Text: RWA Knowledge Circle

Editor: RWA Knowledge Circle

Introduction

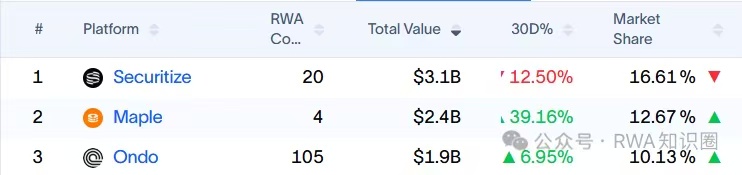

Recently, a phenomenon worth pondering has emerged in the RWA circle. Securitize, ranked first in the RWA market share, Ondo, ranked third, and the leading digital asset exchange Coinbase have all focused their attention on the same issue at almost the same time—equity tokenization (Equity RWA).

If this had happened a year or two ago, such "synchronous resonance" would have been rare.

Securitize and Ondo both started with compliant financial asset RWA, focusing their core products on U.S. Treasury bonds and cash-like assets; Coinbase has long been viewed as the infrastructure platform of the crypto market, gradually expanding from exchanges and public chains to the application layer.

However, recently, these three institutions have coincidentally begun to align with stock on-chain, which is clearly not a coincidence.

1. Not a "brainstorm" from the platform, but regulation is setting the direction

The timing is crucial. On December 7, 2025, SEC Chairman Paul Atkins publicly stated:

In the next two years, the U.S. financial market will migrate entirely to blockchain.

The SEC (U.S. Securities and Exchange Commission) is the core regulatory body of the U.S. capital market, responsible for securities issuance, exchange regulation, and market order. The public statements of the SEC Chairman are often not personal opinions but concentrated releases of regulatory direction for the coming years.

Almost simultaneously, the Nasdaq exchange also clearly stated that it is advancing on-chain trading solutions for stocks.

These two signals combined are already quite clear: equity on-chain is evolving from an "exploratory direction of Web3" to a migration path recognized by traditional finance.

In this context, platforms like Securitize and Ondo, as compliant RWA platforms, and infrastructure platforms like Coinbase entering equity tokenization is not radical innovation but rather a natural progression.

2. Industry consensus is converging towards "on-chain capital markets"

Beyond regulation, internal judgments within the industry are also rapidly unifying.

On December 21, Sid Powell, co-founder and CEO of Maple Finance, the second-ranked platform in the RWA market, stated:

In a few years, institutions will no longer distinguish between DeFi and TradFi; ultimately, all capital market activities will be completed on-chain.

Earlier, on October 8, Binance founder CZ also publicly expressed a similar judgment, believing that RWA is one of the most important directions for Web3 in the coming years because it truly connects blockchain with real-world assets systematically.

From a market structure perspective, this consensus did not arise out of thin air.

Currently, private credit and government bonds still dominate the RWA market, and the reasons are quite practical:

Not all real assets have high-frequency trading demands

Insufficient volatility limits on-chain liquidity

Significant differences in regulatory recognition of RWA across countries; whitelist, KYC, and licensed issuance have not yet been unified

In contrast, the legal and regulatory paths for financial assets are already highly mature, with clear ownership and defined trading logic, making them more suitable for initial scaling.

Therefore, you will see a clear trend:

The larger the institution, the more inclined they are to advance RWA along the mature path of government bonds → stocks, rather than starting from the complex equity structures of small and medium-sized enterprises.

3. Different solutions for "stock RWA" from the three institutions

Interestingly, although the goals are the same, the methods of realization by the three institutions are completely different.

1. Ondo: Bringing the "real stock market" on-chain

Ondo Global Markets launched in September this year, offering over 100 types of on-chain tokenized stocks, allowing non-U.S. investors to participate in the U.S. stock market around the clock through blockchain settlement.

Its biggest feature is that liquidity does not come from AMM pools but directly from Nasdaq and the New York Stock Exchange.

In other words, Ondo's stock tokens are not "exchanged on-chain" but are each 100% backed by real custodial shares, making the model closer to the reserve mechanism of stablecoins. This allows it to incur almost no slippage during large transactions. On the compliance front, Ondo has received FMA approval to offer tokenized U.S. stocks and ETFs in 30 European countries.

The data is also very straightforward:

In the first week of December, the trading volume of Ondo stock tokens on the Bitget platform exceeded $88 million, with a market share of 73%. Currently, Ondo Global Markets has achieved a cumulative trading volume of $2 billion on Ethereum and BNB Chain, with a TVL exceeding $350 million.

On December 18, Ondo launched Ondo Bridge in collaboration with LayerZero, supporting 100+ stocks and ETFs for 1:1 cross-chain transfers across multiple chains.

2. Securitize: Native on-chain stocks, more inclined towards institutional and closed structures

Securitize has chosen the most complex but also the most "institutionally native" path.

On December 17, Securitize announced plans to launch native on-chain stock products in the first quarter of 2026, with core features including:

Real shares issued directly on-chain

Synchronously written into the official capital structure table of the issuer

Tokens representing complete shareholder rights (dividends, voting, etc.)

More importantly, Securitize itself is a registered transfer agent with the SEC, ensuring that token holders are legally direct shareholders rather than holding indirectly through SPVs or intermediaries. However, it is important to note that this model does not equate to "unlimited splitting and free circulation."

In practice, whether to open circulation, set whitelists, or restrict transfer objects can still be fully controlled through compliance structures and company bylaws. This is why this model is more suitable for institutional issuers, private placement structures, or targeted equity arrangements.

3. Coinbase: Putting stocks into a "financial super app"

Coinbase's approach is more platform-oriented.

On December 18, Coinbase announced it would introduce stock trading, prediction markets, and various other assets; on December 20, CEO Brian Armstrong announced that in-house stock trading was officially launched. Currently, Coinbase supports:

24-hour stock trading

Crypto assets and perpetual contracts

Prediction markets (in collaboration with Kalshi)

Integration of decentralized exchange functions

It plans to launch institutional RWA services called Coinbase Tokenize in early next year. Its goal is very clear: one account for all assets; one interface to complete all financial operations.

4. On-chain equity is becoming an undeniable long-term variable

Stocks are one of the core asset forms in the modern financial system, and on-chain equity is transitioning from marginal exploration to a mainline direction driven by both institutions and industries. Whether it is Ondo's market-oriented path, Securitize's institutionally native path, or Coinbase's platform integration path, they are essentially answering the same question:

When capital markets migrate on-chain, in what form should stocks exist?

Understanding this change does not mean immediately participating in it, but it helps establish a cognitive framework for the future financial structure.

As RWA gradually transitions from "concept" to "infrastructure," equity tokenization is likely to be one of the most iconic nodes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。