The digital renminbi is expected to be rapidly implemented in the next two years:

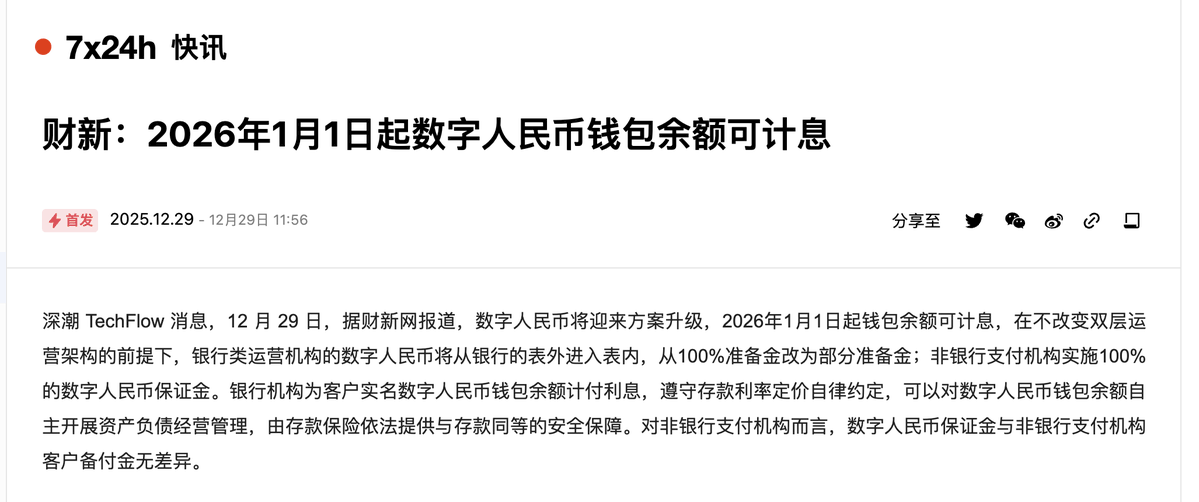

Caixin announced: The digital renminbi will undergo a plan upgrade, and starting from January 1, 2026, wallet balances will earn interest, clearly advancing its usage scenarios!

If the digital renminbi becomes more widespread, more account-based, and more penetrable, it will only make the exchange of digital currency for renminbi easier to identify and trigger.

For Dongda, the biggest issue and the most sensitive area is capital outflow. The crackdown on digital currency in recent years largely stems from this point, as transferring assets has become too easy.

Future transaction lines (C2C withdrawals): Regardless of whether you use a bank card, third-party payment, or the potential future digital currency, as long as the transaction is classified as related to virtual currency, it is considered a highly sensitive capital flow in the mainland.

The traceability and penetrability of digital currency are stronger, so it will definitely gradually make everyone accustomed to using the digital renminbi to fend off external risks.

If there is still no good withdrawal channel domestically, I think it will become increasingly troublesome in the future.

Everything should be done early. While the digital renminbi is not yet so widespread, I suggest everyone take advantage of these years to explore different options. Once a certain stage is defined as illegal, it will become very troublesome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。