Original Title: The Case of Lighter

Original Author: PlayRisk

Original Translation: SpecialistXBT, BlockBeats

TL;DR

Compared to other Perp DEXs, Lighter's valuation is undervalued.

Currently, most circulating tokens are priced by early users of Hyperliquid. This group has become wealthy by holding Perp DEX tokens, and even to hedge risks, they will buy Lighter. 99% of VCs have missed out on $HYPE, and they are in urgent need of the next target.

Narrative occupies the vast majority of token valuation, and Lighter's signals are already very clear.

Today's token price relies entirely on "programmatic" spot buying (such as automatic repurchases). Unless the spot buying is strong enough, it is difficult for the token to rise (refer to the lessons of ETHFI and GRASS). Currently, only the Perp DEX sector has truly run this logic.

Lighter's Vlad is closely related to Robinhood's Vlad, and it is very likely that Robinhood will direct orders to Lighter in the future.

The zero-fee business model is very popular among users.

Large holders need privacy; no one wants their liquidation price to be observed by the entire network.

Valuation Analysis

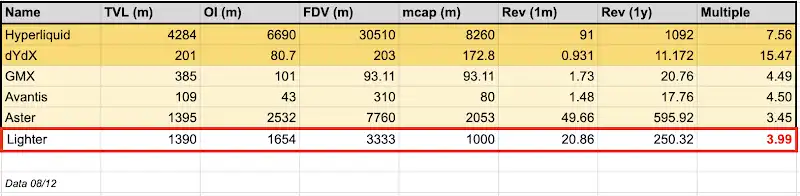

From the current OTC market, Lighter's FDV is about $3.3 billion. Assuming an airdrop ratio of 30%, its initial circulating market cap is about $750 million. In comparison, Hyperliquid's circulating market cap is as high as $8.2 billion.

From a revenue perspective (note: Lighter's revenue has not yet been validated in the market for a year like Hyperliquid), if we simply annualize based on the past month's revenue, Lighter's annualized revenue could reach $250 million. This means Lighter's price-to-sales ratio (market cap/revenue) is only 2.5 times, far lower than Hyperliquid's 7.6 times, which is ridiculously cheap.

Now let's look at a closer competitor, Aster. Aster's TVL is comparable to Lighter's, and its open interest (OI) is about a billion more than Lighter's, but its FDV is as high as $7 billion, with a circulating market cap of about $2 billion. In contrast, Lighter's trading price is only one-third of Aster's.

Ask yourself: Even considering Aster's halo effect from Binance/CZ, is it reasonable for Lighter to be priced at only one-third of Aster? I believe that, based on the current valuation, Lighter is severely undervalued fundamentally.

Looking at the fundamentals, you will find that only two tokens can maintain a high revenue multiple in the long term: Hyperliquid and DYDX. Why? The former has the most transparent repurchase mechanism, while the latter has stood the test of time in this industry. Unlike other listed Perp DEXs, Lighter does not have a top-tier promoter like CZ, nor does it have the liquidity support of Coinbase to artificially prop up prices, and it does not face the "lack of real users" dilemma that other competitors do.

Additionally, note that the OTC market (SOTC) usually has a discount because buyers bear the default risk (if the opening price is twice the OTC transaction price, sellers have the incentive to default), which leads people to hesitate to pay high prices in OTC and instead wait for actual market performance.

I have a reason for choosing to annualize based on the past month's revenue: In the crypto circle, everyone has a 7-second memory, and no one has the ability to see or trade the future a year out. Therefore, only the recent month's immediate revenue is the most important indicator.

Capital Flow

Hyperliquid's ability to emerge as an independent market is due to the initial skepticism of many market makers regarding its model. This led to those sharp-sensed retail investors sweeping up all the tokens and then selling them at high prices to latecomers.

In the past few months of communication with numerous VCs, I have noticed a phenomenon: except for Paradigm, almost everyone has missed out on Hyperliquid. This means that every VC with a liquidity fund (the vast majority do) will try to catch the next $HYPE.

Who is the next Hyperliquid? It's simple: by doing a "pattern match" between Lighter's storyline and Hyperliquid, you will find that it is Lighter.

Looking at the token distribution, you will find that Hyperliquid's large token holders have also become Lighter's large holders and deep users. The secret to this group's wealth is simple: Hold.

Ask yourself, if this group is unwilling to sell their tokens and even wants to buy more (because Lighter's current momentum is comparable to that of HYPE back in the day), what will happen? Selling pressure disappears, and buying increases. Even if you are a whale like Paradigm holding a $700 million HYPE position, you must buy its competitor—the one that could potentially take you down. If Lighter doubles, triples, or even increases tenfold, and you don't allocate to it, that would be a dereliction of duty. Paradigm is currently only looking at trading infrastructure/exchange projects, which perfectly aligns with Lighter… is it unreasonable to buy a $50 million hedge?

Yes, Lighter once raised $68 million at a $1.5 billion FDV (equity valuation of $1 billion), which indeed priced in part of the VC's capital flow. But note that in this round of financing, each LP's limit was only $2 million, and the terms included a 1-year lock-up period + 3-year vesting period. This means many participants will still view this token from a liquidity trading perspective, not just as an investment. Moreover, this round of financing was oversubscribed by 6 times; unless you have a strong relationship with the team, you simply cannot squeeze in.

"Every year, there are one or two tokens that force everyone to rebalance their positions."

Similarly, most retail investors also missed out on the wealth creation myth of Hyperliquid, only able to watch the victorious parade of Hyperliquid community members on Twitter. For a whole year, Hyperliquid was the only choice in the market, the only outlet for people to express the view of "shorting CEX / going long on DEX." Until Aster's TGE, but they messed up the expectation management after the TGE, leading to a large outflow of funds and idling in the OTC market, waiting for the next attractive target.

Narrative Premium

I believe this is the biggest factor determining price, especially in the first two weeks after TGE. The pricing of any asset at TGE and the subsequent valuation in the first two weeks are meaningless because the market is flooded with price-insensitive buyers. This creates a dynamic where people overhype and overvalue. As Jeff said, "Price is short-term human emotion."

Based on this alone, Lighter deserves a higher valuation. From any metric, it is the most anticipated token release by the end of this year.

Expected indicators when valuation peaks

Token Buyback

Passive spot buying is the only thing that can support the token price. BTC has MicroStrategy's Saylor, ETH has Tom Lee, but for altcoins, the market only recognizes income buybacks. If you want to keep the token price strong, you need passive buying in the form of buybacks. Hyperliquid understands this well.

Lighter is essentially a replica of Hyperliquid. Founder Vlad has clearly stated that they will conduct buybacks. While we cannot expect them to buy back 97% of the tokens, buying back 30% or 50% is reasonable. As long as there is an eight-figure (tens of millions) passive buying, that is attractive enough.

Note: In their $68 million financing (mainly for the insurance fund), the team has allocated part of the funds for token buybacks at TGE. This is similar to the $75 million spot buying of early Hyperliquid.

Deep Binding with Robinhood

Vlad Tenev (Robinhood's Vlad1) once interned for Vlad (Lighter's Vlad2) at Addepar, and they became acquainted. Robinhood is an investor in Lighter, and Vlad1 is also an advisor to Lighter.

There have been multiple rumors about using Lighter on the Robinhood chain. Lighter's goal is composability and will integrate into Ethereum L1, ultimately achieving collateralized LLP token lending. This composability aligns with Robinhood's vision of "tokenizing everything" and putting everything on-chain.

While this is speculative, I support the argument that Robinhood will acquire a significant stake in Lighter (whether through tokens or equity). Given the similarity of their "payment for order flow" (PFOF) models, I speculate that once Robinhood holds shares in Lighter, it will direct a large portion of its traffic to Lighter. This will further strengthen this storyline.

RWA Trading

While not limited to Lighter, RWA contract trading has proven to be a key early product-market fit. Data shows that Lighter's daily trading volume for all RWA products is $517 million, with an open interest (OI) of $271 million. Compared to Hyperliquid, Lighter is rapidly catching up and even surpassing.

A key difference is that Lighter's RWA services are not provided by third parties in the ecosystem but are self-operated. This makes coordination and the introduction of new tokens smoother and faster. Additionally, most of Lighter's trading volume comes from its forex contracts, while Hyperliquid mainly deals with index contracts (accounting for 80%). Ultimately, this will evolve into a pure competition of liquidity and order book depth to capture users.

Hyperliquid's First True Competitor

The derivatives market is growing rapidly. Despite a group of die-hard fans on Twitter shouting "Hyperliquid is the only one," the market is large enough to accommodate multiple top players. Robinhood has also opened contract trading because the dominance of contracts in the crypto space is too strong, and they are indeed a superior trading method compared to options.

Solving the full-margin issue is the most significant challenge that Hyperliquid has outsourced to Flood and Fullstack Trade. As far as I know, Flood is at least six months away from resolving this issue. In contrast, Lighter's larger team is likely to tackle this problem. Yes, Hyperliquid has a first-mover advantage, but if Lighter can quickly integrate this feature, it may very well take a slice of their market share.

Privacy

While Hyperliquid has built a cult-like community culture, its architecture has a fatal flaw for large holders: complete transparency.

On Hyperliquid, leaderboards and on-chain data broadcast every large position, entry price, and liquidation point to the entire world. This turns trading into a PvP arena, where predatory players like me can specifically hunt for whale liquidation orders and front-run large funds. Using liquidation data to predict tops and bottoms on lower time frames is traceable, and I know many traders consistently make money through such strategies.

Lighter positions itself as the antidote to this risk. By obfuscating trading flows and masking position data, its operational model is closer to an on-chain dark pool rather than a standard DEX. For "smart money" and large funds, anonymity is not just a feature—it is a necessity. If you have a large amount of capital, you absolutely cannot trade in a place that directly hands your cards and liquidation points to the opposing side. As DeFi matures, venues that can protect users' alpha will inevitably attract the largest capital flows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。