Written by: Glendon, Techub News

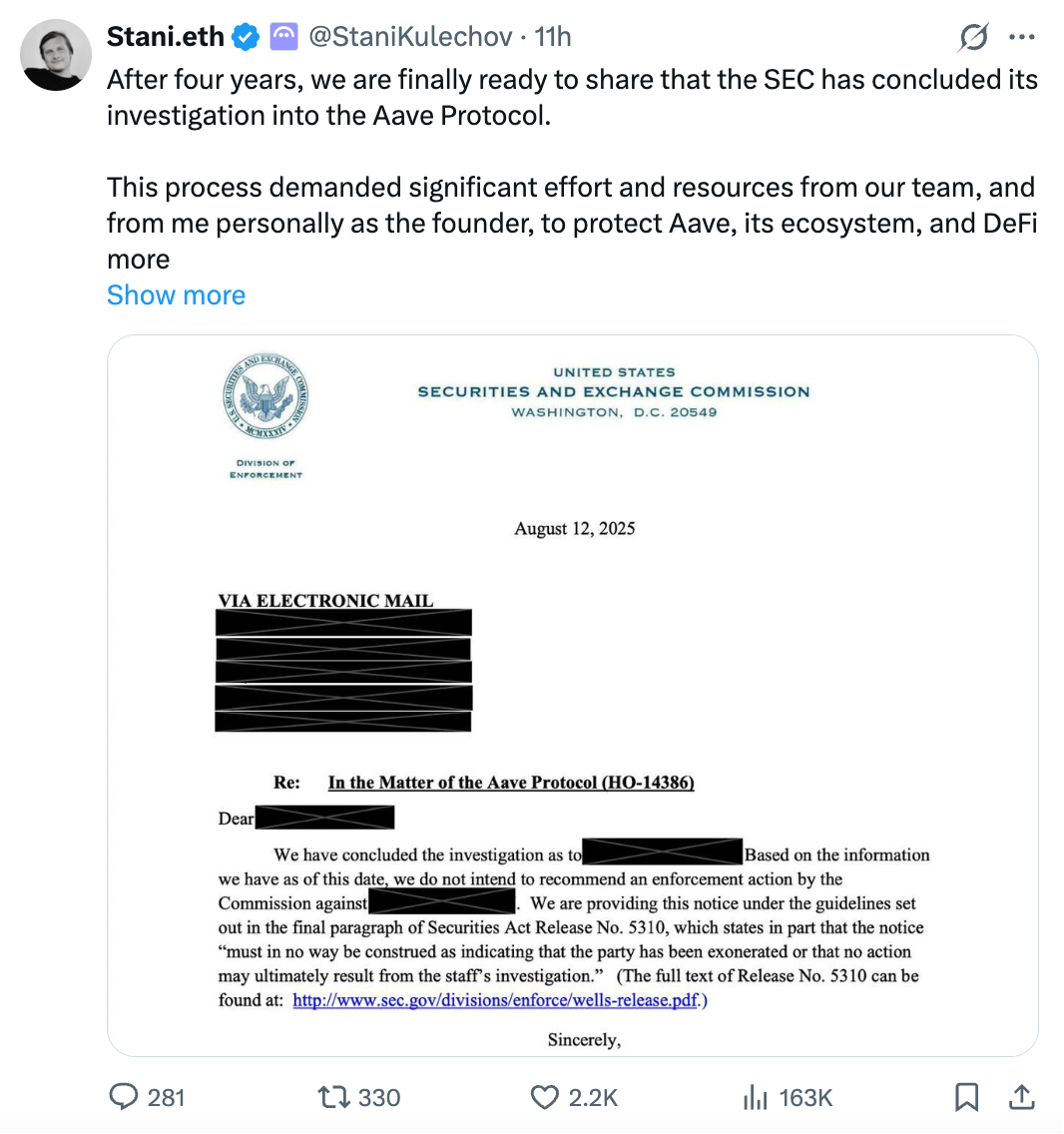

Today, the leading DeFi protocol Aave has reached a significant turning point in regulatory matters. Aave founder and CEO Stani Kulechov tweeted early this morning that the U.S. Securities and Exchange Commission (SEC) has officially concluded its four-year investigation into the Aave protocol. He expressed, "To protect Aave, the ecosystem, and the broader DeFi space, the Aave team has invested significant effort and resources. In recent years, DeFi has faced unfair regulatory pressure. We are pleased to break free from these constraints and enter a new era where developers can truly build the financial future."

The conclusion of this investigation marks the end of the long-standing regulatory uncertainty hanging over Aave, clearing key obstacles for the protocol's development. At the same time, this is seen as a sign of DeFi beginning to engage in dialogue with regulatory authorities.

However, as the shadow of compliance risks gradually dissipates, Aave is still embroiled in internal turmoil over issues such as sovereignty and revenue. Currently, the power struggle between Aave DAO and Aave Labs is escalating, drawing widespread attention within the community. Community members are increasingly vocal about the disputes over leadership and revenue distribution between the two parties. This conflict not only exposes the deep-seated governance contradictions that have accumulated within Aave but also reflects the potential crisis in governance within the DeFi space. So, where will this highly publicized controversy surrounding Aave lead?

The Dispute Over Aave's Revenue Distribution

To understand this dispute in depth, we first need to clarify the roles of Aave Labs and Aave DAO. Aave Labs is the developer and core product builder of the protocol, responsible for the front-end interface, new feature development, and technical upgrades; Aave DAO, on the other hand, is the decentralized governance organization that holds governance power, with holders of the governance token AAVE voting on major matters such as protocol parameters, interest rates, fund allocation, and development direction. In simple terms, the DAO manages the protocol layer, while Labs represents the product layer.

This "development team + decentralized governance" structure is a typical model adopted by many crypto projects. Ideally, Aave Labs and Aave DAO would form a positive collaboration, with Labs responding to market changes and proposing innovative solutions that align with ecological development (such as upgrading to Aave V3 and V4, proposing the Horizon plan, etc.), while the DAO relies on community consensus mechanisms to ensure that every decision is both fair and sustainable through the final voting process.

However, when there are disagreements over profit distribution or development direction, this model can lead to governance friction. The recent dispute between the two parties originated from the controversy over the control of the protocol interface and revenue attribution triggered by the integration of CoW Swap, which acted as a catalyst, completely exposing the blurred boundaries of responsibilities between the development team and the governance body, bringing previously hidden issues to the surface.

On December 4, Aave Labs announced an important decision: CoW Swap would replace Paraswap as the default exchange integration tool on aave.com. Aave Labs stated that this move aims to provide better exchange services, effectively resist MEV (Maximum Extractable Value) attacks, and launch a flash loan product specifically designed for intent-based infrastructure.

This move appears to be an upgrade of the adapter business, but in reality, it has laid bare the contradictions between Labs and the DAO. Orbit protocol representative EzR3aL was the first to question Labs in the governance forum, asking whether Labs was "privatizing" the protocol's value and unilaterally making decisions that cut Aave DAO's recommended revenue sources.

EzR3aL stated that in the original Paraswap routing, users could perform any type of exchange without leaving Aave (the protocol), which would improve user retention and redistribute income such as referral fees back to the Aave DAO treasury. However, after switching to CoW Swap, the situation changed; the exchange operation would charge users about 15 to 25 basis points in front-end fees, but this fee would not flow into the DAO treasury, instead going to a private address controlled by Aave Labs.

EzR3aL further emphasized that this is by no means a small amount. Assuming only $200,000 is transferred weekly, Aave DAO's loss over 365 days would exceed $10 million. Moreover, this is just based on his results from testing transactions on two networks; the actual figure could be higher.

Meanwhile, Marc Zeller, founder of the Aave contribution team Aave Chan Initiative (ACI), also pointed out that the front-end revenue of aave.com should have been funneled back to the DAO, but the CoWSwap solver relies on external free flash loans, bypassing Aave facilities and further reducing DAO income.

In response to these criticisms, Aave Labs quickly rebutted in the forum, insisting that "the interface is operated by Aave Labs, completely independent of the DAO-managed protocol. Moreover, the front-end interface is a product, not a component of the protocol, and Aave Labs has the right to independently decide how to operate and profit to support its continued development." They emphasized that the original exchange adapter used to support this process was built and maintained by Aave Labs. The surplus provided by Paraswap to the DAO was never a mandated right of the protocol. Therefore, with the change in routing logic, that surplus would naturally disappear.

Stani Kulechov further elaborated that these traditional swap adapters, which were not originally intended to charge fees, are not particularly noteworthy. They only generate revenue when there is a surplus, and Labs previously gave this unexpected windfall to Aave DAO in the form of "extra donations," amounting to about $50,000 to $75,000 per month. However, in his view, this money might be better suited for the users.

His implication is: "This revenue does not belong to the DAO; the surplus fees received by the DAO previously were merely a generous act by Aave Labs."

At the same time, he indicated that Aave Labs hopes to achieve profitability through the Cowswap adapter to provide sufficient funding for the application. He believes this should not be funded by the DAO, nor should the DAO bear this risk, and this statement seems to delineate the boundaries between Labs' profit-making activities and the DAO.

However, Stani Kulechov's statements did not gain community support; instead, they intensified the controversy. What initially began as a discussion around revenue distribution has now shifted its core focus to the competition over Aave's brand assets and intellectual property (IP).

The Dispute Over Brand Assets and Intellectual Property

Marc Zeller raised a core question in the forum: "Who is the owner of the Aave trademark? Aave Labs or Aave DAO, who has the right to benefit from the Aave brand?"

EzR3aL bluntly stated that Aave Labs is able to collect this fee because the Aave brand has a high level of recognition and reputation in the crypto industry. And Aave DAO has already paid for this brand.

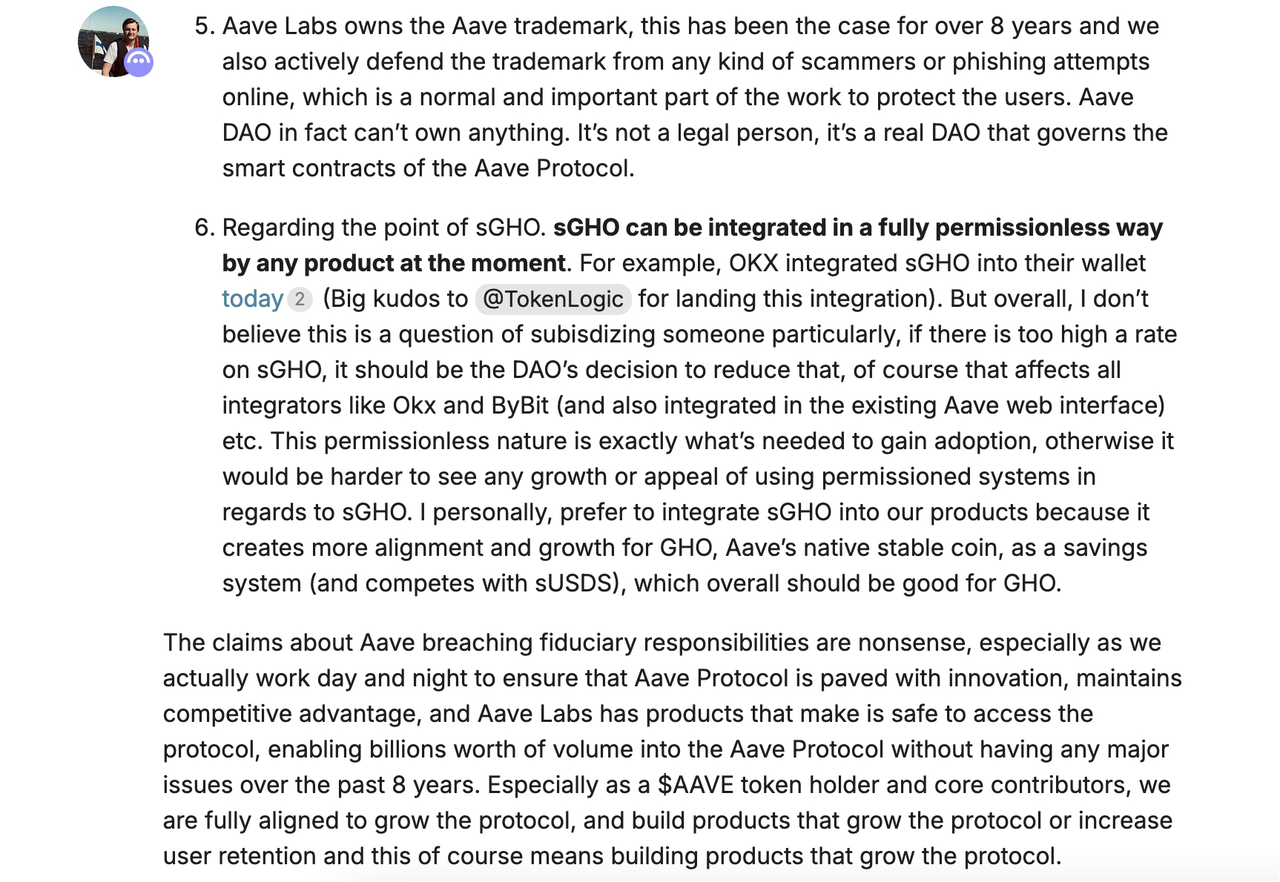

In response, Stani Kulechov countered that the DAO's responsibility is to manage the smart contracts and on-chain parameters of the Aave protocol, but does not include managing the brand. Although past governance proposals have granted the DAO broad rights to use the Aave brand for the benefit of the Aave protocol, Aave ecosystem, and Aave DAO, in reality, Aave DAO cannot own any assets. Because it is not a legal entity, but a decentralized autonomous organization managing the smart contracts of the Aave protocol. Aave Labs, on the other hand, has owned the Aave trademark for over eight years.

Although Stani Kulechov spoke with conviction, many community members did not buy his argument and still believe that Aave Labs is appropriating a significant amount of revenue that should belong to the DAO.

Today, former Aave Chief Technology Officer Ernesto Boado officially released the "Transfer of Brand Asset Control to Token Holders" ARFC proposal in the Aave community. The proposal includes clearly defining the ownership and usage rights of Aave brand assets and intellectual property (covering domain names, social media accounts, naming rights, etc.) and granting the DAO control over these rights.

The proposal points out that Aave has always developed around the core concept of decentralization since its inception. The project initially raised funds through a decentralized financing mechanism (ICO), allowing token holders to own and manage it through a true DAO. Ideally, Aave should be self-sufficient, and its value and accountability should be inherent to Aave DAO itself.

Although in practice, Aave Labs has always been seen as a reliable manager of communication channels or important portals (such as aave.com) within the Aave ecosystem, this default assumption that Aave Labs represents Aave is detrimental to the long-term development of AAVE. Therefore, the proposal aims to clearly stipulate the DAO's control over Aave brand assets and intellectual property.

In addition, some AAVE token holders have proposed more radical solutions. Aave DAO participant "tulipking" proposed the Aave Improvement Proposal (AIP) yesterday: the "poison pill plan." This proposal suggests that the DAO adopt this plan to merge with Aave Labs, fully taking control of its intellectual property (including its published code and brand trademarks) as well as company equity. This proposal undoubtedly indicates that the ongoing discussions among Aave community members regarding protocol revenue distribution and ultimate control have further escalated. Currently, the post has been closed by EzR3aL due to "not undergoing a temporary review."

As the situation develops, Aave Labs and Aave DAO clearly cannot afford to respond perfunctorily; they will have to clarify the boundaries of their rights through formal governance proposals.

It is worth mentioning that during this period, Stani Kulechov revealed Aave's strategic blueprint for 2026. This strategy is primarily based on three pillars: Aave V4, Horizon, and Aave App. Among them, Aave V4 is a comprehensive redesign of the Aave protocol, which will enable Aave to handle assets at the trillion-dollar level; Horizon is a market specifically established by Aave for institutional-grade real-world assets (RWA), allowing qualified institutions to use tokenized assets such as U.S. Treasury bonds and other credit instruments as collateral to borrow stablecoins; the flagship mobile application Aave App aims to abstract all complexities and provide a user experience that addresses real needs in the current economy.

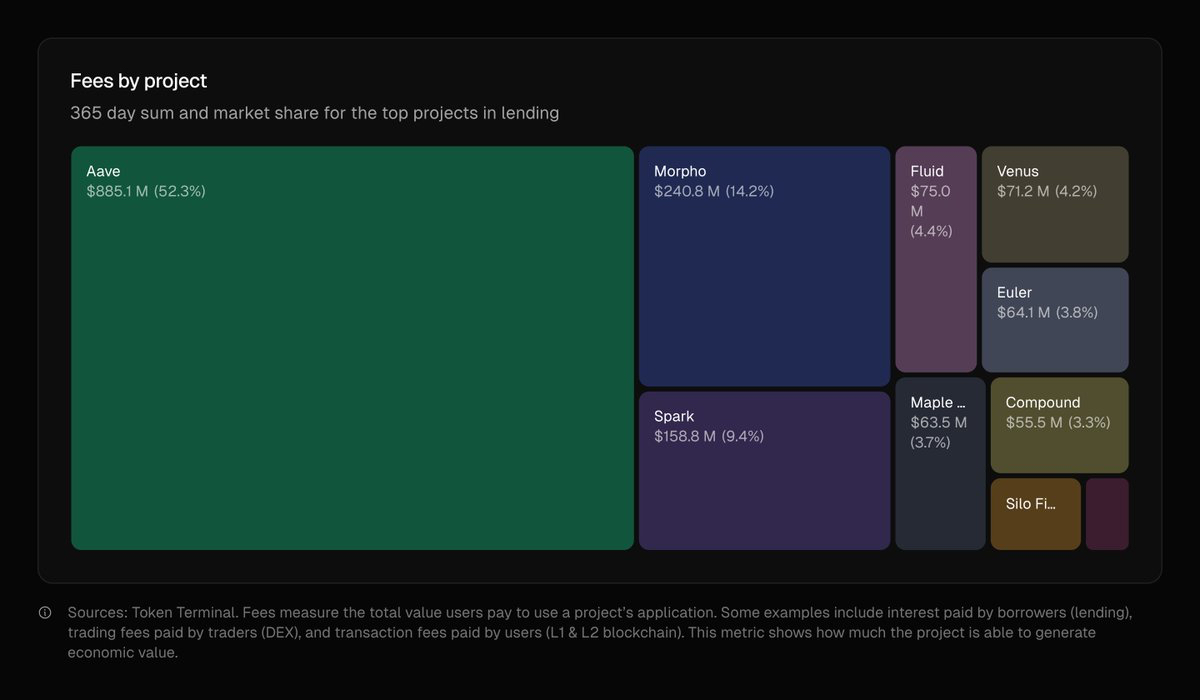

The strategic document indicates that 2025 will be Aave's most successful year to date, with net deposits peaking at $75 billion, cumulative deposits reaching $3.33 trillion, and nearly $1 trillion in loans issued. At the same time, Aave generated $885 million in fee revenue, accounting for over 52% of all lending protocol fees, surpassing the total of its next five competitors. Additionally, the scale of the Aave protocol is now comparable to that of the top 50 banks in the U.S., holding a 59% share of the DeFi lending market and 61% of all active loans in DeFi.

From these achievements, it is clear that the Aave Labs team has excelled in various areas, including the Aave application, Horizon RWA verticals, and Aave V4. As Stani Kulechov stated, "Aave Labs has been established for over seven years, and few teams can match us." It must be acknowledged that Aave Labs' operational capabilities are quite impressive. So the question arises: is it really feasible to significantly weaken Aave Labs' leadership in the aforementioned governance proposals, or even to oust them?

It is important to clarify that as a decentralized organization, the DAO has inherent limitations in efficient operation. Its decision-making process is relatively complex, coordination costs are high, and it is difficult to respond quickly and execute decisions. Moreover, if a new team is to be hired to take over operations, that team would not only need to spend a lot of time familiarizing themselves with the project, technical architecture, and business logic, but differences in team dynamics could also lead to operational disconnects.

Stani Kulechov's stance is very clear: Aave Labs' mission is to drive the long-term success of the Aave protocol. Aave Labs and its employees, as the largest holders of AAVE, aim to create value for the protocol's primary fee acquisition mechanism through all the products they develop, and this value ultimately belongs to the DAO. This indicates that Aave Labs and the DAO are aligned in their fundamental interests.

Therefore, from a comprehensive perspective, the binary opposition between Aave Labs and the DAO is actually unnecessary. In response to this controversy, potential paths for governance proposals could focus on mechanism innovation. For example, constructing a transparent framework that allocates a portion of front-end trading fees to the DAO treasury while ensuring that Aave Labs can obtain sustainable development funding, thus balancing short-term incentives with long-term ecological construction; or promoting Aave Labs to transition to a DAO-led model, such as controlling key decisions or assets through on-chain voting to strengthen governance consistency. Regardless, the core objective of these paths is to maintain the value proposition of AAVE. Any decentralization scheme that undermines the consistency of interests could weaken the protocol's competitiveness.

In fact, the contradictions over sovereignty and revenue distribution are not only challenges faced by Aave but are also unavoidable issues for the entire crypto industry. As Aave continues to expand its business landscape, making longer-term structural adjustments will help improve platform management and reduce recurring governance friction. In this incident, both parties are also expected to reach a mutually beneficial solution that aligns their interests. As the shadow of regulatory risks dissipates, when the governance contradictions between Aave Labs and the DAO are properly resolved, Aave's development may usher in a new peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。