The timing of the latest non-farm employment data released in the United States is quite intriguing. This is not because the data brought shocking surprises, but because it confirms a reality that many market participants have already sensed: the U.S. economy is slowly and unevenly entering a transitional period, and the difficulty of reaching a policy consensus within the Federal Reserve is increasing.

While news headlines often focus on whether the employment data is "better" or "worse" than expected, this reporting style overlooks a more important point. Monetary policy is not based on a single data point. More importantly, the non-farm employment report is just one of many reference factors in the Federal Reserve's decision-making process, and it is not the most influential factor.

To understand what the data means for interest rate expectations, it helps to look at the issue from a more macro perspective.

Background of the Latest Non-Farm Employment Data

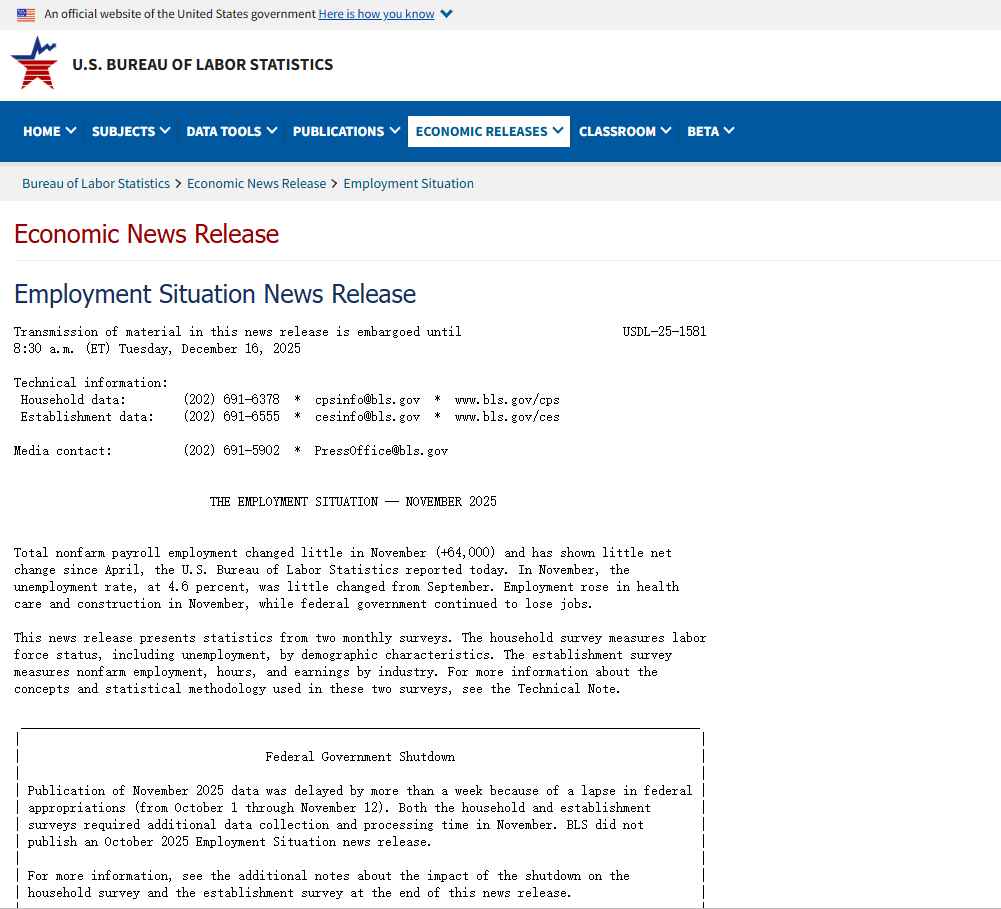

The employment report released yesterday did not come out monthly but combined data from October and November due to the data interruption caused by the U.S. government shutdown in October. This alone means that these data need to be interpreted more cautiously than usual.

Several details stand out.

First, the employment data for October was significantly revised downwards. The non-farm payrolls decreased by about 105,000, which is a notable deterioration compared to previous estimates. However, the shutdown during the pandemic may have affected the collection and reporting of data, leading to lower reliability of the October data than usual.

Second, 64,000 new jobs were added in November. Although this is slightly above market expectations, the increase is far from strong. Meanwhile, the unemployment rate rose to 4.6%, reaching a new high in years, also exceeding general market expectations.

Third, the new job additions remain highly concentrated. Most of the new jobs came from healthcare and construction, while growth momentum in other sectors—especially some service industries—lagged far behind these two industries.

Overall, the report paints a picture of an economy that is still adding jobs, but the growth is uneven and slowing down.

What Does the Data Reveal About the Labor Market?

The most important significance of this report lies not in whether the final data exceeded expectations, but in the patterns behind the data.

The job market is clearly cooling down, but it has not collapsed. There is currently no evidence to suggest a sudden surge in mass layoffs or unemployment benefit applications. On the contrary, the labor market seems to be entering a gradually weakening phase.

This dynamic is a typical characteristic when an economy transitions from the late stage of a cycle expansion to a slowdown. Companies are facing rising cost pressures—including wages, financing costs, and input prices—while income prospects have also become unclear. However, the current situation is not sufficient to justify mass layoffs.

As a result, companies typically adopt more moderate responses. Hiring slows down, job vacancies remain unfilled, salary increases become more difficult, and bonuses are reduced or even canceled. These adjustments weaken labor demand but do not trigger a sudden employment shock.

Sector-specific data also supports this view. Hiring in the healthcare sector remains strong, primarily due to structural demand rather than cyclical growth. Hiring in construction reflects ongoing projects and infrastructure momentum, rather than an acceleration of the overall economy. The weak job growth in non-essential services is particularly noteworthy.

From this perspective, a 4.6% unemployment rate is not concerning—but it does confirm that the labor market is gradually returning to a state of weakness.

Stagflation Dynamics and Policy Tension

This employment report is closely related to a broader macro theme: the increasing risk of stagflation.

On one hand, inflationary pressures remain high. Companies' input costs are still elevated, and price stability has not fully recovered. Under normal circumstances, this usually means a need to tighten monetary policy.

On the other hand, economic growth momentum is weakening. Hiring is slowing down, growth expectations are moderating, and business confidence is also declining. These factors typically indicate a need to ease financial conditions.

This tension explains why divisions within the Federal Reserve have intensified. Policymakers face a trade-off between controlling inflation and avoiding unnecessary economic damage. The latest employment data did not resolve this dilemma; rather, it confirmed it.

Importantly, this is why the market interpreted this report as slightly positive for risk assets. Not because job growth is strong, but because the data supports the view that the economic slowdown is manageable rather than a hard landing.

Why Non-Farm Employment Data Has Limited Impact on Rate Cuts

Although non-farm payrolls receive significant attention, they are not the primary driving factor for interest rate decisions.

The Federal Open Market Committee (FOMC) meets approximately every six to seven weeks, holding eight meetings a year. In contrast, most macroeconomic indicators—including inflation and employment data—are released monthly. Therefore, the weight of any single data point is limited.

More importantly, the Federal Reserve evaluates a range of indicators. While employment is important, it is not the most critical factor in deciding on rate cuts.

From a policy perspective, the relative importance of key indicators is typically ranked as follows:

- Personal Consumption Expenditures (PCE) inflation

- Consumer Price Index (CPI)

- Non-farm payrolls

- Weekly initial unemployment claims

- Purchasing Managers' Index (PMI)

- Quarterly GDP

All of these indicators, except for GDP, are released monthly. They often send conflicting signals. Focusing too much on any one indicator—especially wage data—can lead to misleading conclusions.

This is why trying to predict rate cuts based on a single employment report often leads to disappointment.

The Real Driving Factor: The Path of Rate Cuts, Not the Meetings Themselves

One of the most common mistakes investors make is treating each FOMC meeting as an isolated event. In reality, the market is more concerned with the direction of policy rather than the outcome of any single meeting.

If a one-time rate cut is not followed by subsequent easing policies, it holds little significance. Conversely, even without an immediate rate cut, expectations for future easing cycles can have a significant impact on asset prices—especially in the cryptocurrency market.

Therefore, while employment data is important, it is secondary. It helps build a more macro narrative but rarely independently determines policy.

Ultimately, what matters is whether inflation will continue to slow down when economic growth decelerates enough to support sustained easing policies. Judging this requires months of data, not just a single report.

Letting the Market Play Its Maximum Role

Another point that is often overlooked is that individual investors do not need to replicate the work of professional macro trading departments.

Markets are not driven by isolated opinions or social media comments, but by the collective expectations of institutions managing trillions of dollars in assets, supported by teams of economists, strategists, and data analysts.

Instead of manually weighing each data point, it is often more effective to observe the convergence of these expected outcomes.

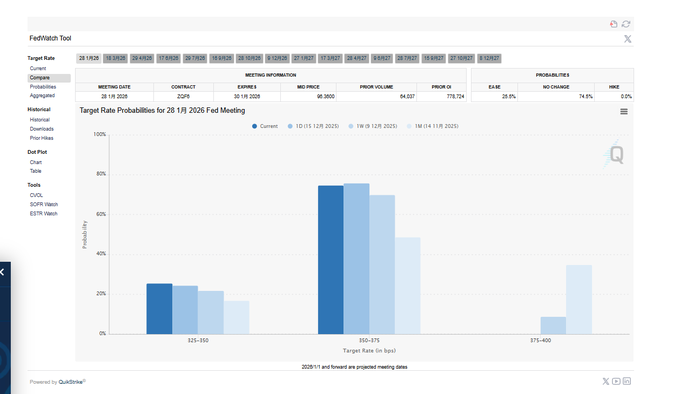

At this point, tools like CME FedWatch become very valuable.

Using CME FedWatch to Track Rate Expectations

The CME FedWatch tool aggregates real-time pricing of interest rate futures to estimate the probability distribution of market expectations for the Federal Reserve's upcoming decisions.

Investors would be better off looking at how the market positions itself rather than guessing whether the Fed will cut rates and by how much.

This tool also allows users to track changes in expectations over time, providing deeper insights into whether sentiment is gradually shifting or reacting to short-term noise.

For anyone looking to understand rate expectations, this approach is more effective and reliable than reacting to individual data releases.

The tool can be accessed here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Seeing Beyond the Surface

The latest non-farm employment report fully achieved its intended purpose: it confirmed a trend rather than creating a new one.

Job growth is slowing down, but it has not collapsed. Inflationary pressures persist, but economic growth is weakening. Policy trade-offs are becoming more complex, not simpler.

In this context, making investment decisions based solely on one month of employment data is not very meaningful. It is more important to focus on the long-term interactions between inflation, economic growth, and policy expectations.

For investors willing to take a step back, use the right tools, and focus on the direction of policy rather than news headlines, the signals are much clearer than what the noise suggests.

The above views are referenced from @Web3___Ace

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。