Author: Spinach Spinach

In December 2025, the Hong Kong Financial Services and the Treasury Bureau and the Securities and Futures Commission jointly released an important document. The document is divided into two parts: one is a consultation summary regarding the licensing system for VA trading services (VA Dealing), and the other is a further public consultation on VA advisory services and VA asset management services.

For industry practitioners, the first question to clarify is: which parts of this document are "confirmations of the old system" and which are "truly new things"?

This article will break it down one by one.

I. Clarifying the Background: Which Systems Have Been Implemented?

Before interpreting this document, it is necessary to review the existing framework for virtual asset regulation in Hong Kong. The following systems have already come into effect and are not new content in this document:

1. VATP Licensing System (Effective June 2023)

The licensing system for Virtual Asset Trading Platforms (VATP) officially started on June 1, 2023. Any centralized virtual asset trading platform operating in Hong Kong or actively marketing to the public in Hong Kong must obtain an SFC license. As of now, 11 institutions have obtained formal licenses.

2. Traditional License Upgrade for VA Services (Circular by End of 2023)

In December 2023, the SFC and HKMA jointly issued a "Joint Circular on Virtual Asset-Related Activities for Intermediaries," allowing intermediaries holding traditional financial licenses to provide virtual asset-related services after meeting specific conditions:

- Institutions holding Type 1 license (securities trading) can provide VA trading services to clients through "comprehensive account arrangements."

- Institutions holding Type 4 license (securities advisory) can provide advisory opinions on VA trading.

- Institutions holding Type 9 license (asset management) can manage portfolios containing VA (subject to a 10% exemption or other conditions).

By mid-2025, approximately 40 institutions had upgraded to Type 1, 37 to Type 4, and 40 to Type 9 licenses. These upgrades were completed under the existing framework and are not changes brought about by this document.

II. Core Content of This Document: Three Key Points

After clarifying the background, let's look at what new information this document actually presents. The core content can be summarized into three key points:

First Point: Consultation Summary on VA Dealing License (Confirmation of Details)

In June 2025, the Financial Services and the Treasury Bureau and the SFC initiated a public consultation on the "VA Trading Services Licensing System." Section A of this document is a summary response to that consultation, confirming the following key details:

(1) Final Confirmation of Scope and Definition

The definition of VA Dealing services will be closely aligned with Type 1 license (securities trading) under the Securities and Futures Ordinance. Specifically, anyone engaging in the following activities for business purposes will need to apply for a license:

- Entering into or offering to enter into agreements with others to buy, sell, subscribe for, or underwrite virtual assets.

- Inducing others to enter into the above agreements.

The "limb (b)" mentioned in the original consultation document (involving activities related to VA derivatives and structured products) has been removed, as such activities are typically regulated under Type 1, Type 2, or Type 11 licenses, and do not require duplicate licensing.

(2) Confirmation of Exemptions

The following circumstances may be exempt from needing to apply for a VA Dealing license:

- Transactions conducted through SFC-licensed VA dealers.

- Transactions conducted as a principal.

- Intra-group transactions.

- Using VA as a means of payment for goods or services.

- Activities related to HKMA-licensed stablecoin issuers.

- Transactions conducted by licensed VA asset managers as part of providing management services.

(3) No "Deemed Licensed" Transition Arrangement

This is one of the most concerning issues for practitioners. The SFC has clearly stated that it will not provide a "deemed licensed" transition arrangement. On the effective date of the new system, all unlicensed VA trading service providers must immediately cease related business.

The SFC explained that a "deemed licensed" arrangement could lead to public confusion regarding the regulatory status of institutions, which is detrimental to investor protection. However, the SFC also promised to consider a reasonable effective date to allow market participants time to adjust.

(4) Fast-Track Approval Channel

For institutions already holding SFC licenses (such as VATP licensed platforms and upgraded Type 1/4/9 licensed companies), a fast-track approval channel will be provided. These institutions have already passed the appropriate candidate review, and the process for applying for new licenses will be significantly simplified.

(5) Prohibition on Unlicensed Entities Marketing to the Hong Kong Public

The document confirms that institutions not licensed or registered by the SFC are prohibited from actively marketing their VA trading services to the Hong Kong public. The SFC will issue further guidance on the specific scope of "active marketing" (whether it includes online advertising, social media, direct outreach, etc.).

Second Point: Further Consultation on VA Advisory License (New Addition)

This is the truly new content in this document. The SFC proposes to add a new independent licensing category under the Anti-Money Laundering Ordinance (AMLO): VA Advisory Service Provider.

(1) Why Add This License?

Currently, if an institution wants to provide advisory services on virtual asset investments, it must hold a Type 4 license (securities advisory) and operate according to the requirements of the Joint Circular. However, the Type 4 license is essentially for "securities," while most virtual assets are not securities.

The addition of an independent VA Advisory license is intended to fill this regulatory gap and ensure the principle of "same activities, same risks, same regulation" is upheld.

(2) Definition and Scope

"Providing advice on virtual assets" includes two types of activities:

- Direct advice: Providing opinions on "whether to buy or sell, which to buy or sell, when to buy or sell, and on what terms to buy or sell" virtual assets.

- Publishing analysis reports: Issuing analysis or research reports to assist recipients in making the above decisions.

(3) Exemption Circumstances

Referring to the exemption framework of the Type 4 license, the following circumstances may be exempt:

- Providing advice only to wholly-owned subsidiaries within the group.

- As an ancillary activity of a licensed VA dealer or VA asset manager.

- Ancillary activities of lawyers, barristers, and certified public accountants in practice.

- Ancillary activities of registered trust companies in fulfilling their duties.

- General information provided through public publications or broadcasts.

(4) Regulatory Requirements

The requirements that VA Advisory service providers must comply with will be fundamentally consistent with those of Type 4 licensed companies, including:

- Anti-money laundering and counter-terrorism financing (AML/CFT) requirements.

- Financial resource requirements: HKD 5 million in paid-up capital; HKD 1 million in liquid funds (not holding client assets) or HKD 3 million (holding client assets).

- Knowledge and experience requirements (e.g., passing regulatory knowledge exams).

- Client suitability assessments, risk disclosures, conflict of interest management, etc.

Third Point: Further Consultation on VA Management License (New Addition)

Similar to the VA Advisory license, the SFC also proposes to add another independent licensing category: VA Asset Management Service Provider.

(1) Definition and Scope

"Virtual asset management" refers to managing virtual asset investment portfolios for others, with the authority to make investment decisions. A typical scenario is a fund manager—clients hand over funds to you, and you decide what to buy and when to trade.

(2) No Minimum Threshold

This is a key detail. The SFC has clearly stated that there will be no 10% minimum threshold.

Currently, Type 9 licensed companies can be exempt from additional VA-related requirements when managing portfolios if the proportion of virtual assets is below 10%. However, under the new VA Management licensing system, as long as the portfolio contains any proportion of virtual assets, a license will be required.

The SFC's reasoning is:

- Virtual assets themselves carry high risks, and even a small proportion should adhere to the same regulatory standards.

- Prevent institutions from deliberately keeping holdings below the threshold to evade licensing requirements.

This regulation may impose significant compliance pressure on small asset management institutions.

(3) Custody Requirements: Under Consideration

The SFC is considering whether VA asset managers must custody client assets with SFC-licensed custodians.

Under the current Type 9 licensing system, institutions managing private equity funds can choose offshore custodians as long as due diligence is sufficient. If the new regulations tighten this flexibility, it will significantly impact existing operating models.

At the same time, the SFC acknowledges a practical issue: private equity/venture capital funds may invest in newly issued tokens that may not yet be supported by licensed custodians. Therefore, the SFC is considering allowing self-custody within certain limits without requiring a custody license.

(4) Regulatory Requirements

Similar to VA Advisory, the requirements that VA Management service providers must comply with will be fundamentally consistent with those of Type 9, including AML/CFT requirements, financial resource requirements (HKD 5 million paid-up capital, HKD 1 million - 3 million in liquid funds), client suitability assessments, etc.

III. Timeline and Practitioner Action Guidelines

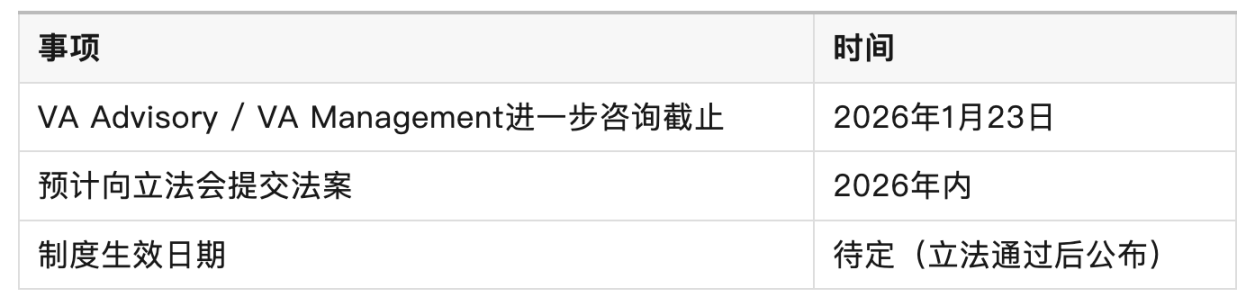

Timeline

Practitioner Action Guidelines

1. If you are currently engaged in OTC or VA trading services

- The VA Dealing license consultation has been completed, with legislation expected in 2026.

- There is no "deemed licensed" transition arrangement; applications must be completed before the effective date.

- It is recommended to contact the SFC immediately (fintech@sfc.hk) to initiate pre-communication.

2. If you are currently providing VA investment advisory services

- The VA Advisory license is currently in the consultation stage and has not yet been finalized.

- If you have feedback, you can submit it to the Financial Services and the Treasury Bureau by January 23, 2026.

- If you already hold a Type 4 license, you can apply through the fast track in the future.

3. If you are currently engaged in VA asset management

- The VA Management license is also in the consultation stage.

- Pay special attention to the regulations on "no minimum threshold" and "custody requirements."

- If you already hold a Type 9 license, you can apply through the fast track in the future.

4. If you already hold a VATP license or Type 1/4/9 licenses

- You will enjoy a fast-track approval channel under the new licensing system.

- However, you still need to pay attention to specific requirements and prepare application materials in advance.

IV. Summary: Core Information of This Document

In one sentence, the core information of this document can be summarized as follows:

Hong Kong is expanding its virtual asset regulation from "single-point regulation of trading platforms" to a "full licensing matrix"—with independent licensing requirements for trading, advisory, and asset management, fully aligned with the traditional financial Type 1/4/9 licensing system.

For practitioners, the core changes to pay attention to are:

2026 will be a key year. The legislative process, implementation details, and effective dates—each milestone will directly impact practitioners' compliance strategies. It is recommended to closely monitor subsequent announcements from the SFC and the Financial Services and the Treasury Bureau and to initiate pre-communication procedures as early as possible.

This article is based on the "Legislative Proposal Consultation Summary for Regulating Virtual Asset Trading" and the "Further Public Consultation on Regulating Virtual Asset Advisory Services and Asset Management Services" published by the Hong Kong Financial Services and the Treasury Bureau and the Securities and Futures Commission in December 2025, for informational reference only and does not constitute legal or investment advice.

Reference: https://apps.sfc.hk/edistributionWeb/gateway/EN/consultation/doc?refNo=25CP12

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。