

However, as experts analyze, if monetary policy overly compromises to accommodate fiscal expansion, it may damage the credibility of the Federal Reserve, trigger a decoupling of inflation expectations, and even lead to a new round of uncontrolled inflation. This constitutes the fundamental reason for the Federal Reserve to maintain its independence.

6. The Global Market's Silent Watch

● For the global market, the personnel competition occurring in Washington will directly determine the capital flows and asset prices for the coming years.

● Analysts believe that if the future policy path of the Federal Reserve is perceived by the market as being overly influenced by political considerations, its long-accumulated "credibility capital" will be depleted. This may lead to a long-term loss of confidence in U.S. assets. Although there may be a market frenzy in the short term due to interest rate cut expectations, the depreciation of institutional trust will be profound and difficult to repair.

● Currently, the market is in a state of silent observation. U.S. Treasury Secretary Scott Basset expects the appointment of the new chairman to be announced in early January next year. Regardless of who ultimately takes the position, this new chairman will face a severe test on their first day in office on how to balance the dual mission of stabilizing prices and achieving full employment while resisting political pressure.

At present, both "Kevins" are waiting for Trump's final decision. Walsh, as the named candidate, has gained a leading advantage; Hassett, on the other hand, is attempting to win the support of those in the market and Congress concerned about political interference with his public declaration of "independence."

Whoever ultimately takes the helm of the Federal Reserve will stand at a historical crossroads: on one side is the president's urgent demand for lower interest rates and economic stimulation; on the other side is the global market's keen attention to whether the Federal Reserve can defend its decision-making independence and maintain the credibility of dollar assets. The outcome of this showdown will extend far beyond a simple personnel appointment; it concerns rules and expectations.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。