The agreement, announced Wednesday, provides Fluidstack with long-term access to IT capacity under a triple-net lease structure, with Google serving as a financial backstop for lease payment obligations throughout the base term, according to Hut 8’s disclosure. Hut 8 shares spiked more than 10% following the announcement.

Under the terms of the deal, the base lease includes a 3% annual rent escalator and carries an expected total contract value of $7 billion over 15 years. If all renewal options are exercised, the potential value could reach approximately $17.7 billion. Fluidstack also holds a right of first offer for up to an additional 1,000 MW of future capacity at the site, contingent on power expansion.

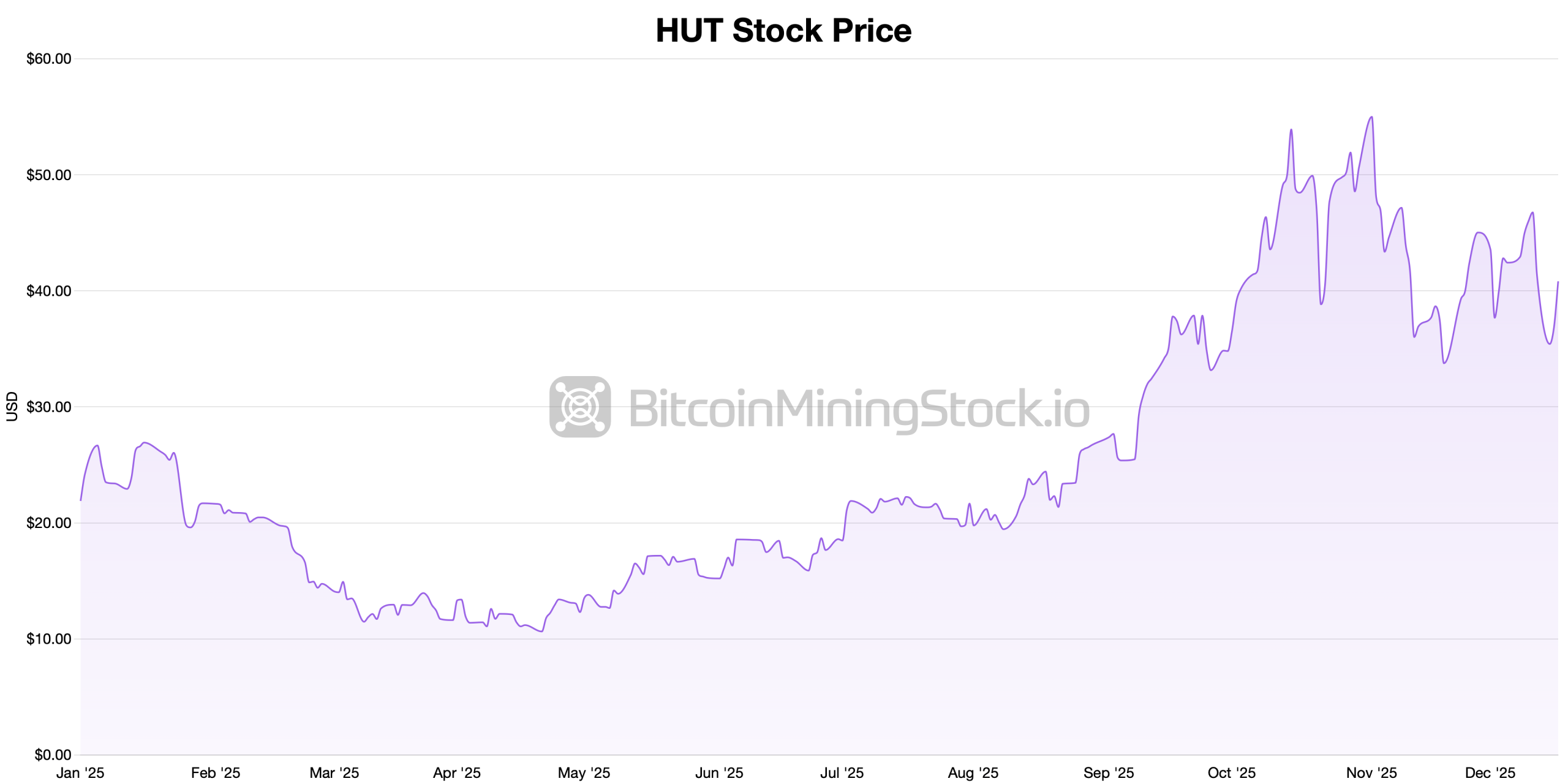

Hut 8 stock price on Dec. 17 via bitcoinminingstock.io.

The River Bend campus is being developed in West Feliciana Parish, with initial construction supported by 330 MW of utility capacity secured through Entergy Louisiana. The first data hall is scheduled for completion and commissioning in the second quarter of 2027, with additional facilities expected to come online later that year.

Project-level financing is expected to cover up to 85% of total costs, with J.P. Morgan and Goldman Sachs acting as loan underwriters, subject to final agreements and customary closing conditions. Hut 8 and Fluidstack also plan to execute an operations services agreement covering ongoing data center management, backed by an additional Google payment guarantee.

Also read: How Bitcoin Miners Are Tapping Into the AI Gold Rush – Part 1

Google has adopted a similar posture with several bitcoin mining firms that have shifted their focus toward AI infrastructure. In the latter half of September, the company extended comparable backing to Terawulf and Cipher Mining. Through these arrangements, Google works alongside data center operators to accelerate infrastructure buildouts for rising AI and cloud workloads while navigating power and energy limitations.

The project reflects a broader strategic shift for Hut 8 as it increases exposure to AI and high-performance computing (HPC) infrastructure while continuing to operate within energy-intensive digital asset markets. The company has classified the River Bend capacity as “Energy Capacity Under Construction,” advancing it from earlier development stages.

Local officials estimate the project will support roughly 1,000 construction jobs at peak activity and generate at least 265 direct and indirect jobs once operational, with additional employment anticipated if future expansion phases proceed.

As bitcoin miners contend with steep drops in revenue tied solely to mining, supplemental income from AI workloads has offered a meaningful financial cushion. On the other hand, at the current pace, the trend suggests the AI sector could eventually absorb these operators altogether, pushing traditional bitcoin mining further into the background.

- What is the size of Hut 8’s AI data center lease?

The agreement covers 245 MW of IT capacity under a 15-year lease. - Who is leasing the capacity from Hut 8?

The capacity is leased to AI infrastructure firm Fluidstack. - What role does Google play in the agreement?

Google provides a financial backstop covering lease payment obligations. - When is the data center expected to come online?

The first data hall is scheduled for completion in Q2 2027.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。