| Hot News |

1: The EU's Digital Asset Tax Transparency Bill will take effect in January 2026

2. "BTCOG Insider Whale" continues to hold positions, with total floating losses reaching $53.23 million

What do we think about Bitcoin and Ethereum today? Today, we won't talk about feelings, only about levels and direction. Both Bitcoin and Ethereum are entangled near key support and resistance levels, so market sentiment remains cautious, with weak trading volume and intense long-short battles.

Three sentences to summarize today's market on Christmas Eve:

First: Bitcoin has not escaped the bearish consolidation pattern. If it breaks support, we will look for a deeper correction.

Second: Ethereum must surpass short-term resistance to regain the right to push higher. However, the key neckline still faces strong pressure.

Third: The market needs more incremental funds to enter before we can see a meaningful rebound.

Tonight's levels will determine tomorrow's trend. Currently, the 12-hour consolidation range is 86000-90000. The pressure zone is at 86500-87000, and Bitcoin's price is currently fluctuating around 88000. The short-term volume is insufficient, and the bulls lack strength to break through the upper pressure significantly. Therefore, the 4-hour structure remains bearish, and a breakout above 90663 cannot confirm a strong counterattack.

So, the strategy for today, Christmas Day, is to wait for a pullback to the true support level before going long. If we encounter resistance without volume when pushing directly, we will first look to short the rebound at a high. How can we be more prudent? That is, after the price stabilizes at 86066 to 84403 on a pullback, we will look to buy low and aim for a rebound to around 89177 to 90663. If the volume is weak, we will consider shorting or reducing positions.

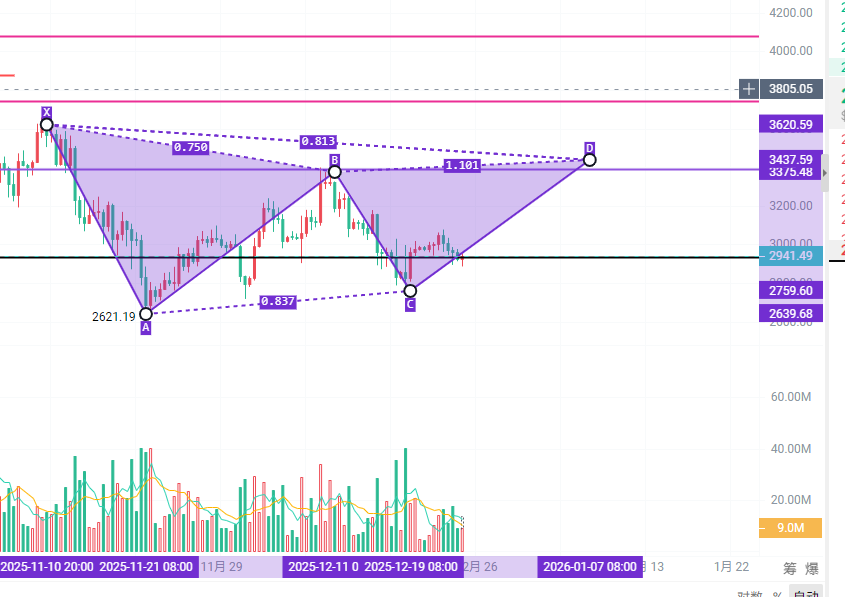

Let's take a look at Ethereum's real-time levels. The support zone is at 2887-2970, and the pressure zone is at 2980-3030. Ethereum is currently also in a consolidation phase, breaking through short-term resistance. 2980-3030 is crucial; otherwise, it may continue to focus on corrections. The MACD and moving average structure are showing price without volume in the short term. Tommy has previously reminded everyone that currently, incremental funds are not entering the market, and liquidity is weak. The main force is in a short-term setting range liquidation box. Therefore, retail investors can only wait until large orders are liquidated before considering entry; otherwise, they risk being caught off guard. During the day, it is now in a waiting position for a pullback, looking for long opportunities and waiting to sell high on rebounds. So today's strategy is to wait for a pullback to 2887 to 2788, and if it stabilizes, we will consider buying low and aiming for a rebound to 3030. If we encounter strong resistance, we will then consider selling high and going short.

In summary, today's direction is that Bitcoin is in a bearish consolidation, waiting for a pullback to confirm going long, while Ethereum needs to stand above this short-term pressure to confirm a bullish stance. The current consolidation range remains. Spot trading is still in a rhythm of waiting for rebounds, selling high, and buying low on pullbacks.

Finally, let me show you the liquidation range map.

Christmas Eve is not calm; retail investors have also been spooked by the prices. I am Tommy, a participant in the B circle who trades and rests. Please do not try to bear this market alone.

I am Tommy, bringing you the latest market interpretations and trading ideas every day.

Levels are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Lastly, everyone should remember the two key points I mentioned in my last article: focus on trial positions in the short term, and once we move away from our target range, it will be the last opportunity to make significant gains before the end of the year. I am K-line Life Tommy, your real-time crypto steward.

For more related coin analyses, please follow the official account for details. ↓

Mainly focused on spot, contracts, BTC/ETH/ETC

Specializing in style: K-line trading

Original volume trading strategy.

Short-term wave highs and lows, medium to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, monthly head predictions.

Official account QR code (K-line Life Tommy)

Warm reminder: The only official WeChat account at the end of the article is created by the author!!

Please be cautious in distinguishing between true and false, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。