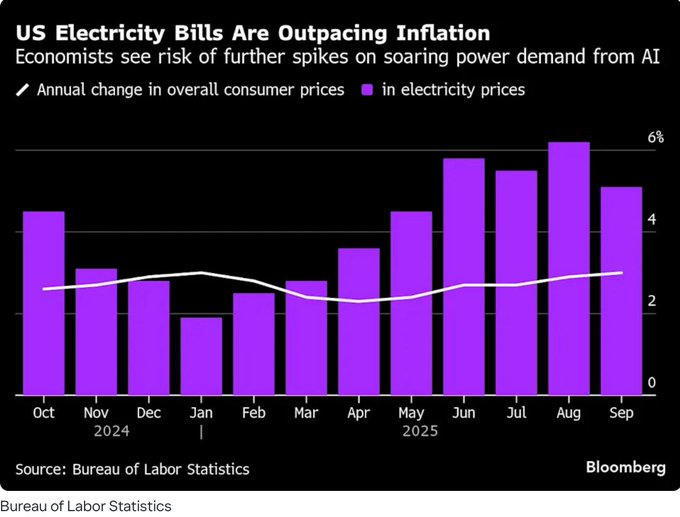

A very realistic situation is that the increase in electricity prices in the United States is almost twice that of inflation, and this round of rising electricity prices is not a traditional energy cycle but is driven by structural changes in demand.

On one hand, the increase in electricity demand is driven by AI data centers, cloud computing, and high computing power; on the other hand, grid upgrades, energy storage construction, and the integration of new energy sources into the grid have also raised transmission and distribution costs. Moreover, this cost increase is almost reversible, unless the United States abandons its plans to become an AI hub.

For Bitcoin, the impact of this change is even more pronounced. BTC is an asset that relies heavily on electricity as a core production factor. When electricity prices continue to rise, the marginal cost of the entire network's computing power is systematically elevated, and the breakeven point for mining shifts upward.

However, from my personal perspective, this will not lower the long-term value of BTC; rather, it will continuously raise the lower limit of the $BTC price. As electricity prices increase, inefficient mining machines and high-cost miners are forced to exit, concentrating computing power among entities with higher efficiency and lower marginal costs, which in turn forces the supply curve of BTC to rise in the long term.

Of course, some friends say that mining can be done outside the United States, which is fine, but it should be noted that the electricity consumption brought by AI and computing power is also seeking low electricity prices outside the U.S. From a long-term perspective, the increase in global average electricity costs is difficult to avoid, and ultimately, it is highly likely that the prices of products based on electricity as a fundamental cost will rise.

In simpler terms, the downward price range of BTC will gradually increase with the rise in electricity prices. Traditionally, a 20% drop in the average shutdown price is likely to be the bottom limit for Bitcoin prices.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。