Solana ETFs didn’t have the luxury of a full calendar year, but they made their presence felt almost immediately. Officially launched in U.S. markets on Oct. 28, 2025, spot solana ETFs entered a landscape already shaped by bitcoin and ether. What followed was a tightly packed year-end stretch that revealed both investor appetite and a maturing approach to altcoin exposure.

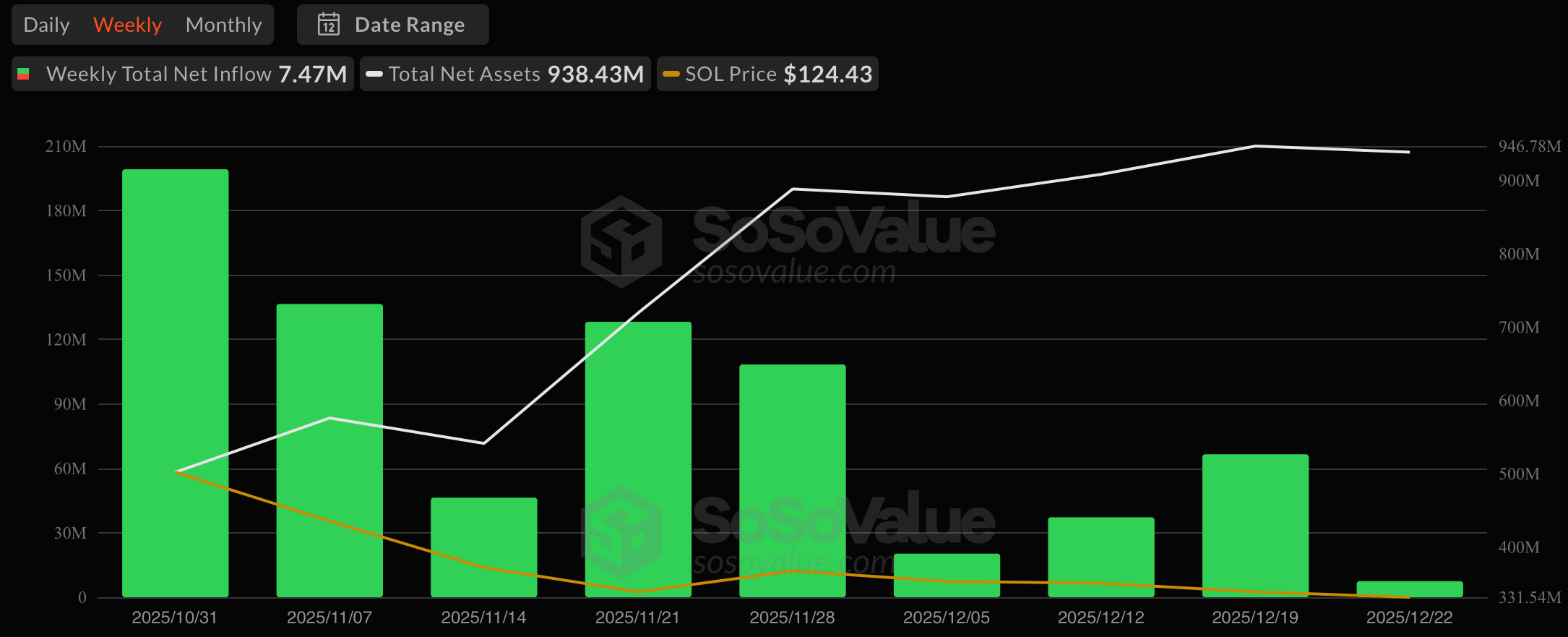

The debut week set the tone. By October 31, solana ETFs had already pulled in $199.21 million in net inflows, lifting total net assets to $502 million. Trading activity was brisk, with nearly $255 million changing hands, signaling strong early participation rather than tentative experimentation.

November accelerated the trend. Over the four weeks ending November 28, Solana ETFs recorded uninterrupted inflows totaling more than $419 million. The standout was the week of November 7, when $136.5 million flowed in alongside $260.9 million in traded value. By mid-month, net assets had crossed $700 million, then quickly climbed toward $900 million as institutional interest broadened beyond the initial launch wave.

Solana ETFs have finished every week in the green since launch.

Liquidity remained a defining feature. Weekly trading volumes consistently ranged between $180 million and $295 million throughout November, suggesting solana ETFs were being actively used as tactical exposure tools rather than passive buy-and-hold products.

December brought a shift in pace but not direction. Inflows moderated, yet remained firmly positive. Across the four December reporting weeks, solana ETFs added another $161.5 million in net inflows. The strongest week came just before mid-month, when $66.55 million entered the products alongside a spike in trading volume to $270.75 million. By December 22, total net assets stood at $938.43 million, just shy of the $1 billion milestone.

Notably, there were no weekly net outflows during Solana ETFs’ first two months on the market. While inflows tapered toward year-end, the absence of capital flight underscored relatively stable conviction among early adopters, even as broader crypto markets rotated and digested volatility elsewhere.

Read more: Solana ETFs Shine as Bitcoin, Ether Funds Bleed Over $300 Million

The story of Solana ETFs in 2025 is one of timing and clarity. Launching after investors had already grown comfortable with spot crypto ETFs proved advantageous. The products arrived into a market that understood the structure, risks, and use cases.

Looking ahead to 2026, the key question is sustainability. With nearly $1 billion in assets and solid liquidity already established, solana ETFs enter the new year with momentum. Future flows will likely hinge on network performance, ecosystem growth, and whether solana can continue to distinguish itself as more than a high-beta trade within institutional portfolios.

- When did U.S. Solana spot ETFs launch?

Solana spot ETFs debuted on October 28, 2025, entering the market late but with immediate investor traction. - How much capital did Solana ETFs attract in 2025?

They drew nearly $1 billion in net assets within two months, with consistent weekly inflows and no net outflow weeks. - What stood out about Solana ETF trading activity?

Liquidity was strong from launch, with weekly trading volumes regularly between $180 million and $295 million. - What will influence Solana ETF performance in 2026?

Sustainability will depend on solana’s network performance, ecosystem growth, and its role in institutional portfolios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。