CoinW Research Institute

Since entering the stock tokenization business in June, Robinhood (NASDAQ: HOOD) has been accelerating its transformation from a single retail trading platform to a deeply integrated financial infrastructure in Web3. By mapping U.S. stocks onto the blockchain, Robinhood aims to address core pain points in traditional finance, such as the long-standing T+N settlement delays, cross-border access restrictions, and high commissions. Within this framework, investors can participate in the allocation of global high-quality assets through stock tokens, enabling continuous trading 24/5. This not only lowers the entry barrier for asset participation but also enhances the accessibility and inclusiveness of cross-regional financial services. As of now, Robinhood has completed the tokenization mapping of 1,491 stocks, with a total market value of tokenized stocks reaching $13.55 million. Additionally, Robinhood's growth in emerging areas such as prediction markets is also noteworthy. The operational report for November 2025 shows that its event contract trading volume has exceeded 3 billion contracts in a single month, with a month-on-month growth of 20%, making it one of the fastest-growing core engines. Against this backdrop, CoinW Research Institute will further analyze Robinhood's existing core business matrix and product logic, and explore its further possibilities.

I. Robinhood's Path to Breakthrough

1. Robinhood's Zero-Commission Growth Engine

Robinhood's rise is seen as a typical case of business model innovation in the fintech sector. Its founding team has successfully broken through the barriers of the mature financial market through three core strategies: pioneering zero-commission trading, maintaining a mobile-first experience, and creating a highly approachable brand image. Among these, the zero-commission service is the core driving force behind its first-mover advantage. By eliminating the explicit costs of trading, Robinhood has significantly lowered the entry barrier for retail investors into the capital market, thus rapidly accumulating a massive number of retail investors.

Behind this "free model" is its cleverly designed Payment for Order Flow (PFOF) profit mechanism. Robinhood directs customer trading orders to high-frequency traders or market makers for execution, who profit from the bid-ask spread of the orders and pay rebates to Robinhood. Although the PFOF model has faced regulatory controversy due to issues related to trade execution quality and potential conflicts of interest, it has indeed provided long-term financial viability for the zero-commission strategy. Through this mechanism, Robinhood has successfully transformed early traffic dividends into a solid asset scale, laying a foundation for its subsequent foray into comprehensive financial services. Meanwhile, Robinhood's success has not only forced traditional financial giants to pay attention to the zero-commission model but has also provided a reference for other industries in user growth strategies. For example, decentralized perpetual contract platform Lighter and other Web3 projects are attempting to replicate this low-friction, high-growth path in the DeFi space, leveraging low-cost trading methods to achieve a new round of user expansion.

2. Robinhood as the Biggest Beta in Coin-Stock Integration

As the crypto asset system gradually merges with stock tokenization, Robinhood has become one of the key platforms in the coin-stock integration market and is regarded as the most representative Beta under this trend. Its core advantage lies in its unique positioning at the structural level, integrating regulated traditional brokerage services with crypto asset trading functions within the same system, forming a hybrid financial system that combines compliance attributes with on-chain efficiency. In terms of asset tokenization, Robinhood's tokenized stocks essentially represent a mapping model of regulated custodial assets on the blockchain, where licensed entities first hold real assets in compliance and then generate corresponding tokens on-chain for internal trading, thus reflecting the holdings and changes of real assets on-chain. Specifically, Robinhood uses its European subsidiary, which holds a Lithuanian securities license, as the compliant entity to legally procure and custody U.S. stocks and other assets within the traditional financial system, then generates stock tokens on Arbitrum according to the corresponding custody scale, limiting trading to its own platform. During operation, each token transaction is synchronously reflected in the on-chain ledger, while the backend system dynamically adjusts the corresponding mapping relationship based on the actual holdings in the regulated account. In the future, Robinhood also plans to gradually migrate this mapping and settlement system to its self-developed Robinhood Chain to enhance the system's on-chain autonomy and support cross-chain circulation.

From a business advancement perspective, Robinhood's advantages are more reflected in its user structure and product distribution capabilities. Robinhood simultaneously covers traditional stock investors and crypto asset trading users, allowing stock tokenization products to be directly embedded into existing account systems and trading scenarios without relying on external traffic or additional user education costs. This model of having a single account with multiple asset access reduces the cold start difficulty of stock tokenization products and makes it easier to achieve large-scale promotion. In horizontal comparison, Robinhood's market position lies between crypto-native issuance platforms and traditional large brokerages, with significant differences from both. Compared to token issuance institutions like Backed, which primarily target professional or accredited investors, Robinhood focuses more on retail users, emphasizing usability, trading frequency, and user experience in product design. Meanwhile, compared to traditional brokerages, although the latter has advantages in institutional services and professional trading, their progress in blockchain asset issuance, on-chain settlement, and round-the-clock trading is relatively cautious, and stock tokenization has not yet become a core business focus.

It is important to note that Robinhood's attempts at stock tokenization have already sparked regulatory controversy. In June 2025, after Robinhood launched stock tokens including OpenAI in the European market, OpenAI publicly stated that it had not established any partnership with Robinhood and had not authorized the issuance of any form of tokenized equity, emphasizing that the related tokens do not represent actual equity in OpenAI. Following this statement, regulatory agencies also expressed related controversies, and Robinhood subsequently delisted the related token products. This indicates that Robinhood's current tokenization business is still in a transitional phase, with significant boundary issues regarding actual equity mapping, issuance authorization, and legal attributes.

_Source: @OpenAINewsroom, _https://x.com/OpenAINewsroom/status/1940502391037874606

3. Robinhood Enters the Prediction Market Track

With the advancement of tokenization-related businesses, Robinhood has also begun to extend its business boundaries into prediction markets, but its approach is not to build infrastructure from the top down; rather, it starts with specific product forms like event contracts to gradually guide retail users to participate in event-based trading. In October 2024, Robinhood officially launched event contracts through its Robinhood Derivatives platform, allowing users to trade based on the outcome of the U.S. presidential election, using the occurrence of the event as the basis for contract settlement. This marks Robinhood's first expansion of retail trading scenarios from traditional asset price fluctuations to pricing expressions of macro events and uncertainties themselves. Subsequently, in 2025, Robinhood continued to enrich the coverage of event contracts, extending this model to more scenarios such as sports events, gradually making prediction markets an independent product branch within its retail trading system. From a product logic perspective, these event contracts are neither traditional gambling nor standard financial derivatives; they are closer to a probability-based risk expression tool operating within a regulatory framework.

After completing preliminary validation at the product level, Robinhood began to enhance its trading and clearing capabilities related to prediction markets. In November 2025, Robinhood announced a joint venture with Susquehanna International Group (SIG) to acquire 90% of MIAXdx (formerly LedgerX). MIAXdx is an institution regulated by the U.S. Commodity Futures Trading Commission (CFTC) and holds important qualifications such as Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO). This transaction still requires regulatory approval and is expected to close in early 2026. On this basis, Robinhood is introducing top quantitative market makers like SIG to provide institutional-level liquidity support for event contracts, alleviating common issues of insufficient depth and large spreads in prediction markets. Additionally, in December 2025, Robinhood, along with leading prediction market platform Kalshi, crypto trading platforms Crypto.com and Coinbase, and sports betting platform Underdog, jointly participated in the establishment of a prediction market industry alliance to promote compliance construction of prediction markets within the regulatory framework. On December 17, Robinhood's CEO stated, "We are in the early stages of a super cycle for prediction markets, and as it develops, we should see user adoption and trading volume continue to grow, with the contract scale traded annually reaching trillions."

_Source: Robinhood, _https://robinhood.com/us/en/newsroom/robinhood-prediction-markets-joint-venture/

II. Robinhood Business Data

1. Robinhood Comprehensive Business Data

According to Robinhood's Q3 2025 financial report, Robinhood achieved a net revenue of approximately $1.27 billion, a year-on-year increase of about 100%. Among this, trading revenue grew by 129% year-on-year to $730 million, primarily driven by cryptocurrency revenue of $268 million (over 300% growth), options revenue of $304 million (50% growth), and stock revenue of $86 million (132% growth); net interest income increased by 66% year-on-year to $456 million, mainly due to the growth of interest-earning assets, although partially offset by a decline in short-term interest rates; other income grew by 100% year-on-year to $88 million, primarily due to an increase in Robinhood Gold subscription users. During this period, the total asset scale on the Robinhood platform grew by 119% year-on-year to approximately $333 billion, demonstrating the rapid expansion of user assets. This indicates that Robinhood's revenue sources have gradually expanded from a single trading commission and Payment for Order Flow (PFOF) model to multiple business lines including interest income, crypto trading, subscription services, and derivatives, presenting a more diversified business structure.

2. Robinhood Stock Tokenization Business Data

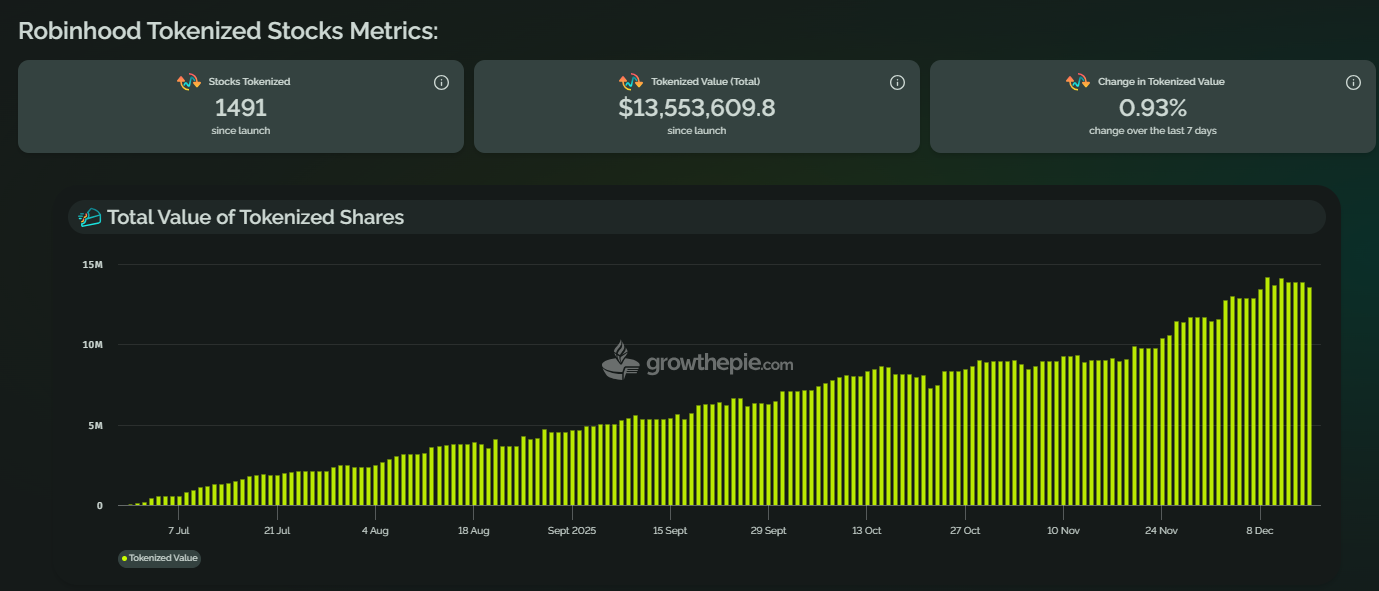

As of now, Robinhood has tokenized 1,491 stocks, with a total market value of tokenized stocks reaching approximately $13.55 million. In the last 7 days, the change in total tokenized value has seen a growth of 0.93%. Since the launch of the stock tokenization business, the total value of tokenized assets has shown a continuous and steady upward trend, especially with recent accelerated growth, indicating a sustained increase in market demand for Robinhood's tokenized stock products.

Source: growthepie, https://www.growthepie.com/quick-bites/robinhood-stock

Among these on-chain assets, the top five tokens are concentrated in high liquidity and highly sought-after tech giants and popular stocks. Here are the specific details of the top five:

a. YieldMax MSTR Option In. (MSTY): Tokenized value of approximately $1.6 million. This asset ranks first with the highest tokenized total value, indicating strong market demand for financial instruments related to MicroStrategy (often associated with Bitcoin exposure). Its stock price is $31.76, with a total of 50,272 shares tokenized, and the number of shares has increased by 47.8% in the last 7 days.

b. Alphabet Class A (GOOGL): Tokenized value of $1.06 million. As a Class A share of a tech giant, its tokenized value ranks second, reflecting the continued appeal of large tech stocks. Its stock price is $308.22, with 3,448 shares tokenized, but the number of shares has decreased by 6.1% in the last 7 days.

c. Microsoft (MSFT): Tokenized value of $790,000. Microsoft's tokenized value ranks third. Its stock price is $474.82, with 1,669 shares tokenized, and the number of shares has increased by 1.0% in the last 7 days.

d. BitMine Immersion Techn. (BMNR): Tokenized value of $720,000. This asset ranks fourth, with a stock price of $30.95 and a total of 23,312 shares tokenized, with the number of shares decreasing by 4.3% in the last 7 days.

e. Meta Platforms (META): Tokenized value of $660,000. As another major tech giant, Meta Platforms' tokenized value ranks fifth. Its stock price is $647.51, with 1,029 shares tokenized, and the number of shares has increased by 1.7% in the last 7 days.

3. Robinhood Prediction Market Business Data

Since the official launch of the presidential election event contracts in October 2024, the prediction market has rapidly grown to become one of the fastest-growing emerging business lines in Robinhood's history in terms of user penetration and revenue growth. According to Robinhood's November 2025 operational data report, the trading volume of its event contracts reached 3 billion contracts in November, a month-on-month increase of about 20% from 2.5 billion contracts in October. This data reflects a phase of increased monthly trading activity for Robinhood's prediction market contracts and indicates a rising participation of retail investors in event-driven assets.

III. Summary

Overall, Robinhood's continuous layout in stock tokenization, crypto assets, and prediction markets reflects a systematic expansion based on the boundaries of platform capabilities rather than blind expansion of a single business. Robinhood is gradually incorporating asset forms and risk expression methods that were previously fragmented under different regulatory and technical systems into a unified operational framework through a unified account system, compliant underlying structure, and Web3 technology architecture. This means that Robinhood is evolving from a traditional securities trading entry point into a more universal financial service carrier. Robinhood's practices also provide a real-world constrained observation sample for the integration of traditional finance and on-chain finance. It is advancing asset tokenization and new trading forms like event contracts within existing regulatory frameworks, effectively probing the feasible boundaries of blockchain technology in supporting securitized assets and large-scale retail participation. This process reflects the ongoing interplay between institutional space and technological frontiers. This model attempts to unleash the efficiency advantages of on-chain technology while maintaining control over core issues such as ownership recognition, risk disclosure, and regulatory compliance. In the context of accelerating digitalization of financial infrastructure, such explorations based on real regulatory environments will become an important reference for assessing the feasibility of tokenizing traditional assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。