After Bitcoin reached a new high of $123,000, the market underwent a structural adjustment, with a market cap shrinkage of over 20%. Altcoins experienced a decline of 80%-99%, and the entire industry sought a new direction amid growing pains of maturity.

At the beginning of 2025, the cryptocurrency market was filled with optimism, with analysts predicting that Bitcoin would break the $200,000 mark. However, by the end of the year, the market presented a different picture: the total global cryptocurrency market cap had shrunk by about 20-30% from the peak at the beginning of the year, most altcoins experienced an 80%-99% crash, and Bitcoin's market cap share returned to over 60%, back to levels seen in 2019-2020.

The market completed a transition from speculative frenzy to value return amid severe volatility.

I. Annual Trajectory: From Cycle Disillusionment to Structural Restructuring

● The cryptocurrency market in 2025 did not continue the expected four-year cycle bull market but instead became a year of "structural adjustment" for the industry. Since mid-2025, the market has shown high volatility and downward pressure, with major asset prices continuously correcting and trading volumes shrinking, leading to a general lack of investment confidence.

● Bitcoin's performance this year was dramatic. In July, Bitcoin reached a historic high of $123,000, and the market was filled with optimism. Several well-known institutions and industry leaders predicted that Bitcoin would soar to $180,000-$200,000 or even higher by the end of the year.

● However, the reality was starkly different. By December, Bitcoin had fallen about 30% from its 2025 peak, exhibiting extreme volatility throughout the year, having repeatedly surged above $100,000 and also dropping below $75,000.

● The depth of the market adjustment far exceeded expectations. After a brief rebound in the first half of 2025, mainstream token prices entered a correction phase starting in October, with further declines in November. The prices of the Top 50 tokens nearly fell back to levels seen after the FTX collapse in 2022.

II. Market Structure: Bitcoin Strengthens Dominance, Altcoins Suffer Heavy Losses

● In the market structure adjustment of 2025, Bitcoin's dominance significantly increased. Bitcoin's market cap share reached an impressive 64% in 2025, maintaining above 60% for most of the year, returning to levels seen in 2019-2020.

● As the year progressed, market sentiment changed. After reaching a peak, Bitcoin's market share fell below 60% by the end of August. By September, Bitcoin's dominance stabilized at around 57.9%, coinciding with the total market value of altcoins reaching $1.12 trillion.

● In stark contrast to Bitcoin, the altcoin market performed poorly. In 2025, most altcoins experienced an 80%-99% crash, leading to a highly fragmented market with 40 to 50 million different coins available.

● The strong accumulation in the second quarter of 2025 pushed the Altseason index to break the 75 threshold in the third quarter, briefly confirming the altcoin season. However, the liquidity recovery driven by tariffs, combined with outflows from ETFs, triggered a sharp decline, with the Alt Szn index dropping to about 19 by the end of the year, returning the market to a Bitcoin-dominated season.

III. Key Events: Summer Frenzy and Regulatory Breakthroughs

● July 2025 became a turning point for market sentiment. On July 18, the cryptocurrency market experienced a "carnival," with Ethereum breaking $3,600 per coin, reaching a new high since January; XRP surged nearly 20%.

On that day, the global cryptocurrency market cap first surpassed $4 trillion. This was not only a symbolic breakthrough but also marked a structural repositioning of cryptocurrency within the global financial system.

● Significant progress was also made in the regulatory field. On July 17, the U.S. House of Representatives passed three cryptocurrency-related bills, including the "Guidance and Establishment of a National Stablecoin Innovation Act."

● U.S. President Trump is expected to sign an executive order allowing approximately $9 trillion in U.S. 401(k) retirement savings plans to invest in cryptocurrencies, gold, and other alternative assets. If implemented, this policy could fundamentally change how Americans manage their savings.

IV. Institutional Entry: Capital Migration from Margins to Mainstream

2025 witnessed institutional capital gaining full control over liquidity in the cryptocurrency market. After years of observation, institutional capital finally surpassed retail investors, becoming the dominant force in the market.

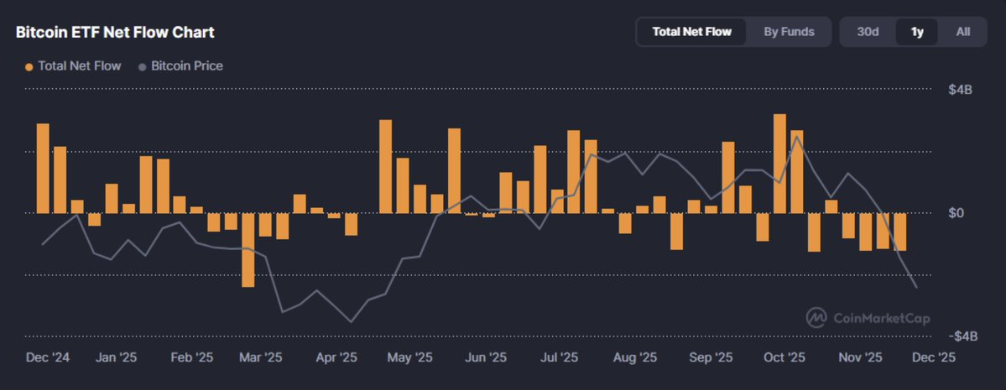

● The capital flow into U.S. spot Bitcoin ETFs was particularly significant. In just the fourth quarter of 2025, weekly inflows into U.S. spot Bitcoin ETFs exceeded $3.5 billion. BlackRock's IBIT became a leading player, holding nearly 700,000 Bitcoins.

● The shift in institutional investment models is also noteworthy. Bitcoin is no longer viewed as a curiosity-driven asset but is regarded as a macro tool with portfolio utility.

● Ownership dynamics have changed: large asset managers tend to hold Bitcoin directly, while pension funds and endowment funds typically gain exposure through ETFs. Financial advisors have regained dominance among institutional investors, now controlling 50% of all 13-F Bitcoin ETF assets.

V. Emerging Trends: From Speculative Narratives to Infrastructure Value

In 2025, several key areas transitioned from speculative narratives to actual infrastructure, signaling a direction of industry maturity.

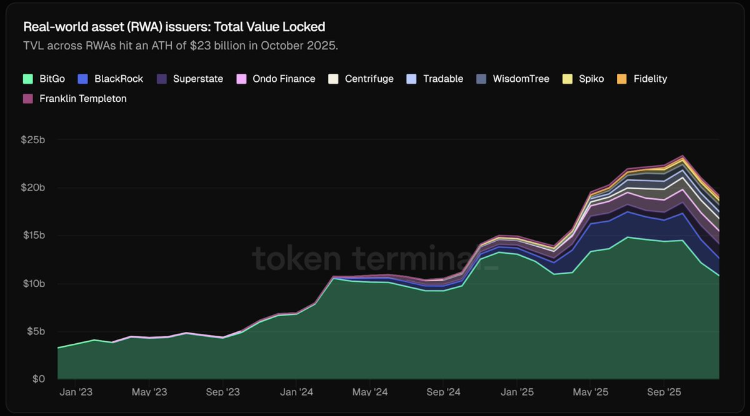

● Tokenization of physical assets shifted from concept to infrastructure in capital markets. By October 2025, the total market cap of RWA tokens exceeded $23 billion, surging nearly fourfold year-on-year. About half of this consists of tokenized U.S. Treasury bonds and money market strategies.

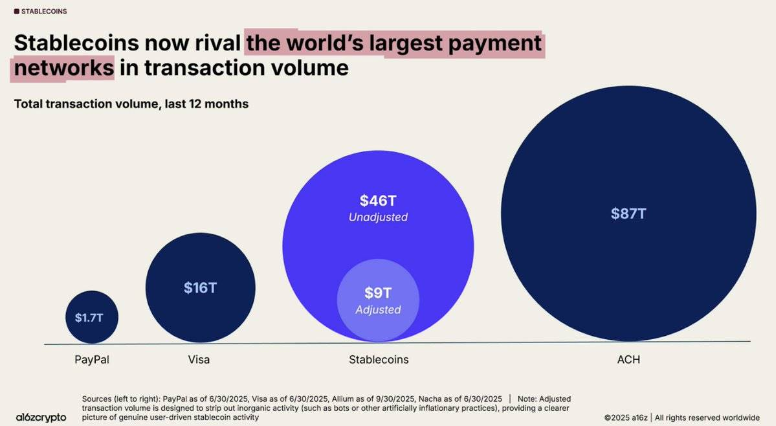

● Stablecoins, as the "killer application" in the crypto space, fulfilled their core promise in 2025: large-scale programmable dollars. Over the past 12 months, on-chain stablecoin transaction volume reached $46 trillion, a year-on-year increase of 106%.

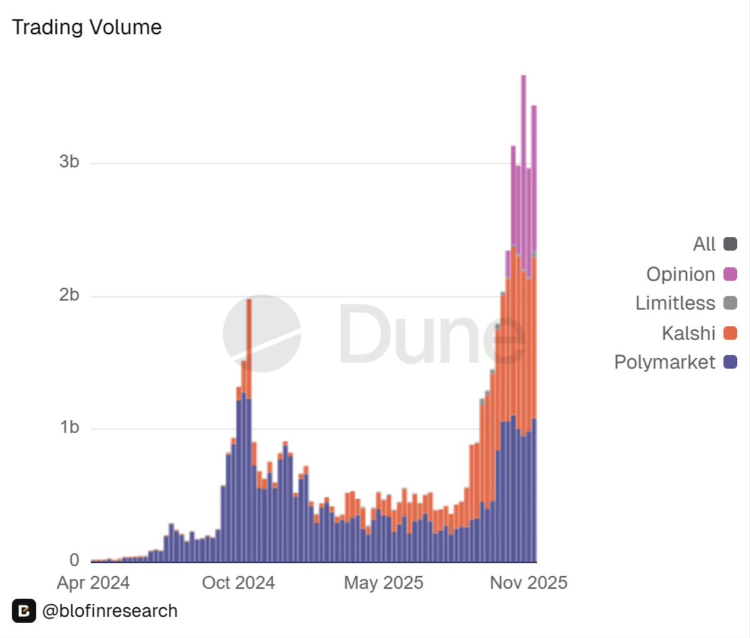

● Prediction markets became one of the fastest-growing verticals in 2025, with nominal weekly trading volume reaching $3.8 billion for the first time. This marks the transition of blockchain markets from "toys" to genuine financial infrastructure.

VI. Technological Evolution: Scalability Competition and Second Layer Breakthroughs

Bitcoin's second-layer solutions made significant progress in 2025, processing transactions off-chain while leveraging the security and decentralization of the main Bitcoin blockchain.

● The Lightning Network, as the most prominent second-layer implementation, enables almost instantaneous transactions through payment channels. Other solutions like Stacks bring smart contract capabilities to the Bitcoin ecosystem, while Rootstock, as a sidechain, makes complex programmable transactions possible.

● The Ethereum second-layer space exhibited a "winner-takes-all" scenario. Arbitrum, Base, and Optimism attracted most of the new TVL and capital flows, while smaller Rollup projects saw their revenue and activity drop by 70% to 90% after incentives ended.

● Meanwhile, the trading volume of cross-chain bridges surged, reaching $56.1 billion in July 2025 alone. This indicates that "everything is Rollup" still means "everything is fragmented," as users continue to face isolated balances and duplicated liquidity.

VII. Liquidity Challenges: Global Differentiation and Internal Tensions

The cryptocurrency market in 2025 faced serious structural liquidity issues. Global liquidity showed structural differentiation, with the crypto market becoming the "tail end." Market participants gradually shifted their focus to fundamentals, income, buybacks, and other actual values.

Exchange data shows that Bitcoin reserves have decreased by about 8% since early August, with the value of reserves in USD dropping from about $300 billion to $250 billion in November. This indicates a trend of investors withdrawing from exchanges, reinforcing sell signals.

The industry also faced multiple internal challenges. VC investment shrank, with total financing only accounting for about half of 2024, leading to tight funding chains for projects. DeFi yields significantly decreased, dropping to below 5% compared to 2024.

Security incidents were frequent, with losses exceeding $2 billion in the first half of the year due to hacking attacks, and congestion events on Layer 1 chains also affected market confidence.

### VIII. Value Reconstruction and Regulatory Clarification

● Looking ahead to 2026, the market will focus more on fundamentals, alignment of interests, value accumulation, and compounding leverage. The industry will enter a phase of value reconstruction, with enterprises, startups, and traditional finance professionals playing more important roles.

● The tokenization of securities field saw a significant breakthrough by the end of 2025. The U.S. Securities and Exchange Commission issued a "no-action letter," clearly stating that it would not take enforcement action against the securities tokenization pilot program of a DTCC subsidiary. This means that starting in 2026, more securities tokenization projects will be seen.

● The regulatory environment will trend towards normalization. The U.S. Congress is pushing to grant the CFTC greater jurisdiction over the cryptocurrency spot market. The CFTC is expected to launch a policy early next year that may allow stablecoins to be used as tokenized collateral in the derivatives market.

● Market participants need to cultivate genuine competitive advantages; otherwise, even the most seasoned players may face challenges. Competitive advantages can manifest in various areas: from trading skills to industry insights, from technical expertise to community building.

Looking back at the end of 2025, the total cryptocurrency market cap fluctuated around the $3 trillion mark, with Bitcoin hovering around $88,000. Analysts generally believe that Bitcoin is facing its worst fourth-quarter performance since 2018.

The once-hyped "super cycle" narrative is unraveling. Market focus has shifted to macro risks, seasonal weakness, and geopolitical uncertainties. Ethereum's trading price is not much different from 2022, while internal industry issues abound, from hacking attacks to tight funding chains for projects, every market participant faces difficulties.

The true legacy of the cryptocurrency market in 2025 may be: a shift from mere price speculation to infrastructure building and exploration of practical application scenarios.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

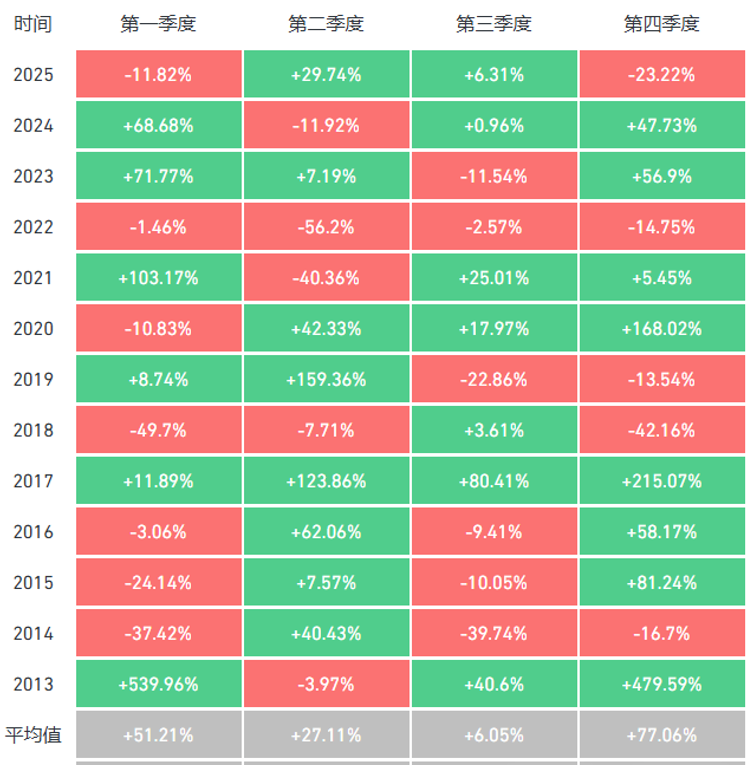

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。