A founder of an investment institution announced on social media that he is preparing to invest another $1 billion in Ethereum. Market data shows that his current position has an unrealized loss of $141 million, but he still insists that the crypto market will experience an epic bull market in 2026.

Trend Research, a secondary investment institution under Yi Lihua, began bottom-fishing ETH at the beginning of November when the price was $3,400. So far, they have purchased approximately 580,000 ETH, with a total value of about $1.72 billion and an average cost of around $3,208.

Faced with an unrealized loss of about $141 million, he chose to double down rather than cut losses. This high-leverage, bullish operation is becoming a microcosm of the crypto market's expectations for 2026.

1. Aggressive Positioning

● The crypto market is entering an end-of-year adjustment period, but some institutional investors are showing a rare aggressive attitude. Yi Lihua, founder of Liquid Capital, publicly stated on social media that he firmly believes this is the "best buying zone for ETH."

● Yi Lihua reflected on his investment experience in the crypto market. He mentioned that before the "312" incident, when Bitcoin was trading sideways between $7,000 and $8,000, he sold all his Bitcoin because he could not bear the pressure of the bear market.

● Although he successfully avoided the subsequent crash, he also missed the entire bull market cycle where Bitcoin soared from its low to $69,000. He described this experience as "a huge failure case of missing tens of thousands of dollars for the sake of a few thousand dollars."

● Now, Trend Research continues to increase its holdings of ETH through borrowing leverage, borrowing 887 million USDT from Aave, with a leverage ratio of about 2 times. Yi Lihua stated, "This time, we have the same script; we successfully escaped the top and liquidated before 1011, but this time we choose to continue to increase our positions."

2. Market Outlook

● Industry analysis institutions present a cautiously optimistic tone regarding the 2026 crypto market outlook. Bankless's top ten predictions suggest that Bitcoin will break the four-year cycle pattern and set a new historical high. If this prediction comes true, it will overturn the historical pattern of peaks occurring one year after each halving since 2013. More notably, Bankless predicts that Bitcoin's volatility will be lower than that of Nvidia.

● Institutional demand is structurally exceeding the new issuance of ETH. This is primarily driven by the growth of Ethereum spot ETFs and tokenized assets, creating a demand floor that did not exist in the early cycle.

● Galaxy Research provided a more specific price prediction: Bitcoin has a certain probability of reaching $250,000 by the end of 2026. However, the company also pointed out that there is a high degree of uncertainty regarding recent market trends.

3. Structural Transformation

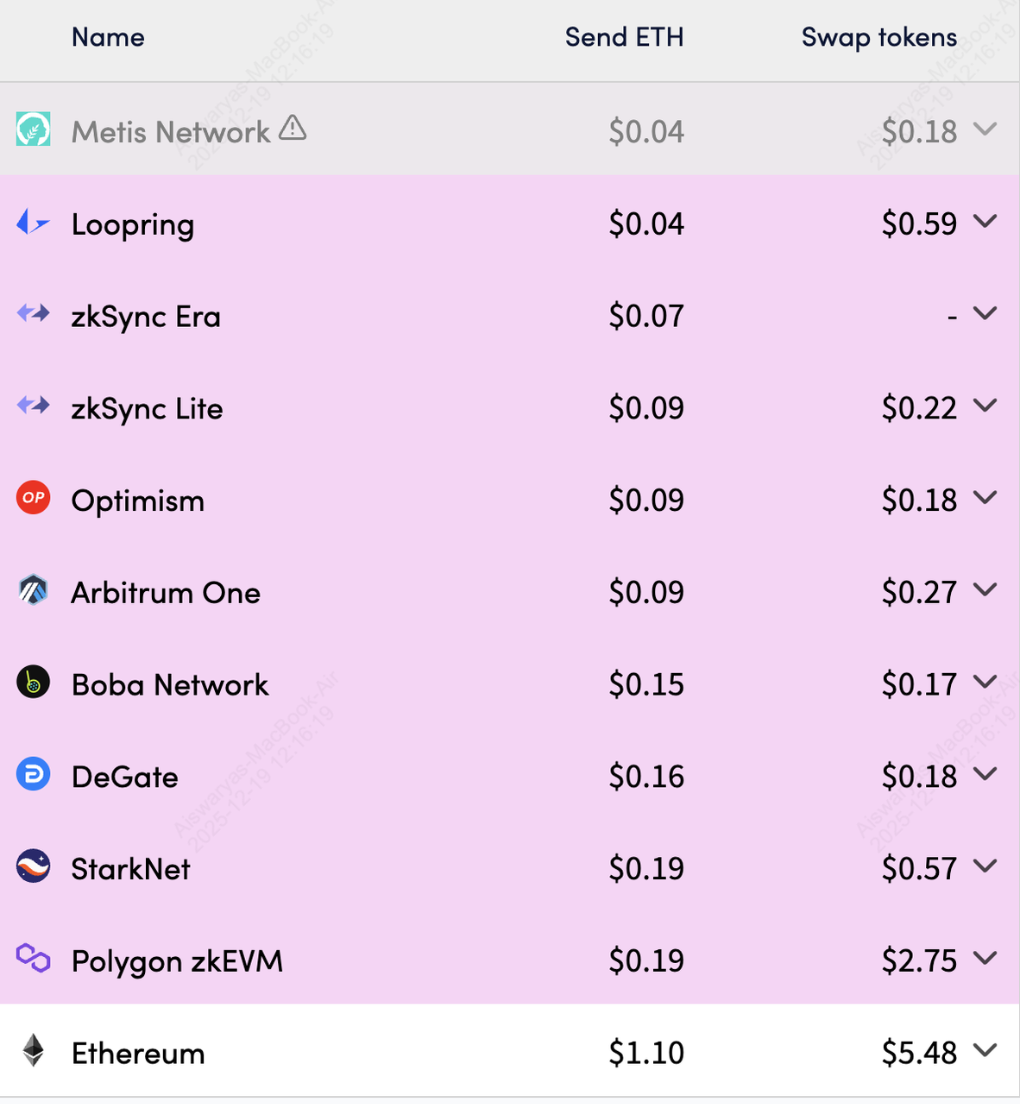

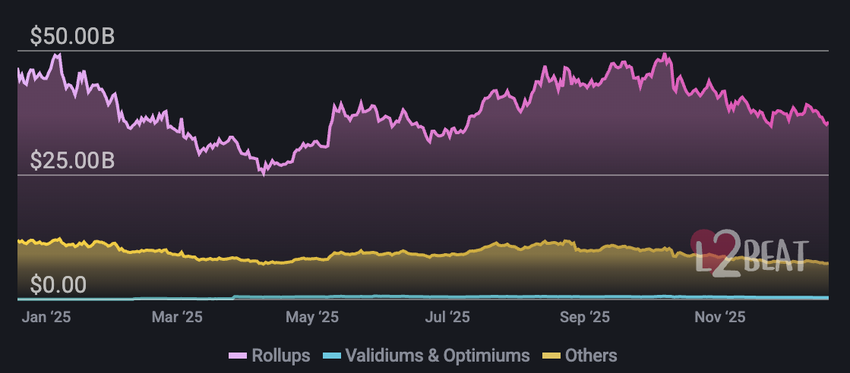

● Ethereum will undergo its most significant structural transformation since the launch of smart contracts in 2026. Layer-2 now handles most retail activities, while Layer-1 anchors settlement, staking, and institutional demand.

● The total locked value in DeFi on Ethereum Layer-1 exceeds $67.8 billion, while the funds locked in Ethereum Layer-2 networks are about $43 billion. This highlights a clear separation between settlement and execution.

● Retail activities are increasingly concentrated on Layer-2, while institutional capital enters through regulated Ethereum spot ETFs and tokenized financial products. This positions Ethereum's base layer as a settlement, staking, and security backbone.

4. The Rise of New Narratives

The driving force of the crypto market in 2026 is changing. The integration of traditional finance and crypto technology will become a major narrative. Larry Fink, CEO of BlackRock, wrote in The Economist, declaring, "We have finally discovered the use of blockchain — that is tokenization."

● The year of tokenization and the return of ICOs are seen as a dual revolution. With the departure of SEC Chairman Gary Gensler, cryptocurrencies finally have the tolerance needed from regulators.

● The growth of stablecoins has become an undeniable force. Galaxy predicts that stablecoin trading volume will exceed Automated Clearing House (ACH) transactions, and stablecoins collaborating with traditional financial institutions will see consolidation.

● Galaxy's research shows that the supply of stablecoins continues to grow at a compound annual growth rate of 30%-40%, with trading volume also climbing. Stablecoin trading volume has surpassed major credit card networks like Visa.

5. Risks and Challenges

Despite the generally optimistic outlook from institutions for 2026, the market still faces multiple uncertainties.

● A Messari report points out that Ethereum is still below the historical highs of the previous cycle relative to Bitcoin.

● Ethereum continues to maintain a high correlation with Bitcoin, performing more like a leveraged Bitcoin proxy rather than an independent currency asset. The core issue is that many investors view price increases as an opportunity to exit liquidity.

● Benzinga analysis suggests that Ethereum faces uncertainty in 2026. The ETH/BTC exchange rate has erased all gains from the previous cycle, and market confidence is at a multi-year low.

● Jeff Ko, chief analyst at CoinEx Research, predicts that liquidity in 2026 will be more concentrated in blue-chip crypto assets, making it difficult for traditional altcoin seasons to occur, with the vast majority of altcoins left behind.

6. The Wave of Institutionalization

2026 may be the year of complete institutionalization of the crypto market. Bankless predicts that as institutional demand accelerates, ETF purchases will exceed 100% of the new supply of Bitcoin, Ethereum, and Solana.

● Half of the Ivy League's endowment funds will invest in cryptocurrencies, and the U.S. will launch over 100 crypto-related ETP products. These predictions collectively paint a picture of a year where institutional funds, regulatory frameworks, and traditional financial infrastructure fully enter the market.

● Coinbase's institutional division believes that a "DAT 2.0" model will emerge in 2026. This model will go beyond simple asset accumulation, focusing on professional trading, storage, and procurement of sovereign blockchain space, viewing it as an important resource for the digital economy.

● For crypto-native players, this is both an opportunity and a challenge. The opportunity lies in the market size expanding exponentially, while the challenge is that the rules of the game are being rewritten by traditional finance.

When asked why he continues to increase his position despite the unrealized losses, Yi Lihua responded, "We know it will eventually rise significantly; we just don't know which day." His institution is prepared with an additional $1 billion in funds and plans to continue increasing its holdings of Ethereum.

Public data shows that Bitmine Immersion Tech currently holds 4.07 million ETH, valued at approximately $11.97 billion; SharpLink Gaming holds 863,020 ETH, valued at approximately $2.54 billion. The total amount of Ethereum held by institutions is still increasing.

Market observers are beginning to debate whether this is the starting point of the next bull market or yet another capital game based on leverage and narrative.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。