Author: Blockchain Knight

Time always comes unexpectedly, and K-line fluctuations are always beyond expectations. This is the footnote of 2025. Now we stand at the tail end of time, looking back at the past and looking forward to the future.

As 2025 comes to a close, the crypto industry cannot be said to have experienced grand waves, but it has certainly weathered calm seas. From the frenzy sparked by Trump Coin at the beginning of the year, to the return of Ethereum in midsummer, and the bloodbath brought by 1011 in late autumn, the ups and downs of the crypto market have been outlined.

However, aside from these K-line fluctuations, the crypto industry has finally welcomed another spring.

In January, the White House issued an executive order, completely abandoning the previous "restrictive regulation" approach.

In March, Trump launched a Bitcoin reserve plan, incorporating 200,000 seized Bitcoins into the strategic reserve.

In April, the U.S. Department of Justice disbanded its special crypto enforcement team, freeing up development space for compliant platforms.

In July, the U.S. stablecoin bill (GENIUS) officially took effect.

In August, Hong Kong's "Stablecoin Regulation" was officially implemented.

These events are not isolated; they form a clear logical chain around "compliance": the U.S. legislation restructured to address the core concerns of institutional entry, while the effectiveness of Hong Kong's regulations opened up compliance channels in Asia.

Looking back at the development history of cryptocurrencies over the past decade, the relationship between the industry and regulation has always evolved through a game of chess. The intensive introduction of compliance policies worldwide in 2025 marks the industry's formal farewell to barbaric growth and its entry into a new development period.

Therefore, if one word must summarize the development of the crypto industry in 2025, it should be—compliance.

But where will the industry head after achieving compliance? Are the development dividends still present? This is what we should ponder.

Ten Years of Regulatory Changes: How to Transition from Prohibition to Regulation?

Over the past decade, global crypto regulation has roughly gone through three stages: "rejection and prohibition, cautious exploration, and regulated development," with the shift in regulatory attitudes responding sharply to the expansion of the industry.

When Bitcoin was born in 2009, its decentralized nature kept it outside the traditional financial regulatory system. Most regions around the world remained silent on this emerging phenomenon, while a few regarded it as a "speculative tool" or "vehicle for crime."

Before 2015, the crypto market was worth less than $10 billion, and global regulation was primarily focused on prohibition and warnings.

In 2013, the central bank in China issued a notice on "Preventing Bitcoin Risks," clearly stating its non-monetary nature; in 2014, Russia classified crypto trading as illegal; and the U.S. SEC only regarded it as an "investment tool to be cautious of."

At this time, the industry was completely in a regulatory vacuum, with transactions mostly completed through third-party platforms, and incidents of hacking and fraud were frequent.

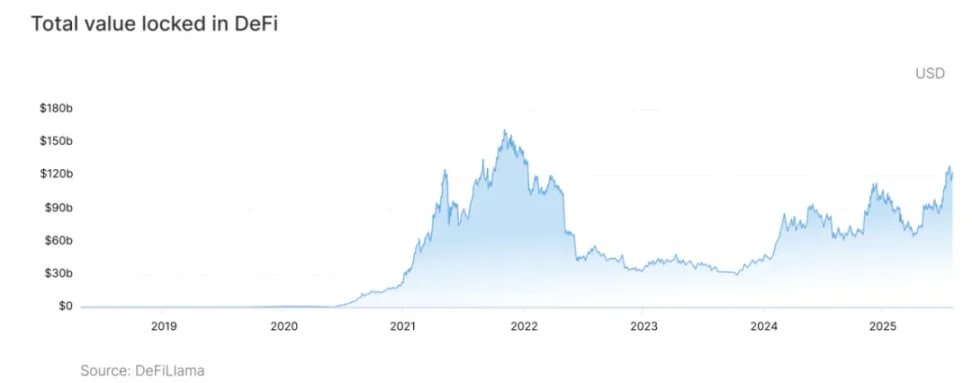

From 2017 to 2022, with the rise of the Ethereum ecosystem and the explosion of the DeFi wave, the crypto market cap surpassed $2 trillion, and regulation entered a cautious exploration phase.

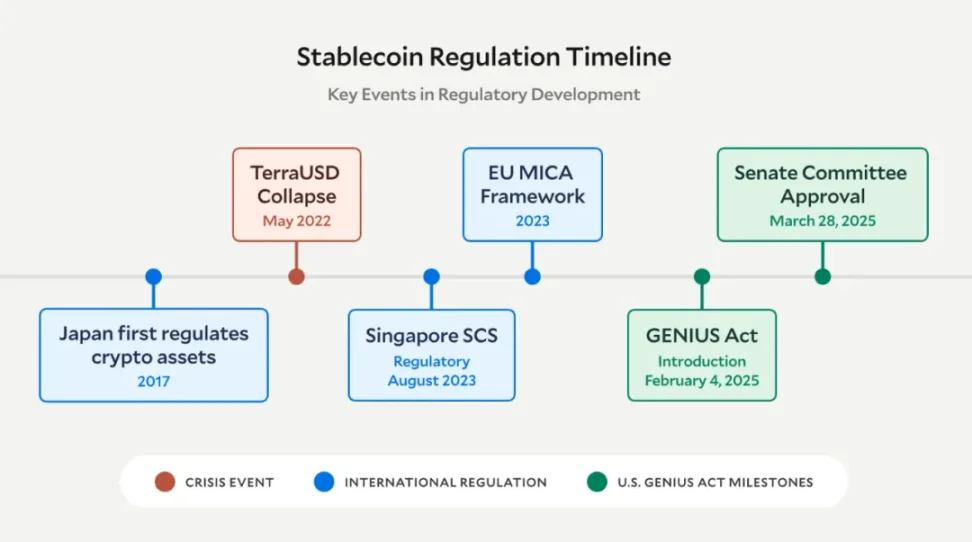

Japan became the first country to attempt to regulate crypto trading, amending the "Funds Settlement Act" in 2017 to issue licenses to crypto exchanges; Switzerland, through its "Crypto Valley" strategy, built an inclusive regulatory framework allowing banks to conduct crypto custody services.

During this phase, the U.S. SEC began to clarify its regulatory stance, defining some tokens as "securities" and cracking down on the chaos of ICOs, but conflicts still existed between federal and state regulatory standards.

During this period, while some regions in Asia issued bans, a global regulatory consensus began to form, as outright prohibition could not stifle technological innovation; establishing an adaptive regulatory system was key.

From 2023 to the present, regulation has entered a normalization phase. After experiencing risks such as the FTX collapse, the industry's demand for compliance has become unprecedentedly urgent.

The European Union took the lead, with the MiCA bill set to fully take effect by the end of 2024, becoming the world's first unified crypto regulatory framework; the U.S. SEC adjusted its regulatory strategy, shifting from "broad securitization recognition" to categorized regulation; countries like Singapore and the UAE established dedicated regulatory bodies to create compliance sandboxes.

This systematic regulation laid the foundation for the explosion of compliance trends in 2025.

Why is 2025 Considered a Year of Compliance Breakthrough?

As we reach 2025, global crypto compliance has achieved a qualitative leap, with Western markets represented by the U.S. and EU establishing clear legal frameworks, while Hong Kong, with its stablecoin regulations, accelerates the compliance process in Asia, forming a regulatory network covering major economies.

In 2025, the U.S. completed a comprehensive restructuring of its crypto regulatory system, becoming the core of global policy change.

On January 23, the Trump administration issued the executive order "Strengthening America's Leadership in Digital Financial Technology," rescinding the restrictive policies of the Biden era and establishing a regulatory tone of "promoting innovation."

This executive order directly propelled a series of subsequent bills: on July 18, the GENIUS bill was signed into law by the president, establishing a regulatory framework for stablecoins, with the federal government responsible for managing issuers of systemically important stablecoins with a market cap exceeding $10 billion, requiring reserve assets to be 100% pegged to the U.S. dollar.

At the same time, the House of Representatives passed the "Digital Asset Market Clarity Act," clarifying the classification standards for crypto assets: excluding decentralized tokens like Bitcoin and Ethereum from the category of securities, while implementing differentiated regulation for centralized stablecoins and security tokens.

Additionally, the U.S. compliance breakthrough is also reflected in strategic innovations.

On March 6, Trump signed an executive order to establish a "Strategic Bitcoin Reserve," incorporating 200,000 Bitcoins seized by the Department of Justice into the national reserve and implementing a permanent ban on sales, thereby reinforcing Bitcoin's scarcity through institutional locking. This initiative set a precedent for sovereign nations to allocate crypto assets.

The direction of regulatory enforcement was also adjusted simultaneously. In April, the Department of Justice disbanded the national cryptocurrency enforcement team, clarifying that it would only target serious illegal activities and would no longer initiate criminal prosecutions against compliant trading platforms, creating a more relaxed development environment for the industry.

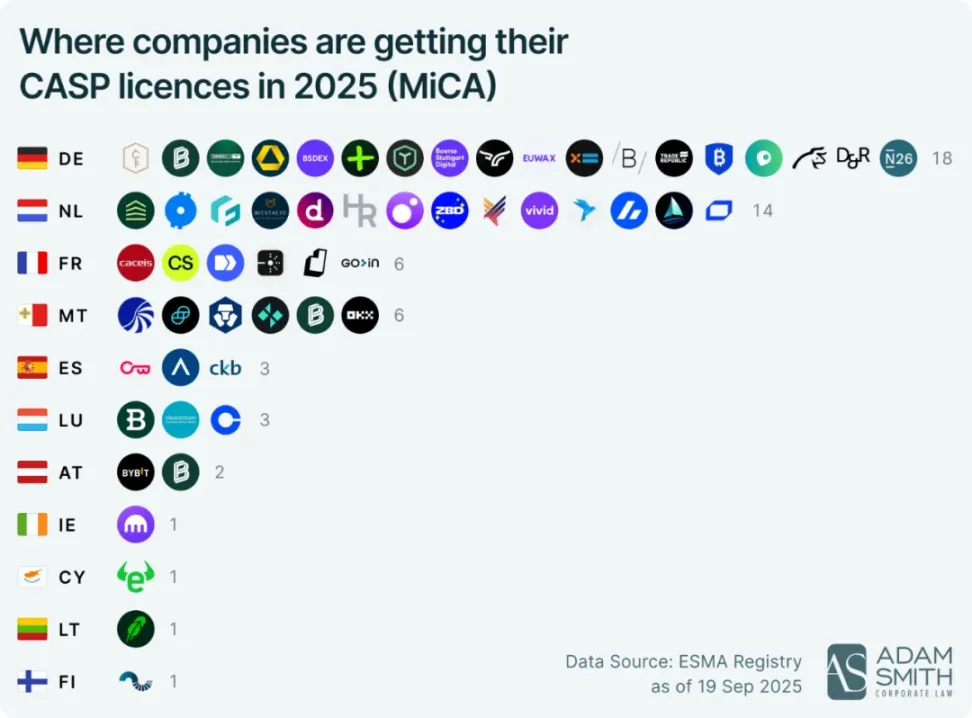

The EU, through the deep implementation of the MiCA bill, constructed the world's strictest compliance system. By November 2025, 57 institutions had obtained MiCA licenses, achieving full-chain regulation from issuance to custody.

The focus of the bill is that as long as a crypto asset service provider obtains a license in one EU member state, it can operate compliantly across all 27 member states.

This classification regulatory model has already shown results: Tether (USDT) was completely delisted from EU exchanges for failing to meet audit standards, while Circle's compliant stablecoin, backed by reserve disclosures, captured a significant share of the EU stablecoin market.

More groundbreaking was that in November, the decentralized lending protocol Aave passed the Central Bank of Ireland's review, becoming the first DeFi project to obtain MiCA approval, marking the beginning of regulatory coverage over the decentralized ecosystem.

Similarly, the compliance process in the Eastern market also achieved a key breakthrough in 2025, with the implementation of Hong Kong's stablecoin regulations becoming an important milestone.

On August 1, the "Stablecoin Regulation" was officially implemented, clarifying that stablecoin issuers must obtain a license from the Hong Kong Monetary Authority (HKMA) and require stablecoins pegged to fiat currencies to hold low-risk reserve assets in a 1:1 ratio.

This regulation not only standardized stablecoin issuance but also laid the foundation for Hong Kong to build an Asian crypto financial center. By the end of September, 36 institutions had submitted license applications.

Globally, the compliance trend in 2025 has formed two new characteristics:

First, the regulatory framework has shifted from "fragmentation" to "unification," with the U.S. federal-level legislation and the EU's MiCA establishing cross-regional standards.

Second, the regulatory scope has extended from "centralized institutions" to "decentralized ecosystems," with DeFi and NFTs beginning to be included in regulations.

As 2025 comes to a close, compliance is no longer the "tightening spell" of industry development but rather a "pass" to attract trillions of dollars into the market, becoming the core trend driving the industry towards maturity.

Industry Self-Regulation: Institutions Accelerating Compliance Implementation

Of course, the implementation of the regulatory framework also relies on the proactive actions of industry institutions; after all, regulation without cooperation is just a piece of paper.

In 2025, leading platforms such as Coinbase and OKX, along with investment institutions like a16z and Fidelity, became bridges connecting regulation and the market through compliance layouts and policy promotion, accelerating the industry's compliance process.

Coinbase, as one of the earliest compliant institutions in the U.S., obtained one of the first Bitcoin trading licenses (BitLicense) issued by New York State back in 2014, and subsequently acquired money transmission licenses in 46 states/regions, allowing it to operate legally across all 50 states.

In 2025, to adapt to the MiCA bill, Coinbase relocated its new headquarters to Luxembourg, achieving full coverage of the European market across 27 countries through the MiCA license.

This year, Coinbase also invested hundreds of millions of dollars to acquire Liquifi and Echo to lay out asset issuance and public sales, positioning itself as a compliant platform for future token issuance and meeting institutional clients' demands for compliant and efficient digital asset management tools.

Similarly, another established exchange, OKX, has built an industry benchmark with its "global licensing layout + technical compliance." As one of the first exchanges to initiate compliance transformation, it became the first global trading platform to obtain a complete operating license in the UAE in 2024, and that same year, it also obtained a major payment institution license in Singapore.

After the official implementation of the EU's MiCA bill, OKX became one of the first global exchanges to obtain a MiCA license and operate in Europe. At the same time, OKX strictly conducts KYC/AML and offers a variety of compliance products to adapt to the regulatory requirements of different countries/regions, establishing a global compliance operation system, with its global compliance team and risk control scale exceeding 600 people.

Additionally, OKX has also increased its presence in the U.S. market this year, currently obtaining operational licenses in about 47 states and some regions, significantly bringing in senior personnel with backgrounds in U.S. regulation and traditional finance, such as former New York State Department of Financial Services head Linda Lacewell, who was appointed as Chief Legal Officer and restructured OKX's legal and compliance department after taking office.

Meanwhile, Binance, which had previously struggled with compliance issues, has been working to repair its compliance image through license acquisition. After facing regulatory controversies, Binance accelerated its license applications in 2025 and has now obtained compliance licenses in 30 countries/regions worldwide.

Recently, Binance officially received a global license from Abu Dhabi ADGM/FSRA, becoming the first exchange to obtain comprehensive permission under that regulatory framework, accelerating its compliance layout.

As OKX founder and CEO Star said, "We see more and more crypto companies starting to learn how to develop healthily within the regulatory framework," Binance founder CZ also emphasized that the mainstream adoption of cryptocurrencies will be a slow process, and a clear regulatory framework is the primary prerequisite.

Additionally, some investment institutions are promoting the improvement of the compliance framework through policy lobbying and ecosystem building.

In 2025, a16z invested tens of millions of dollars to advance the compliance process for cryptocurrencies and participated in the revision discussions of the GENIUS Act and the "Digital Asset Market Clarity Act," pushing for the inclusion of "protecting innovation" clauses that exempt decentralized protocols from certain compliance obligations.

Financial giants like Fidelity and BlackRock are aligning with compliance progress by issuing Bitcoin spot ETFs and managing crypto asset trusts, while also engaging in discussions with government and regulatory bodies (such as the SEC and CFTC) to promote a clear and feasible regulatory framework.

It is precisely because of the efforts and cooperation of these industry institutions that Bitcoin has transitioned from a regulatory vacuum at its inception in 2009, to a global warning after the ICO chaos in 2017, and finally to the formation of a global collaborative compliance network in 2025, allowing the crypto industry to finally shed the label of being in a "gray area."

Is Compliance Making the $10 Trillion Dream a Reality?

Disordered development has long been the biggest bottleneck restricting the growth of the crypto industry—FTX's collapse led to a 70% market shrinkage in 2022, and regulatory ambiguity made traditional institutions hesitant.

The improvement of the compliance framework in 2025 is opening up new growth spaces for the market.

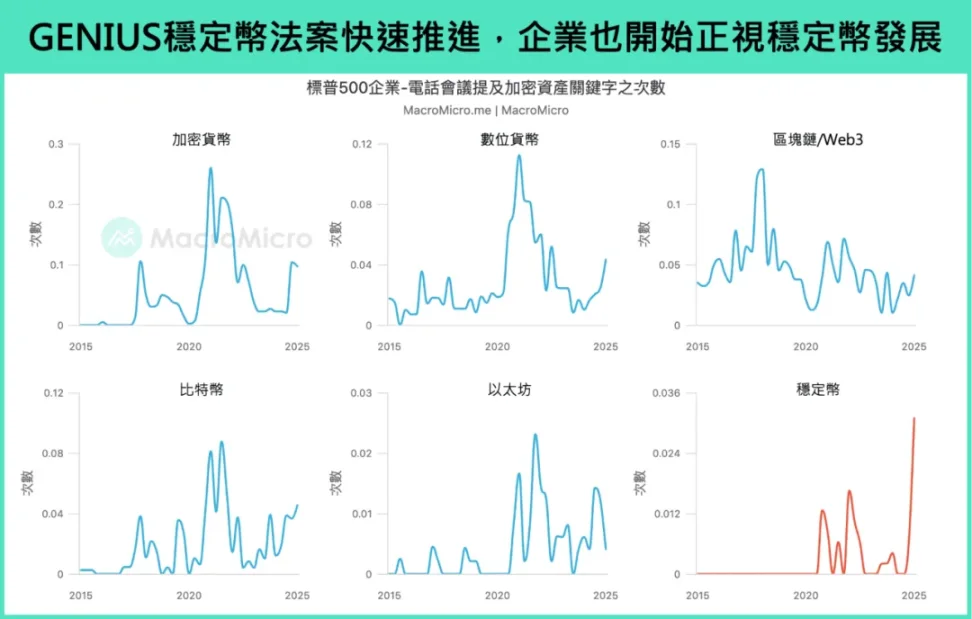

Compliance has activated the demand for enterprise-level asset allocation. In the past, due to regulatory uncertainty, most enterprises adopted a wait-and-see attitude towards crypto assets, but the clarity of the global compliance framework in 2025 has accelerated the entry of corporate funds.

According to CoinGecko, in the first three quarters of 2025, the global enterprise-level crypto asset allocation scale surpassed $120 billion, a 450% increase compared to the entire year of 2024. The entry of enterprises not only brings incremental funds but also enhances the liquidity and stability of crypto assets.

The explosive growth of crypto ETFs has become an important channel for capital entry. After the GENIUS Act took effect, the SEC relaxed the approval standards for crypto ETFs, and dozens of crypto ETFs were approved for listing in 2025.

As of November, the total management scale of U.S. crypto ETFs surpassed $140 billion, with BlackRock's Bitcoin ETF reaching $70 billion, becoming the most popular and fastest-growing product.

At the same time, the popularity of ETFs allows ordinary investors to participate in the crypto market through traditional brokers without directly interacting with crypto trading platforms, significantly lowering the participation threshold.

The benefits of compliance extend beyond capital growth; they also involve the reconstruction of ecological value. Under the compliance framework, the application scenarios of crypto assets are extending from speculative trading to the real economy. For instance, Walmart and Amazon are exploring the use of stablecoins for cross-border supply chain settlements, with expected settlement costs reduced by 60%.

The realization of these scenarios allows crypto assets to truly integrate into traditional finance and the real economy, providing solid support for the $10 trillion market goal.

From the unregulated barbaric growth to the comprehensive implementation of the compliance framework in 2025, the crypto industry has completed its leap into mainstream finance over more than a decade.

However, the improvement of regulation is not the endpoint of industry development but rather a new starting point for the "golden decade."

With the formation of a global compliance network and the accelerated integration of traditional capital and the real economy, the crypto market is moving from the margins to the center. Compliance will continue to serve as a core driving force, propelling the industry to achieve a scale breakthrough from $3 trillion to $10 trillion, reconstructing the global financial value system.

Although the crypto market is still under the panic of 1011, as we stand at the beginning of 2026, those of us involved in industry building can only hold onto hope and focus on doing every task at hand well.

Because "life is always, and only, this moment we are experiencing now," just as Satoshi Nakamoto wrote a white paper 17 years ago, giving birth to an entirely new industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。