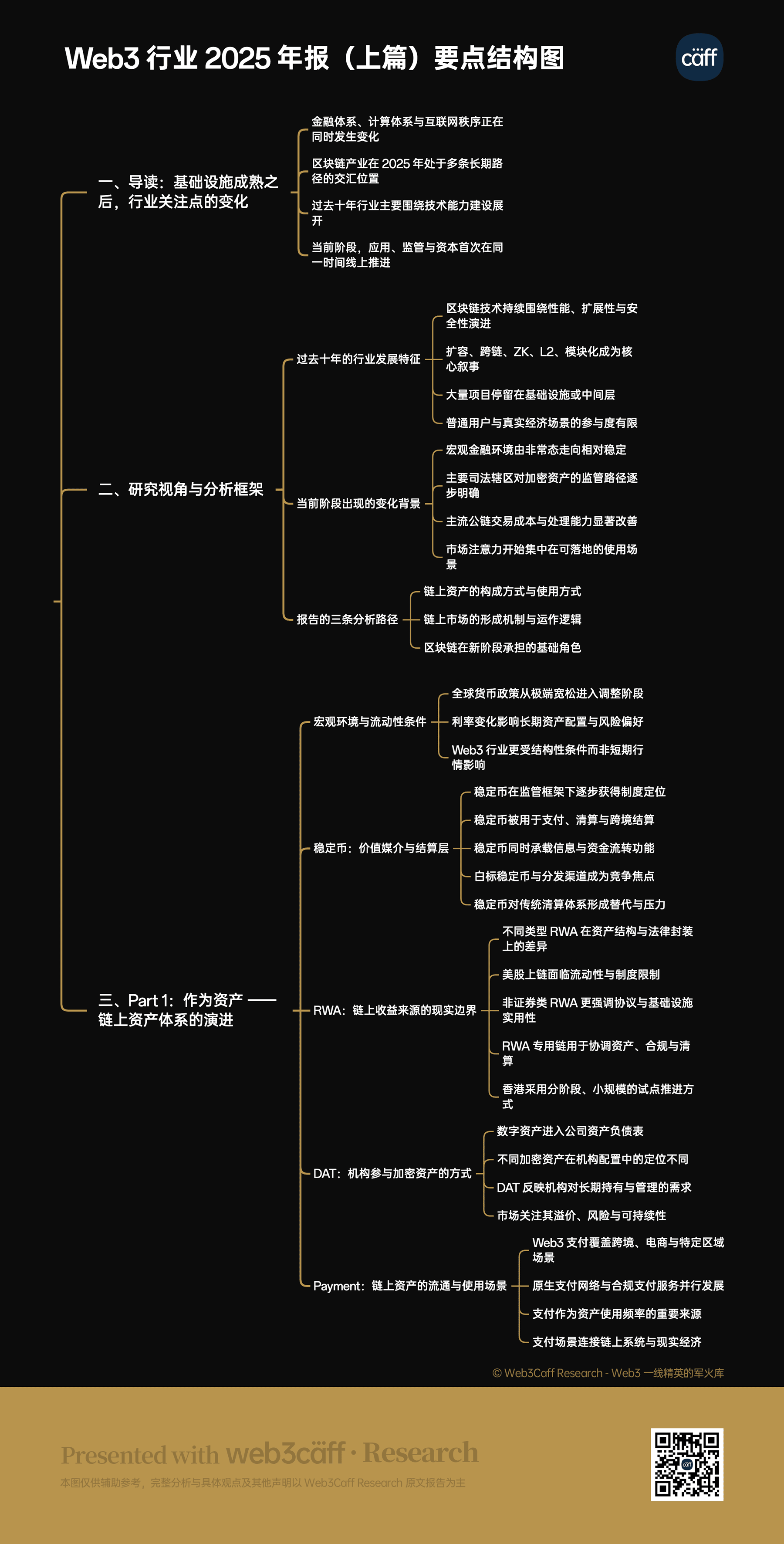

We are in an era that few understand, but which is rapidly taking shape: the financial system, computing system, and internet order are quietly being rewritten. For the first time, humanity needs to answer three questions simultaneously, and the Web3 industry is precisely where these three lines converge for the first time in 2025. Over the past decade, the narrative of Web3 has always revolved around infrastructure: scalability, cross-chain, ZK, L2, modularization—technology has continuously advanced, but applications, regulation, and capital have never aligned at the same moment. This year, for the first time, all three have landed on the same timeline: in terms of regulation, for example, the U.S. has completed key legislation, and stablecoins and Bitcoin have officially entered the national strategic system. Hong Kong has made significant regulatory progress in stablecoin legislation, the refinement of virtual asset service regulation, and the structural pilot of RWA; the interaction costs of mainstream public chains have dropped to below a few cents, and the performance bottlenecks of infrastructure no longer limit product innovation; capital has returned from narrative-driven to real-world assets and real trading behavior. This means that the Web3 industry has finally entered a structural landing era that it has never truly possessed in the past decade. Chains no longer need to prove they can run; they need to prove they are worth using. The full text is divided into three main lines, discussing on-chain assets as assets, as markets, and as the development path of blockchain, and how they form deep intersections with global finance, technology, and national governance systems. The first part, "As Assets," starts with preventive interest rate cuts, U.S. legislation, and stablecoin regulation, explaining how stablecoins, RWA, and DAT constitute a new layer of value intermediation, yield anchoring, and fund management. In this layer, USDC is eroded by white-label models, public chains begin to reclaim interest margin taxes, and the on-chain process of RWA and U.S. stocks brings a dual game of systems and liquidity, while on-chain payments shift from being technology-driven to scenario-driven, presenting a development pattern differentiated by region and path. This stage is reflected not only in the adjustment of the U.S. financial structure but is also validated in the institutional realization of international financial centers like Hong Kong. The second part, "As Markets," will discuss the evolution of market microstructure, leverage, and consumer-grade applications, with PrepDEX and prediction markets as star projects, explaining why the blockchain market is not a financial tool that "departs from reality to virtuality," but rather a market machine that is being institutionalized, data-driven, and automated. It also answers a commonly overlooked question: why the improvement of market efficiency actually promotes the maturity of the asset system. The third part, "As Blockchain," focuses on the underlying technology and the new demands of the AI era. Blockchain is no longer marketed as "decentralized," but has become the infrastructure for the machine economy and the native system of intelligent agents. New mechanisms such as A2A micropayments, distributed agents, and distributed training enable the internet to shift from "human access to the network" to "machine access to the network." This report attempts to answer not whether the "Web3 market will continue to grow," but a deeper question: after the end of the infrastructure era, where will the value of Web3 be redefined? In a larger, more complex, and more realistic system, how will the boundaries of Web3 be reshaped?

Author: K, Researcher at Web3Caff Research

Cover: Photo by Visax on Unsplash, Typography by Web3Caff Research

Word Count: The full text contains over 43,500 words

Acknowledgments: Thanks to Dasong, Yueyue, and Shijun for providing valuable industry information and insights during interviews, which served as important references for this research.

Note: Due to length, this research report is published in two parts. This is the first part (including chapters: Introduction, PART 1), and the remaining chapters (Part II, Part 3, Future Outlook) will be updated in the second part.

Table of Contents

- Introduction: From Technological Race to Value Creation, the Major Shift in Blockchain in 2025

- PART 1, As Assets: A New Cycle in the Rhythm of Infrastructure Construction

- The Major Regulatory Shift in the U.S.: From Law Enforcement Suppression to Institutional Protection

- The "BITCOIN Act": Bitcoin Included in the National Strategic Reserve System

- The "GENIUS Act": Establishing a Licensing Framework for Stablecoins

- The "CLARITY Act": Defining Clear Boundaries for Token Attributes

- Significant Progress in the Hong Kong Market: Transitioning from "Institutional Construction Period" to "Structural Realization Period"

- Stablecoin Legislation Implemented, Hong Kong Officially Enters the "Rule Executable" Stage

- RWA Shifts from "Policy Encouragement" to "Structural Pilot," but the Pace Remains Cautious

- Refinement of Virtual Asset Service Regulation, Market Enters "Structural Layering"

- Hong Kong in International Comparison: Not the Fastest, but Possibly the Most "Durable"

- Value Intermediation Layer: Stablecoins as a New Internationalism for On-Chain Dollars

- Medium is Information: Native Innovation of Information/Settlement Integration

- Distribution is Power: The "Yield Recovery" Movement in the Era of White-Labeling

- Yield Anchoring Layer: RWA Asset Structure Differences: Equity vs. Yield Rights vs. Certificates

- On-Chain Advantages of Non-Equity RWA: The Main Battlefield for Efficiency Improvement

- U.S. Stocks On-Chain: The Divided Trajectory of Reality and Potential

- Fund Management Layer: DAT Narrative Shift: From On-Chain Assets to Manageable Assets

- Market Landscape: The Rise of DAT and Capital Expansion Path

- Risk Structure: Premium Dependence and Cyclical Vulnerability

- Asset Layering: Strategic Positioning of Bitcoin, Ethereum, and Solana

- Application Circulation Layer: Payment Web2 Payment Giants: Stripe and PayPal

- Native Payment Gateways: Alchemy Pay and CoinsPaid

- Region-Focused Emerging Payment Networks: AEON Protocol and Gnosis Pay

- Summary: 2025, the Year of Industrialization for On-Chain Finance

- Part II, As Markets: Trust Disintegration, Technological Maturity, and Trader Preference Restructuring Led by Hyperliquid

- By People, For People: Returning to Public Goods and Trust Machines

- Trinity: The Collaborative Logic of HyperCore, HyperEVM, and HyperBFT

- The "Builder Economy" Era of Builder Codes

- The Era of "Native Stablecoins" Issued by USDH

- Regulatory Boundaries and Institutional Tension: The Real Constraints and Future Challenges of Hyperliquid

- Prediction Markets Led by Polymarket: How Does Information Become a Commodity?

- Polymarket: A Convergence of Timing, Location, and Human Harmony

- Using "Prediction Markets" as an Information Engine for Future Integrated Evolution

- Compliance Boundaries and Risk Warnings: Institutional Controversies and Real Constraints of Prediction Markets

- The Arrival of the Post-VC and Post-Narrative Era: The Post-VC Era of Bottom-Up Trading, Information, and Fundraising

- The Post-Narrative Era: Real Economic Value Becomes a New Metric

- Part 3, As Blockchain: A2A Basic Protocol: Ensuring Trustworthy Agent Behavior with a Cryptographic Constitutional Layer

- Payment, x402 Protocol

- Identity, ERC-8004 Protocol

- DeAgent: On-Chain Autonomous Agents with Asset Rights and Yield Rights

- From Meme Culture Assets to Infrastructure: The Evolution of ai16z Towards ElizaOS

- Virtuals Protocol: Assetization of AI Agents and Collaborative Governance Networks

- DeAI: An Intelligent Supply Network Driven by Open Computing and Data Collaboration

- Bittensor: The Era of AI Mining with Proof-of-Intelligence

- Sahara AI: A Full-Stack AI Economic System

- Future Outlook: Opportunities and Challenges After 2025

- Key Point Structure Diagram

- References

Introduction: From Technological Race to Value Creation, the Major Shift in Blockchain in 2025

In 2025, the entire industry finally crossed a watershed moment that no one can pretend to ignore: from a decade dominated by infrastructure to a decade driven by applications. You can understand it as the "end of Web3's adolescence"—the wild, rebellious years of competing in computing power, TPS, cross-chain, and ZK are over; products that can truly make ordinary users willing to spend money, stay, and participate are just beginning.

This shift is not just rhetoric; it is the first time that the underlying conditions have truly matured. a16z clearly articulated this in "State of Crypto 2025": the processing capacity of mainstream chains has increased from "a few TPS" a few years ago to over 3400 TPS today, and fees have dropped from twenty dollars to a few cents or even less than a penny. In other words, chains are no longer a bottleneck, technology no longer challenges entrepreneurs, and users are no longer kept at bay. In other words, the infrastructure of the public chain era is now sufficiently mature, and the next decade is truly worth investing in application landing, public goods, open-source tools, and structured financing.

One of the important backgrounds supporting the industry's gradual entry into the application exploration phase is the relatively clear policy environment at a phased level. For example, as the U.S. and Hong Kong gradually form clearer policy paths on key issues such as crypto asset regulation, stablecoin frameworks, and compliant custody, institutions, developers, and infrastructure providers are beginning to reassess the long-term feasibility of blockchain applications. This clarity does not come from a single policy shift but is reflected in a series of institutional discussions, regulatory practices, and legislative processes, achieving a phased consensus on the "innovation space under compliance conditions." In such an environment, the pace of capital allocation has begun to warm up, and foundational modules such as compliant stablecoins, payment tracks, custody, and clearing gradually meet the conditions for large-scale landing, providing a realistic soil for richer application forms.

The author particularly reminds: Stablecoins are virtual currencies (Tokens), and please be aware that the issuance and participation in investing in Tokens are subject to varying degrees of regulatory requirements and restrictions in different countries and regions. In particular, issuing Tokens in mainland China is suspected of "illegal issuance of securities," and providing services related to Token trading and cryptocurrency transactions also falls under "illegal financial activities" (mainland Chinese readers are strongly advised to read the "Compilation and Key Points of Laws and Regulations Related to Blockchain and Virtual Currencies in Mainland China"). Therefore, please do not make related decisions based on this information, and strictly comply with the laws and regulations of your country and region, refraining from participating in any illegal financial activities.

When the policy environment no longer constitutes a significant source of uncertainty and the performance constraints of infrastructure continue to decline, changes within the industry also become apparent, leading to real change: revenue begins to shift from the network layer to the application layer. a16z has marked this trend clearly with the concept of "Real Economic Value"—measuring whether a chain is successful is no longer based on its ecological narrative, but rather on whether users are willing to engage in real economic activities on it.[1]

Against this backdrop, we finally see the three core uses of the Web3 industry in 2025 fully blossoming (editor's note: Blockchain technology has a wide range of application scenarios and can be applied in multiple real-world fields, primarily aimed at solving trust, collaboration, and rights confirmation issues. These include: finance and payments (cross-border settlement, clearing and reconciliation), assets and property rights (real estate, equity, intellectual property confirmation and circulation), supply chain and manufacturing (traceability, anti-counterfeiting, process transparency), government and public services (electronic licenses, data sharing, voting), healthcare and education (trustworthy storage of medical records and diplomas), content and cultural creativity (copyright registration, revenue sharing), as well as energy and the Internet of Things (device collaboration, carbon data and energy trading). Therefore, this report aims only to analyze representative cases of the Web3 industry under market changes in 2025 and does not claim to be comprehensive.):

- First, as assets. Stablecoins, DAT, RWA, and on-chain payments are becoming the largest entry point for large-scale adoption. Stablecoins have formed the fastest dollar clearing network globally, on-chain payments are being reinvented, and RWA is bringing traditional yields onto the blockchain, making the chain a layer for "distributing real yields";

- Second, as markets. Hyperliquid and Solana now account for 53% of the total revenue-generating trading volume across the network, indicating that high-frequency trading, contracts, and prediction markets are becoming new economic engines. Price discovery markets are not a byproduct but the core force driving liquidity, optimizing infrastructure, and cultivating user culture;

- Third, as a computing and coordination network. Blockchain is finally beginning to empower AI, rather than waiting for AI to empower Web3. From verification computing, model ownership, and data traceability to decentralized reasoning networks, on-chain assets are taking shape as an "AI coordination layer." Previously, we discussed "what chains can do"; now we discuss "what AI can do on chains."

This also explains why Jiawei Zhu from IOSG said: "The glorious era of infrastructure is in the past; we have undoubtedly entered the application era." [2] Peter Pan from 1kx also provided the same judgment: the application layer investment cycle has been immature over the past seven years, but the next seven years will be completely different, as the external constraints faced by application innovation are significantly easing against the backdrop of continuously improving technological capabilities and gradually clarifying regulatory environments.[3]

Thus, the key in 2025 is not "whether applications will come," but rather "applications finally have the soil to be born." The chain is fast enough, the costs are low enough, the regulations are loosened, and user attention has returned. The past decade was preparation for today; the next decade will be the era where various real business models truly run on the chain. Infrastructure will not disappear, but it will no longer be the narrative center; from now on, everything must return to the value of the product itself.

The application era of Web3 is not about to arrive; it has already begun.

The author particularly reminds: The following content is only an objective analysis of the special attributes and development laws of the blockchain and Web3 industries and does not constitute any proposal or offer. Please do not make related decisions based on this information, and strictly comply with the laws and regulations of your country and region (mainland Chinese readers are strongly advised to read the "Compilation and Key Points of Laws and Regulations Related to Blockchain and Virtual Currencies in Mainland China"), and refrain from participating in any financial activities prohibited by the laws of your country and region.

PART 1, As Assets

A New Cycle in the Rhythm of Infrastructure Construction

In 2025, the global macro environment is at a delicate and critical turning point. Since the pandemic, major economies have experienced unprecedented monetary easing, and under the combined effects of economic recovery, declining inflation, and recalibrated policy expectations, the logic of global liquidity allocation is changing. This change does not manifest as a dramatic directional shift but rather as a transition from an emergency state to normalized management.

The current liquidity environment is neither the extraordinary period of "unlimited easing + extremely low interest rates" in 2020 nor the wait-and-see phase before the policy turning point in 2019. Major economies, represented by the U.S., have gradually entered a rate-cutting phase after experiencing high inflation and a rate hike cycle. For example, by the end of 2024 and the beginning of 2025, the Federal Reserve is expected to maintain the policy rate at around 4.25%, with expectations for multiple adjustments throughout the year.[4] This indicates that macro-financial conditions are shifting from a tight constraint state to a more flexible range.

For the Web3 industry, such an environment does not directly correspond to a specific short-term market change; rather, it reshapes the external conditions for infrastructure construction.

First, the marginal decline in capital costs and stable expectations make long-term technological investments and infrastructure construction more predictable. During periods of high interest rates and significant uncertainty, companies and development teams often tend to compress cycles and postpone projects involving heavy assets or long R&D paths. However, in the current "moderate warming but still constrained" environment, engineering decisions are beginning to return to rationality, emphasizing sustainability, scalability, and alignment with real demand.

Second, since this round of environmental adjustment is not "crisis-driven easing," the pace of infrastructure development is more likely to exhibit gradual characteristics. This means that Web3's underlying modules—including compliant stablecoins, payment tracks, custody and clearing systems, cross-chain and data availability—are more likely to be gradually refined in real usage scenarios rather than rapidly stacked under short-term capital pressure. While this pace may slow explosive expansion, it is beneficial for accumulating architectural maturity and system stability.

Finally, against the backdrop of gradually clarifying policies and macro expectations, infrastructure providers, developers, and application teams are beginning to reassess the boundary conditions for long-term investments. The construction of foundational modules is no longer solely serving speculative demands but is increasingly focused on compliance, security, performance, and sustainable operations. This provides a realistic and solid foundation for more complex application forms in the future.

Therefore, from the perspective of infrastructure, 2025 appears to be a year where construction conditions are realigned. Liquidity has not driven a comprehensive acceleration but has provided the necessary buffer space for the Web3 system to transition from experimental structures to sustainable engineering. In such a cycle, the industry's development path is more likely to present a "rational advancement" process rather than a sharp leap driven by short-term emotions.

The Major Regulatory Shift in the U.S.: From Law Enforcement Suppression to Institutional Protection

Over the past three years, the U.S. has taken significant actions that have also had a major impact on the global Web3 industry. Therefore, the author uses the U.S. as a reference point for the following analysis. First, we know that in 2025, the "BITCOIN Act" and "GENIUS Act" were passed, and the "CLARITY Act" was approved by the House of Representatives, marking a consensus in the U.S. on key issues such as stablecoins, market structure, and digital asset regulation.

Notably, after Trump took office, he clearly expressed support for the development of the blockchain industry and promoted the implementation of crypto-friendly policies. This political signal not only significantly boosted industry confidence but also provided a rare policy window for project parties, capital, and developers. With clear regulatory and policy support, the entire industry gradually established a sustainable "self-sustaining mechanism."

- The "BITCOIN Act": A presidential executive order officially signed on March 5, 2025;

- The "GENIUS Act": Completed the legislative process and officially signed on July 18, 2025;

- The "CLARITY Act": Completing the legislative process, having passed the House and is now submitted for Senate review.

The "BITCOIN Act": Bitcoin Included in the National Strategic Reserve System

On March 5, 2025, Trump exercised his presidential executive order power to sign the "BITCOIN Act," marking the federal government's first attempt to formally include Bitcoin in the national strategic reserve system. The act establishes a "strategic Bitcoin reserve," planning to purchase 200,000 Bitcoins annually over the next five years, totaling 1 million Bitcoins, while unifying all Bitcoins confiscated or legally obtained by the government into the reserve. This reserve will be stored in geographically distributed cold wallets for high-level custody, establishing a transparent on-chain asset proof mechanism (Proof of Reserve), and will be jointly supervised and managed by third-party audits and the Federal Audit Office.

To ensure long-term stability, the act stipulates that all Bitcoins held by the government must be held for at least 20 years, during which time selling, exchanging, or disposing of them is prohibited, and the use of personal or corporate legal crypto assets is explicitly forbidden. Additionally, the act allows state governments to voluntarily deposit their digital assets into the national reserve, ensuring secure custody through independent accounts while retaining full ownership. This institutional design not only strengthens federal digital asset governance but also provides a custody solution under a decentralized architecture.[5]

The significance of this act is profound: it not only confirms Bitcoin's "strategic reserve status" for the first time in U.S. legislation but also sends a clear signal—Bitcoin is transitioning from a highly volatile asset to a national-level financial asset. Furthermore, by introducing public audits, decentralized reserves, and long-term holding mechanisms, the U.S. is attempting to construct a "gold standard for the digital age," reinforcing the credibility of the dollar and enhancing its dominance in the global crypto financial order. This act may become a systemic starting point for triggering a Bitcoin allocation competition among other countries.

The "GENIUS Act": Establishing a Licensing Framework for Stablecoins

This act proposed by the U.S. Congress has passed all legislative processes and was signed on July 18, 2025, aiming to establish a federal regulatory framework for payment-type stablecoins (i.e., digital assets pegged to fiat currencies and promising fixed-value redemptions). The act stipulates that only licensed issuers can issue stablecoins to U.S. users, primarily including three types of institutions: subsidiaries of federal insurance banks, non-bank issuers meeting federal requirements, or stablecoin issuers compliant with state laws. If opting for state regulation, the issuance scale must not exceed $10 billion. All legitimate issuers must be subject to oversight by the corresponding federal or state financial regulatory agencies.

In terms of compliance requirements, licensed issuers must hold USD or highly liquid assets as stablecoin reserves at a 1:1 ratio and publicly disclose reserve details and redemption policies on a monthly basis. Additionally, the act clearly regulates the usage restrictions of reserve assets, compliance requirements for custody services, and the auditing and enforcement powers of federal agencies over issuers. For foreign stablecoin issuers wishing to enter the U.S. market, they must be recognized by the Treasury as being under "equivalent regulation" and meet information disclosure obligations.[6]

The significance of this act lies in the fact that it provides a clear legal pathway for stablecoins, a key blockchain infrastructure asset, eliminating the legal uncertainty of "whether it constitutes a security," while ensuring the safety of user funds and system stability. By establishing a compliance licensing mechanism and transparent regulatory standards, the U.S. government is integrating stablecoins into the core of the financial system, which is expected to promote commercial banks, payment companies, and even card organizations to enter the on-chain settlement field.

The "CLARITY Act": Defining Clear Boundaries for Token Attributes

The "CLARITY Act," proposed by the U.S. House of Representatives on May 29, 2025, is currently under review by senators and aims to establish a regulatory system specifically for "digital commodities," defining them as digital assets that derive value from blockchain technology. According to the act, these assets are primarily regulated by the Commodity Futures Trading Commission (CFTC) and cover market participants such as digital commodity trading platforms, brokers, and market makers. Any digital commodity wishing to be listed on a compliant trading platform must operate on a "mature blockchain," or its issuer must regularly submit information disclosure reports.

The act provides a pathway for digital commodities on "mature blockchains" to be exempt from SEC securities registration, provided their annual sales volume is below a set threshold and they meet relevant disclosure obligations. The SEC retains regulatory authority over certain special scenarios, such as broker trading activities on securities trading platforms or ATS. Furthermore, all digital commodity platforms and related intermediaries must comply with the Bank Secrecy Act (BSA), bearing compliance responsibilities such as anti-money laundering and customer identification. The act also establishes a temporary registration mechanism to manage existing platforms and assets before formal regulations are implemented.[7]

The introduction of this act represents a significant institutional breakthrough for the blockchain industry. It is the first time at the federal level that the regulatory boundaries between the commodity attributes and security attributes of digital assets have been clearly delineated, providing a clear compliance exemption pathway for projects with a high degree of decentralization, effectively reducing legal uncertainty and compliance costs for entrepreneurs. At the same time, it constructs a unified market framework for trading platforms, ATS, custodians, and others, accelerating the compliance infrastructure for institutional entry, marking the gradual incorporation of on-chain assets into the regulatory framework of the mainstream U.S. financial system.

The introduction of these three acts indicates that the U.S. is transforming into a major rule-maker for the global crypto market. This shift profoundly impacts the evolution of the dollar and the U.S.'s global strategic position. As traditional dollars face the shock of de-dollarization, the U.S. chooses to actively absorb crypto assets as part of its national asset structure, supplementing its strategic reserves with Bitcoin as "digital gold," extending the on-chain settlement power of "digital dollars" with stablecoins, and consolidating its global capital pricing power through regulatory output.

For the global blockchain industry, this signifies a transformative change is occurring. First, with the U.S. regulatory path clarified, a large amount of capital, entrepreneurs, and infrastructure development forces will flow back to the U.S. market to conduct on-chain financial business under compliant identities. Second, compliant U.S. dollars will become the settlement standard for the global on-chain economy. Third, project parties will be institutionally diverted: one group will move towards complete decentralization to obtain regulatory exemptions, while another group must accept the securities compliance path or be excluded from the U.S. market.

More critically, the "Bitcoin Act" may trigger a global race among countries to establish their own Bitcoin strategic reserves. Following the U.S.'s lead in institutionalizing BTC reserves, countries such as Argentina, Russia, and the UAE may follow suit, sparking a new wave of digital asset reserves anchored by Bitcoin. This could become the starting point for the birth of a new financial system, signaling the emergence of a "crypto version of the Bretton Woods system."

In summary, through the aforementioned three acts, the U.S. has completed the national strategic absorption of Bitcoin, unified global regulation of stablecoins, and clearly delineated compliance pathways for crypto assets. In 2025, the U.S. is attempting to rebuild its global hegemony's institutional foundation in the digital financial era by constructing an on-chain asset structure. For the entire industry, behind the green light of policy is a paradigm shift driven by geopolitical power, financial order, and technological narratives.

Significant Progress in the Hong Kong Market: Transitioning from "Institutional Construction Period" to "Structural Realization Period"

If the core narrative of the Hong Kong industry in 2023-2024 was still about "returning to the table," then entering 2025, the market's focus has clearly shifted to institutional realization and structural differentiation. Hong Kong is no longer primarily relying on roadmaps or future promises to attract participants but is beginning to substantively screen market entities that can long-term adapt to its financial system through a series of executable institutional arrangements. In this process, the evolution logic of Hong Kong's Web3 market is gradually shifting from "whether to open" to "how to retain," and the core variables of market competition are changing accordingly. In light of this shift, Web3Caff Research has continuously tracked the evolution of Hong Kong's Web3 policies and market structure over the past two years, forming a series of phased research conclusions.

Stablecoin Legislation Takes Effect, Hong Kong Officially Enters the "Executable Rules" Stage

In 2025, the "Stablecoin Ordinance Draft" was officially passed and entered the implementation preparation stage, marking Hong Kong as one of the few financial centers globally to complete legislation on fiat-backed stablecoins. Unlike earlier regulatory statements or regulatory sandboxes, the core significance of this legislation lies not in "whether to support stablecoins," but in clarifying the legal attributes of stablecoins as financial infrastructure. Regarding the institutional details of this legislative framework, international comparisons, and its impact on global stablecoin compliance pathways, Web3Caff Research has systematically analyzed these in previous specialized studies (see "Market Trend Insights: Hong Kong Passes the 'Stablecoin Ordinance Draft,' Its Impact on Global Stablecoin Compliance and RMB Internationalization Strategy").

From an institutional design perspective, Hong Kong's stablecoin regulation emphasizes three points: first, the high certainty and auditability of reserve assets; second, the capital thresholds and ongoing compliance capabilities of issuing entities; and third, the usage scenarios and risk isolation mechanisms. This means that stablecoins are no longer viewed as marginal financial innovations but are incorporated into a regulatory framework on par with payments, clearing, and custody.

The direct result of this change is that the stablecoin market is beginning to see "compliance premiums" and "threshold eliminations." Some projects that originally relied on regulatory gray areas for survival are being forced to exit, while participants with backgrounds in banking, payments, or large financial institutions are beginning to accelerate their layouts. Thus, Hong Kong's stablecoin ecosystem is shifting from "concept competition" to "institutional endurance competition."

RWA Shifts from "Policy Encouragement" to "Structural Pilots," but the Pace Remains Cautious

In 2025, Hong Kong's progress in the RWA (Real World Assets on-chain) field exhibits a typical "financial center-style restraint." The government and regulatory agencies clearly support the direction of asset tokenization but have not opened up large-scale commercial applications all at once; instead, they are piloting controllable assets such as government green bonds, fund shares, and certain structured notes. A systematic analysis of the asset structures, legal encapsulation methods, and clearing pathways of RWA in different jurisdictions has been conducted by Web3Caff Research in previous extensive studies (see "RWA Track Q4 2025 Research Report"), and this article focuses on discussing its feasibility boundaries within the Hong Kong institutional framework.

The core of this strategy is not conservatism but emphasizes the synchronization of assets, law, and clearing. Hong Kong's RWA advancement path clearly distinguishes itself from some emerging markets' models of "going on-chain first, then supplementing compliance," insisting instead on prioritizing asset ownership, investor protection, and clearing mechanisms. This also means that, in the short term, the scale expansion speed of RWA is limited, but once it is operational, its institutional credibility will significantly exceed that of most competing regions.

From market feedback, the participants in Hong Kong's RWA ecosystem in 2025 are changing: narrative-driven Web3 projects are noticeably decreasing, replaced by traditional financial institutions, custodians, accounting firms, and infrastructure providers. This indicates that the positioning of RWA in Hong Kong is not as a traffic entry point but as an institutional experimental ground for the organization of the next generation of financial assets.

Refinement of Virtual Asset Service Regulation, Market Enters "Structural Layering"

With the gradual refinement of staking service guidelines, custody requirements, and investor protection rules, Hong Kong's on-chain asset market is showing clear layering in 2025. On one hand, compliant trading platforms, licensed institutions, and institutional-level service providers have gained clearer development space; on the other hand, the operating costs for small and medium platforms have significantly increased, leading to a rise in industry concentration. Web3Caff Research has conducted specialized analyses on the impact of the refinement of staking service regulation on market structure and institutional participation boundaries (see "Market Trend Insights: Hong Kong Securities and Futures Commission Issues 'Staking Service' Guidelines").

This change does not simply represent a "tightening," but rather a transition of market structure from wild expansion to professional division of labor. Functions such as trading, custody, staking, market making, and asset management are being broken down into different compliant modules, with institutions beginning to choose their positioning based on their advantages, rather than pursuing a "full-stack" platform model.

It is noteworthy that the refinement of regulation also provides Hong Kong with a differentiated advantage: compared to purely relying on loose policies to attract projects, Hong Kong is shaping a "high-cost but highly credible" market environment. This environment may not be conducive to quantity expansion in the short term, but it helps attract long-term capital and cross-border institutions.

Hong Kong in International Comparison: Not the Fastest, but Possibly the Most "Durable"

From a global perspective, Hong Kong in 2025 is not the most aggressive region in terms of Web3 policy. Singapore still holds advantages in regulatory efficiency, the U.S. is beginning to accelerate at the legislative level, and Europe is establishing unified rules through MiCA. However, Hong Kong's unique value lies in its combination of common law system, international financial network, and interface with the Chinese market. Web3Caff Research has continuously tracked the systematic comparison of Web3 policy paths across major global jurisdictions in multiple studies (see "Market Trend Insights: Global Web3 Policy Game Escalation").

This combination determines that Hong Kong is more suited to assume the role of "institutional intermediary": it is neither a completely decentralized experimental field nor a purely traditional financial extension, but a transitional node that integrates blockchain technology into a mature financial order. From stablecoins to RWA, from custody to clearing, Hong Kong is validating whether Web3 can operate long-term within a high-standard financial system.

Overall, 2025 is the year when the Hong Kong Web3 market completes its transition from policy commitment to institutional reality. After this year, Hong Kong will no longer be suitable for projects that rely on conceptual financing or regulatory arbitrage, but for participants genuinely wishing to exist long-term in the global financial system, its institutional value will begin to emerge.

Value Intermediary Layer: Stablecoin

A New Internationalism of On-Chain Dollars

Stablecoins play a key ecological role as the "fiat currency interface," serving as the value intermediary layer in the entire crypto finance ecosystem. On one hand, they are the settlement unit for on-chain liquidity and transactions, providing users with value anchoring and low volatility, becoming the mainstream pricing tool in DeFi, CEX, and payment scenarios; on the other hand, they act as a bridge connecting on-chain finance with the real financial system, providing foundational assets for RWA, lending, yield aggregation, and other applications. In this process, some international financial centers (such as Hong Kong) have begun to take on the role of institutional translation and compliance acceptance, allowing stablecoins to be "legally accessed" in different jurisdictions. For insights into the strategic position of stablecoins in the macroeconomy, you can read Web3Caff Research's publication in August this year titled "Latest 20,000-Word Research Report on the Stablecoin Track 2025." [8]

Building on the previous chapter, the U.S. government's crypto-friendly new policies have laid the foundation for industry development. In 2025, an unprecedented deep binding relationship was established between the U.S. and stablecoins, transforming it from a mere game between regulators and the industry into a tripartite structure of policy, capital, and technology jointly reshaping the on-chain extension of dollar hegemony. Markets like Hong Kong, with mature financial regulatory systems, are also beginning to become important new institutional interfaces.

First, at the policy level, with the promotion of the "GENIUS Act," the U.S. has officially established a federal compliance framework for stablecoins, clarifying core regulatory rules such as the qualifications of stablecoin issuers, reserve requirements, and auditing mechanisms. Following this "policy green light," the U.S. government, Wall Street capital, and payment giants quickly banded together to form a "new financial mafia" in the stablecoin field: Circle announced its IPO, valued at over $10 billion; Stripe acquired stablecoin infrastructure Bridge; giants like Robinhood and Stripe began building their own stablecoin systems or even issuing chains; BlackRock launched BTC and ETH ETFs, with assets under management exceeding $175 billion, steadily expanding its control over the digital asset system. Additionally, markets like Hong Kong, through local legislation and regulatory frameworks, have also enabled their stablecoin competitive landscape to gain executable compliance points within the international financial network.

Second, in terms of strategic function, stablecoins are becoming a new pivot for on-chain dollars in the U.S. As noted by a16z in the "State of Crypto 2025," stablecoins currently hold over $150 billion in U.S. Treasury bonds, making them the 17th largest holder of U.S. debt, reinforcing the on-chain extension of the dollar.[1] They play a "dual role" globally: on one hand, they serve as a global store of value, with dollar stablecoins like USDC/USDT becoming the default pricing unit and payment intermediary for on-chain transactions in most countries; on the other hand, they are also significant buyers of U.S. Treasury bonds, continuously channeling dollar liquidity back into the U.S. financial system through on-chain re-staking and RWA financing mechanisms, solidifying the U.S. government's minting power and debt cycle. As an international financial center, Hong Kong's synchronized advancement in stablecoin and RWA regulation will also become an important institutional entry point for global competition in stablecoins through high-standard regulation.

Finally, the issuance, distribution, and yield structure of stablecoins have become key nodes in the on-chain geopolitical financial control. Whoever controls the distribution channels of on-chain stablecoins holds the programming authority of the on-chain monetary order. The competition for "stablecoin autonomy" among Circle, Paxos, PayPal, Stripe, and Robinhood reflects the underlying game of a new hegemonic structure in the era of digital dollars.

The Medium is the Message: Native Innovation in Information/Settlement Integration

Stablecoins are reconstructing the essential logic of currency, pushing us from a "bank-centric settlement network" to a "financial internet based on cryptographic primitives." Jesse Walden of Variant Fund has pointed out that the greatest innovation of stablecoins lies not in their anchoring to fiat currencies, but in their role as a protocol carrier that integrates information and settlement: on-chain transactions themselves are settlements, and state changes are value transfers. Compared to the disjointed structures of messages (SWIFT) and settlements (ACH, credit card clearing) in traditional systems, stablecoins achieve the fusion of medium as settlement and settlement as value.[9] As Marshall McLuhan said, "the medium is the message," the emergence of stablecoins as a medium not only compresses the spatial and temporal distances in financial activities but also redefines who can become a publisher, settler, and liquidity provider in finance. This change also provides new institutional interface opportunities for some international financial centers (such as Hong Kong).

In the first stage, stablecoins have de-intermediated traditional settlement systems. Compared to the cumbersome structures of cross-border payments relying on clearing houses and exchange rate channels, stablecoins inherently possess on-chain composability and global reach, bypassing the SWIFT network and credit card clearing and points systems, allowing value to flow instantly between wallets.

In the second stage, they have become programming currency tools for enterprises and even nations. Companies like Circle, Stripe, Visa, and Mastercard are building native stablecoin account systems; platforms like Robinhood and PayPal are beginning to explore building their own chains and brand coins, pushing stablecoins towards a phase where applications equal currency and brands equal currency.

Yetta Sing of Primitive Crypto proposed in her article "From Interface to Network" that stablecoins will become the "next generation liquidity layer" in the crypto financial stack. This is not only an improvement in clearing efficiency but also a systemic architectural reconstruction. Visa, Mastercard, Ripple, and Stripe are actively laying out stablecoin infrastructure, constructing full-stack stablecoin channels from user payments to enterprise settlements, from C2B to B2B. The underlying drive of this evolution is the gradual elevation of stablecoins' role as network interfaces to become financial distribution channels.[10]

Distribution is Power: The "Yield Recovery" Movement in the Era of White Labeling

In 2025, the power structure of stablecoins is undergoing fundamental reorganization. Taking the U.S. as an example, with the passage of the "GENIUS Act," stablecoin issuance is no longer limited to a few trusted financial institutions but is formally included under the "federal licensing framework," marking the entry of the U.S. into the era of white label stablecoin-as-a-service. This change not only affects the U.S. domestically but also poses new requirements for institutional adaptation in international financial centers. In other words, any licensed bank, payment company, or even tech enterprise can issue their own stablecoin products through compliant channels, similar to enterprise SaaS services. This regulatory shift fundamentally alters the competitive landscape of the stablecoin industry—from "who can issue tokens" to "who owns distribution and user channels."

Over the past decade, the moat of the stablecoin industry has primarily been held by issuers. According to Delphi Digital, Tether and Circle together monopolize about 85% of the market share (totaling $265 billion). However, the business model of issuers has clear structural flaws. Although Circle is the issuer of USDC, it must share more than half of its reserve interest income with distribution partner Coinbase. In 2024, Coinbase thus earned $908 million, accounting for 53% of Circle's total interest income.[11] This means that the true profit center in the stablecoin ecosystem has shifted from "issuing tokens" to "user retention and distribution channels"—Coinbase controls users, custodial assets, and distributes profits, while Circle merely plays the role of infrastructure for token minting.

With policy relaxation and regulatory clarity, more traditional financial and tech companies are beginning to join the race to issue stablecoins. The GENIUS Act provides a unified standard: requiring 1:1 reserves, transparent audits, and prohibiting re-staking, ensuring that each stablecoin possesses the same credit rating as the dollar. Hong Kong's emphasis on reserves, audits, and risk isolation in stablecoin regulation makes it an important compliance node for the internationalization of white label stablecoins. This not only lowers compliance thresholds but also creates fertile markets for white label stablecoins. Enterprises do not need to build their own reserves and clearing systems; they can simply utilize "stablecoin-as-a-service" infrastructure to issue branded stablecoins for settlement and points systems within their ecosystems.

This trend directly undermines the dominance of USDC. Coinbase and Circle previously jointly controlled the circulation and profits of USDC through the Centre alliance, but as the white labeling model emerged, the competitive landscape quickly became multipolar. DeFi applications, L2 networks, and public chains have all taken action, exemplified by Hyperliquid's USDH stablecoin bidding case—Hyperliquid refused to continue providing free reserve income to Circle and instead chose a white label solution provided by Native Markets (a third-party compliant issuance model where applications or public chains dominate distribution and profit allocation), channeling 50% of interest income back to the ecosystem fund. This move not only brought direct cash flow to the platform but also symbolized that "chains and applications are beginning to reclaim financial dominance from issuers."

The success of this model is triggering profound changes in the on-chain financial system. The yield from stablecoins (i.e., the "on-chain interest tax") has become a core source of reclaimed value. In the past, over $30 billion in stablecoin reserves on public chains like Solana, Arbitrum, and BSC generated about $1.1 billion in interest income for Circle and Tether each year, with nearly all of this income flowing to off-chain financial institutions. Now, with the proliferation of white label solutions, these public chains are attempting to internalize interest income for ecosystem development and incentive programs. MegaETH launched the USDm stablecoin to support Sequencer operations; Jupiter introduced JupUSD, integrating stablecoin yields into lending, perpetual, and DEX modules to form a closed-loop growth engine. From a macro perspective, the evolution direction of the stablecoin industry has shifted from "centralized issuance monopoly" to "ecosystem-level stablecoin autonomy."

Yield Anchoring Layer: RWA (Real-World Asset)

Asset Structure Differences: Equity vs. Revenue Rights vs. Certificates

In the development trend of on-chain finance, "RWA (Real-World Assets) on-chain" is gradually becoming an important bridge connecting on-chain finance with the real economy. However, RWA is not a single asset class; it encompasses a variety of highly heterogeneous asset forms. From private credit, bonds, and real estate to carbon credits and stocks, they exhibit essential differences in legal structure, off-chain dependency, and integration with DeFi, making it impossible to generalize.

It is particularly important to note that the on-chain path for equity-type assets fundamentally differs from that of other RWAs. For instance, U.S. stocks, as representative equity assets, face higher regulatory sensitivity and governance closure in their on-chain transition. Mechanisms such as equity voting, shareholder rights, dividends, and tax reporting are deeply embedded in U.S. SEC regulations and corporate governance systems, making it difficult to fully encapsulate them through a single on-chain token. In contrast, bonds (especially short-term notes) have clear and stable cash flow structures, real estate emphasizes rights confirmation and registration systems, and carbon credits focus on auditability and composability—these assets more naturally adapt to on-chain certificates, DeFi collateral, and structured finance, possessing protocol-level utility.

The differences in off-chain dependency are also a key factor. U.S. stock tokens often must be mapped through complex systems involving brokerage accounts, clearinghouses, and custodians, meaning that on-chain transactions are essentially still constrained by traditional financial infrastructure. Other RWA assets, however, can more easily interface as off-chain API services or on-chain verification mechanisms, enabling lightweight and automated issuance and tracking processes.

In DeFi scenarios, this differentiation trend is even more pronounced. On-chain stocks typically can only be used in closed scenarios or synthetic trades, making it difficult to embed them into open DeFi protocols. In contrast, stable cash flow assets such as bonds, private loans, and real estate debt are becoming the main underlying components for on-chain lending, staking, and yield aggregation, forming a new layer of liquidity foundation for DeFi structural yields.

From a policy and international finance perspective, stock tokenization easily touches upon the red lines of capital account openness and securities ownership, often serving more as a symbolic gesture; whereas bonds, carbon credits, and accounts receivable types of RWAs are more commonly used as neutral instruments for "on-chain financial infrastructure going abroad," exporting financing structures and compliance interfaces.

In summary, to build a real, efficient, and compliant RWA financial system, it is essential to clarify the structural differences among these assets. Not all "off-chain assets" should be equated to the same on-chain mapping path; rather, their respective legal attributes, liquidity structures, off-chain coupling degrees, and DeFi adaptability should be modeled and analyzed in detail. This is not only a respect for reality but also a necessary path for the evolution of on-chain financial systems.

On-Chain Advantages of Non-Equity RWAs: The Main Battlefield for Efficiency Improvement

As of November 2025, according to data from RWA.xyz, the total market size of on-chain RWAs has reached $35.8 billion, nearly tripling since the beginning of the year, reflecting the rapid expansion of this field in a short time. Among them, private credit occupies 52% of the market share, firmly in first place, followed by U.S. Treasury bonds (24%), then institutional alternative funds (8%) and commodities (8%). In contrast, stocks account for only 2%, placing them in a marginal position.[12] This set of data reveals a key trend: the core value of on-chain RWAs lies not in simply "transporting existing financial assets," but in "enhancing the operational efficiency of assets that lack liquidity and transparency in the traditional financial system." For specific background, you can read Web3Caff Research's publication in June this year titled "Latest 25,000-Word Research Report on the RWA Track Q4 2025." [13]

The traditional private credit market has long faced issues such as poor liquidity, opaque credit information, and limited financing channels, making it difficult for small and medium-sized enterprises and marginalized financial needs to access capital. Blockchain technology effectively reduces intermediary costs and improves capital utilization efficiency by introducing on-chain funding pools, contract execution, and cross-border stablecoin payments, thereby bringing "protocol-level leverage" to private credit. This has allowed it to achieve product-market fit (PMF) first among RWAs. For example, U.S. Treasury bonds are already globally recognized as highly liquid, safe, and standardized assets; their on-chain presence is more about meeting the demand for stable collateral in DeFi scenarios (such as USDe, sDAI) rather than addressing structural financing pain points. Therefore, while they occupy an important share, they are not the fastest-growing or most disruptive segment.

As the RWA track heats up rapidly, optimizing custody, circulation, and composability efficiency from the infrastructure layer of the chain has gradually become a focal point in the industry. According to Web3Caff Research's publication in August 2025 titled "20,000-Word Research Report on RWA-Specific Chains," the infrastructure for RWAs needs to achieve systematic optimization across eight dimensions: 1) Compliance and convenience of fiat funding channels; 2) Safe and efficient cross-chain interoperability; 3) High throughput and instant finality; 4) Innovation in Web3 user experience; 5) Regulated privacy protection mechanisms; 6) Compatibility with DeFi ecosystems; 7) Simplified asset issuance processes for institutions; 8) Moderately centralized governance structures.[14] From this checklist, it is evident that the on-chain transition of RWAs is fundamentally a "tool efficiency issue" rather than an "asset definition issue"—the challenge lies not in whether the assets are real, but in how they can circulate and be composed efficiently, safely, and at low cost on-chain.

Currently, although most RWA projects are still deployed on the Ethereum mainnet or EVM-compatible chains, dedicated chains tailored for RWAs (whether self-built L1s or Ethereum-based dedicated L2 Rollups) are rapidly emerging.[15] For example, Plume Network is defined as a "full-stack L1 dedicated to RWA," and more related content can be found in Web3Caff Research's publication in May titled "10,000-Word Research Report on RWA L1 Public Chain Plume Network." [16]

The advantage of general-purpose L1s lies in their deep ecosystems and strong security, naturally possessing a large number of DeFi protocols, users, and liquidity resources, allowing assets to be quickly composed, traded, and market-formed once on-chain. However, this also brings compliance thresholds, operational complexities, and transaction cost issues, especially for institutional assets, where the openness of DeFi can become a burden.

In contrast, dedicated chains (including Permissioned L1s and Customized L2s) may have relatively weaker liquidity but can build more targeted compliance and risk control logic for specific asset types. For instance, RWA-specific chains can default to integrate KYC/AML modules, audit loops, permission controls, and on-chain/off-chain data bridging interfaces, naturally adapting to complex asset structures such as private credit, fund shares, and real estate certificates. These assets are typically high-value and low-frequency trades, requiring extremely high standards for latency, cost, and regulatory collaboration, which general-purpose public chains struggle to meet.

The trade-off between the two can be understood as: general-purpose chains emphasize "breadth," while dedicated chains stress "depth." The former resembles a highway, encouraging all assets and protocols to traverse freely; the latter resembles rail transit, with clear planning and orderly structure, suitable for heavy assets and compliant institutions. However, regardless of the path taken, the essence of RWAs still revolves around the collaboration of off-chain processes—including custody, bridging, auditing, and judicial arbitration mechanisms, which cannot be solved solely by the "chain."

The author believes that in the short to medium term, mainstream institutions will still favor Ethereum and its L2s as issuance platforms, as their ecosystems are mature, deployment is quick, and developer resources are abundant. For example, Robinhood's announcement to tokenize stocks and launch an L2 platform on Arbitrum has further boosted VC confidence in Ethereum L2s. However, in the medium to long term, the rise of RWA-specific chains is almost an inevitable trend. They will not replace Ethereum but will form a functional division of labor with it: Ethereum will handle open liquidity and composability, while dedicated chains will serve asset issuance, existence, settlement, and regulation.

On-Chain U.S. Stocks: A Split Trajectory of Reality and Potential

As RWA (Real World Assets) has become one of the central narratives in the industry since 2024, on-chain U.S. stocks, as the most symbolic and controversial asset type, are experiencing a new wave of attempts. Looking back at history, the path of on-chain U.S. stocks can be roughly divided into four stages [17]:

- STO (Security Token Offering) Stage (2017–2019): This stage emphasized the compliant issuance of securities-type assets, hoping to automate management by placing equity into blockchain smart contracts. However, high operational costs, unclear regulations, and insufficient liquidity prevented it from breaking out of closed experimental fields, leading to early stagnation;

- Synthetic Asset Stage (2020–2021): Synthetic stocks represented by sTSLA and mTSLA created on-chain price-tracking products through over-collateralization. Although highly innovative, they were essentially trading derivatives, facing systemic risks and liquidity exhaustion, ultimately exiting during market downturns;

- CEX Exploration Stage (2021–2022): Leading centralized exchanges like Binance and FTX attempted to launch "on-chain stocks" and collaborated with custodians to hold real stocks;

- Compliant RWA Model Stage (2024–Present): From Dinari, Backed, to Kraken, Bybit, and Exodus obtaining SEC approval to put stocks on-chain, this round of practice emphasizes compliant pathways, off-chain custody, and on-chain mirroring, attempting to open the door to equity on-chain in the form of "digital certificates."

It can be seen that the first three paths failed due to liquidity dilemmas or regulatory pressures. The current RWA model, while more pragmatic and robust, still faces numerous structural obstacles. Although the technical barriers for on-chain U.S. stocks have significantly lowered, mainstream crypto venture capital remains generally pessimistic about their prospects, primarily due to "liquidity misalignment." Potential buyers of on-chain stocks are largely limited to users with existing on-chain funds. In contrast, off-chain potential users tend to prefer using their existing securities accounts or brokerage platforms for trading, rather than going out of their way to cross-chain purchase USDC or set up wallets. In other words, the market for on-chain stocks does not bring in new money; it merely dilutes the existing money.

Yuki Yuminaga from Fenbushi further pointed out that the issue with tokenizing assets on-chain is the extremely high cost of "rebuilding" liquidity. Over the past few decades, Nasdaq and NYSE have established mature market-making mechanisms and high-frequency trading systems; on-chain, price discovery, trading depth, and arbitrage channels need to be restarted through AMM or DEX markets, which is almost a "de-globalization" process starting from scratch.[18] Therefore, a more realistic issue is that most on-chain stocks are "pseudo-equity assets" without voting rights or shareholder rights, their financial functionality is inferior to that of on-chain stablecoins, and they lack the growth potential of native crypto assets, making it naturally difficult to fit into the core allocation logic of VCs.

Despite various structural issues, on-chain U.S. stocks still have several visible mid-term values, such as enabling 24/7 global trading, breaking through the time limitations of traditional trading platforms, which is somewhat attractive to asynchronous market users. Furthermore, in the future, on-chain stocks, as standard ERC-20 assets, can be used in financial modules such as lending, collateral, and liquidity provision, forming new combination strategies. The premise for realizing these advantages is that users are already on-chain, already hold stablecoins, and already have DeFi operational habits. This determines that at the current stage, on-chain U.S. stocks are more suitable as a supplementary tool rather than a foundational asset.

Fund Management Layer: DAT (Digital Asset Treasury)

Narrative Shift: From On-Chain Assets to Manageable Assets

In 2025, DAT (Digital Asset Treasuries) became the intersection of capital markets and blockchain narratives, emerging as one of the fastest-growing segments with the strongest capital aggregation effect in the RWA narrative. This phenomenon is not accidental but the result of multiple structural trends converging:

First, the clarification of the regulatory environment has paved the way for DAT. With the approval of Bitcoin spot ETFs and the large-scale tokenization of U.S. Treasury bonds, on-chain assets have begun to possess real legal status and a clear compliance framework. This allows institutions to "safely" allocate funds on-chain through forms such as funds, trusts, and SPVs, with DAT playing the role of a "treasury" connecting traditional capital with the on-chain world.

Second, the market narrative itself has also shifted. In recent years, the blockchain industry has been keen on narratives around infrastructure (L2, DA, Modular), while starting in 2025, it has shifted towards the concrete landing of the "asset layer." Instead of building new networks, it is better to provide a usable and combinable asset pool for capital. DAT has risen in this context; it is essentially a structured financial product that packages assets, aggregates yields, and builds portfolios, akin to a blockchain version of "Grayscale Trust + Active ETF."

Third, the product forms of DAT are evolving. From the initial "buying U.S. Treasury bonds on-chain" to the current "re-staking + multi-asset strategy combinations," more and more DAT products are taking on active management responsibilities, incorporating yield routing and leverage structures. This means they are not just a "storage place" for assets but also an on-chain "asset strategy engine."

From a macro perspective, the end of the interest rate hike cycle and market recovery have led a large amount of "low-risk preference" capital to seek new allocation channels, and DAT meets core demands such as transparency, compliance, strong combinability, and visible yields. Therefore, DAT is not a fleeting phenomenon but an inevitable product of the intersection of the current capital market, on-chain assets, and product engineering. It is both an extension of RWA and a concrete form of asset financialization moving on-chain.

Market Landscape: The Rise of DAT and Capital Expansion Pathways

As of October 2025, the DAT market has experienced explosive growth, with the total number of DAT companies soaring from 4 at the beginning of 2020 to 142, with 76 new companies added in 2025 alone, demonstrating a surge in institutional enthusiasm for crypto assets. In terms of regional distribution, the U.S. leads with 60 companies (43.5%), followed by Canada (19 companies) and Hong Kong (10 companies). Although Japan has only 8 companies, it is home to the fifth-largest DAT company in the world and the largest in Asia—Metaplanet.[19]

In 2025, DAT companies' expenditures on crypto asset purchases reached $42.7 billion, with over half occurring in the third quarter, particularly with $22.6 billion spent in Q3 alone, setting a historical record. Strategy (formerly MicroStrategy) topped the list with a $70.7 billion BTC position, accounting for nearly half of all DAT companies' crypto assets and holding 3.05% of the total BTC supply. Other emerging DAT companies like BitMine Immersion, Sharplink, and Forward Industries quickly made the list in the latter half of 2025, showcasing the rise potential of the Altcoin DAT market.[19]

The strength of DAT is closely tied to the upgraded capital strategies behind it. These companies continuously purchase Bitcoin through capital market tools and, under the premise that their stock prices are significantly higher than their net asset value (NAV), build a self-reinforcing capital flywheel, creating a leverage effect that far exceeds traditional Bitcoin spot holdings. Essentially, it packages Bitcoin exposure in a "corporate form" and leverages public market financing capabilities to financialize and capitalize the act of "holding Bitcoin."

The core model of DAT relies on a "positive feedback loop": when its stock price exceeds the corresponding Bitcoin value (NAV) per share, the company can conduct small-scale financing through an "At-the-Market Offering" (ATM) mechanism. Since new shares are issued at a premium, after obtaining funds, the company buys Bitcoin, which in turn increases the amount of BTC represented by each share (because the BTC acquired from new shares exceeds the dilution ratio), further raising the NAV and supporting the continued rise of the stock price.

For smaller companies that have not yet reached the ATM execution threshold, they can also quickly finance through the PIPE (Private Investment in Public Equity) model to specific institutions or angel investors. Although PIPEs typically come with share discounts and equity dilution, they remain a viable path for many emerging DATs to initiate BTC purchase plans. In a better market environment, such discounted financing can often quickly transform into an accelerator for stock price increases.

To assess the capital efficiency of a DAT, a key indicator is "Bitcoin Yield"—the amount of Bitcoin that can be converted per unit of equity. The higher the Bitcoin Yield, the more efficiently the company can accumulate BTC assets without significantly diluting shareholders, often corresponding to a higher market valuation premium.[20]

Risk Structure: Premium Dependence and Cyclical Vulnerability

However, this model also carries significant cyclical risks: once a company's stock price falls to or below the NAV level, further financing will "dilute" the BTC content per share, causing the capital flywheel to fail and potentially reverse into a negative feedback loop. As VanEck analysts have stated, "When you trade at NAV, issuing new shares is no longer a strategic action but a predatory one."[20] Therefore, DATs are not simply "companies holding tokens," but capital market agents for on-chain assets. Their valuations reflect not the current price of BTC but a derivative of their "future purchasing power" for Bitcoin. These companies translate the narrative of crypto assets into the language of capital markets, introducing financial leverage and market liquidity for BTC through public listing channels, while also exposing themselves to higher emotional and institutional risks.

Many VC investors have also pointed out potential issues with the DAT model. For instance, Spencer Bogart from Blockchain Capital warns that the risk of DAT premium corrections is very high, especially when the underlying asset rises, but the DAT premium quickly shrinks, leading to a situation where "the direction is right but still losing money." Investors may find themselves standing at high positions, bearing "double risks." Emma Cui from LongHash Ventures noted that a large number of new DATs are currently being issued, and in the coming months, there will be unlocks of founder/insider shares, creating additional supply pressure. If participants do not keep up with the purchasing pace, premiums may quickly compress or even turn negative, resulting in systemic negative feedback.[22] Yuki Yuminaga from Fenbushi believes that when the market is good, premiums can lose weight, and valuations can be pushed up by market sentiment (20%-100% premium). Under volatile conditions or adverse news (such as the FTX incident), GBTC once fell to a -40% discount, and DATs may also repeat this pattern.[23]

In summary, DAT is not merely a new packaging of "companies holding tokens," but a key player in the financialization process of Bitcoin—a trading machine that can turn BTC into "enhanced stocks." Their success depends on market sentiment, regulatory space, financing capabilities, and transparency of information disclosure, shining brightly in favorable market conditions, while potentially evaporating in value during unfavorable environments.

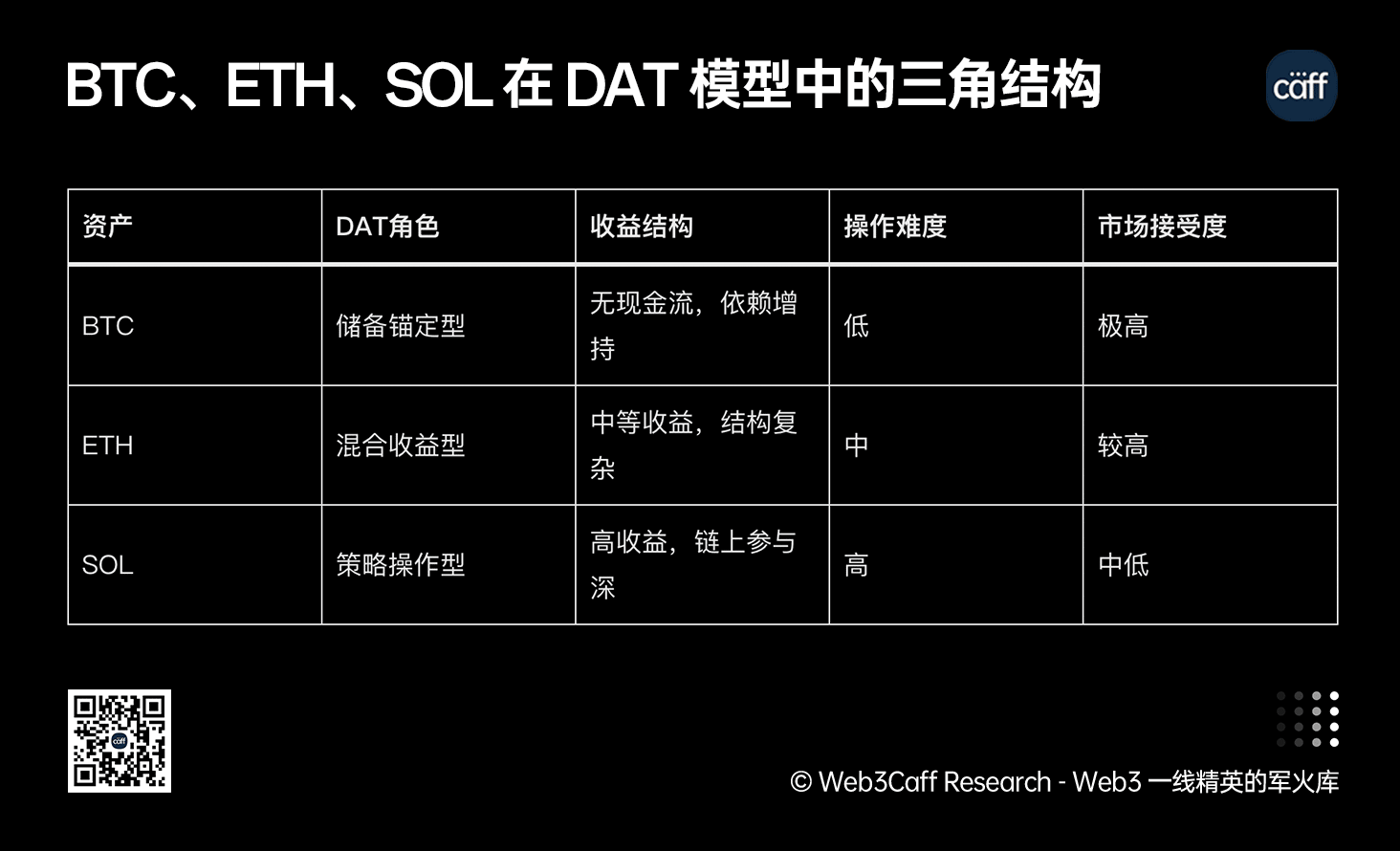

Asset Stratification: Strategic Positioning of Bitcoin, Ethereum, and Solana

As Digital Asset Treasury (DAT) gradually becomes an important organizational form connecting traditional corporate structures with on-chain systems, the functional roles of different on-chain assets within it are beginning to show clear differentiation. This differentiation is not based on short-term market performance but more on the technical attributes of the assets themselves, governance structures, and their adaptability to existing institutional systems.

First is Bitcoin (BTC). In the current DAT structure, BTC remains the most typical and mature core allocation asset, holding an absolute dominant position.[19] This status does not stem from its on-chain operability; rather, it arises from its extremely low system complexity. With a fixed total supply, no governance participation, and a singular function, it is closer to a "digital reserve asset," which can be incorporated into the balance sheets of traditional companies and capital markets in a relatively familiar manner. BTC-type DATs, represented by Strategy, do not fundamentally rely on on-chain participation but build corporate valuation and capital structure logic through asset holdings. The advantage of this model lies in its clear structure and low operational threshold, but it also determines that it primarily serves a static reserve and value anchoring function within DAT.

In contrast, Ethereum (ETH) presents distinctly different characteristics within the DAT framework. ETH is both an asset and a platform, and its value is not entirely independent of the on-chain ecosystem but is deeply embedded in systems such as smart contracts, DeFi, NFTs, and Layer 2.[19] This allows ETH-type DATs to theoretically possess richer participation spaces, including on-chain governance, infrastructure collaboration, and structural integration with ecological applications. However, this platform attribute also significantly increases the complexity at the organizational and compliance levels. The usage of ETH is highly diverse, and the relevant infrastructure is still in a continuous evolution phase, making it difficult to standardize quickly. Therefore, at the current stage, ETH resembles a hybrid underlying unit with both asset and infrastructure attributes, and its role within DAT is still being explored.

Solana (SOL) represents a more experimental path. In the current DAT practices, the overall share of SOL remains limited, but exploratory structures built around it have begun to emerge.[19] These attempts do not view SOL merely as a passively held asset but as a highly programmable and participatory on-chain operational infrastructure, attempting to integrate corporate structures, on-chain governance, and ecological collaboration more closely.[24] The potential of this model lies in its native nature and operational depth, but it also implies higher organizational complexity and institutional challenges. Compared to BTC and ETH, SOL-type DATs are closer to a strategic experiment, and their replicability and long-term stability remain to be validated.

In summary, BTC, ETH, and SOL are forming a clearly defined triangular structure within the DAT model:

Image source: Web3Caff Research researcher K's creation

Which model will dominate in the future depends on multiple external variables: market cycles, regulatory progress, capital structures, and the maturity of on-chain applications. DAT is not a victory for any single asset but a gradually standardizing and structuring experimental space, where the applicability of different assets will determine their institutional roles and financialization paths in the next cycle.

Application Circulation Layer: Payment

Web2 Payment Giants: Stripe and PayPal

In the current on-chain asset ecosystem, "payments" are moving from the margins to the forefront. According to the "Payments Market Report 2025," by 2024, over 560 million people will be using on-chain asset-related transactions, and the overall revenue from digital payments is expected to exceed $3 trillion by 2028, with on-chain payments gaining increasing attention.[25]

Such rapid growth and limitless potential are attracting "top players" in the traditional payment sector, such as Stripe and PayPal. First, Stripe restarted its crypto payment support as early as 2022, allowing U.S. merchants to accept USDC stablecoins issued by Circle, with network coverage including Ethereum, Solana, and Polygon.[26] Additionally, a report from Stripe indicated that its stablecoin payment was available in over 70 countries on its first day, with merchants still receiving dollar settlements while users could complete payments using on-chain wallets.[27]

Moreover, PayPal launched its stablecoin PayPal USD (PYUSD) in August 2023, characterized by "100% backed by U.S. dollar deposits, U.S. Treasury bonds, and similar cash equivalents." [28] By October 2024, PayPal had completed its first corporate payment (to EY) using its stablecoin to validate its commercial use.[29] The latest data shows that in April 2025, PayPal announced an annual reward of 3.7% for users holding PYUSD to incentivize them to hold tokens in their PayPal/Venmo wallets for payments. Additionally, PYUSD plans to expand to the Stellar blockchain to enhance low-cost global payment capabilities.[30]

I believe that Stripe's approach demonstrates that crypto payments are not just about "allowing users to pay with crypto assets," but rather about "enabling merchants to accept stablecoin settlements while retaining dollar revenues," which is a bridging model. Stripe's policy of "merchants in the U.S. accepting USDC while settlements are still in dollars" illustrates this point. Payments made in USDC still revert to fiat currency settlements, reducing the new risks for merchants. Therefore, in the payment sector, "making it easy for merchants to accept" is key, not just "making users pay."

The launch of PYUSD by PayPal, its promotion for commercial payments, reward mechanisms, and expansion to the Stellar network all signify that traditional payment companies are bringing crypto payments from the margins into the mainstream. PayPal has over 430 million users and millions of merchant accounts. This resource advantage brings a "scale effect" that could accelerate the adoption of on-chain payments.

Despite the good performance of Stripe and PayPal, the current proportion of merchants, large-scale offline entities adopting, and users genuinely using on-chain payments as a substitute for traditional payments remains small. There are still gaps compared to traditional payments in terms of merchant experience, payment experience, volatility and exchange issues, regulatory compliance, cross-chain and network support, and refund/return mechanisms.

Native Payment Gateways: Alchemy Pay and CoinsPaid

Alchemy Pay's core business is to provide merchants with a payment gateway that supports both traditional fiat and crypto asset settlements. Its official website claims coverage in 173 countries/regions, supporting various payment methods including Visa, Mastercard, Apple Pay, Google Pay, and local transfers.[31] On its "Payment Acceptance" page, Alchemy Pay states that merchants can choose to settle in local fiat while also supporting crypto asset payments via POS API/SDK without bearing volatility risks.[32] The company also disclosed that by 2025, its "Ramp" business (fiat ↔ crypto bridge) has served approximately 300 local channels and digital assets, with over 50 fiat payment capabilities.[33] Additionally, in July 2025, Alchemy Pay announced that it had obtained a "Money Transmitter License (MTL)" in South Carolina, marking a milestone in its compliant expansion in the U.S.[34] From this data, it is evident that Alchemy Pay's significant advantages include global coverage, multi-currency support, and a high compliance posture. If merchants are concerned about crypto asset volatility, fiat settlements, or difficulties in regional payment access, Alchemy Pay's product design precisely targets these pain points. This makes it highly likely to penetrate scenarios where "merchants are willing but hesitant."