Let's talk about the judgment on the long cycle and the altcoin season based on a friend's topic.

Joshua's data indicates that "the number of tokens that have fallen more than 80% from their peak has reached as high as 330! Even if we relax the criteria to a 50% drop, there are still 382 tokens deeply trapped in this situation." Although I don't know the size of his sample, I ran the top 100 tokens by market capitalization using AI to see which ones have dropped the most from their 2025 peak to now.

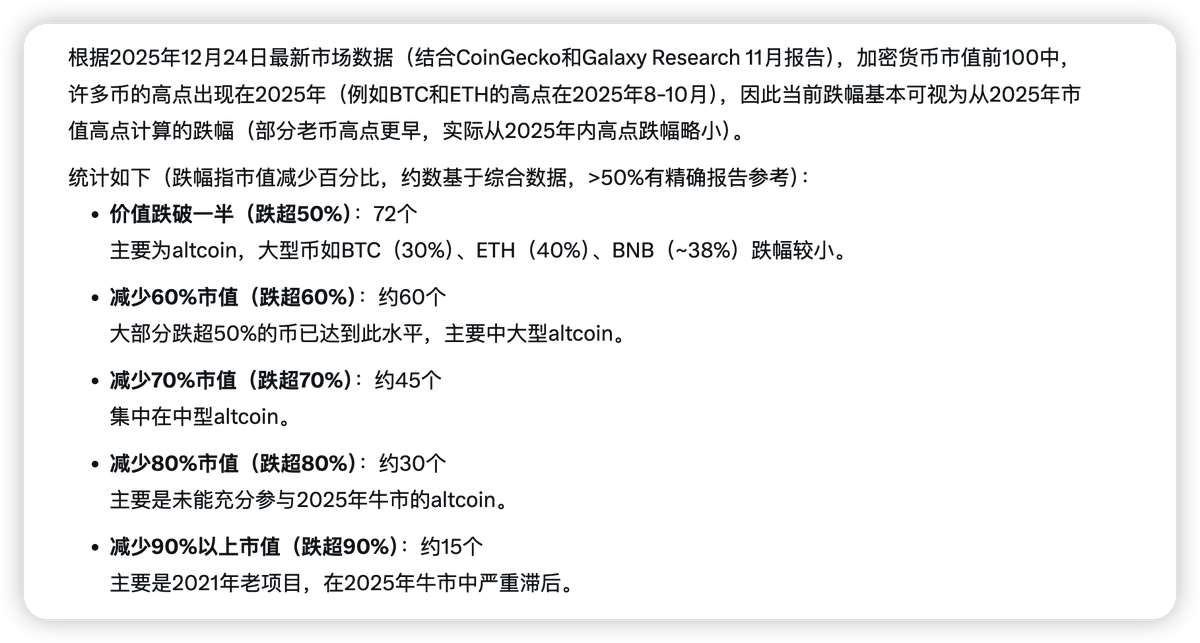

Among them, 72 tokens have seen their market cap drop by more than half, 60 tokens have decreased by 60%, 45 tokens have decreased by 70%, 30 tokens have decreased by 80%, and 15 tokens have decreased by more than 90%.

Even $BTC has a pullback of 30%, let alone others. So what is the reason for this situation? I think the most direct cause is the Federal Reserve's monetary policy. Since 2022, interest rates have been raised, and we are still in a liquidity-tight situation, which naturally means there won't be much capital flowing into cryptocurrencies, especially into "altcoins."

Many friends attribute this to the end of VC coins, but it should not simply be due to the high market cap of VC coins. Instead, in a situation of insufficient market liquidity, even the big players are hesitant to control the market for long periods. This is also why some friends have said that the altcoin season has arrived in the past year, and I would pour cold water on that.

Not to mention altcoins, even many stocks in the top 500 by market cap have not fully recovered. The comparison I use most often, Nike, has dropped 30% just in 2025, and from its peak in 2021 to now, it has dropped nearly 70%. But it should be noted that Nike's revenue for the fiscal year 2025 was $46.3 billion, and it has still dropped this much. For most cryptocurrencies, which are essentially worthless, a halving is already mild.

Therefore, I believe the fundamental reason is not that altcoins are failing, but that this stage (monetary tightening) is simply not suitable for large-scale risk pricing.

The Federal Reserve has aggressively raised interest rates since 2022, pulling rates from near zero to 5.5%. Although there have been a few symbolic cuts at the end of 2024 and into 2025, the actual liquidity tightening continues, and the balance sheet reduction will not stop until December 1, 2025. The real available liquidity in the market has not returned to the levels of 2021.

Risk assets are most afraid of the combination of "high interest rates + liquidity recovery." In such an environment, funds will prioritize flowing into the safest and most certain assets, such as U.S. tech giants, government bonds, and cash, rather than flooding into the high-risk, high-volatility crypto market, especially those altcoins where the narrative outweighs actual value.

Cryptocurrencies are essentially amplifiers of risk appetite. Only when global liquidity is abundant and investors have so much money that they don't know where to throw it will it trickle down to altcoins.

Currently, the situation is that although institutional money has come in a bit (mainly BTC and ETH spot ETFs), this money is very rational and disciplined, only daring to buy large coins and not chasing small coins. Retail money has been siphoned off by high interest rates (time deposits, money market funds), and coupled with the psychological shadow left by previous rounds of crashes, there is hardly any new capital willing to go all in.

The criticism of VC coins is merely superficial. The real problem is the entire market lacks "dumb money." Without a continuous influx of incremental funds to take over, any high-valuation project will be brought back to reality. Big players are also hesitant to push prices up because if they do, no one will take over, and if they crash the price, they will be the first to get liquidated. This is the fundamental reason for the recent year's "false altcoin season" repeatedly starting and failing. There has always been capital trying to drive the altcoin market, but unfortunately, in the face of a broader liquidity shortage, it is like an ant trying to stop a chariot.

In this round, I have almost not lost money on altcoins, mainly because I didn't touch them. Apart from a few mainstream tokens and platform coins with potential, I haven't bought any after my own research. Because the current cycle does not have the possibility of an "altcoin season," not buying naturally means not losing.

If we really reach a point where liquidity is about to reverse, the altcoin season will come again; this is an inevitability of economic development, and there is nothing to question. So what I am doing now is gradually swapping some tokens that still have value in this cycle for tokens that may rise in the next cycle, using reallocation instead of cutting losses.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。