Where is the direction of Ethereum's Bollinger Bands heading? Will a volume contraction rebound at the hourly level lead to a new low? Is it possible to drop below 2,700 and then below 2,600? Where are the support levels for the medium to long term?

Let's analyze the market around this theme.

Today is December 17, 2025. From the daily level, Ethereum's Bollinger Bands are currently flat, indicating a sideways movement. We can either go long when it comes down or buy at the lower Bollinger Band, or we can short near the middle Bollinger Band with a stop loss.

In the short term, the upper Bollinger Band does not show strong momentum based on volume; it may take until next month to break through the middle Bollinger Band and reach the upper band. In this sideways oscillation structure, if we can grasp the rhythm well, we can profit from both long and short positions.

Going long around 2,800 should have a stop loss, with the middle band pressure acting as a dividing line for long and short positions around 2,797-2,800. For short positions, it would be around 3,050-3,060, and if it gets aggressive, approximately near 3,100.

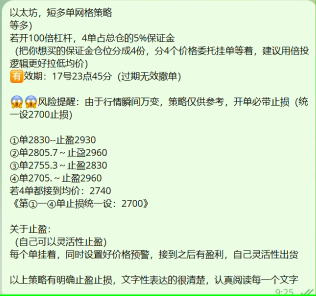

Next, we can go long at 2,805 or 2,810, placing the stop loss at 2,800. If it breaks 2,800, we will look at the 2,718-2,730 range, with a stop loss at 2,700. We can divide the desired position into four parts and place orders at four different prices, setting stop losses in stages.

This is a grid trading strategy for a weekly K-level long position for your reference. This approach is divided into two parts, focusing only on long positions near 2,700, skipping 2,800, which has its pros and cons.

If it only retraces to around 2,800, you might miss the support rebound to 3,000. If the short-term long position directly drops to 2,700, then the 2,800 position would incur a loss, saving costs.

If you want to capture the market more perfectly without being affected by losing positions, we can reduce the position size to four orders.

Set the total position size to 5% of the total capital, and decide how much leverage to use. Tonight, at 23:45, we will cancel the orders to avoid any midnight fluctuations, as it can be difficult to control the market movements late at night in domestic time.

Therefore, we can deploy this strategy during the day before going to sleep, placing orders in batches from 2,830 to 2,705, and then at 2,700.

Setting a stop loss of 40 dollars still offers good value.

For more strategies, follow the public account BTC-ETH Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。