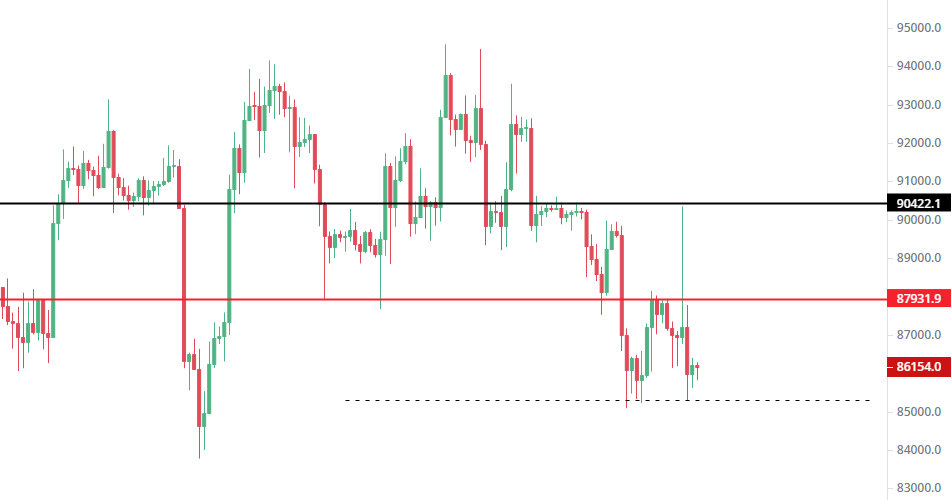

As of the morning of December 18, the price of Bitcoin has quickly retreated after surging above $90,000 last night, and it has now fallen below the $86,000 mark, with a decline of over 2% in the past 24 hours. At one point during the trading session, it dipped below $85,000, reaching a recent low. This surge and subsequent drop is not an isolated event, but rather a concentrated reflection of the current market's heightened caution amid macroeconomic uncertainty, a fragile market structure, and the upcoming release of key data. In the short term, Bitcoin is expected to maintain a weak oscillating pattern.

Core Market Dynamics: The Driving Force Behind the Surge and Retreat

Leverage Liquidation and "Liquidity Sweep": The sharp price drop last night was accompanied by a large-scale liquidation of leveraged positions. Data shows that during a recent similar fluctuation, over $520 million in long positions across the market were forcibly closed within 24 hours, with longs accounting for as much as 87%. This was not triggered by sudden negative news, but rather by the excessive concentration of long leveraged positions in a liquidity-poor environment, which led to a chain reaction of "liquidation" when prices slightly broke below key support levels (such as $86,000). This phenomenon of "liquidity sweep" indicates that the current market rebound is unstable and can easily reverse due to internal position imbalances.

Ongoing Spot Selling Pressure: A deeper layer of selling pressure comes from the spot market. Data shows that the inflow of "Wholecoiner" (addresses holding more than 1 BTC) to exchanges has dropped to its lowest level since 2018. This may seem like a positive signal, but analysis indicates that greater selling pressure comes from a group of investors who entered near the historical high in October (around $126,000), with an average cost of about $103,000. As long as the price rebounds close to their cost line, this group of "stuck positions" will emerge, creating strong resistance and stifling any recovery attempts.

02 Multi-Dimensional Factor Analysis

Macroeconomic Factors: The core focus shifts to inflation data: After the Federal Reserve's "hawkish rate cut" in December, the market is confused about the subsequent policy path. The upcoming U.S. CPI and PCE inflation data this week will be key in determining year-end market sentiment. Any inflation data that exceeds expectations could reinforce the "hawkish" narrative and suppress risk assets. Risks from the Bank of Japan's monetary policy: The market is highly alert to potential tightening measures from the Bank of Japan. Historically, rate hikes by the Bank of Japan have triggered an average adjustment of about 20% in Bitcoin. If funds from "yen carry trades" flow back in large quantities, it could lead to a tightening of market liquidity.

Market Funds and Sentiment: Institutional fund inflows slow down: Bitcoin spot ETF funds continue to show net outflows, indicating strong profit-taking and cautious sentiment among institutions. Standard Chartered has thus lowered its Bitcoin price target for the end of 2025 from $200,000 to $100,000. Divergence among long-term investors: Despite the weak market, "whales" like MicroStrategy continue to accumulate (buying nearly $1 billion in BTC over two consecutive weeks), indicating that some long-term believers view the adjustment as an accumulation opportunity. However, this has not offset the broader pessimistic sentiment.

Technical Trends: Key support levels breached: Bitcoin has effectively fallen below the recent key support range of $86,000-$87,000. The current price is testing around $85,000, which is the Fibonacci 0.786 retracement level of the upward trend since April and is seen as a mid-term lifeline. Momentum indicators are weak: The RSI and MACD on the 4-hour chart continue to operate in a weak range, indicating that bears still dominate. Any rebound will first face severe tests at $91,000 (the midpoint of the previous trading range) and $94,700 (a strong resistance level).

03 Trend Forecast and Key Nodes

In summary, Bitcoin has entered a clear defensive posture under multiple pressures. From today (December 18) to the end of this week, the market will mainly be influenced by the tug-of-war between technical repair demands and macroeconomic tensions.

Short-Term Trend (Next 24-48 hours): It is expected to oscillate around the core area of $85,000-$86,000. After just experiencing leverage liquidation, there is a technical demand for a rebound from oversold conditions, but the upside will be strictly limited. The first resistance level is around $86,500, with stronger resistance at $88,000. Without significant positive news, the rebound is unlikely to sustain.

Core Observation Nodes

Downside Risk: $85,000 is the last line of defense that must be maintained. If the daily closing price confirms a drop below this level, it could trigger broader stop-loss and panic selling, with downside targets directly pointing to the $78,000-$80,000 range.

Upside Turning Point: To reverse the current downturn, Bitcoin must first recover and stabilize above the $91,000 mark. However, this requires significantly positive macro data or large-scale spot buying to drive it, which is quite challenging in the current environment.

Conclusion

The surge and retreat of Bitcoin yesterday is an inevitable result of the market's weak liquidity, high macro uncertainty, and weakening technical structure. The current market has completely shifted from the trading logic of "Federal Reserve rate cuts" to pricing concerns about "inflation data" and "central bank policy independence." Before the release of key economic data, the market will remain in a highly sensitive and fragile state. For investors, the importance of capital preservation far outweighs aggressive tactical plays at this time. It is recommended to closely monitor the $85,000 support level and the upcoming U.S. inflation data, as these will be key in determining Bitcoin's year-end closing trend.

This article is exclusively contributed by "Coin Whale," please indicate the source when reprinting. There may be delays in online publication, and market conditions can change rapidly. For those trading contracts in Bitcoin or Ethereum, or for those feeling lost in their investment journey, you can follow Coin Whale to communicate with teachers in real-time. Entering the market requires a detailed understanding of all related investment risks, and risks are borne by the individual.

Warm reminder: For more timely strategies and information, please scan the QR code to follow the public account. The comments and advertisements below this article are unrelated to me, please read carefully. Thank you for your support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。