2025 proved to be another watershed moment for Web3 and blockchain in particular, with as many as 80% of Fortune 500 companies thought to have adopted the latter. The noticeable shift toward real-world asset ( RWA) tokenization and institutional interest, which relies heavily on blockchain, was one of the factors that helped the technology grab a greater share of the public’s mindshare.

However, it was the accelerated adoption of cryptocurrencies, particularly in the U.S., that ensured the blockchain technology was not completely overshadowed by the rise of artificial intelligence (AI). Much of this is owed to the Trump administration, which essentially dismantled the Biden administration’s legal and regulatory hurdles that had hitherto stifled crypto innovation in the U.S. and beyond.

While it was a good year for technology in general, a confluence of factors helped a few protocols stand head and shoulders above the rest. Bitcoin.com News assessed the factors and their impact on the entire Web3 ecosystem to determine the top blockchains in 2025.

This crypto Blockchains of the Year list, curated by the Bitcoin.com News editorial team, ranks the five biggest blockchains that most defined crypto in 2025. Our criteria for inclusion and ordering includes but is not limited to: developer and user activity of the chain, mindshare, and narrative impact.

We’re counting down from Number 5 to Number 1, ending with the News Story of the Year.

5. Tron

Similar to other protocols, the Tron blockchain underwent continuous evolution, driven by a focus on high throughput, low costs, and a decentralized content ecosystem. Some of the key innovations and upgrades on the Tron blockchain in 2025 include the Delegated Proof-of- Stake (DPoS) Consensus, which allows a limited number of elected super representatives (SRs) to validate transactions. This is said to significantly increase transaction throughput and reduce block confirmation time.

Like Hyperliquid, Tron unveiled the Tron Virtual Machine (TVM), an innovation which makes the blockchain EVM-compatible. This compatibility is said to boost interoperability and developer adoption. Other noteworthy upgrades or innovations were the AI integration, implementation of a Bitcoin-Backed Security Integration, as well as the creation of the BitTorrent File System.

During the year, Tron maintained its stablecoin dominance while its DeFi total value locked of $6.2 billion briefly saw it rank as the number five blockchain.

4. Base

In fourth place was Base, an Ethereum Layer 2 blockchain developed by Coinbase, which demonstrated a substantial capacity for transactions, sometimes peaking at impressive numbers. Many experts agree that Base’s focus on low fees and speed makes it highly competitive, and this is evidenced by millions of new users onboarded in 2025 and stablecoin transaction volume, which at one point surpassed that of major networks like Solana and Ethereum for a period. Activity is primarily concentrated in the decentralized finance ( DeFi) and social categories.

In 2025, Base achieved one of its core and highly ambitious goals: scaling the network to provide a near-instant, extremely low-cost user experience. During the year, the Base team also floated the idea of launching a dedicated network token, and the Base- Solana Bridge was rolled out to allow users to move assets seamlessly between Base’s ERC20 tokens and Solana’s SPL tokens.

3. Solana

At number three is Solana, which is home to pump.fun, a memecoin token launching platform that took the world by storm in the first half of 2025. One of the most anticipated updates on Solana during the year was the Firedancer Validator Client upgrade, which is said to eliminate the “single point of failure” risk. The Alpenglow Consensus Upgrade, which was initiated in early September, was another important innovation that helped to shorten transaction finality to the 100–150 milliseconds range.

While Solana itself had a solid year, it was Pump.fun, which dramatically lowered the barrier to entry for token creation, that fueled an explosion of activity on the Solana network. Pump.fun’s simplicity, speed, and social-media-like interface made it immensely popular, generating hundreds of millions in revenue from trading fees.

However, concerns that the platform’s easy token launch process was being seized on by scammers and fraudsters appeared to halt Pump.fun’s momentum. Still, this controversy seemingly did little to hurt or help Solana’s native token, SOL, which followed market trends. After reaching an all-time high of $293 in early January, SOL gradually declined and by early April, it was trading close to $100 as global markets processed U.S. President Donald Trump’s reciprocal tariff announcement. As trade war fears began to dissipate, SOL resumed an uptrend that saw it reach $250 in September, but an Oct. 10 liquidation cascade ultimately ended the rally.

2. Hyperliquid

In 2025, Hyperliquid, a custom Layer-1 blockchain optimized for a high-performance decentralized exchange ( DEX), introduced several transformative upgrades and innovations. One of the most significant was the launch of HyperEVM, an Ethereum Virtual Machine ( EVM)-compatible execution layer. This has been hailed because it brought general-purpose programmability to Hyperliquid’s performant financial system. Another important upgrade was the Hyperliquid Improvement Proposal 3 (HIP-3) update, completed in Q4 2025, which is seen as a major step toward full decentralization.

The launch of the Simplified Cross-Chain Deposits feature in February 2025 drastically improved the user experience for onboarding capital. According to Hyperliquid, this eliminates the need for users to manually wrap or bridge assets before trading, making the process as simple and fast as a centralized exchange ( CEX) deposit while maintaining the on-chain transparency of a DEX.

There were also changes to the fee structure as well as refinement of tokenomics, which Hyperliquid hopes will maintain competitiveness and support the HYPE token.

The upgrades and innovations made to Hyperliquid helped it achieve major breakout success and high popularity in 2025, solidifying its position as the leading platform for decentralized perpetuals. Its popularity was driven by its lightning-fast custom Layer-1 (Hypercore) and the launch of HyperEVM, which attracted significant volume, users, and institutional interest. According to OAK Research, by mid-2025, Hyperliquid was accounting for 70% to 75% of all trading volume on decentralized perpetuals platforms.

It also reached record-breaking volumes, with weekly trading volumes reportedly averaging $47 billion during the first half of the year, with projections that it will reach a cumulative trading volume exceeding $3.465 trillion by the end of 2025.

The popularity of the protocol can also be observed in its native token, Hyper, which reached an all-time high of $59.30 on Sept. 19, 2025. While it has trended downward since then, Hyper was up by 350% with just two weeks remaining before 2025 ends.

1. Zcash — Blockchain of the Year

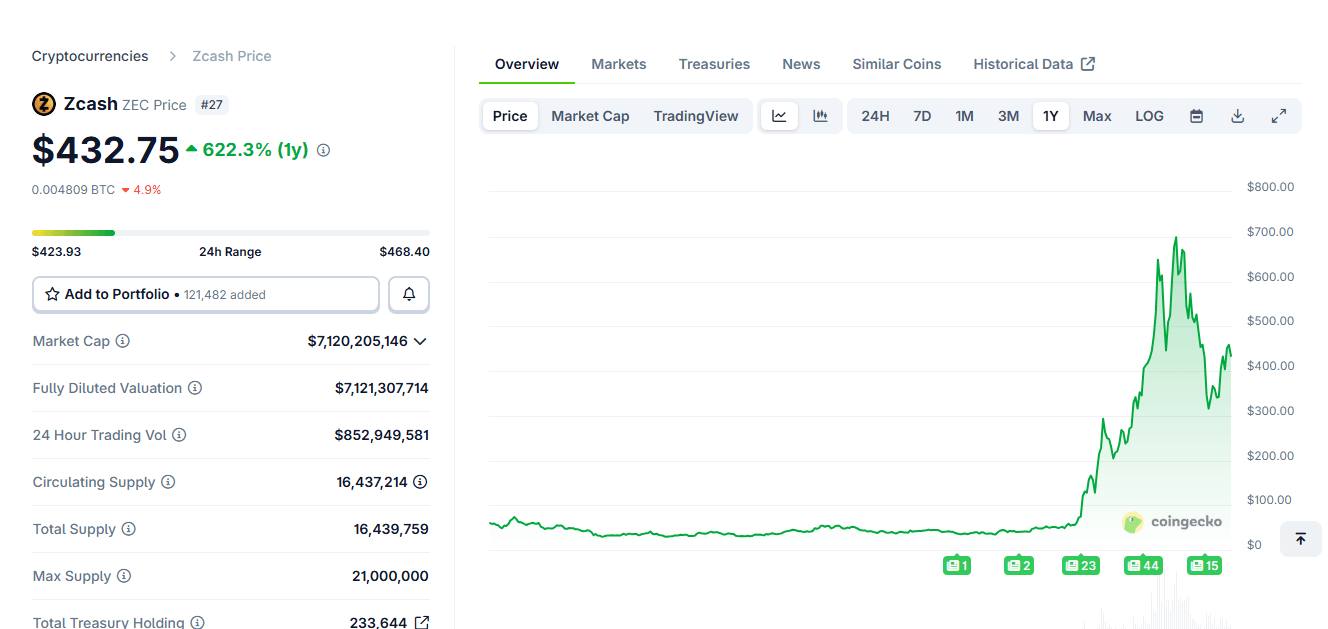

At the top of our list of the five best blockchains was the privacy protocol Zcash, which saw its native coin, ZEC, add billions of dollars in value in less than 90 days. The surge in the privacy coin was attributed to a number of factors, including key upgrades or additions to the blockchain during the year. Developers’ objective with these improvements was to enhance user privacy, improve the user experience (UX), and prepare the network for future scalability and interoperability.

The key improvement for the Zcash blockchain came in the form of Network Upgrade (NU) 6.1, which fixed a long-standing bug in the Remote Procedure Call (RPC) methods. This fix ensured that unshielding transactions from the Orchard shielded pool were correctly reflected in wallets and block explorers, providing better accuracy for users and infrastructure providers.

The Zashi wallet and usability enhancements, as well as the development and testnet activation for Ztarknet, were the other important developments that positioned Zcash to capture growing interest in financial privacy and the zero-knowledge technology ecosystem. The halving event in November was another factor that helped make Zcash the poster protocol for the privacy narrative.

Besides the upgrades, Zcash also won the backing of prominent privacy advocates, which directly helped to fuel ZEC’s surge. As noted by Bitcoin.com News and several other media outlets, ZEC traded under $50 for much of the first three quarters of 2025. However, at the beginning of Q4, ZEC kicked off a rally that at one point saw its year-to-date gains approach 1,500%. Although it subsequently pared off many of those gains, ZEC was still up by over 600% as of Dec. 13, making it one of the best performers in 2025.

The coins of other privacy-focused blockchains also rose phenomenally during the year, but it is ZEC that has seemingly retained the interest of investors and privacy advocates alike. There is no doubt the coin’s performance was partly due to renewed interest in privacy and why this matters in this age, when surveillance tools are becoming more sleek and adept.

Read more: The Recipe for 1,500% Gains: Aurora Labs CEO Breaks Down ZEC Surge and Crypto’s Privacy Pivot

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。