What to know : APT dropped 2.8% Trading volume was 35% above monthly average. The elevated activity validated genuine repositioning despite APT's relative weakness against larger digital assets.

fell 2.8% over 24 hours as the layer-1 token faced headwinds from sector rotation with traders favoring bigger cryptocurrencies over mid-cap alternatives.

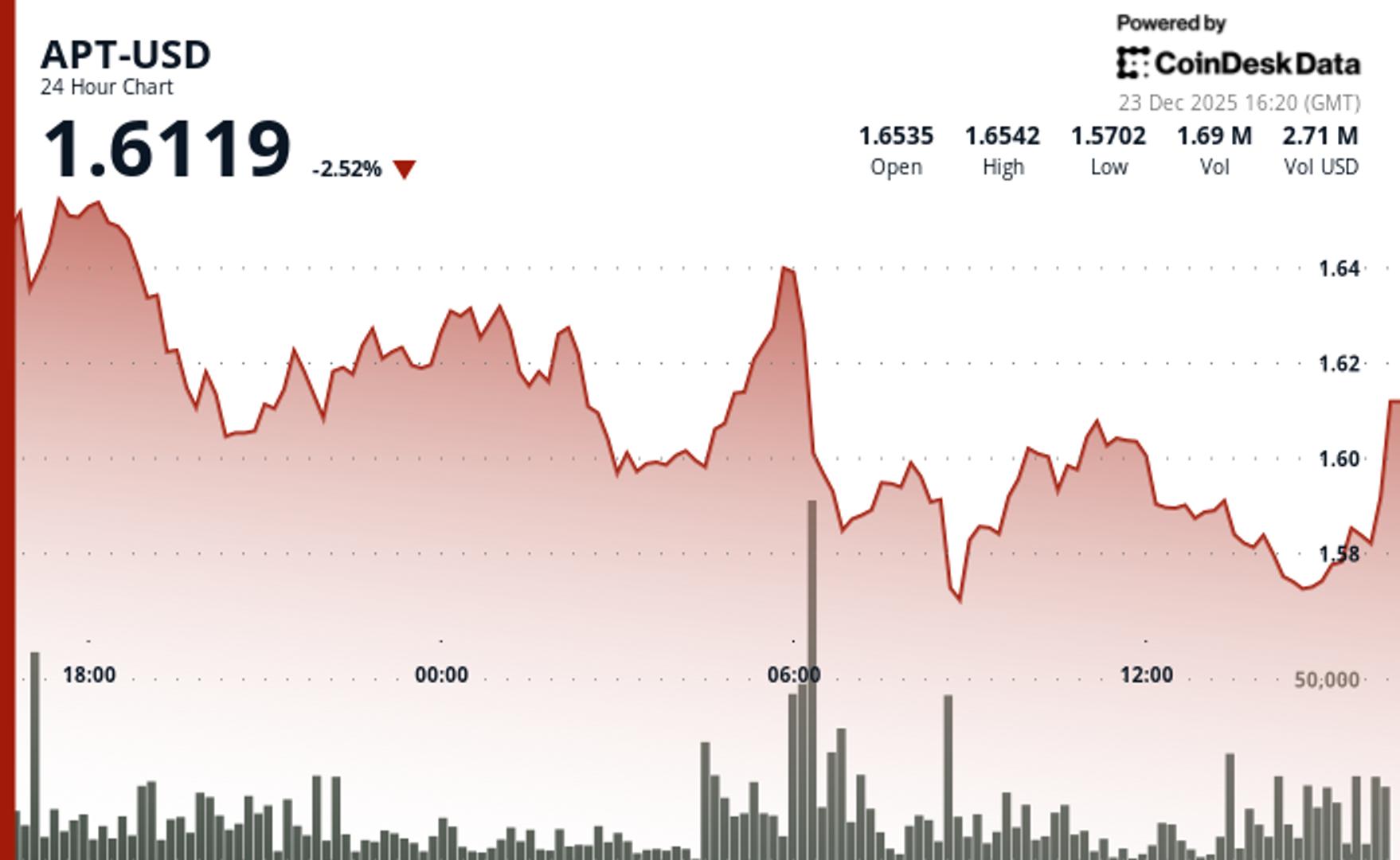

APT traded within a 10 cent range, declining from $1.66 to $1.57 before staging a late-session recovery, according to CoinDesk Research's technical analysis model.

The model showed that volume rose 35% above the 30-day average, signaling institutional participation rather than retail noise.

The elevated activity validated genuine repositioning despite APT's relative weakness against larger digital assets. Selling pressure dominated morning hours as growth-oriented blockchain narratives faced broader market skepticism, according to the model.

The token's resilience at key support levels suggested accumulation emerged during weakness, the model said.

The broader market gauge, the CoinDesk 20 index also declined, and was 2.8% lower at publication time.

Technical Analysis:

- Primary support established at $1.57-$1.575 after successful defense during selloff

- Key resistance remains at $1.64 level where morning rejection occurred

- Exceptional volume spike of 7.3 million at 06:00 breakdown confirmed distribution

- Final hour breakout volume of 93,449 validated bullish reversal pattern

- Overall 35% volume increase above 30-day average signaled institutional interest

- Bearish trend with lower highs dominated morning session trading

- Immediate upside target at $1.64 resistance with $1.575 stop-loss level

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。