Introduction

In 2025, the cryptocurrency industry truly matures. Driven by macroeconomic benefits, Bitcoin rises to become a global macro asset, and the crypto market officially takes the world stage. Maturity comes with pressure—unprecedented liquidation scales, liquidity market makers under strain, and increasingly fragmented regulation. However, beneath market volatility, the crypto industry is undergoing a profound structural reshaping: Decentralized Autonomous Technologies (DATs), large-scale Real World Assets (RWA) on-chain, intent-driven infrastructure, and an increasingly mature stablecoin system are continuously expanding the boundaries of the crypto economy.

LBank Labs, in collaboration with CoinGecko and CoinGape, jointly released the "2026 Crypto Industry Panorama Outlook," providing forward-looking insights for institutions and professional investors, analyzing the key drivers of the next cycle. This report systematically outlines the most influential investment themes for 2026, including the evolution of macro trends, the next generation of DeFi, stablecoin integration, prediction markets, and the tokenization process of the real-world economy. The synthetic economy is no longer just a vision for the future; it is being gradually built on the blockchain. In 2026, it will truly reveal who is shaping this new landscape.

Macro Market and Regulation: Structural Reshaping in the Post-Crash Era

The market in 2026 operates within a structural environment defined by "long-term high interest rates" and post-crash liquidation. With the U.S. Federal Reserve maintaining the benchmark interest rate in the range of 3.00%–3.25%, a critical 3% "risk-free return" threshold has been established for all digital assets. This interest rate level requires decentralized finance (DeFi) protocols to create real and sustainable utility and returns, pushing the entire ecosystem to clearly move away from inflationary token economic models. This high-interest environment sharply contrasts with the European Central Bank's dovish rate-cutting policy, leading to significant carry trade inflows into dollar-denominated stablecoins, further solidifying the dollar's dominant position in the crypto economy. Meanwhile, the market structure was fundamentally reset during the "flash crash event" on October 10, 2025. This $19 billion liquidation event, triggered by geopolitical factors, quickly cleared the remaining high-risk speculative leverage in the market, laying the foundation for a recovery led by capital-strong institutions and robust protocols focused on real application value.

Currently, the global regulatory landscape has clearly differentiated into two distinct economic systems. On one end is the "regulated system," encompassing institutions and projects operating under the U.S. "GENIUS Act" (the National Stablecoin Innovation Act) and the European MiCA framework. The GENIUS Act is significant as it defines stablecoins as strategic tools for maintaining the dollar's status as the global reserve currency and mandates issuers to hold 100% unencumbered reserve assets. Although this system significantly enhances security, it also presents issuers with a "yield problem," driving market demand for innovative secondary PayFi protocols.

On the other end is the "sovereign market," primarily dominated by highly vertically integrated platforms operating entirely outside the direct regulatory scope of the Federal Reserve. As the regulatory pace in major Asian markets gradually converges, this clear structural differentiation indicates that the crypto industry is irreversibly moving towards institutionalization, compliance, and a new global phase driven by real application value.

DeFi Track: Innovative Evolution and the "Post-AMM Era"

The DeFi ecosystem in 2026 is gradually moving away from the speculation-driven early stage, with Real World Assets (RWA) becoming the core source of on-chain yields. The RWA supercycle is not driven by retail investors but stems from institutional-level "financial physical laws" following the end of the zero interest rate policy (ZIRP). Through legally structured special purpose vehicles (SPVs), tokenized bonds and U.S. Treasury securities are systematically introduced on-chain, providing the market with predictable and sustainable on-chain yields.

This deep integration significantly enhances the efficiency of financial infrastructure, shortening the traditional bond settlement cycle from T+2 to under 10 minutes, making on-chain execution an essential efficiency requirement for large banks. Meanwhile, dynamic DeFi protocols are accelerating their integration with new digital banks in Web2. An increasing number of fintech companies are routing backend yields to compliant DeFi liquidity pools, offering retail users high-yield savings products under the guise of "invisible DeFi."

This trend is blurring the boundaries between non-custodial wallets and traditional bank accounts, sparking intense competition around user entry points and interaction interfaces. DeFi no longer exists in an explicit form but is embedded in the mainstream financial system as infrastructure.

This structural shift is also accompanied by a technological revolution centered on specialization and performance. The era of general-purpose Layer-1 is over, replaced by dedicated blockchains built around performance optimization for specific application scenarios. Hyperliquid is a typical representative of this trend, successfully bridging the long-standing performance gap between CEX and DEX by fully migrating the order book on-chain. Hyperliquid adopts a vertically integrated approach similar to "Apple," simultaneously building the blockchain itself, the exchange system, and token standards, thereby eliminating reliance on external ecosystems and directly challenging traditional centralized exchanges on pure performance. With a finality confirmation time of 0.2 seconds, it achieves trading speed and execution efficiency close to that of centralized systems. While RWA brings traditional financial yields on-chain, Ethena successfully expands crypto-native yields into "internet bonds." Its Delta-neutral strategy, which involves going long on staked ETH while simultaneously shorting perpetual contracts, stabilizes the yield structure while avoiding the reserve requirements of the GENIUS Act. Currently, this mechanism has formed a floating annual yield rate of about 8%–12%. This "internet bond" is becoming an independent risk-free yield benchmark within the crypto system, serving as a crypto-native reference rate distinct from the federal funds rate, and gradually evolving into the default "checking account" for institutional funds in the DeFi ecosystem.

Stablecoin Track: Diverging Development Paths

By 2026, stablecoins have clearly completed their transformation from a medium of exchange to a systematic settlement layer for the internet, with trading volumes comparable to global card networks. This maturation process fundamentally stems from the "Treasury sponge effect" established by the GENIUS Act. The act requires regulated stablecoin issuers to hold short-term U.S. Treasury securities as reserve assets, formally incorporating stablecoins into the dollar's global output system and creating a structural demand of up to $150 billion on the short end of the U.S. yield curve that is insensitive to price. In a multipolar global landscape, stablecoins have thus evolved into strategic financial tools serving U.S. debt financing.

The core contradiction within this system lies in the "yield problem." Since the GENIUS Act prohibits regulated stablecoin issuers (like USDC) from paying interest to token holders, the market structurally separates the "monetary attributes" (the stablecoin itself) from the "sources of yield" (DeFi protocols). This divergence has given rise to the "PayFi" application form, where users deposit zero-interest stablecoins into various protocols to earn yields in other on-chain scenarios. As a result, funds are continuously flowing from the traditional banking system to crypto financial infrastructures that offer 24/7 availability and higher capital efficiency.

The current market presents three distinctly different issuer strategies, with clear winners emerging at the payment channel level. Tether (USDT) is no longer limited to stablecoin issuance; instead, it is leveraging its massive floating capital to transform into a diversified alternative asset management platform, investing over $5 billion in AI computing power and commodity trade financing, significantly reducing reliance on the U.S. banking system. In contrast, Circle (USDC) has chosen to fully embrace the banking system, promoting deep compliance and integration with traditional finance.

Meanwhile, the regulated market is facing challenges from non-dollar stablecoins, such as euro stablecoins (like EURC) compliant with MiCA requirements, which are gradually gaining adoption in Europe due to a wave of delistings; in emerging markets, the trend of "crypto dollarization" continues to accelerate. At the same time, the PayFi tech stack represented by PYUSD issued by PayPal on Solana has established a clear advantage in small payments and cross-border remittances, thanks to sub-tier fees and confidential transfer protocols aimed at B2B scenarios.

Against the backdrop of significant differentiation in the stablecoin system, emerging issuers are accelerating productization and scaling through collaboration with leading exchanges, with World Liberty Financial (WLFI) being a representative example. In August 2025, LBank became one of the first centralized exchanges (CEX) to partner with WLFI, launching its dollar-pegged stablecoin USD1 and simultaneously introducing a points-based loyalty system based on USD1. Users can accumulate points and earn additional yields through USD1 spot trading, holding, and staking, which can be redeemed for rewards and governance token airdrops within the WLFI ecosystem, thus transforming stablecoin usage into long-term participation incentives. Meanwhile, LBank further launched USD1 wealth management products, allowing users to connect USD1 to DeFi protocols for higher yields, effectively alleviating the structural pain point of "stablecoins not earning interest" within a compliant framework. Through the triple linkage of trading, incentives, and yields, this collaboration not only significantly enhances the global circulation efficiency of USD1 but also provides retail users with a clear path to smoothly transition from payment stablecoins to yield-generating PayFi assets.

Ultimately, the regulatory arbitrage of the "yield problem" can be resolved through two clear paths: one is the issuance of tokenized Treasury products that generate yields for institutions (like the BlackRock model); the other is the creation of packaged tokens for retail users, which build yield-generating derivative versions on top of stablecoins. As a result, merely holding non-interest-generating native stablecoins is gradually losing its appeal to end users.

Payment Track: The Rise of PayFi

PayFi has become the most representative growth track in 2026, reflecting the deep integration of payment mechanisms and the time value capabilities of DeFi, creating new financial products that are difficult to achieve within the traditional financial system. Essentially, PayFi is the practical realization of "programmable money," automating the management of the timing and triggering conditions of fund flows through smart contracts.

In B2B scenarios, the most influential applications of PayFi include invoice factoring and supply chain finance. Liquidity pools can provide real-time advances of stablecoin funds to businesses based on tokenized invoices, thereby releasing working capital that would otherwise be locked in 60–90 day payment terms, directly introducing the "time value of money" into the on-chain system. Meanwhile, streaming payroll is gradually replacing the traditional payday model, enabling payments to employees to be made per second, significantly enhancing the efficiency of fund circulation and the speed of currency flow.

In the evolution of the new banking system, the DeFi-as-a-Service (DaaS) model is playing a key role. New digital banks that are friendly to crypto assets (such as Revolut, Juno, and Xapo) are no longer just payment channels but are gradually developing into full-stack DeFi service providers. By 2026, these institutions will act as trusted "curators" by abstracting wallet management and gas fees, directly integrating backend lending protocols like Morpho and Aave into the user interface.

Under this framework, new banks can offer users "disposable yield accounts," where idle funds are automatically routed to low-risk, over-collateralized DeFi vaults to earn institutional-level yields (approximately 4%–5% annualized), while still allowing for instant spending via debit cards. In this model, new banks become the distribution layer for DeFi protocols, providing inclusive access to global on-chain yields while retaining the familiar interactive experience of traditional banking applications.

The adoption logic for merchants and enterprises is entirely driven by economic efficiency, namely cost and speed. In the cross-border B2B payment sector, stablecoins have gradually become the default settlement channel, enabling settlements to be completed in seconds at a fraction of the cost of traditional systems, thus bypassing the high fees and multi-day delays of the SWIFT network. Merchant-side integration is nearly frictionless, with professional service providers handling stablecoin processing and settling fiat currency to merchant bank accounts, keeping the blockchain payment channel "invisible" to merchants. This overwhelming efficiency advantage is forcing traditional banks to incorporate stablecoin channels into their corporate financial service systems. Additionally, multinational companies are accelerating the adoption of on-chain fund management solutions, utilizing stablecoins to achieve 24/7 instant liquidity transfers between global subsidiaries, fundamentally eliminating the long-standing "funds retention" issue within traditional banking systems.

Prediction Market Track: Formation of Corporate Hedging Layer

By 2026, the prediction market industry has completed a comprehensive transformation from unregulated "flash casinos" to an event contract version of the "New York Stock Exchange." The key turning point comes from the re-entry of the U.S. market: platforms like Polymarket have received no-action letter support from the U.S. Commodity Futures Trading Commission (CFTC) and have acquired licensed exchanges; meanwhile, Kalshi has integrated with mainstream brokerage platforms like Robinhood, allowing event contracts to directly reach over 25 million retail user accounts.

Although political events will still drive trading volume during specific cycles, the real growth engine has shifted to high-frequency, sustainable sources of liquidity. Among these, sports betting has become the new core of transaction volume, while the rise of corporate earnings derivatives has made prediction markets a daily tool for fundamental investors for the first time. Traders can now position themselves around whether a company will exceed earnings per share expectations by $0.03, evolving prediction markets from event-driven products into high-frequency financial instruments.

On the technical side, the infrastructure of prediction markets is rapidly evolving towards high performance and automation. The demand for settlement markets within 15 minutes for assets like BTC and ETH is continuously rising, triggering a "competition among oracle providers," with the market leaning towards low-latency solutions (such as Chainlink and Pyth) for instant price confirmation, rather than relying on longer settlement cycles with higher security dispute resolution mechanisms. In this context, a significant proportion of trading volume is now completed by AI agents and automated trading models, with prediction markets gradually surpassing human decision-making-based trading models.

The competitive landscape also shows clear differentiation. One type is represented by Kalshi, embodying the "Las Vegas model," whose core advantages lie in compliance, deep integration with fiat systems, and providing deposit interest services to users through regulated identities; the other type is represented by Polymarket, embodying the "DeFi model," which dominates purely in transaction volume due to its crypto-native innovation capabilities and highly liquid hot events.

At the same time, new risks for 2026 are gradually emerging, including wash trading, oracle attacks, and ongoing regulatory friction arising from state and regional legal fragmentation. These factors continuously require platforms to maintain high vigilance in governance mechanisms and technical protections to ensure that prediction markets can scale while maintaining long-term stable operations.

AI Agent Track: Formation of the Agentic Economy

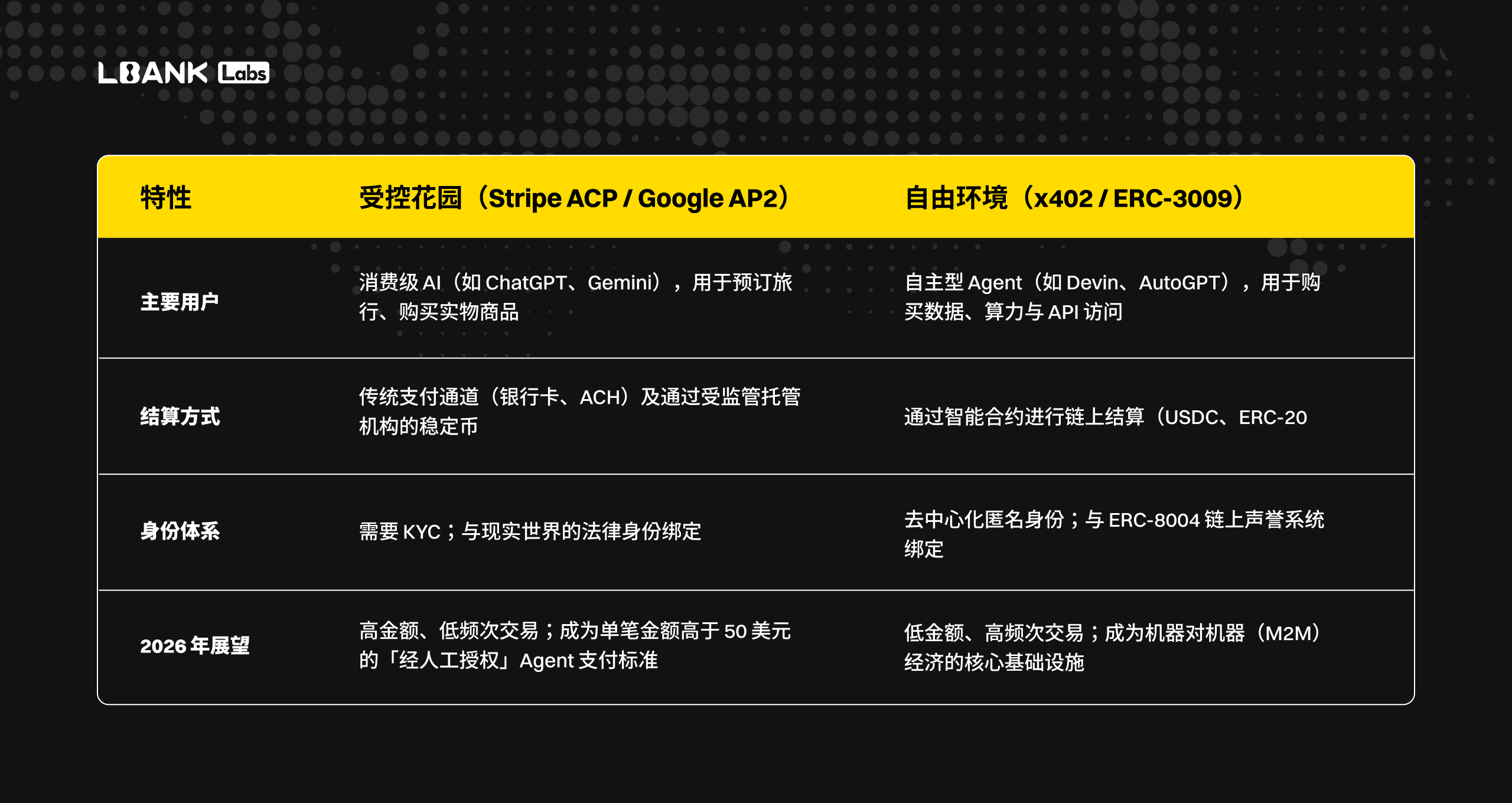

In 2026, the Agent economy has achieved its first large-scale implementation. Evolving from initially pay-per-use, clunky prototype systems to production-grade infrastructure driven by delayed settlement and automated trust mechanisms that are nearly invisible to users. The key breakthrough comes from the potential x402 V2 mechanism: facilitators can batch aggregate thousands of micro requests (for example, $0.001 for each token, API call, or search result) and complete settlement through a single on-chain transaction, thereby compressing costs on a scale and triggering fierce competition among specialized clearing institutions—some focusing on extreme speed, while others emphasize zero-knowledge privacy protection.

In this process, LBank has taken the lead in targeting the AI Agent payment track driven by the x402 protocol, launching multiple x402 protocol concept tokens, including BNKR (up 996%), PING (989%), ZARA (347%), X420 (291%), SANTA (250%), AURA1 (240%), etc. Through continuous intensive new launches and deep support, LBank has seized the narrative inflection point, becoming the preferred channel for early investor layouts and occupying a leading position in the x402 ecosystem acceleration; moreover, LBank has launched zkPass and initiated the BoostHub event, accelerating the formation of real transaction scenarios and on-chain payment demands, pushing the x402 protocol from proof of concept to high-frequency, sustainable use.

The same technical framework also resolves the long-standing structural conflict between AI labs and content owners. The traditional robots.txt mechanism has gradually become ineffective, replaced by a dynamic "pay-per-crawl" pricing list, allowing AI Agents to negotiate in real-time for the content they need and pay only for the actual tokens consumed. This model fundamentally eliminates the subscription burden for both parties, returning content acquisition and value exchange to a refined, on-demand, and programmable economic logic.

The long-standing final bottleneck of trust is being thoroughly resolved through the "reputation as collateral" mechanism. ERC-8004 has evolved from an early draft into a de facto credit scoring system: Agents with a good payment history (whose actions are recorded immutably through x402 logs) can obtain Net-30 or Net-60 credit limits from facilitators, thus eliminating the need for instant prepayment in every operation.

Meanwhile, users only need to grant limited permissions once through the ERC-7710 session key, after which the entire "protocol layer"—including the discovery mechanism based on ERC-8004, the negotiation process between Agents, and the payment settlement completed through x402—will be hidden behind a single "Agent Authorized" switch. Wallets no longer appear in the user interface; the software will automatically and seamlessly pay for the computing power, data, and services required to complete tasks.

In this model, the Agent economy is no longer in the demonstration phase but has officially become the default operating state. Payment, trust, and execution are integrated into the capabilities of the infrastructure layer, allowing Agents to operate continuously with minimal user intervention, accelerating the decentralized intelligent economy towards large-scale implementation.

Robot Track: DePAI and the Machine Economy

By 2026, the integration of crypto and robotics will evolve from scattered DePIN experiments into a true machine economy, driven by the widespread adoption of the x402 protocol (HTTP 402 Payment Required). This simple and universal standard enables robots and AI Agents to autonomously discover, negotiate, and pay for resources such as electricity, bandwidth, maintenance services, or takeoff and landing permissions in the real world, with settlements primarily completed in stablecoins.

In this system, unmanned delivery machines can automatically recharge at any solar energy station, warehouse robots can dynamically lease ground space from competitive facilities, and autonomous vehicles can bid in real-time for road priority without the need for human subscriptions or off-chain bills. The era of closed, isolated robot clusters is coming to an end, replaced by an open, freely collaborative hardware network, where machines themselves act as independent economic entities, earning and spending autonomously.

With the rise of "Agent-based commerce," the boundaries between software Agents and physical robots will further blur. AI Agents will routinely employ physical hardware to complete real-world tasks and pay fees to robot clusters through smart contract escrow mechanisms, a process that can be completed on coordination layers like Virtual Protocol and OpenMind's FABRIC. At the same time, high-value robotic devices will also be tokenized into income-generating assets, allowing investors to hold shares in drone delivery networks or cleaning robot clusters in specific cities (like New York or Singapore) and automatically receive distributions allocated to token holders after settling operational costs through x402.

From an ecological structure perspective, the machine economy will exhibit a clear division of labor: Base will dominate in Agent intelligence and complex collaboration layers, Solana will handle the massive, sub-tier cost high-frequency micropayments between machines, while Peaq will serve as the authoritative ledger for device identity and physical proof of work. Together, these three will form the "nervous system" of the emerging robotic economic system, supporting the DePAI-driven machine economy towards large-scale operation.

About CoinGecko

Since its establishment in 2014, CoinGecko has been the world's largest independent cryptocurrency data aggregation platform, trusted by millions of users globally. CoinGecko provides a 360-degree view covering the entire market, offering reliable data support for over 19,000 cryptocurrencies across more than 1,400 exchanges. Whether for price tracking, market trend analysis, or application development, CoinGecko is dedicated to providing insights that accelerate users' decision-making and exploration in the crypto market.

About CoinGape

CoinGape is a leading independent cryptocurrency news and content platform, founded and operated by a passionate team of cryptocurrency enthusiasts. The team focuses on in-depth exploration of the blockchain ecosystem and envisions a prosperous future for decentralized finance (DeFi), always adhering to journalistic professionalism and core media ethics to provide readers with accurate and reliable information about the crypto industry. With a high degree of transparency and integrity demonstrated in its crypto news reporting, CoinGape won the Crypto Media Award at the Global Blockchain Show in 2024 and was the runner-up in the Blockchain Life selection. Market analysis, updates on the latest presale projects, crypto financing news, podcast content, and other related areas are core focuses of CoinGape, ensuring that information is accurate, easy to understand, and presented with an objective and neutral stance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。