Selected News

Coinbase's new product launch is imminent, some tokens on the Base chain are starting to rise

Aave governance conflicts escalate, community proposals compete for control of brand assets

U.S. Senator proposes legislation to establish a federal task force to combat cryptocurrency fraud

U.S. pre-market cryptocurrency concept stocks slightly decline, BitMine down 0.57%

Selected Articles

This is one of Hyperliquid's most important upgrades in a long time. The various upgrades of DeFi protocols and Perp DEXs in the past crypto market have actually been addressing the same issue: how to make limited funds generate greater liquidity. The traditional financial derivatives market has had an extremely effective solution: Portfolio Margin. This mechanism once brought over $7 trillion in incremental scale to the traditional derivatives market, completely changing the game for institutional trading. Now, Hyperliquid has brought it on-chain. In today's liquidity-constrained environment, this could be a turning point for the on-chain derivatives market to usher in a new prosperity.

PayPal is about to open a bank. On December 15, this global payment giant with 430 million active users officially submitted an application to the U.S. Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions to establish an industrial bank (ILC) named "PayPal Bank." However, just three months prior, on September 24, PayPal had announced a major deal to package and sell its "buy now, pay later" loan assets worth up to $7 billion to asset management company Blue Owl.

On-chain Data

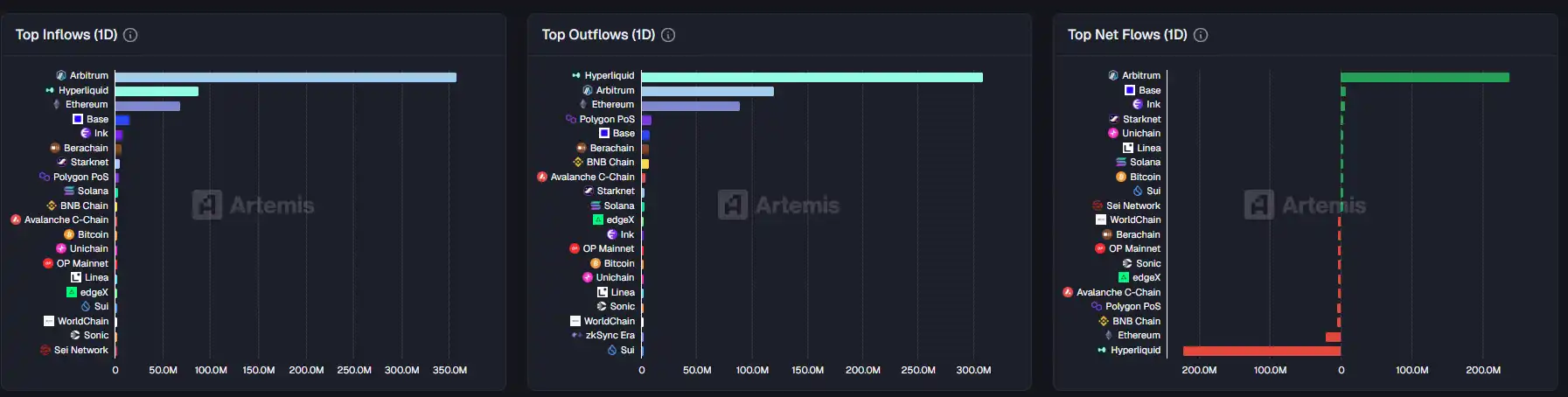

On-chain capital flow situation on December 17

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。