When the world's largest publicly traded Bitcoin holder began hoarding cash in US dollars, the market had far more questions than answers. In early December 2025, Strategy announced the establishment of a $1.44 billion cash reserve, pausing its usual purchasing pace. This company, once seen as having "infinite bullets," is redefining its survival strategy.

The source of its cash reserves is clear—raising funds through a market issuance plan by selling Class A common stock. Between November 17 and 30, 2025, the company sold approximately 8.214 million shares of common stock, raising net proceeds of about $1.478 billion.

This funding will be specifically used to cover preferred stock dividends and debt interest payments for the next 21 months, achieving a "decoupling" of shareholder returns from Bitcoin price fluctuations.

1. Core of the Event: Details of the Reserves and Funding Sources

● Strategy's cash reserve plan clearly demonstrates a shift in the company's financial strategy. The company raised funds by selling common stock through an ATM stock sale plan, specifically selling 8.214 million shares of common stock between November 17 and 30, 2025, raising net proceeds of $1.478 billion.

The vast majority of these funds are used to establish cash reserves, with the company explicitly stating that the reserves will be used to cover dividend payments and debt interest for the next 21 months.

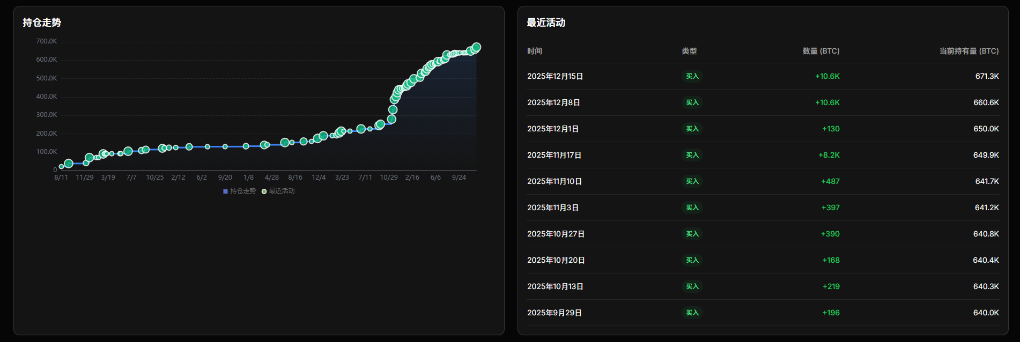

● At the same time as announcing the establishment of cash reserves, Strategy's Bitcoin purchasing activity has noticeably slowed. Data shows that during the same period from November 17 to 30, the company only purchased 130 Bitcoins, with total expenditures of $11.7 million.

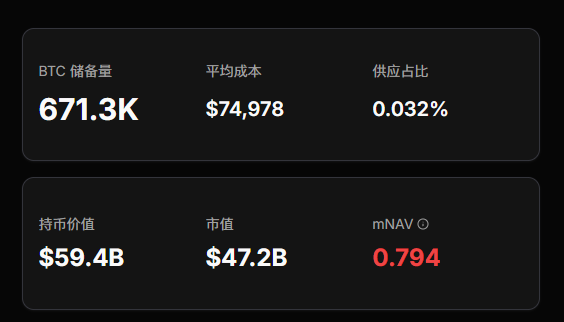

● This stands in stark contrast to the company's previous years of continuous large-scale Bitcoin purchases. As of November 30, 2025, Strategy held a total of 650,000 Bitcoins, accounting for 3.1% of the global Bitcoin supply.

2. Strategic Intent: From Aggressive Expansion to Defensive Consolidation

● The primary goal of Strategy's cash reserve is to protect the company's credit. The company has issued multiple series of preferred stock, including STRF, STRK, STRD, etc., which promise an annualized return of 8%-10%. This high yield commitment brings significant payment pressure, and failure to pay dividends on time could trigger a vicious cycle of credit rating downgrades and rising financing costs.

● Another important consideration for establishing cash reserves is to create a defense line to avoid a "death spiral." The market has long been concerned that if Bitcoin prices plummet, the company might be forced to sell off large amounts of Bitcoin to maintain operations, exacerbating the market decline. The $1.44 billion reserve is a direct response to this concern, providing the company with at least 21 months of buffer.

● Additionally, Strategy aims to attract a broader investor base. By reserving 21 months of dividend funds, the company hopes to attract traditional income-focused investors who value stable cash returns without needing to understand the deeper logic of Bitcoin.

This means that even if Bitcoin prices drop significantly, dividends can still be paid on time, increasing the company's appeal to conservative investors.

3. Market Reaction and Stock Performance

● After the announcement, Strategy's stock price fell more than 10% during intraday trading on December 1, 2025, hitting a low of $156 before closing at $172. The market showed clear concern over the strategy shift of this largest Bitcoin bull.

● Analysts have differing opinions. According to TipRanks, Wall Street analysts still maintain a "strong buy" rating on Strategy's stock, based on 12 buy and 2 hold recommendations over the past three months. The average target price is $467.75, indicating a potential upside of 182.59% from current levels.

● There is intense debate within the Bitcoin community. Some investors view this as a betrayal of the Bitcoin standard strategy, arguing that shareholder rights are being diluted in exchange for depreciating fiat currency. The biggest concern in the market is that when the largest buyer announces a slowdown in purchases, it is a blow to the already fragile market confidence. Strategy has been one of the most significant "buy orders" in the Bitcoin market, and its reduced purchasing power may bring greater downward pressure on Bitcoin in the short term.

4. Financial Challenges and Regulatory Pressures

● Strategy faces multiple financial challenges. Due to the decline in Bitcoin prices, the company has significantly lowered its financial expectations for 2025. Initially, the company projected a year-end Bitcoin price of $150,000, but it has now adjusted this to between $85,000 and $110,000.

Based on this new price range, the company has updated its key targets: the Bitcoin yield target has been lowered to 22% to 26%, and the Bitcoin-to-dollar appreciation target has also been adjusted downward.

● New regulatory challenges are also emerging. MSCI is considering excluding companies that hold more than 50% of their total assets in digital assets from its global benchmark index. MSCI believes that such companies are more akin to investment funds rather than operating companies.

● This proposal poses a direct threat to Strategy. TD Cowen analysts estimate that about $2.5 billion of Strategy's market value comes from the MSCI index, with another $5.5 billion from other stock indices. If excluded from major indices, the company could face capital outflows of up to $8.8 billion.

5. Industry Impact and Future Outlook

● Strategy's strategic shift could have far-reaching implications for the entire Bitcoin industry. As a "whale" holding 3.1% of the global Bitcoin supply, its every move is significant. The company's cash reserve plan marks a shift towards greater emphasis on traditional financial stability in Bitcoin financial companies, which may become a new paradigm for the industry.

● It is worth noting that Strategy's business model heavily relies on continuous financing capabilities. The company's financial statements show that there is still $14.375 billion available for subsequent stock issuances. However, this "ammunition" is limited, especially when market risk appetite declines.

● In the future, Strategy may explore Bitcoin lending models to increase revenue. CEO Phong Le stated, "When traditional financial institutions enter this space and we have more counterparties, lending Bitcoin is an option we will consider."

This shift indicates that the once aggressive "buy and hold" model is adjusting under pressure.

● The company's core metric—mNAV is under close scrutiny. This metric compares the enterprise value to the value of its Bitcoin holdings; when the ratio falls below 1.0, it indicates that the company's stock trading price is lower than the value of its Bitcoin holdings. This could trigger difficult decisions regarding the sale of Bitcoin.

As Bitcoin prices have fallen about 30% from their October peak, Strategy's stock price has dropped by 50%. Once raising nearly $10 billion through preferred stock, convertible bonds, and common stock issuance to invest in Bitcoin, the cycle is showing signs of fatigue under market pressure.

The company holds 650,000 Bitcoins, and its market value once exceeded the value of its Bitcoin assets by several times; now, this premium barrier is thinning. The cash reserves act as a dam built between Bitcoin faith and financial reality, but the real test lies in whether this defense line can hold when the market winter lasts longer than the 21-month buffer period.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。