On the daily chart, ethereum’s broader structure is best described as a strategic standoff between bulls and bears. After a rejection near $3,450, the asset retraced with conviction, but didn’t capitulate—rather, it appears to be consolidating within a range defined by $2,620 on the downside and $3,450 on the top.

Volume rose on the pullback, suggesting that the move wasn’t due to exhausted buyers but an active round of distribution. The price still holds a series of higher lows, lending cautious optimism to the current setup. Resistance sits stubbornly between $3,300 and $3,450, while support is seen at $2,900, followed by a critical band between $2,750 and $2,620.

ETH/USD 1-day chart via Deribit on Dec. 22, 2025.

Moving into the 4-hour chart, ethereum has managed to claw back control above the $3,000 level, which is doing some heavy psychological and technical lifting. The chart displays a constructive series of higher lows from a bounce off $2,773, indicating a controlled ascent rather than a euphoric spike. That said, momentum is clearly slowing near $3,075 to $3,100, a region acting as a short-term supply zone. The price action above $3,000 continues to favor upward continuity—but the market’s affection is fickle. A sustained drop below $2,980 would add a frown to the bulls’ week and invite a structural reevaluation.

ETH/USD 4-hour chart via Deribit on Dec. 22, 2025.

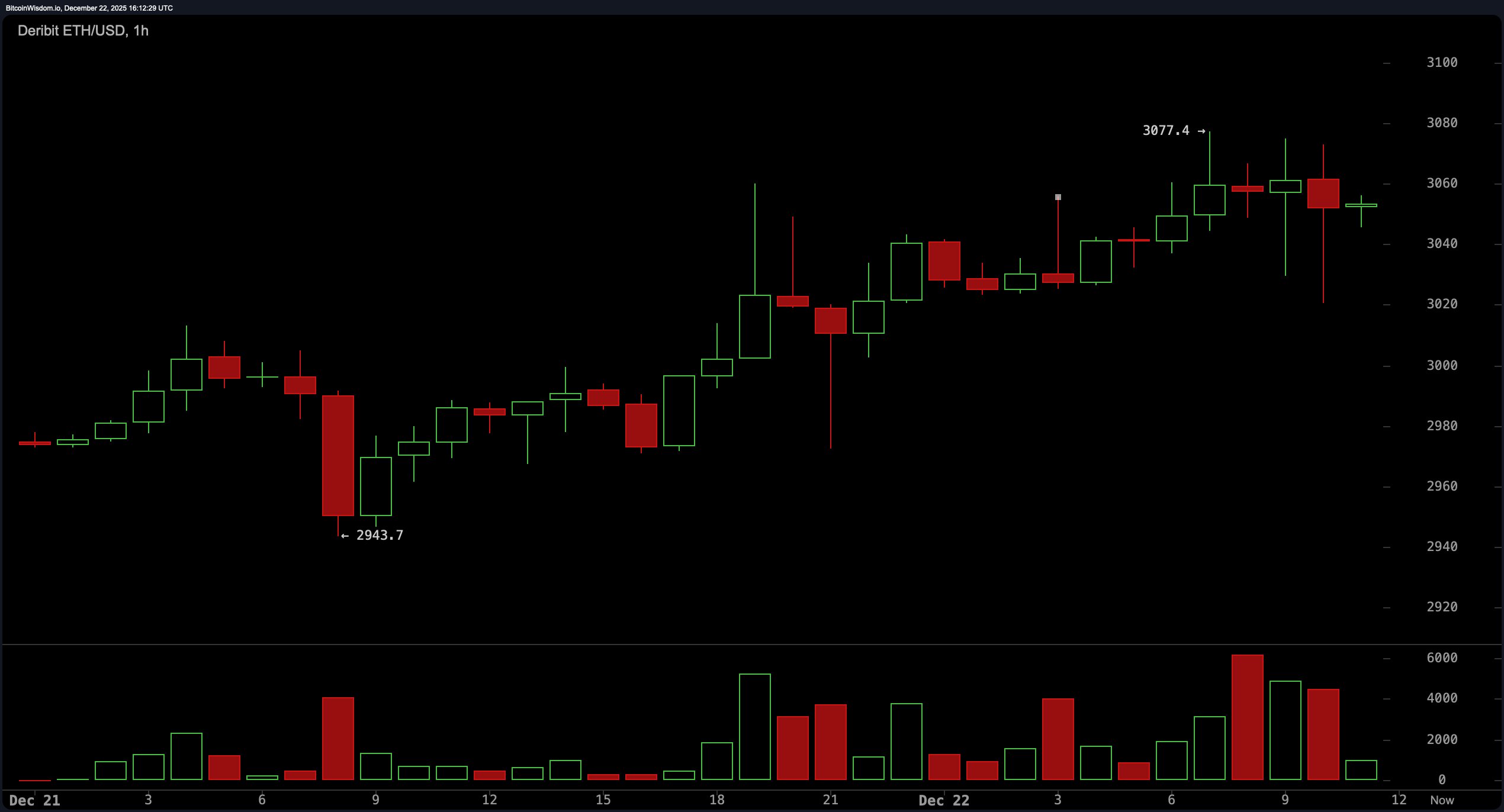

The 1-hour chart tells a tale of consolidation just under $3,077, where ethereum’s candles have developed upper wicks—the classic calling card of seller aggression. Volume spikes during pullbacks suggest dip buyers are active, though they’re more into defending territory than charging new ground. The market appears to be building a base, but it has yet to make that definitive push that would inspire breakout confidence. Until ethereum decisively clears the $3,100 threshold, the range-bound behavior continues to reign supreme, calling for strategic patience over impulsive positioning.

ETH/USD 1-hour chart via Deribit on Dec. 22, 2025.

On the indicator front, ETH’s oscillators remain firmly indecisive. The relative strength index ( RSI) is lounging at 49.6, the Stochastic oscillator clocks in at 34.9, and the commodity channel index (CCI) reads –23.2—all firmly in neutral territory. The average directional index (ADX) confirms a lack of dominant trend at 28.9, while the Awesome oscillator is hovering at –50.6, adding more muddle than momentum. The momentum indicator does show a slight tilt, reading –34.2, and the moving average convergence divergence ( MACD) level stands at –47.2, both hinting at some underlying positive bias despite the neutrality overhead.

Looking at moving averages (MAs), ethereum’s MAs present a mixed bag with a subtle bullish undertone in the short term, and outright resistance in the long term. The 10- and 20-period exponential and simple moving averages (EMA and SMA) lean constructive, with the 10-period EMA at $3,000.6 and the 10-period SMA at $2,976.8 both showing upward potential. However, the 30-period EMA and the 50- through 200-period moving averages—from both EMA and SMA camps—are uniformly above the current price and indicate structural headwinds. These higher-period moving averages suggest ethereum will need more than wishful thinking to punch through resistance and reclaim the highs from earlier this quarter.

Bull Verdict:

Ethereum’s resilience above $3,000 and the structure of higher lows across timeframes suggest the bulls aren’t backing down—they’re simply circling, waiting for the right moment to strike. If momentum can push decisively through $3,100 with volume confirmation, this consolidation could be the prelude to another leg higher, possibly testing the $3,300 zone before year-end. Until then, disciplined optimism is the name of the game.

Bear Verdict:

Ethereum may be propped just above $3,000, but the confluence of flattening momentum indicators and stubborn overhead resistance paints a picture of a rally losing steam. Unless the asset can break and hold above $3,100 convincingly, the path of least resistance leans downward. For now, the tape favors fade-the-rip tactics over chasing strength.

- What is the current price of ethereum?

ethereum is trading at $3,049 as of December 22, 2025. - Is ethereum showing bullish or bearish signals?

ethereum is consolidating above $3,000 with mixed short-term technical signals. - What are key support and resistance levels for ethereum?

Support is near $2,900 and resistance is between $3,300 and $3,450. - What do moving averages indicate for ethereum’s trend?

Short-term moving averages suggest strength, while long-term averages signal resistance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。