Written by: Frank, PANews

The year 2025 is set to be a dramatic and pivotal year for the public chain track in the crypto world. If 2024 was a "carnival night" where various new public chains competed for attention with high airdrop expectations and grand narratives, then 2025 will be the "wake-up call" after the revelry.

When the tide recedes and liquidity tightens, the real data that was once masked by the facade of prosperity begins to surface. We see a "tale of two extremes": on one side, a general halving of secondary market prices and a significant slowdown in TVL growth; on the other side, a counter-trend surge in on-chain fee income and DEX trading volume.

The stark contrast reveals a harsh truth: the market is no longer paying for mere "narratives," and funds are concentrating on leading protocols that possess self-sustaining capabilities and essential use cases.

The PANews data team has comprehensively compiled the core data for 26 mainstream public chains in 2025, from TVL, token prices, fee income, activity levels to investment and financing situations. Through these cold numbers, we attempt to restore the "deflation" process that the public chain market experienced this year and identify the true winners who can still build a solid moat in the winter.

(Data Note: TVL, stablecoin, financing, and fee data are sourced from Defillama; daily active and daily trading volume data come from Artemis and on-chain information; token price and market cap data are sourced from Coingecko. The data period is from January 1, 2025, to December 16, 2025.)

TVL Overview: Growth Plummets, DeFi is Experiencing "De-leveraging" Pain

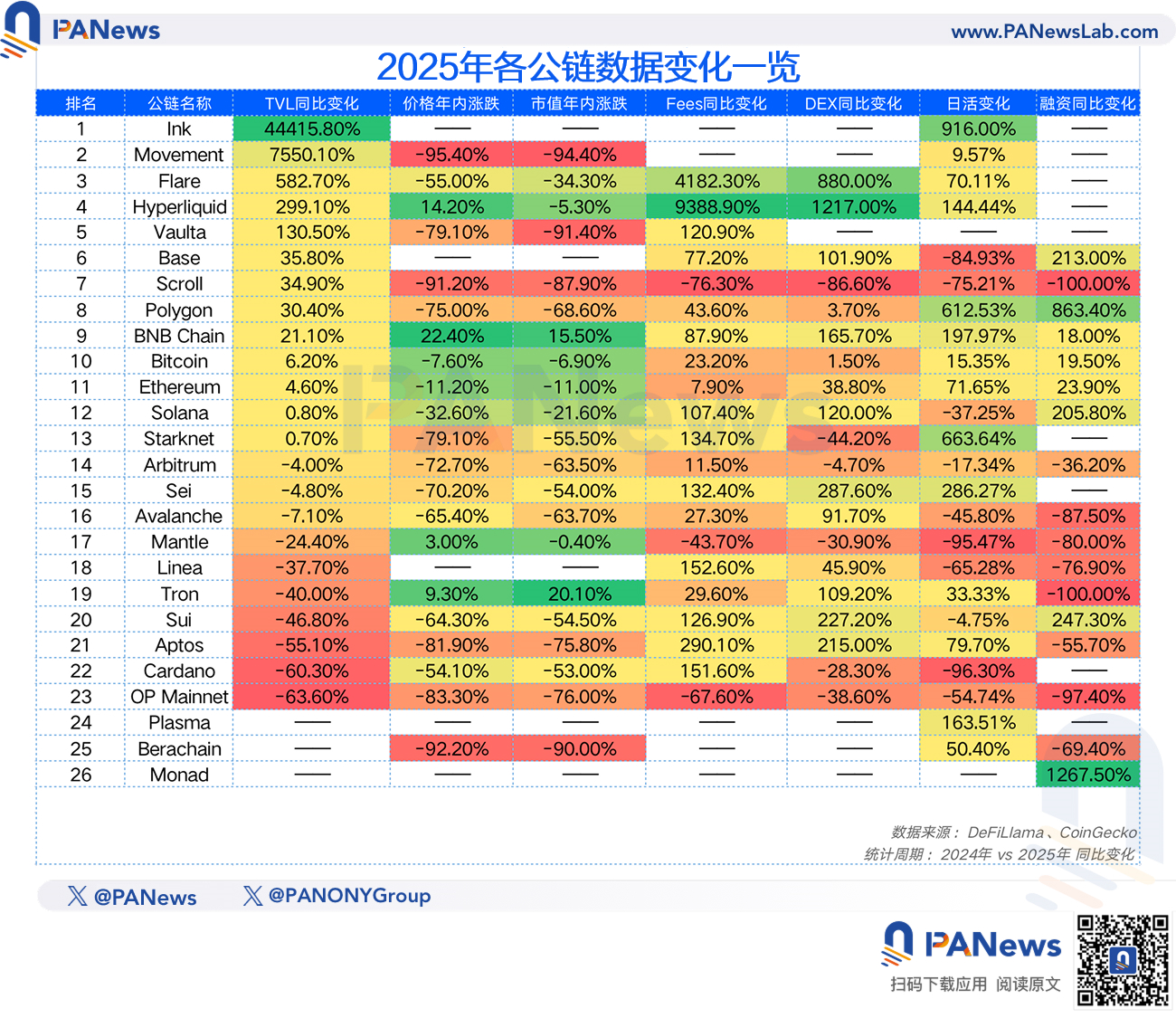

From the perspective of TVL, the most important indicator of public chain prosperity, the top public chains have seen slight overall growth this year, but the growth rate has slowed. The total TVL of the 26 major public chains tracked by PANews grew by 5.89% this year, with 5 newly added public chains starting from a data point of 0. Additionally, only 11 public chains achieved positive TVL growth, accounting for about 42%. In contrast, the annual TVL growth for the 22 mainstream public chains tracked in 2024 was 119%, with a growth rate of 78%.

The slowdown in TVL growth also reflects the chill in the entire crypto market. However, this does not mean that 2025 will be a completely dull year; from the overall industry TVL perspective, the total TVL across the network reached $168 billion in October, a 45% increase from $115.7 billion at the beginning of the year. It was only after October that the market crash caused the entire market's TVL to plummet. Part of this was due to the decline in the prices of various public chain base tokens, and part was the result of many funds choosing to withdraw from the DeFi system amid risk-averse sentiment.

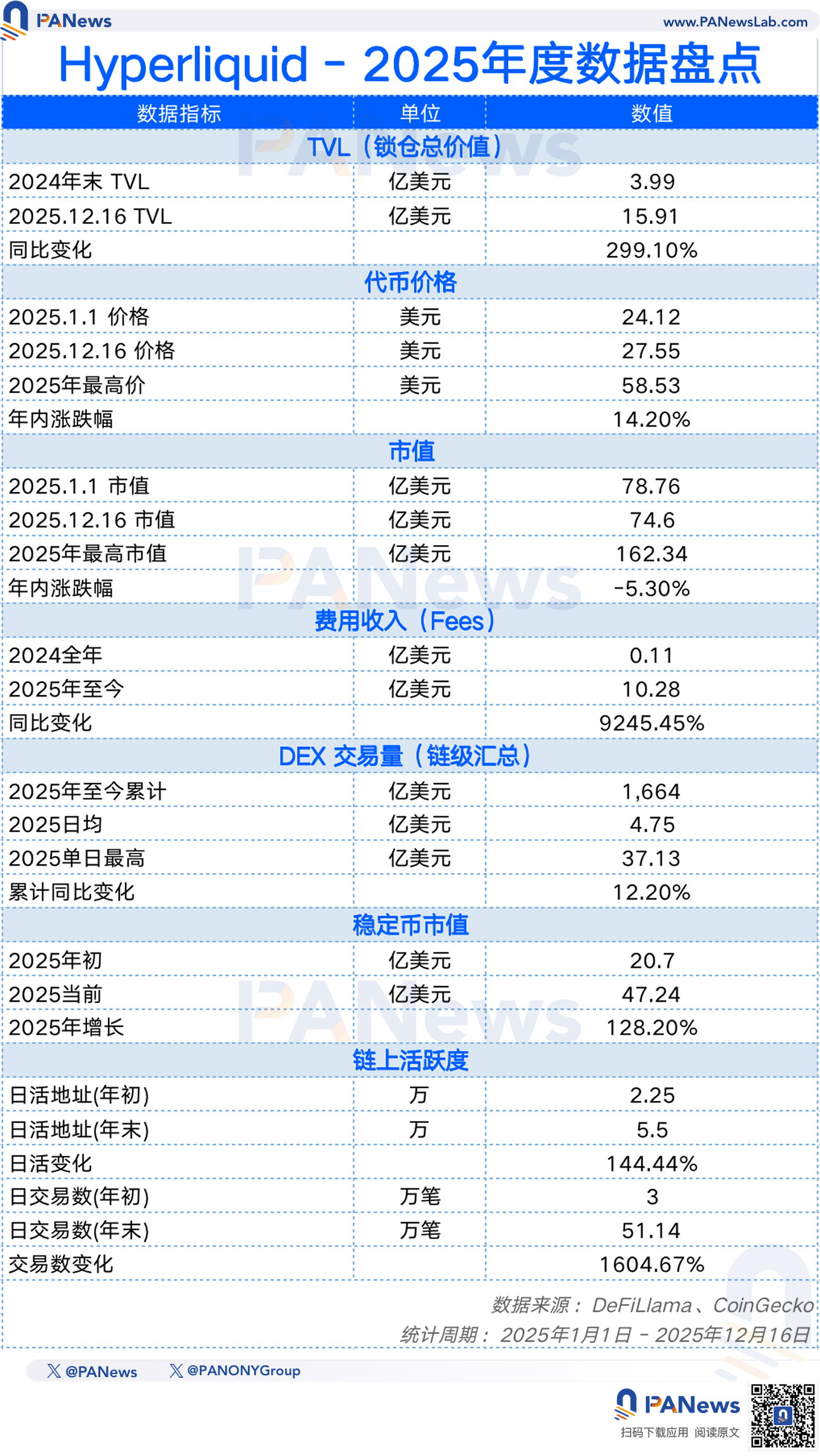

Among the top ten public chains, Hyperliquid is clearly the winner of 2025, achieving a 299% growth in TVL this year compared to the single-digit growth of other public chains. In contrast, Solana has become the most disappointing, with only 0.8% growth; as the MEME coin market cools, this public chain giant seems to be facing a crisis. Additionally, among the 26 public chains tracked, Flare's growth rate exceeded 582%, making it the fastest-growing public chain. OP Mainnet's TVL, on the other hand, fell by 63.6%, becoming the public chain with the most significant decline.

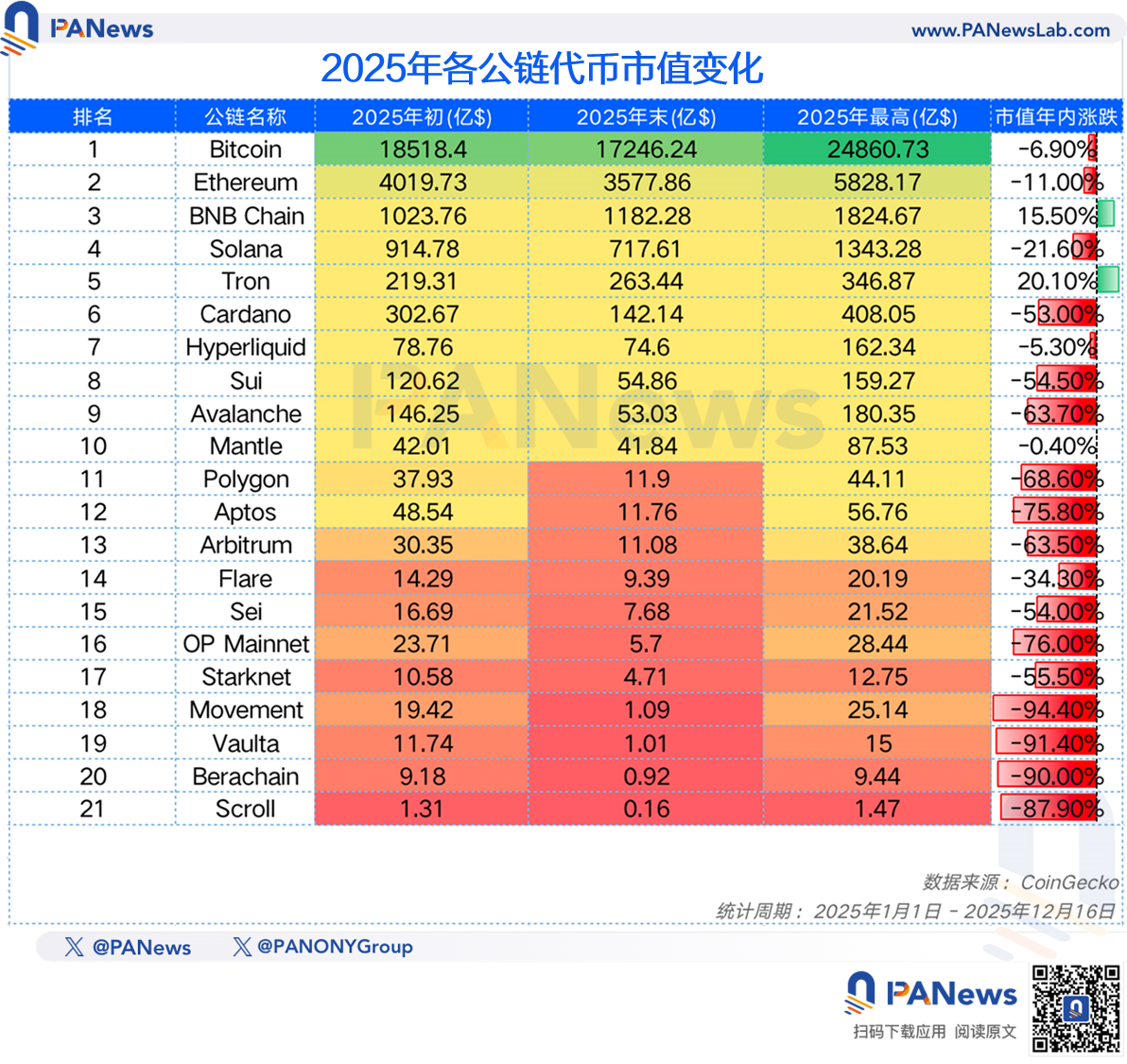

Average Price Halved by 50%, Market No Longer Pays for New Public Chains

In terms of price, the final performance of these mainstream public chains this year is also underwhelming. Compared to the prices at the beginning of the year, the average token price of these 26 public chains has dropped by 50%. Among them, Movement's token price fell by 95%, Berachain's by 92%, and Scroll's by 91%. These new public chains have not gained market recognition.

Among the public chains tracked, only BNB Chain (22%), Hyperliquid (14.2%), Tron (9.30%), and Mantle (3%) have seen price increases this year, while the rest have all experienced declines.

However, the changes behind the TVL and price data are primarily influenced by shifts in crypto market liquidity. Analyzing the ecological development indicators of public chains reveals a different picture.

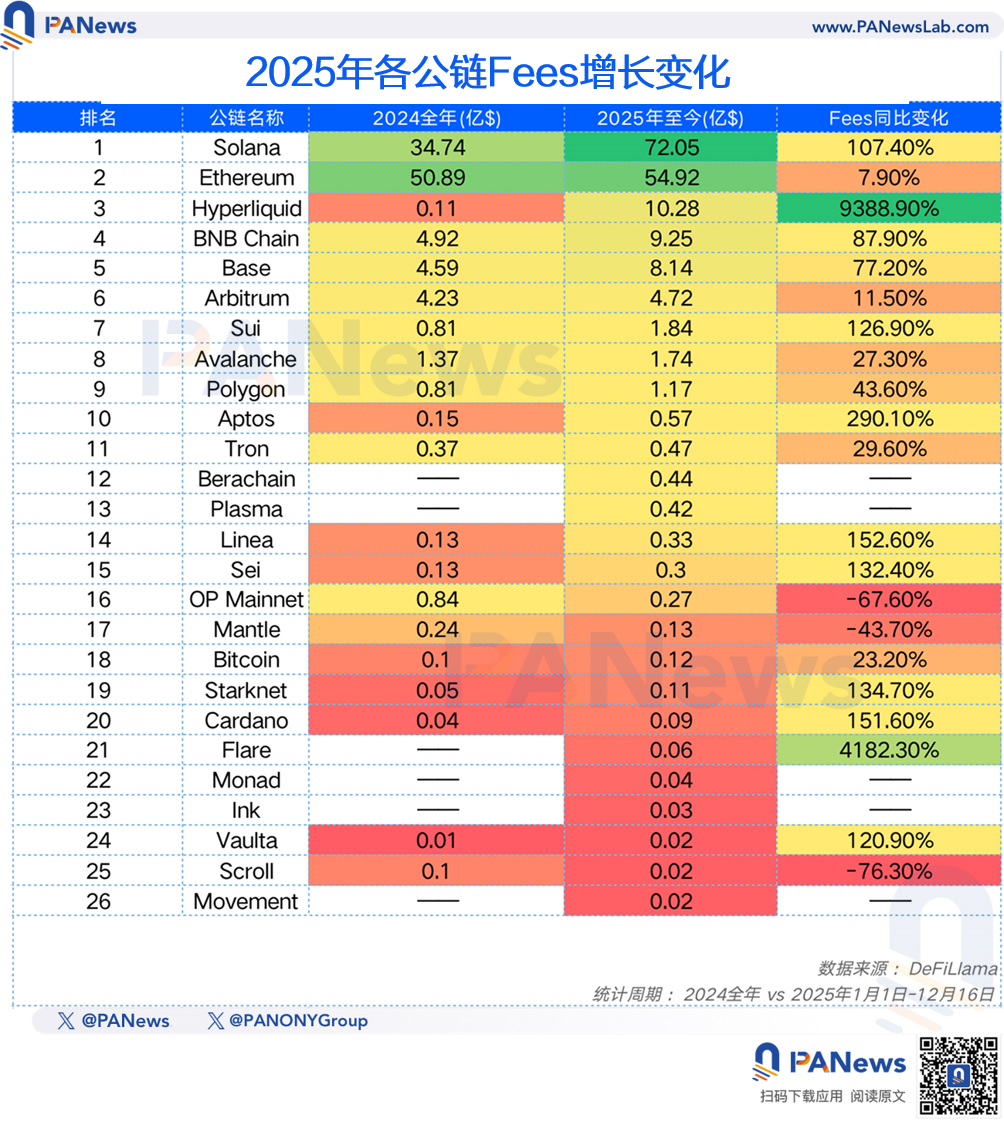

Protocol Revenue Soars, Public Chains Enter a New Phase of "Self-Sustaining"

In terms of on-chain fee generation, the public chains tracked generated a total of $10.4 billion in on-chain fees throughout 2024, which grew to $16.75 billion in 2025, representing an overall growth of 60%. Moreover, except for OP Mainnet, Mantle, and Scroll, which saw declines in fees, all other public chains achieved growth in 2025.

The largest increase in fees was still Hyperliquid (9388.9%), primarily due to its recent launch at the end of 2024, starting from a small base. Additionally, Solana's fees grew by 107%, BNB Chain by 77%, Sui by 126%, and Aptos by 290%. It can be said that the revenue-generating capabilities of mainstream public chains have significantly improved in 2025.

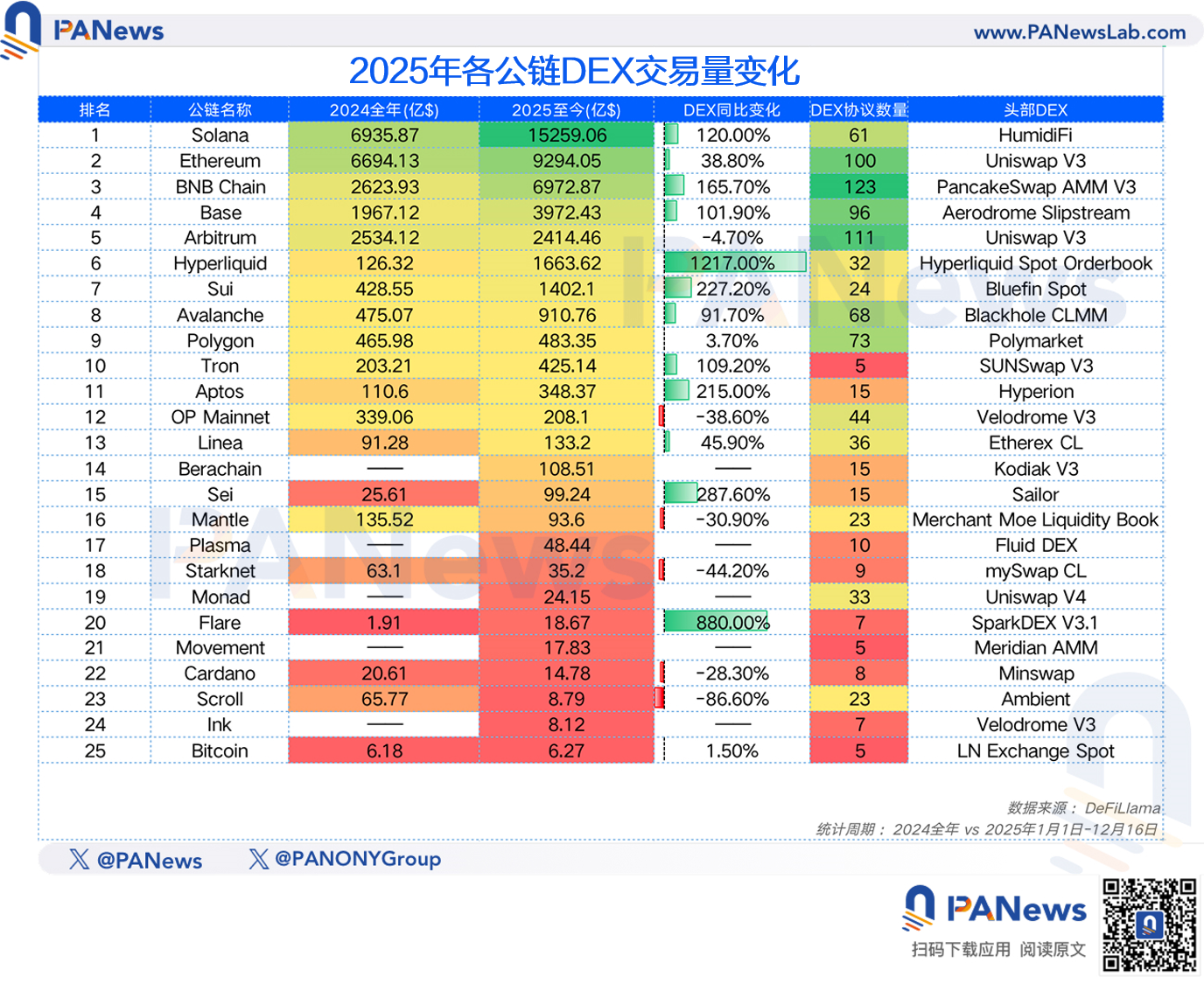

Furthermore, the trading volume of DEX across various public chains also achieved an overall growth of 88%, with an average increase of 163%. Among them, Solana completed a comeback against Ethereum, topping the trading volume with $1.52 trillion, while BNB Chain closely followed with $697.2 billion in trading volume, likely to surpass Ethereum in 2026.

Hyperliquid remains the fastest-growing, with an annual DEX trading increase of 1217.00%, and Flare ranks second with an 880% increase.

As "Airdrop Hunters" Disperse, New Public Chain User Retention is Challenging

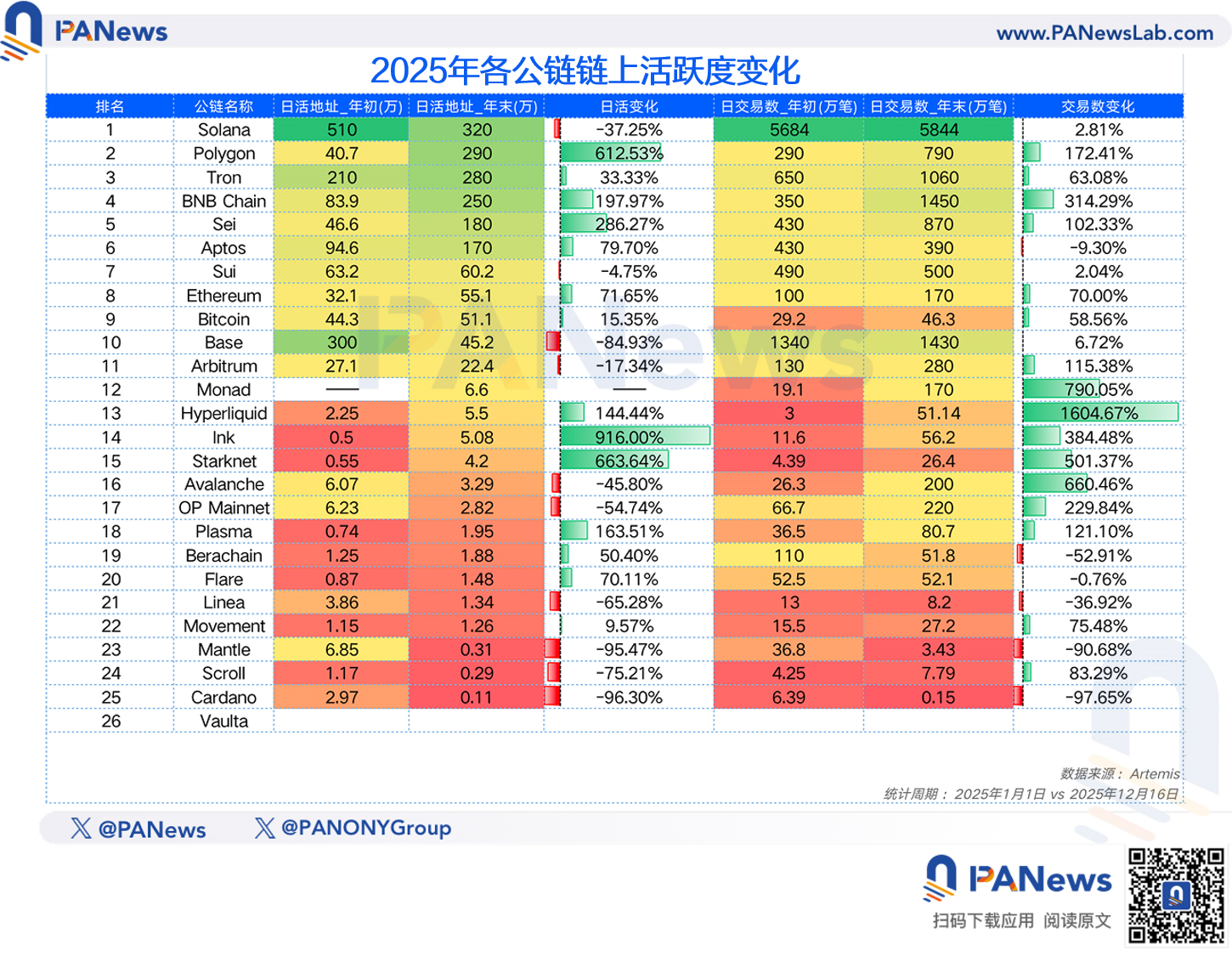

In terms of daily active data, the situation is mixed.

Overall, the number of daily active addresses for these public chains grew from 14.86 million to 17.6 million, representing an overall increase of 18%. Achieving such data performance in a sluggish market is considered a relatively positive signal.

On the other hand, several public chains that previously represented retail investor activity, such as Solana, Base, and Sui, have all experienced varying degrees of decline, with Base seeing an 84.9% drop in daily active users compared to the beginning of the year, and Solana declining by 37%. Recently, however, Polygon's daily active addresses have seen exponential growth, reaching 2.9 million on December 19, a 612% increase from the beginning of the year. Additionally, public chains like BNB Chain, Sei, and Aptos have also seen significant growth in daily active users.

Moreover, in terms of daily transaction counts, these public chains achieved an overall growth of 33% in transaction volume by year-end compared to the beginning of the year. BNB Chain's performance stands out, growing from 3.5 million transactions at the start of the year to 14.5 million, excelling in both scale and growth rate. Although Solana still leads with 58.44 million transactions, it only achieved a 2.8% growth over the year, showing signs of fatigue.

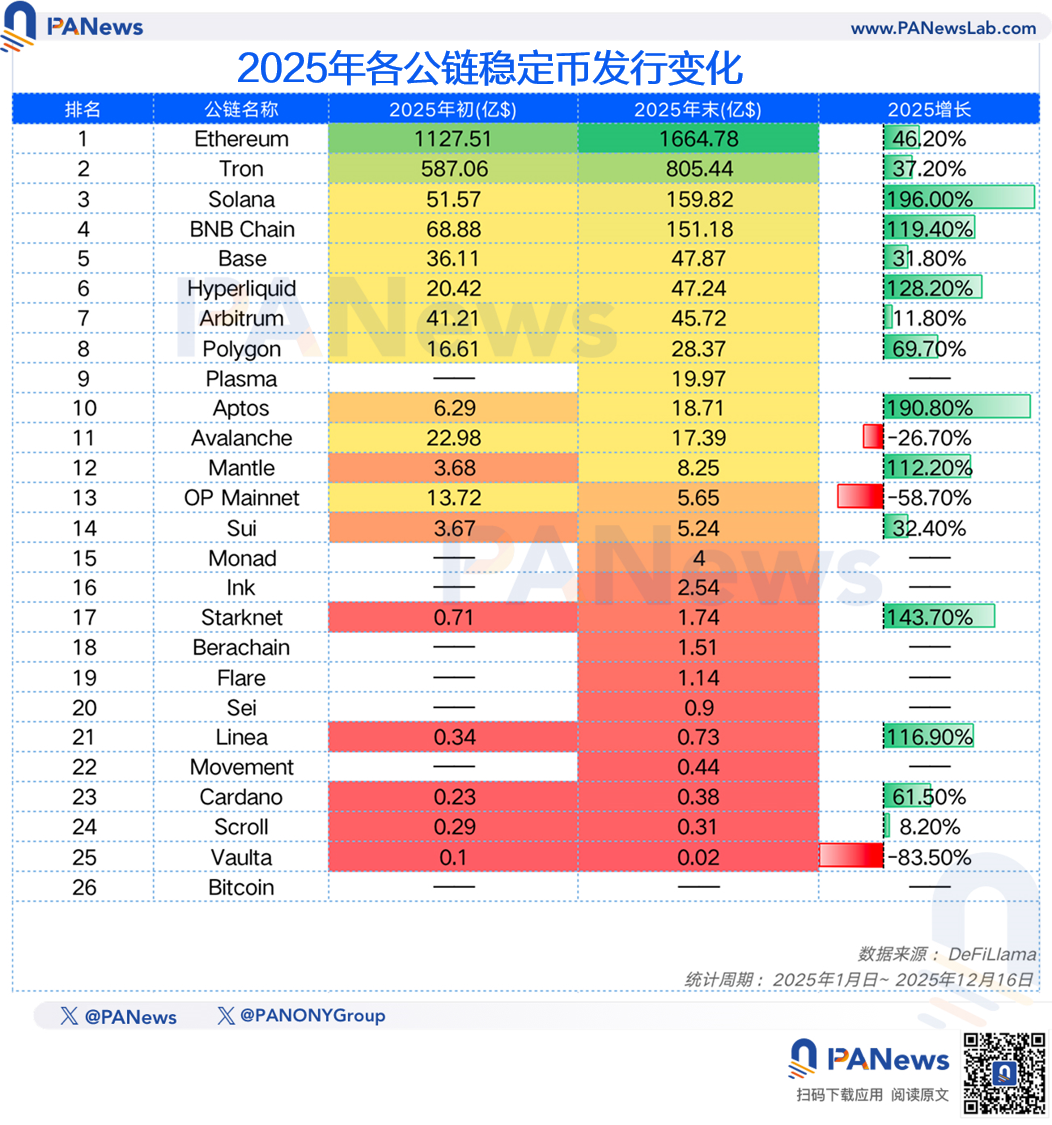

Stablecoins Become the Only "Full Bull Market" of 2025

The stablecoin market in 2025 is set to explode, and the data from public chains corroborates this. Compared to 2024, most public chains have seen significant growth in stablecoin market capitalization, with Solana standing out, experiencing a 196% surge in stablecoin market cap, making it the public chain with the largest increase in stablecoins. Ethereum and Tron, as the top two public chains for stablecoins, maintained annual growth rates of 46% and 37%, respectively. Additionally, some public chains that performed actively this year, such as BNB Chain and Hyperliquid, also achieved substantial growth in stablecoins.

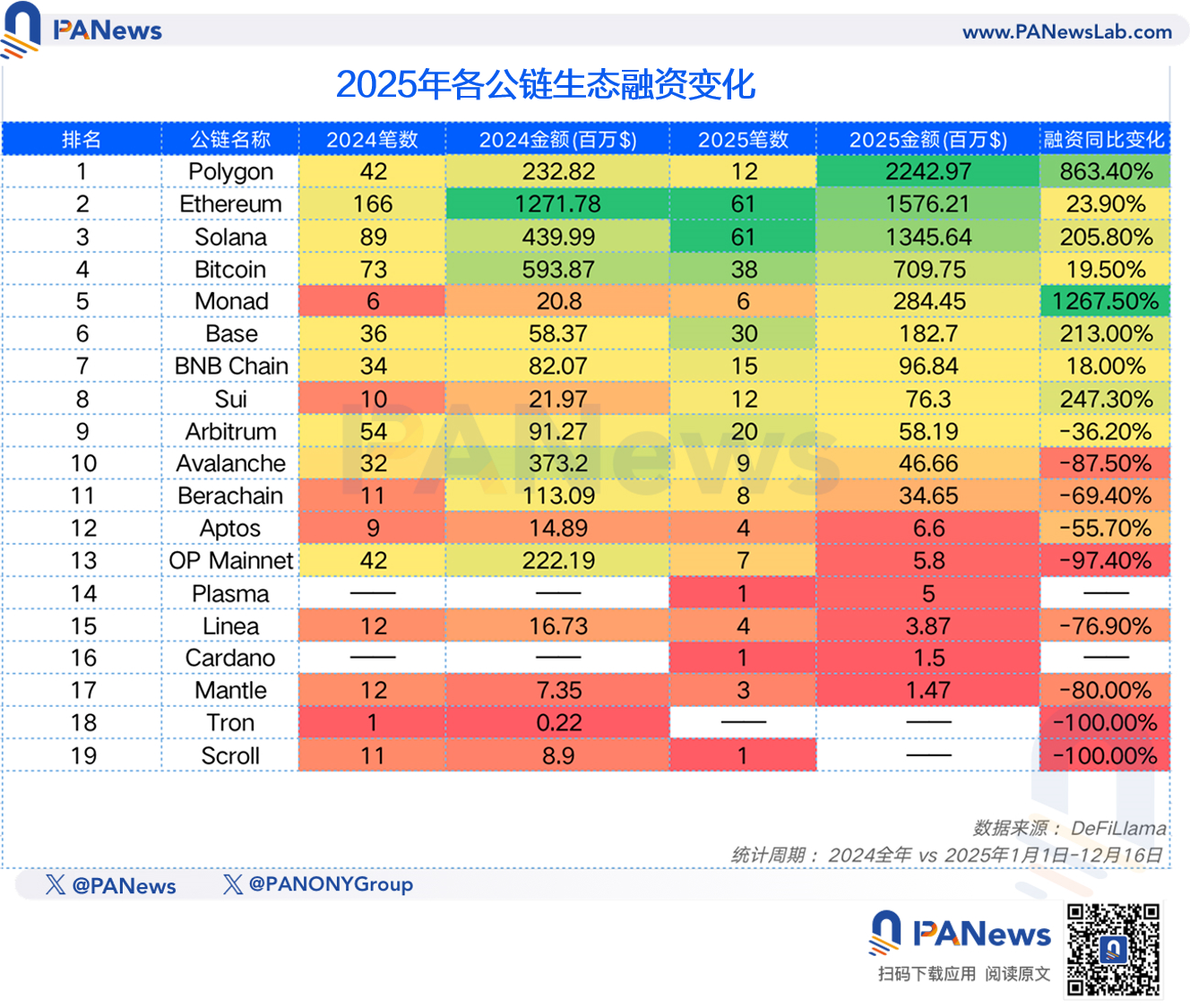

Ecosystem Financing: Polygon Tops with Star Projects, Ethereum and Solana Remain Hot

Additionally, another data dimension worth noting is the financing situation. The crypto industry in 2025 reached new heights in financing, with PANews tracking 6,710 financing events and categorizing them by public chain. The results show a significant decrease in the number of financing events for these public chains, dropping from 640 to 293. However, the total amount increased from $350 million to $667 million, with the average financing amount per event rising from $5.57 million to $22.79 million. This indirectly indicates that it may be more challenging for small and medium-sized entrepreneurial teams to secure financing in the current market, while capital is more willing to invest more in star projects.

In terms of public chain classification, Polygon led with $2.24 billion in financing, followed by Ethereum and Solana, which secured $1.57 billion and $1.34 billion, respectively. However, Polygon's top position in financing is primarily due to Polymarket's massive financing of over $2 billion. A closer look at the number of financing events shows that the main financing activities still occurred within the ecosystems of Ethereum, Solana, Bitcoin, and Base.

The following is an analysis of several public chains that are key focuses in the market:

Ethereum: The Light Boat Has Passed Through Thousands of Mountains, a "Dislocation Period" of Fundamental Recovery and Price Stagnation

As the leading public chain, Ethereum's development in 2025 can be described as "the light boat has passed through thousands of mountains," following a stagnation in ecological data caused by severe L2 diversion in 2024, with market prices lingering. In 2025, Ethereum has actually seen good growth in ecological data, especially in DEX trading volume (up 38.8%), stablecoin market capitalization (up 46%), and on-chain active addresses (up 71%). Additionally, it continues to lead most public chains in terms of ecological financing events and amounts. From these data indicators, the ecological development of Ethereum's mainnet has revived in 2025.

However, in terms of price and TVL data, it remains stagnant due to the overall market correction. Nevertheless, compared to other public chain tokens, Ethereum's price performance shows relatively stronger resilience.

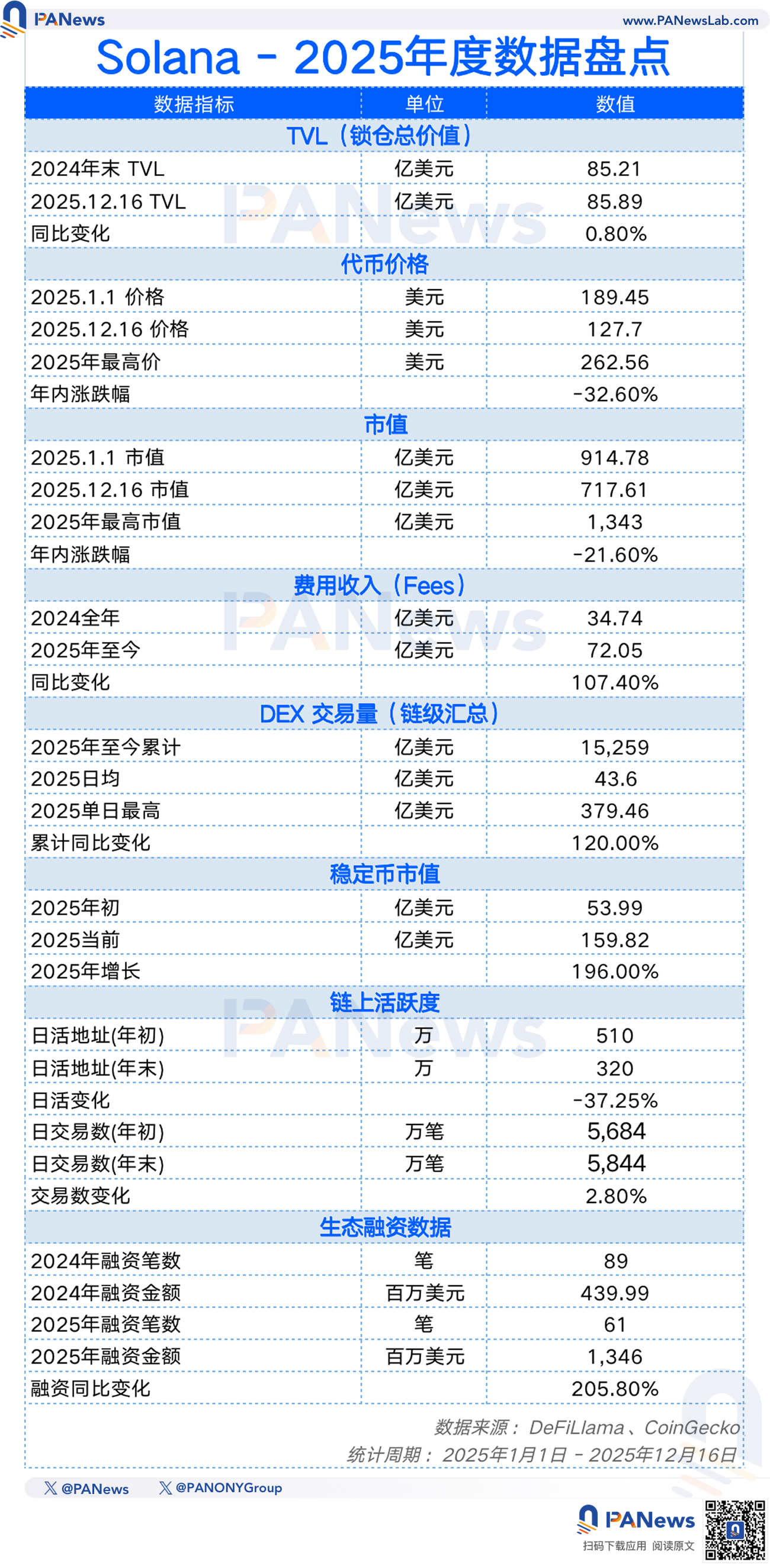

Solana: Success and Failure in MEME, Vulnerability Revealed After the Bubble Bursts

Compared to 2024, Solana presents a different state in 2025: the ecological vulnerability exposed after significant ups and downs. After the MEME market transitioned from boom to bust at the beginning of the year, Solana failed to generate more narratives and instead saw various launch platforms continue to compete in the MEME coin space. Therefore, although there has been significant growth in fee capture and DEX trading volume this year, the token price, year-end active users, and transaction counts have all seen severe declines. This indirectly indicates that the market is voting with its feet, and Solana's bubble of prosperity seems to have burst.

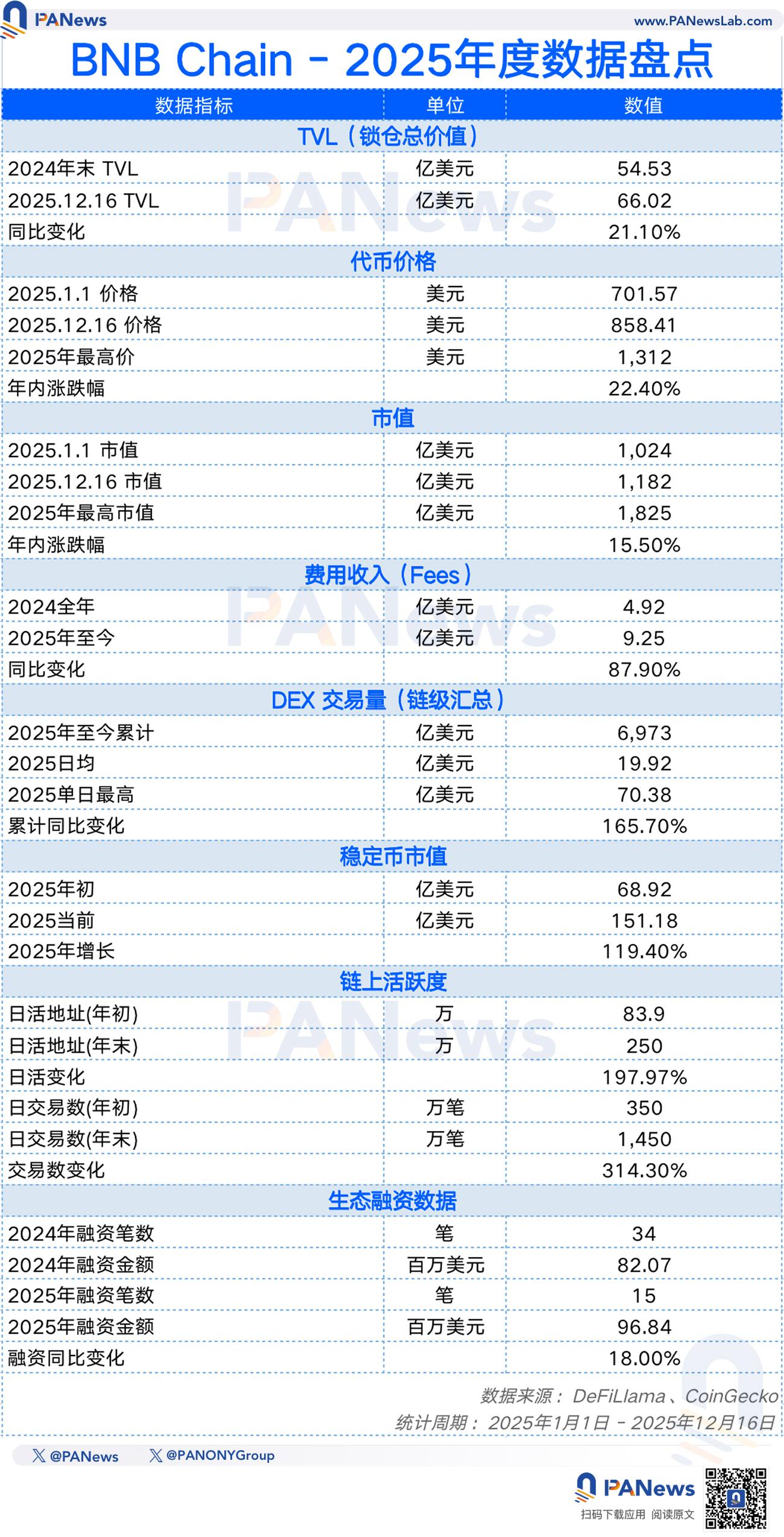

BNB Chain: From Defense to Full Offense, the "Hexagonal Warrior" of Comprehensive Growth

BNB Chain achieved a comprehensive explosion in 2025, realizing positive growth across all data dimensions tracked. Notably, fee income, DEX trading volume, stablecoin market capitalization, and on-chain activity all saw growth of over 100%. This is rare in the current sluggish public chain market.

Of course, such achievements are closely tied to Binance. From high-level executives like CZ actively participating in marketing to the launch of Binance Alpha becoming a "required course" for many retail investors, and the targeting of Hyperliquid by new derivative exchanges like Aster, BNB Chain has shifted from a counterattack in 2024 to a full offensive. This aggressive momentum makes BNB Chain an opponent that cannot be ignored by all public chains.

Hyperliquid: The Biggest Dark Horse of the Year, Teaching the Industry a Lesson with "Real Revenue"

Similar to BNB Chain, Hyperliquid also shone brightly in 2025. Aside from a slight decrease in market capitalization compared to the beginning of the year (-5.3%), all other data showed positive growth, with several metrics recording the largest increases among all public chains.

In 2025, Hyperliquid ranked ninth in total TVL, third in fee generation, sixth in DEX trading volume, and fifth in stable market capitalization. From these rankings, Hyperliquid has become a veritable mainstream public chain, and achieving such results as a newcomer in this market is undoubtedly a significant success. Moreover, it is one of the few public chains in 2025 that can sustain its entire ecosystem through real revenue without relying on inflationary incentives.

However, Hyperliquid has recently encountered strong competitors, with trading volumes from rivals like Aster and Lighter approaching. Unbeknownst to it, Hyperliquid, which was a challenger just a year ago, may find itself in a defensive position in 2026.

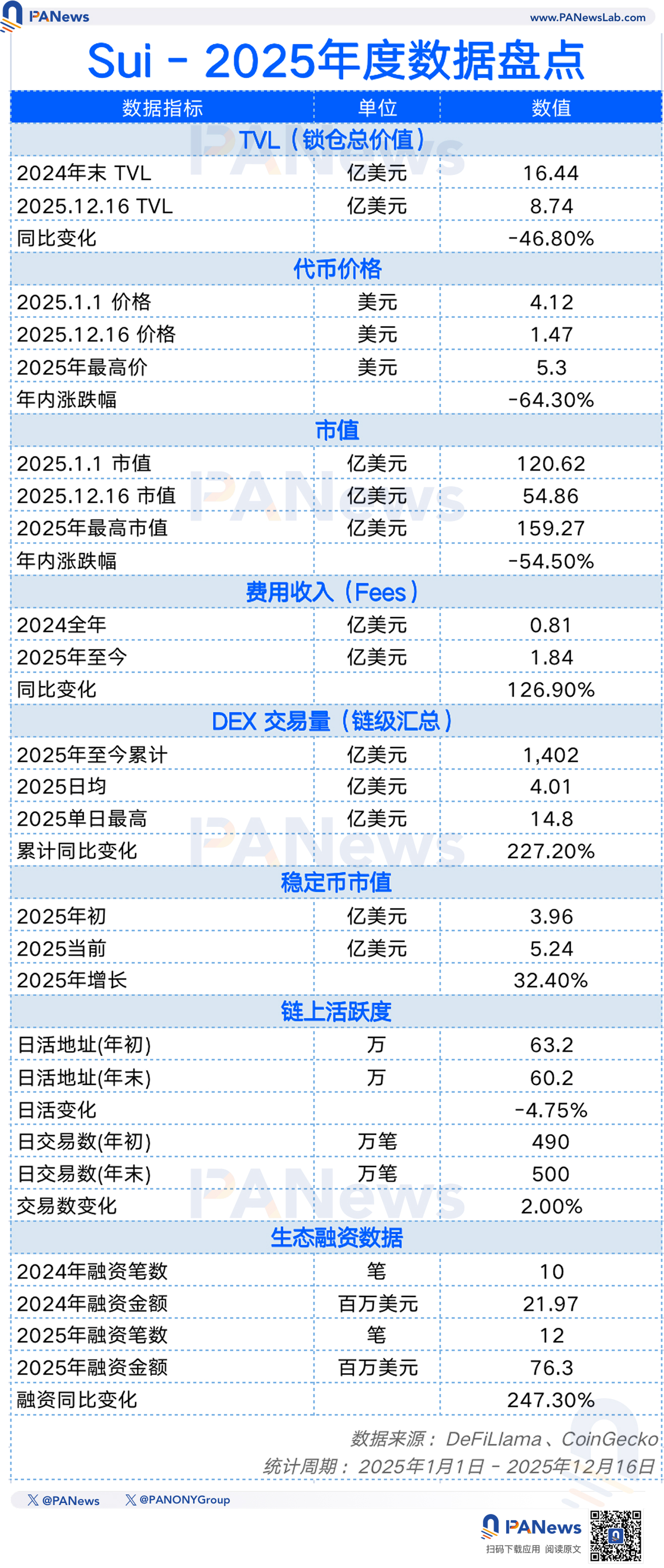

Sui: Unlocking the "Squat" Under Pressure, Urgently Needs to Reshape After the Bubble Bursts

As an emerging public chain that strongly chased Solana in 2024 and was highly anticipated by the market, Sui has remained relatively quiet in 2025. Among all mainstream public chains, Sui's token price decline (-64%) and TVL drop (-46%) reflect the pressure from the market. This is mainly due to Sui entering a "dense unlocking period" in 2025, with a large amount of tokens from early investors and the team entering the market, compounded by the overall market cooling, leading to price pressure.

At the same time, in terms of ecological activity, daily active data and daily transaction counts have remained nearly flat compared to the beginning of the year, reflecting the root of Sui's stagnation this year: a lack of new narratives, following the MEME market without a complete breakout. However, from the perspective of financing amounts and DEX trading volume, the capital market has not completely abandoned Sui, and 2026 may be a year for reshaping after the bubble bursts.

Tron: The Ultimate Pragmatist, The "Cash Flow King" Deepening in the Payment Track

Tron's development trajectory in 2025 sets another narrative style for the public chain market: leveraging the tailwind of stablecoins to continue "quietly making money." Although there has been about a 50% pullback in TVL and token prices, Tron has still generated $184 million in on-chain fees (up 126.9%) thanks to the stable performance of the stablecoin market, with DEX trading volume expanding by 224%. For Tron, rather than chasing trends for new narratives, it is better to focus on the fundamentals of global stablecoin settlement. This pragmatic attitude has made it a public chain with stable cash flow and strong user stickiness.

Looking back at the public chain landscape in 2025, this is not just an annual report card but a reflection of the diverse development of public chains.

The red and black lists of data clearly tell us: the era of "wild galloping" in the public chain track has ended, replaced by a brutal trend of "stock game" and "oligopolization." Whether it is Solana's anxiety over traffic after the MEME tide recedes, Sui's price pain under the pressure of token unlocking, or the brutal market debuts of new public chains like Movement and Scroll, all prove that the false prosperity maintained by VC blood transfusions and point PUA is difficult to sustain.

However, amidst the widespread declines, we can see the evolution of industry resilience. BNB Chain's explosive growth across its ecosystem, Hyperliquid's reliance on genuine revenue, and Tron's pragmatic deepening in the payment track collectively point to the survival rules for 2026: survive not by telling stories, but by making money; not by inflating numbers, but by relying on real users.

The chill of 2025 may be bone-chilling, but it has successfully squeezed out the bubbles that have clung to public chains for years. As we look forward to the upcoming 2026, we have reason to believe that on this cleaner and more pragmatic foundation, public chains will no longer merely be speculative casinos but will truly become the global financial infrastructure for large-scale value exchange.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。