In 2025, @Aptos proved itself as the infrastructure layer for the financial internet.

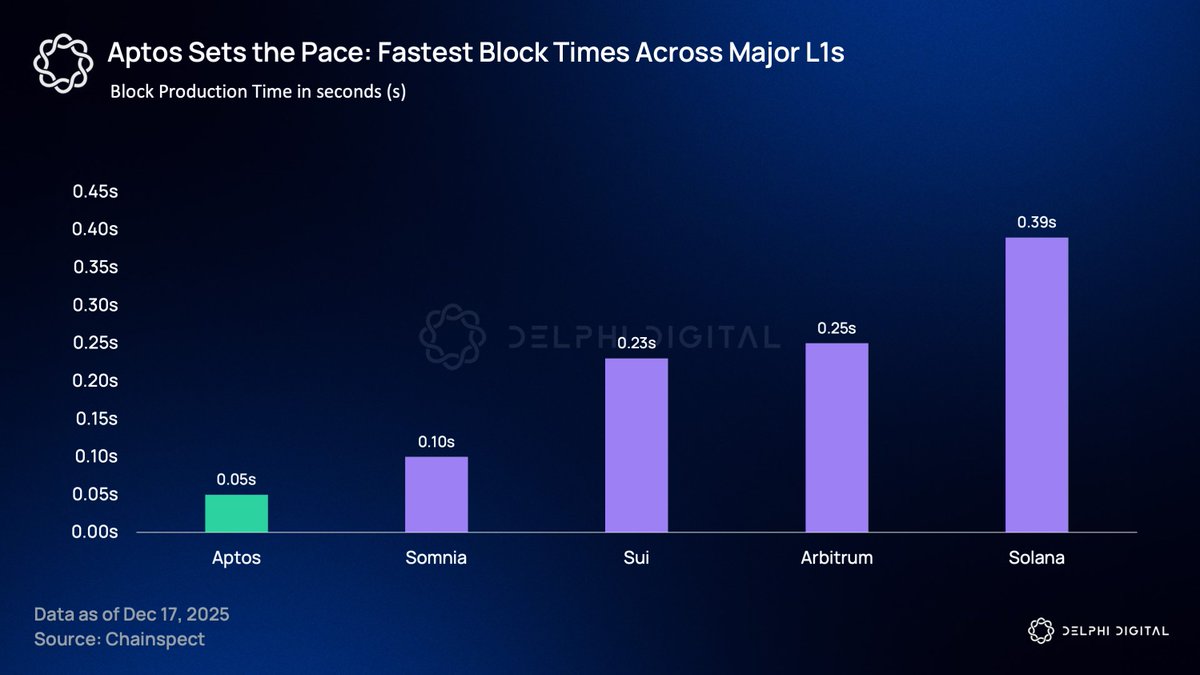

Baby Raptr went live in June and cut validator finality latency by 20% by reducing consensus from six network hops to four. Velociraptr followed in Sept, dropping block times from 100ms to 60ms through optimistic proposals. At 50ms block times, Aptos now produces blocks faster than any other major Layer 1 blockchain on mainnet.

That performance translated directly into real-world utility. Stablecoins became one of the clearest expressions of Aptos’ strengths: moving $200 still costs roughly $12 on traditional rails and about $0.00003 on Aptos. At that level, cost stops being a constraint. Stablecoin market cap reached an all-time high of $1.8B, nearly tripling over the year.

We also saw a real inflection in real-world assets. From effectively zero a year ago, Aptos now supports institutional-grade tokenized finance at scale. BlackRock’s BUIDL fund deployed an additional $500M in October, making Aptos the second-largest host for BUIDL after Ethereum. Platforms like PACT brought private credit fully onchain.

New category-defining products are taking shape. @DecibelTrade is redefining onchain trading with unified spot and perps, combining centralized-exchange performance with transparency, composability, and self-custody.

In parallel, @shelbyserves is tackling decentralized hot storage for AI and enterprise workloads. The system is chain-agnostic by design, with React and Solana SDKs already live on devnet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。