Written by: FinTax

In October 2023, the Council of the European Union adopted Directive (EU) 2023/2226 (DAC8), completing the seventh amendment to Directive 2011/16/EU on Administrative Cooperation in Direct Taxation (DAC). This formally incorporates the Organization for Economic Cooperation and Development (OECD) Crypto-Asset Reporting Framework (CARF) into the EU tax cooperation system. By 2025, EU member states will gradually complete the domestic legal transformation of DAC8. On January 1, 2026, the provisions of DAC8 will officially come into effect, marking the beginning of the first annual reporting of tax information on crypto assets, and the European crypto asset market will gradually move towards substantial implementation.

DAC8 aims to strengthen the overall legal framework for the automatic exchange of information (AEOI) by including crypto asset information in the scope of tax information exchange, in order to combat tax fraud, evasion, and avoidance.

1. CARF and DAC8

CARF is an international standard for the automatic exchange of tax information promoted by the OECD, aimed at regulating cross-border tax information disclosure related to crypto assets. DAC8 is based on CARF and establishes the rules and procedures for the exchange of information on crypto asset users, regulating service providers and their users active in crypto asset trading through the implementation of due diligence procedures and reporting rules.

1.1 Main Content of DAC8

DAC8 stipulates the due diligence and reporting obligations of crypto asset service providers. The directive requires EU countries to obtain information from Reporting Crypto-Asset Service Providers (RCASPs) and exchange this information annually with the taxpayer's country of residence in the EU. RCASPs are required to collect transaction information about their non-resident investors during the reporting year and send this information to the tax authorities of their home country in the following calendar year, and exchange information with the tax authorities of the EU countries where non-resident investors reside within nine months after the end of the reporting year. Thus, the information exchange related to the first reporting year (2026) will be completed by September 30, 2027.

As for the scope of tax information exchange under DAC8, the directive is based on the definition of crypto assets in the EU's Markets in Crypto-Assets Regulation (MiCA), covering a wide range of crypto assets, including electronic money tokens and some non-fungible tokens.

1.2 Relationship between CARF and DAC8

CARF itself does not have legal effect and needs to be implemented through regional or domestic legislation by various regions and countries. The EU institutionalizes CARF through DAC8, integrating it into the EU legal framework.

DAC8 adopts CARF's definitions regarding crypto assets, RCASPs, and reportable users, and aligns with CARF in terms of transaction categories, due diligence rules, and reporting data fields. DAC8 transforms CARF into a mandatory, enforceable mechanism for tax transparency outside the EU and integrates it with MiCAR and existing DAC tools. DAC8 not only coordinates and unifies EU tax information exchange but also effectively incorporates crypto asset reporting into the EU's financial regulatory system.

Additionally, DAC8 makes some extensions to CARF to address EU-specific characteristics. DAC8 establishes compliance outside the EU as a condition for entering the EU market, imposing mandatory reporting obligations on non-EU crypto asset service providers when providing services to EU users.

2. Overview of EU Tax Information Exchange and Regulatory Framework

The EU began issuing the DAC series of directives in 2011. DAC itself does not involve tax collection but establishes a coordinated framework that allows EU member states to collect and exchange tax information related to individuals and companies, meeting the mutual assistance needs of EU countries in the tax field and ensuring administrative cooperation between national tax authorities.

2.1 Evolution of the DAC System

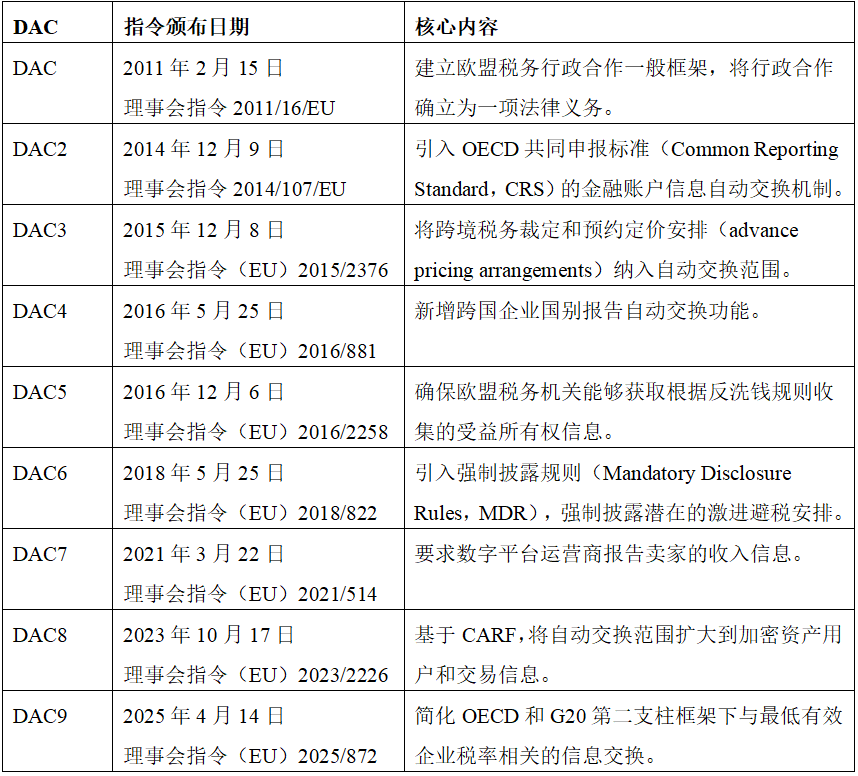

To date, DAC has undergone eight revisions, which have expanded the scope of taxpayers and increased the types of data that need to be reported. The specific evolution of the DAC system from DAC to DAC9 is shown in the table below:

The evolution of DAC reflects the EU's shift from passive information exchange to proactive, systematic, and technology-driven tax transparency, gradually expanding from traditional income to complex cross-border structures and then to the digital and crypto economy.

2.2 Positioning of DAC8 within the DAC System

DAC8 expands the scope of information automatically exchanged under the DAC framework, requiring RCASPs to report reportable transactions and transfer information related to crypto assets and electronic money. It ensures that crypto assets follow the same information logic as traditional financial assets, continuing the DAC tax information exchange framework, improving the coverage of asset categories, and marking the full incorporation of crypto assets into the EU's general tax transparency and administrative cooperation system, rather than being viewed as a special or marginal asset category.

Beyond crypto assets, DAC8 further improves some existing provisions of DAC. It enhances the reporting and communication rules for Tax Identification Numbers (TINs) to facilitate tax authorities in identifying relevant taxpayers and assessing related taxes. At the same time, it grants member states flexibility in penalties and compliance to ensure the implementation of DAC.

3. Formulation and Implementation Process of EU DAC8

The formulation and implementation of DAC8 are divided into the EU level and the EU member states level, specifically:

3.1 Formation of EU DAC8

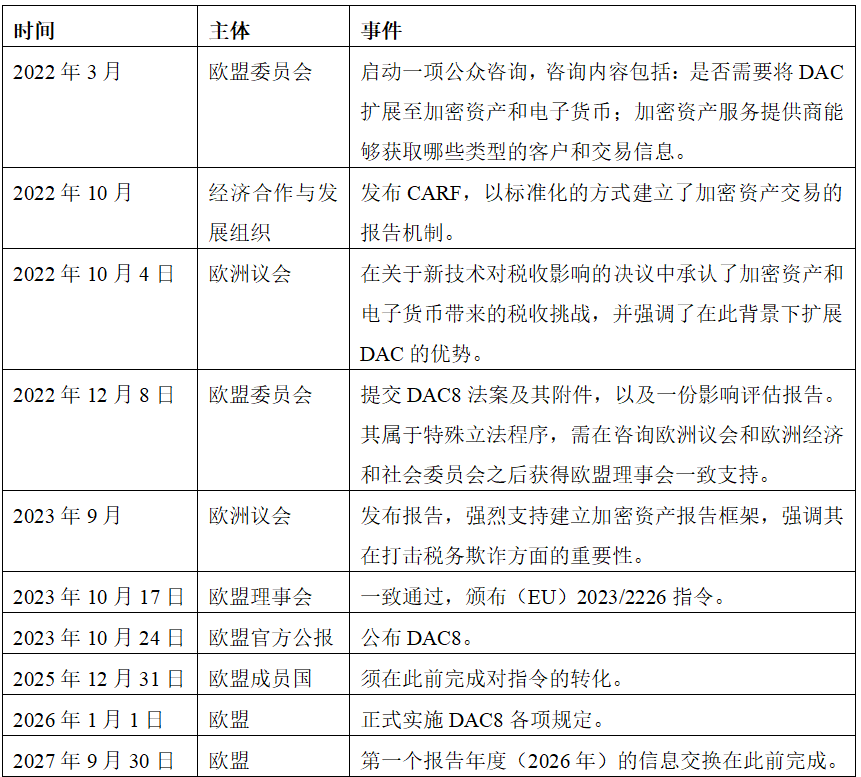

At the EU level, the origins of DAC8 can be traced back to 2022, and the timeline of relevant events for its formulation and implementation is shown in the table below:

3.2 Transformation of DAC8 by EU Member States

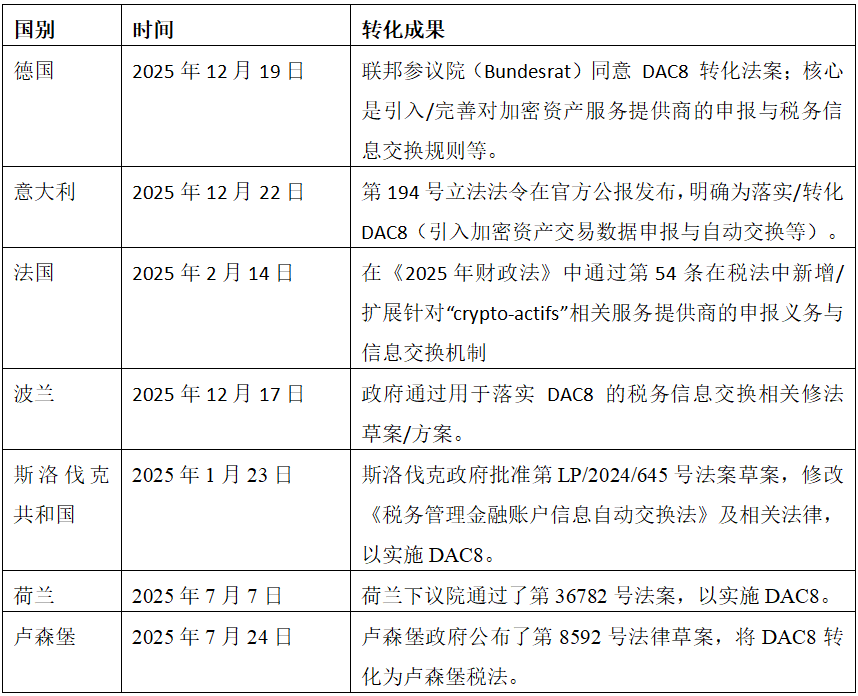

DAC8 sets a transition period for EU member states, requiring them to complete the transformation of DAC8 by December 31, 2025. The transformation results of some member states are as follows:

Overall, at the EU level, DAC8 serves as a tool for coordinated system construction, incorporating crypto asset reporting into the existing EU tax transparency system; at the member state level, it is an administrative system oriented towards transformation, influenced by each country's law enforcement culture, administrative capacity, and policy priorities. The effectiveness of DAC8 depends not only on a unified legal design but also on the ability of member states to transform crypto asset data into effective law enforcement.

4. Potential Impact of DAC8 on the EU Market

4.1 Impact on Crypto Asset Service Providers

For crypto asset service providers, RCASPs are the main channel for information transmission under DAC8. Crypto asset service providers will transform into tax reporting intermediaries, subject to mandatory obligations to determine customer tax residency, collect Tax Identification Numbers (TINs), and classify transactions, while complying with due diligence rules and submitting annual reports to tax authorities. RCASPs are incorporated into the EU's tax administration system.

DAC8 requires crypto asset service providers to have IT systems capable of supporting compliance, legal and tax expertise, and ongoing reporting capabilities. This brings high fixed compliance costs, raising the capital threshold for crypto asset service providers, and smaller providers may face mergers or market exit, accelerating the concentration and specialization of the EU crypto asset market to some extent.

DAC8 applies to crypto asset service providers established in the EU and non-EU crypto asset service providers serving EU users, globalizing compliance standards for the crypto asset industry through market access conditions.

4.2 Impact on Traditional Financial Institutions

The implementation of DAC8 will also have indirect effects on traditional financial institutions such as banks, raising their risk management requirements. The directive incorporates crypto assets into the regulated financial system, making crypto assets a compliance risk factor for traditional financial institutions, forcing them to reassess clients related to crypto assets and strengthen due diligence on clients with high transaction volumes in crypto assets.

4.3 Impact on Individual Investors

DAC8 eliminates the structural tax opacity of crypto assets, with individual investors' tax residency status, crypto asset transaction volumes, and cross-border transactions being reported to tax authorities and automatically exchanged between EU member states. This increases the compliance burden on individual investors to some extent and regulates their crypto asset trading behavior.

Additionally, although DAC8 is not retroactive, the data obtained may trigger audits for previous years. Historical violations of individual investors' crypto asset transactions may be reassessed and subject to penalties.

5. Response and Outlook

In light of the potential impacts brought by the implementation of DAC8, market participants need to enhance compliance awareness, begin data integration, and attempt to transform the compliance burden brought by the transparency of crypto asset trading into their competitive and governance advantages. Specifically:

For crypto asset service providers, they need to register in one EU member state or designate an EU reporting intermediary to centralize DAC8 reporting. At the same time, they can attempt to tag transactions by asset type, transaction nature, etc., integrating tax logic into product design for easier information collection.

For traditional financial institutions, they can collaborate with RCASPs that support DAC8 for risk control related to crypto assets. Utilizing the compliance advantages brought by existing DAC infrastructure, they can develop businesses such as crypto asset brokerage and tokenized securities, re-entering the crypto asset market.

For individual investors, they should fully understand DAC8 and recognize the transparency of crypto asset trading. Their attitude towards crypto asset trading should shift from risk avoidance to compliance planning, choosing EU-regulated RCASPs as trading platforms. For historical compliance issues, they should consider voluntary disclosure and correction of documents. When necessary, they can seek assistance from professional tax advisors.

6. Conclusion

The importance of the crypto asset market is increasingly prominent, but the growth in the use of crypto assets should not come at the expense of tax transparency. The implementation of CARF through DAC8 marks a milestone in European crypto asset regulation. The EU has incorporated the reporting obligations for crypto assets into the DAC system, transforming a non-mandatory international standard into a legally binding, interoperable, and enforceable transparency mechanism. DAC8 eliminates the last major blind spot in European tax information exchange to date, accelerating the normalization process of crypto assets as taxable financial instruments and positioning the EU as a global leader in the governance of crypto asset transparency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。