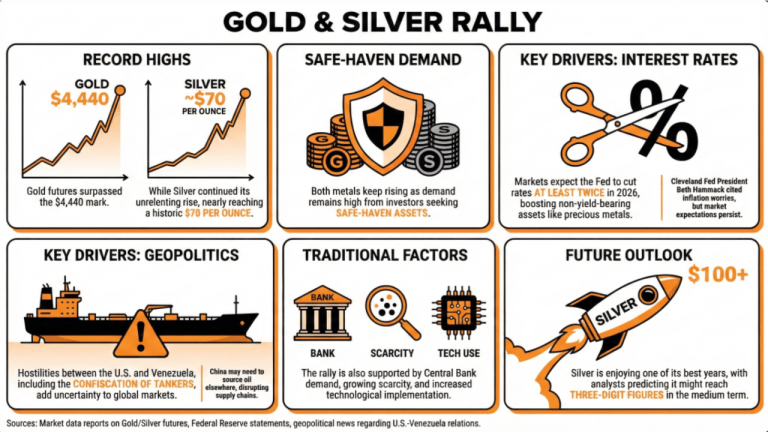

Silver and gold keep rising as demand remains high from investors seeking to take advantage of their safe-haven characteristics.

On Sunday night, both metals reached record high prices, with gold futures reaching numbers surpassing the $4,440 mark. In the same way, silver continued its unrelenting rise, surpassing $69 and almost reaching a historic $70 price per ounce.

Analysts have rationalized this rise, linking it with two different events: the expectation of two interest rate cuts and the ongoing hostilities between the U.S. government and Venezuela.

While Federal Reserve Bank of Cleveland President Beth Hammack recently stated that there was no need for further cuts, citing inflation worries as her justification, the market still expects the Fed to cut rates at least twice in 2026.

Also, the confiscation of at least two tankers carrying Venezuelan oil in the Caribbean is an element that adds uncertainty regarding crude oil prices, as China, Venezuela’s major oil buyer, might have to source this oil from another provider.

In addition to the traditional elements that drive the prices of these metals up, including central bank demand, growing scarcity, and increased technological implementation, these new developments continue to drive the metals rally forward. Gold and silver are not yield-bearing assets, so they can still thrive when interest rates decrease.

Silver is enjoying one of its best years, with analysts considering that it might even reach three-digit figures in the medium term. Gold took a little rest, but it has also been on a tear, scoring several record-high prices throughout the year.

Read more: The Silver Bullet: Prices Surpass Record Levels as Tech Demand Is Projected to Rise Dramatically

- What recent price levels have silver and gold reached?

Gold futures have surpassed $4,440, while silver has continued to rise, recently exceeding $69 per ounce and nearing $70. - What factors are driving the increase in silver and gold prices?

Analysts link the rise to expectations of interest rate cuts and geopolitical tensions, particularly between the U.S. and Venezuela. - Why are investors turning to precious metals as a safe haven?

Silver and gold are traditionally viewed as safe-haven assets, thriving when interest rates decrease, which enhances their appeal during economic uncertainty. - What is the outlook for silver and gold prices moving forward?

Analysts suggest silver might reach three-digit figures in the medium term, while gold continues to set record highs, bolstering investor confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。