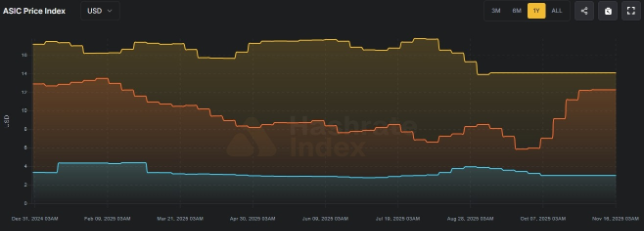

The price of Bitmain's mining machines has dropped to "fire sale prices," with a tag of $3 per terahash, reflecting the harsh reality that miners are facing as daily earnings fall below the $40 survival line, despite hash power reaching an all-time high.

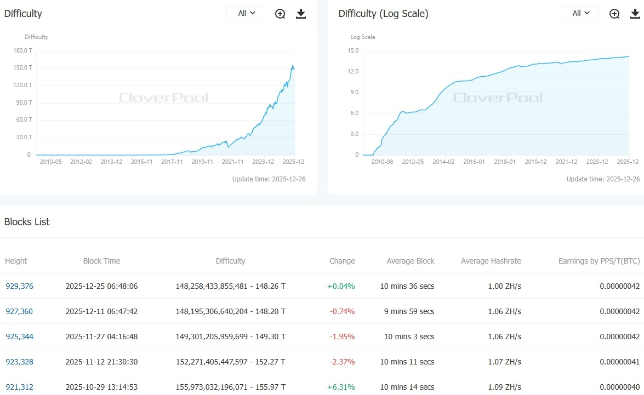

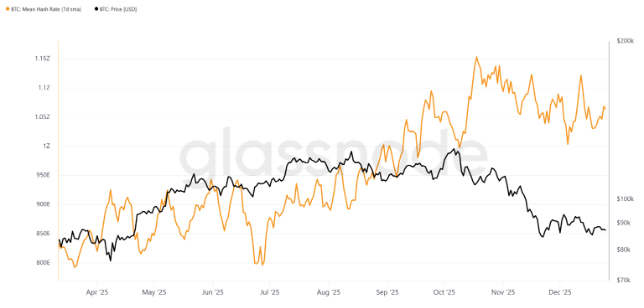

Bitcoin's total network hash rate first broke the historic threshold of 1 zettahash per second (ZH/s) in August 2025, and by early December, this figure had stabilized at around 1.1 ZH/s.

This means that the global Bitcoin network's computing power has reached an astonishing scale of 11 trillion hash calculations per second. Meanwhile, the key metric for measuring mining profitability, the "hash price," has dropped to just $35 to $38 per PH/s per day, hitting a historic low.

1. New Highs in Hash Power

● By the end of 2025, the Bitcoin mining industry presents an unprecedented contradictory picture. On one hand, the total network hash rate continues to soar to historic highs, stabilizing at around 1.1 ZH/s.

● On the other hand, miners' actual earnings have plummeted to historic lows. The key indicator of mining profitability, the "hash price," lingered between $38 and $39.4 per PH/s per day in December, far below the widely recognized breakeven line of $40.

● Miners' survival space is being squeezed from both sides: the front is the ever-increasing competition in hash power, while the back is the persistently low returns. This contradiction is particularly glaring against the backdrop of Bitcoin prices relatively stable around $90,000—where the coin price has not become a lifeline for the mining industry, but rather highlights structural issues within the sector.

The gap between rising hash power and declining earnings is continuously widening, forming an increasingly deep rift in the industry.

2. The Abyss of Costs

● A deep analysis of the mining cost structure reveals that the severity of the problem far exceeds surface numbers. According to industry data, the median production cost of Bitcoin in the second quarter of 2025 has exceeded $70,000. For publicly listed mining companies, the situation is even more severe—the total cost, including equipment depreciation, has reached about $137,800, far exceeding the current market price of Bitcoin.

● Energy costs have become one of the main burdens crushing miners. With global energy prices fluctuating and some regions imposing restrictions on electricity for mining, miners' electricity expenditures continue to rise. In some high-cost mining sites, electricity costs account for over 70% of total operating expenses, making it difficult for them to survive in the current earnings environment.

● Equipment depreciation is another overlooked cost black hole. The rapid iteration of new generation mining machines accelerates the obsolescence of old equipment, and the plummeting prices of the S19 series mining machines directly reflect this trend. Miners face not only operational pressure but also the double blow of asset value depreciation.

3. Price Avalanche

● The mining machine market experienced a price avalanche by the end of 2025. The world's largest mining machine manufacturer, Bitmain, announced significant price reductions for several key mining machines at the end of December, with the extent of the cuts shocking the industry. Among them, the price of the S19 series mining machines has dropped to as low as $3 to $4 per terahash, while the new generation S21 mining machines have also fallen to around $7 to $8 per terahash.

● This round of price cuts is not merely a simple market promotion but reflects a deep-seated demand crisis in the industry. The drop in mining machine prices to "fire sale" levels directly indicates that miners' willingness to purchase new equipment has plummeted.

A mining operator who wished to remain anonymous revealed, "Buying new mining machines now is like catching a falling knife; you don't know where the bottom is or when you can break even."

● The sharp decline in mining machine prices has triggered a chain reaction. First, it lowers the hardware entry threshold for newcomers, potentially attracting a batch of cost-sensitive new miners, further intensifying hash power competition. Second, it significantly shrinks the asset value of existing miners, deteriorating their balance sheets.

Finally, it compresses the profit margins of mining machine manufacturers, which may affect the investment in research and development for the next generation of mining machines.

4. Survival Strategies

● Faced with a harsh survival environment, miners are not sitting idle but are engaging in various forms of self-rescue and transformation. Relocating to areas with lower energy costs has become the most direct response strategy. More and more miners are looking towards regions rich in electricity resources and low prices, such as the Middle East, Central Asia, and Latin America, seeking cost advantages.

● Upgrading equipment is another path to breakthrough. Although the prices of new mining machines have dropped, their higher energy efficiency means lower long-term operating costs. Some cash-rich mining companies are taking advantage of the low-price window to upgrade old equipment with an energy efficiency ratio exceeding 20J/TH to new generation mining machines with an energy efficiency ratio below 15J/TH.

● The exploration of industry diversification is also accelerating. Some miners are beginning to shift their hash power to emerging fields like AI computing, seeking diversified income sources using existing infrastructure. This transformation not only hedges against the risks of Bitcoin mining but also opens up new paths for the long-term development of the industry.

● The utilization of renewable energy has become a consensus in the industry. From wind farms in Texas to hydropower stations in Northern Europe, miners are actively seeking green energy solutions to reduce their carbon footprint and long-term energy costs.

5. Future Directions

The mining winter at the end of 2025 is essentially a deep adjustment and reshuffling of the Bitcoin mining industry. The industry is shifting from extensive growth to refined operations, moving from a single reliance on block rewards to a diversified income structure. Although this process is painful, it contributes to the long-term healthy development of the industry.

● In the short term, the market will undergo a "survival selection," where high-cost, low-efficiency miners will be forced to exit, while mining companies with cost advantages and technical strength will consolidate their market positions. This process may be accompanied by short-term fluctuations in hash power, but in the long run, network security will not be substantially affected.

● In the medium term, industry consolidation will accelerate. Capital-rich publicly listed mining companies may expand their market share through acquisitions of quality assets, forming a more scalable industry landscape. At the same time, mining machine manufacturers will also face consolidation, with technological innovation capabilities becoming the core of competition.

● In the long term, Bitcoin mining will become more specialized and globalized. The ability to acquire energy, capital operation efficiency, and technological innovation capabilities will become the core competitiveness of mining companies. The integration of the industry with the energy sector will deepen, and mining may become an important regulatory tool in the global energy network.

● Changes in the regulatory environment will also affect the direction of the industry. As Bitcoin's status in the global financial system rises, countries will clarify their regulatory policies on mining, and compliance costs may become a new industry threshold.

Mining machines are still roaring, but the blood of profits is drying up. When Bitmain adjusted the price of the S21 immersion mining machine to $7 per terahash, miners clearly remember that just a year ago, the market price for equipment of the same level was still above $15.

Amid the growing pains of industry transformation, the hash power curve on the control room screen of the mining site stubbornly climbs upward, as if to prove the industry's most brutal paradox—the greatest signals of prosperity and the deepest survival crises can coexist within the same set of data.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。